On the 27th of January 2021, I had the pleasure of facilitating the second Digital Benelux FP&A board meeting. The subject under discussion was “The Art and Science of Digitised FP&A Business partnering”, delivered by a truly international board panel of 5 members based in Canada, the UK, the Netherlands and Germany.

On the 27th of January 2021, I had the pleasure of facilitating the second Digital Benelux FP&A board meeting. The subject under discussion was “The Art and Science of Digitised FP&A Business partnering”, delivered by a truly international board panel of 5 members based in Canada, the UK, the Netherlands and Germany.

Below is a summary of what was discussed on the day including a summary of the polling questions and answers.

FP&A Business Partnering: How mature is your model?

Ron Monteiro, Corporate (Senior) Director of Finance at Kruger Products L.P, spoke about how FP&A can increase the maturity and impact within organisations.

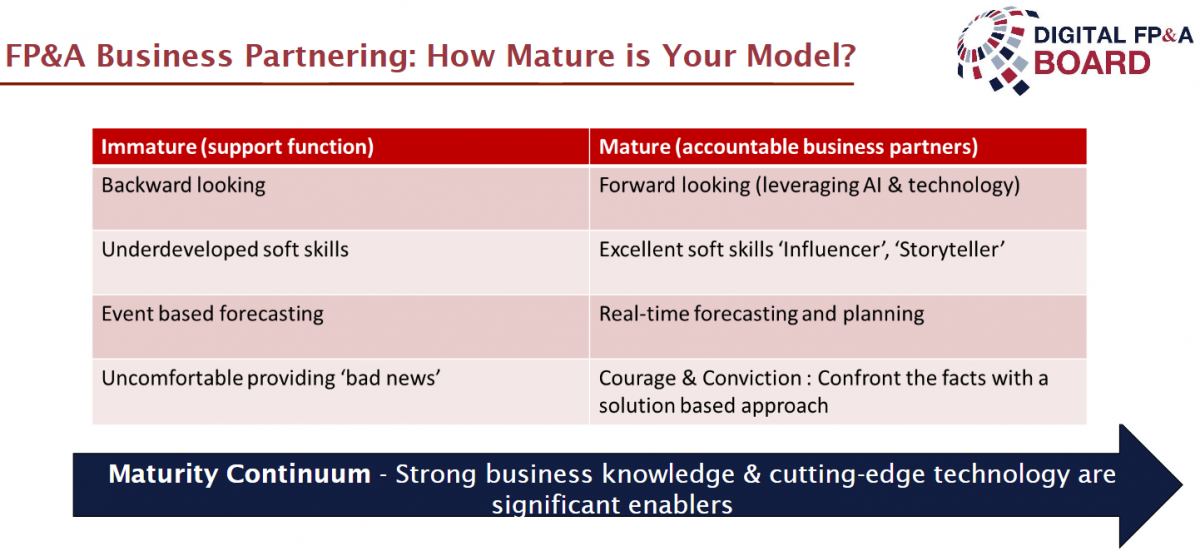

There are 4 elements that can be used when looking at how mature your model is:

Time spent on backwards-looking vs forward-looking analysis. Forward-looking analysis can help impact your business results.

Communication. The role of an ‘influencer’ or a ‘storyteller’ is pivotal and can’t be discarded as technology advances.

Event-based vs real-time forecasting. Unprecedented events such as the pandemic could cause forecasts to become obsolete on the day that they are given.

Issues confrontation with solutions. If you make errors don’t sit and worry about it, you should have the courage and conviction to approach stakeholders with a solution.

Two things that help facilitate all four of these points are having a strong knowledge of the business and the industry, and leveraging technology to allow it to be an enabler to becoming a mature FP&A function.

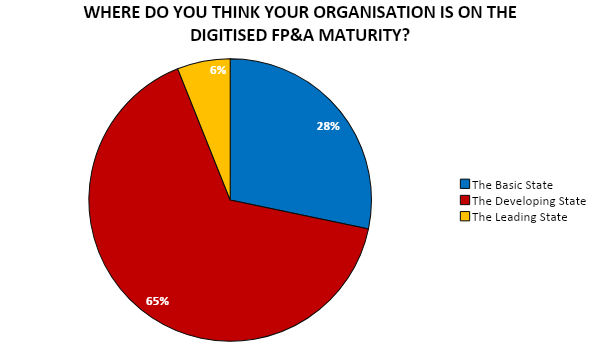

When we looked at where the audiences’ organisations are on the digitised FP&A maturity model, only 28% believed they were at the basic state. Encouragingly 65% were at the developing state with 6% Leading.

Is Modern Collaboration possible without Digitisation?

