Less than a quarter of a Financial Analyst’s time is spent with high value-add analysis -...

FP&A teams have been growing in popularity ever since Eugene Moynihan introduced first wrote about them in "The Financial Analyst and the Computer," Financial Analysts Journal, in 1964, because they have always known about one big thing that drove and accelerated value better than anything else, which other functions and teams sometimes forget. This is why organisations then, and even those today, need a FP&A team. So what is this one big thing?

FP&A teams have been growing in popularity ever since Eugene Moynihan introduced first wrote about them in "The Financial Analyst and the Computer," Financial Analysts Journal, in 1964, because they have always known about one big thing that drove and accelerated value better than anything else, which other functions and teams sometimes forget. This is why organisations then, and even those today, need a FP&A team. So what is this one big thing?

Trust! High levels of Trust drive value. There’s even a trust equation but before we get into that I’d like you to think of someone you work with or have worked with, with whom you have a high level of Trust. What first impressions spring to your mind when you ask yourself:

- What’s it like to work with him/her?

- What’s it like to communicate with him/her?

- How fast can you get things done with him/her?

- What kind of results do you achieve together?

I’d also like you to think of a second person, only this time, you may figure out where this is going, with whom you have a low level of trust or where it’s not where it needs to be. What first impressions spring to your mind when you ask yourself:

- What’s it like to work with him/her?

- What’s it like to communicate with him/her?

- How fast can you get things done with him/her?

- What kind of results do you achieve together?

Can Trust be Quantified by FP&A

Now how would you describe the differences in the relationships? Night and Day? Successful or Unsuccessful? Eager to work with one of them but slow to work with the other? In effect, we’ve just put a qualitative value on the impact of trust but can you put a Quantitative or Financial one to build out the business case for high trust?

Well for many, trust is intangible and that that means people don't really know how to get their arms around it. But the fact is some researchers have attempted to estimate the costs of low trust, in effect, suggesting they are like a very real tax, and likewise the dividends from being a high trust organisation are similarly quantifiable.

Taxes of Low Trust

In 2004, one estimate in the United States put the cost of complying with federal rules and regulations - put in place essentially due to lack of trust - at $1.1 trillion, which was more than 10% of their gross domestic product at the time. A further study conducted by the Association of Certified Fraud Examiners estimated that the average American company lost 6% of its annual revenue to some sort of fraudulent activity.

Dividends of High Trust

Similarly, FTSE Russell discovered if you invested in the publically-traded companies featured on the 100 Best Companies to Work For® list, and each year divested stock in the companies that were no longer on the list and invested in companies added to the list, your returns would be nearly 3x times that of the general market. Furthermore, a 2015 study by Interaction Associates shows that high-trust companies “are more than 2½ times more likely to be high performing revenue organizations” than low-trust companies.

The Trust Equation

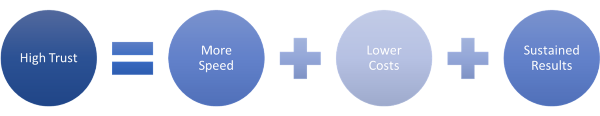

But even intuitively FP&A have always known that we’ve always had to ensure trust in the numbers, whether financial or non-financial, in order to help decision makers drive sustained profitable growth in our organisations. We’ve always aimed to provide an assurance that numbers are as complete and accurate as they can possibly be, whether reporting them historically or projecting them forward to ensure our enterprises continue as going concerns. In essence these relationships can be represented in terms of an equation:

When trust goes up, cost goes down, and speed goes up resulting in a “high-trust dividend” which enables our organisations to succeed in their communications, interactions, and decisions, and to move with incredible speed.

By contrast, when trust is low, in a company or in a relationship, it places a hidden "tax" on every transaction: every communication, every interaction, every strategy, every decision is taxed, bringing speed down and sending costs up. My experience is that significant distrust doubles the cost of doing business and triples the time it takes to get things done.

So given we understand there is a business case for trust we next need to know how to build it. I shall do this in a follow up article but it is also related to why we bring guest FP&A mentors onto our Strength in the Numbers Podcast, that have a credible track record in FP&A because they know role FP&A plays in building trust and they share their stories about how they have practically driven value for their organisations. How their experiences can help you become more influential and solve meaningful problems faster and at lower cost, in fact the episodes are free, so you have no excuse to go onto learn some new practical approaches towards having a more fun, successful and rewarding career in FP&A.

So what techniques would you recommend to build trust with others and increase your impact in the business? Or what steps would you take yourself?

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.

The author Andrew Codd is the producer of the Strength in the Numbers Podcast which interviews real finance practitioners to break down their hard-won lessons and deconstruct their practical methods that work on the job and which you won't typically find in textbooks or exams so that we create more influential finance professionals worldwide who solve meaningful problems for their organisations and in return have fun, rewarding and successful careers in finance.

The author Andrew Codd is the producer of the Strength in the Numbers Podcast which interviews real finance practitioners to break down their hard-won lessons and deconstruct their practical methods that work on the job and which you won't typically find in textbooks or exams so that we create more influential finance professionals worldwide who solve meaningful problems for their organisations and in return have fun, rewarding and successful careers in finance.