Milan Bukumirovic, Managing Director Business Services UK, Ireland & Nordics at Swarovski, spoke about whether collaboration in the modern age is possible without digitisation.

The current pandemic, while causing many struggles, has provided unique insights into how digitisation can change business.

Office space is being reconsidered.

Business support has become busier.

FP&A roles have increased significantly.

These new insights into working and business models are only possible with the help of digitisation. However, it also brings risks with opportunities.

If we are all remote employees, why does it matter which country we are based in?

Digitisation also allows AI to accelerate; with studies showing in the next decade, 400,000 jobs in finance will be replaced.

We can already say the future will be different, but the role of FP&A and finance will still be central for navigating the business.

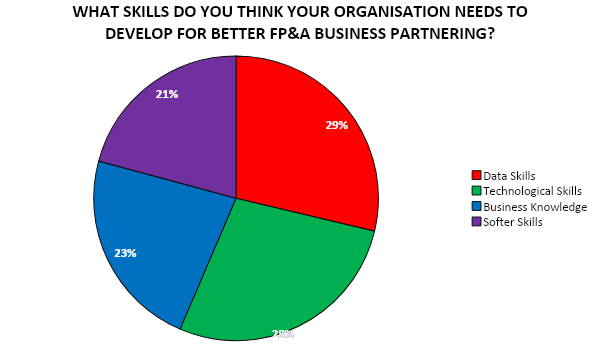

The next poll asked the audience what skills their organisation needed to develop to further their FP&A business partnering. The results were remarkably even, all four responses receiving between 20%-30% of the vote. Data skills was still the most chosen answer, just ahead of technological skills on 29% and 28% respectively, with business knowledge and softer skills coming in with 23% and 21%.

Integrated FP&A Business Partnering

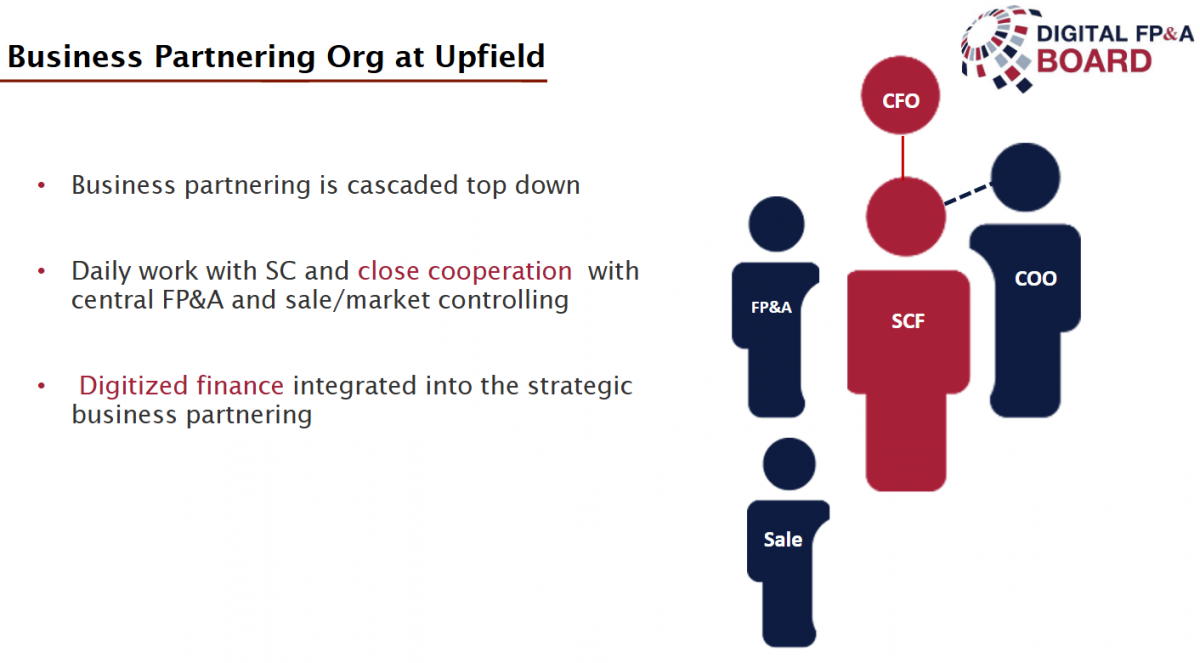

Mirela Maric, Senior Finance Director for Finance Operations at Upfield (ex-Unilever Group), shared with us how the finance business partnering roles evolved at Upfield after the company was acquired.

Upfield is a mature business in the food sector, with the majority of it being in retail. In 2018 they were bought by an investment fund, KKR, from Unilever, and immediately began transforming processes to improve performance, before eventually selling Upfield on.

When they were acquired, FP&A was turbocharged. Finance at Unilever was large, with many expert, specialised roles that simply couldn’t work at a smaller company that required a different skill set, leading to many personnel changes. Soft skills were now crucial to perform proper business partnering and financial knowledge must be much broader, simply because there would be fewer people. No decision could be made unless it was supported by good, high-quality analysis. This means the more people involved, the better a picture you will have, so good communication between departments is crucial.

It was decided to keep the software in use at Unilever, keeping processes, set up, and other functions that were working well and add supply chain software. The company has grown during COVID due to FP&A business partnering providing the opportunity to take a naturally inflexible supply chain and make it agile and adaptable.

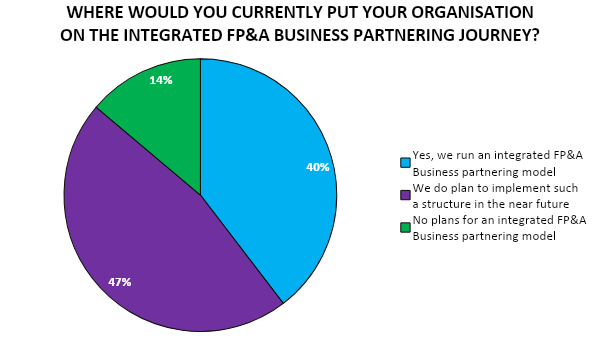

The third poll, asking where organisations are in the journey of integrated FP&A business partnering, pleasingly showed 86% of them were either already or are soon going to be running an integrated FP&A business partnering model. This is indeed key for the future of the organisation.

How Modern Technology Can Enhance and Transform FP&A Business Partnering?

Dr. Karsten Oehler, Professor Controlling & Accounting at Provadis School, Solution Architect at CCH Tagetik Benelux, shared with us how technology can be used to enhance business partnering.

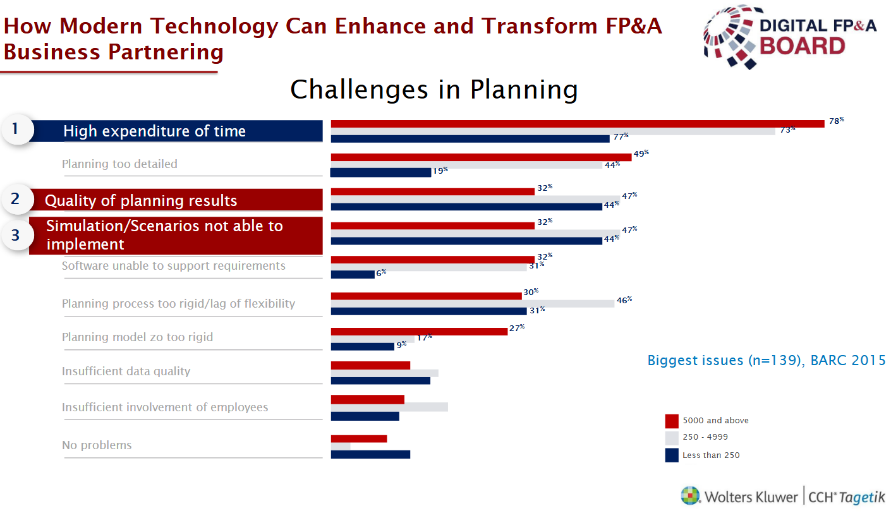

There are three great challenges to planning:

High expenditure of time (long and drawn out processes)

Quality of planning (indication of how things will happen)

Simulation and scenario planning (implementation)

With COVID, history is in some ways out the window, but we will eventually return to normal and predictive approaches. Therefore, using as much technology as possible is the way to go.

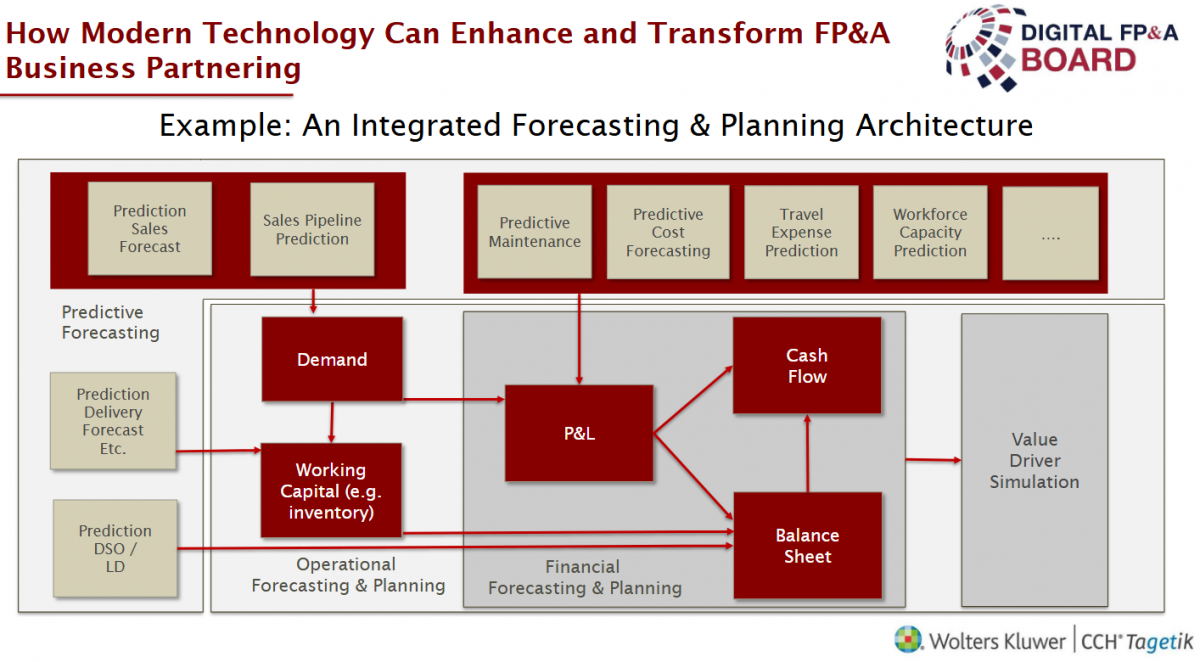

The above-depicted model shows how the process flows and how one can move from the demand plan and the business forecast to all the other various areas within the organisation. This model helps show how these all fully integrated from start to finish rather than separate modules. With technology, one can leverage this entire system to develop an integrated, achievable plan.

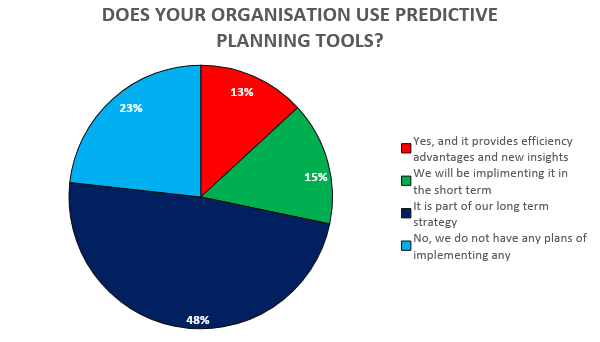

Our final poll, asking about the use of predictive planning tools, showed 63% of our audiences’ firms have identified it as a tool of the future, with most of them looking long term. 13% have already put it to good use while 23% have no intention of implementing any.

Skills Required for Digitised FP&A – A Recruiter’s Perspective

Estelle James, Regional VP – Managed Business Services at Protiviti/Robert Half, shared with us their vision of digitised FP&A and the skillset that is in demand by clients.

Protiviti surveyed over 1000 CFOs and senior leaders to look at trends for the next 12 months. FP&A digitisation and related operations form the top 3 of 5 priorities. 72% of CFOs surveyed ranked FP&A as a priority and 74% ranked internal customers and their changing demands for insights and information.

There are three strong narratives:

COVID has upended finance operations for many but also increased the demands.

In 2020, digital capabilities were stress tested and it became clear who were truly digital and who were operating a digital veneer. CFOs choose to invest in technology.

CFOs are navigating critical human capital dilemmas. There will be less reliance on permanent teams with more flexibility in how to procure and use these skillsets to get the right results.

There has also been a change in many recruitment trends:

While many organisations have reduced their overall staff numbers, we have seen growth in areas like data analytics, cloud-based finance and other specific skills.

Working hours are increasing. 2020 has been tough for many FP&A professionals.

There is a huge digital disparity between companies and sectors and digital FP&A partnering means something different to each of our clients.

In conclusion, it is an exciting but exhausting time to be in FP&A but never more important to be a true business partner and to navigate these challenges and changes within the business.

Conclusions

The maturity model plays a key role for the organisation in order to understand where they are in the digitised FP&A business partnering journey and where they should go next. We have seen the pandemic and previous unknowns completely question the way we work. The skillsets and business partnering model need to match these, so we have to constantly review and adjust these. Ensure teams understand the new model and communicate these through the organisation leveraging technology to better FP&A business partner enterprise-wide.

We would like to thank our global sponsors and partners Tagetik and Robert Half, for their great support with this Digital FP&A Board. Also, we are very grateful to our panel of experts for sharing with us their keen insights and to the FP&A Board attendees for their valued presence!