This is the first part of a three-part series on the business value that data science...

Yes. You read that right. The article is titled Mergers & Executions. It’s not a typo. You might think it should read Mergers & Acquisitions (M&A). However, the fact is, most M&A activities could do better with execution from the pre-acquisition to the post-acquisition stages. This work will draw on practiced methods for companies to execute value-creating, not value-destroying acquisitions, with the guidance of their Financial Planning & Analysis (FP&A) teams.

Yes. You read that right. The article is titled Mergers & Executions. It’s not a typo. You might think it should read Mergers & Acquisitions (M&A). However, the fact is, most M&A activities could do better with execution from the pre-acquisition to the post-acquisition stages. This work will draw on practiced methods for companies to execute value-creating, not value-destroying acquisitions, with the guidance of their Financial Planning & Analysis (FP&A) teams.

Why Companies Engage in M&A

At a rudimentary level, all M&A activity involves simply a build-or-buy decision. A software-as-a-service (SaaS) company, for example, that identifies a gap in the functionality of its product offerings, can decide to develop this missing functionality internally or to buy another company that possesses this functionality. However, an analogous framework is being championed by private equity (PE) firms known as buy-and-build. The buy-and-build strategy is when a PE-owned, established company serves a platform for purchases of a number of smaller companies—which are bolted/consolidated into the more established company.

Some reasons why organizations pursue M&A deals include:

- Adopt a new strategy

- Develop deep competency in its core market

- Enter a new market, thereby scale rapidly and increase headcount and acquire a great management team

- Expand market share in the current industry

- Acquire the product, customer base and technical expertise in a compatible market (e.g. SAP’s 2018 acquisition of Qualtrics for $8B — the deal involved a rich valuation of 20x revenue or Enterprise Value / Sales of 4.7x or Enterprise Value / EBITDA of 18x). High valuations are common today due to the competition between private equity firms and publicly traded corporate acquirers coupled with the low-interest rate environment.

- Enter a new industry (e.g., Salesforce’s 2016 acquisition of Demandware for $2.8 billion represented a move into the e-commerce space). Companies are pursuing deals, today, to ensure future growth prospects, beyond their core competencies

- Vertically or horizontally integrate

The list above is not exhaustive and it is possible to dedicate an article to each reason identified above.

M&A - Prudent Capital Allocation (or Misallocation)

An organization’s M&A strategy is related to its capital allocation decisions. Additional capital allocation decisions in short, mid and long terms include, for example, product development, product launches, geographic expansion, significant research and development initiatives etc.

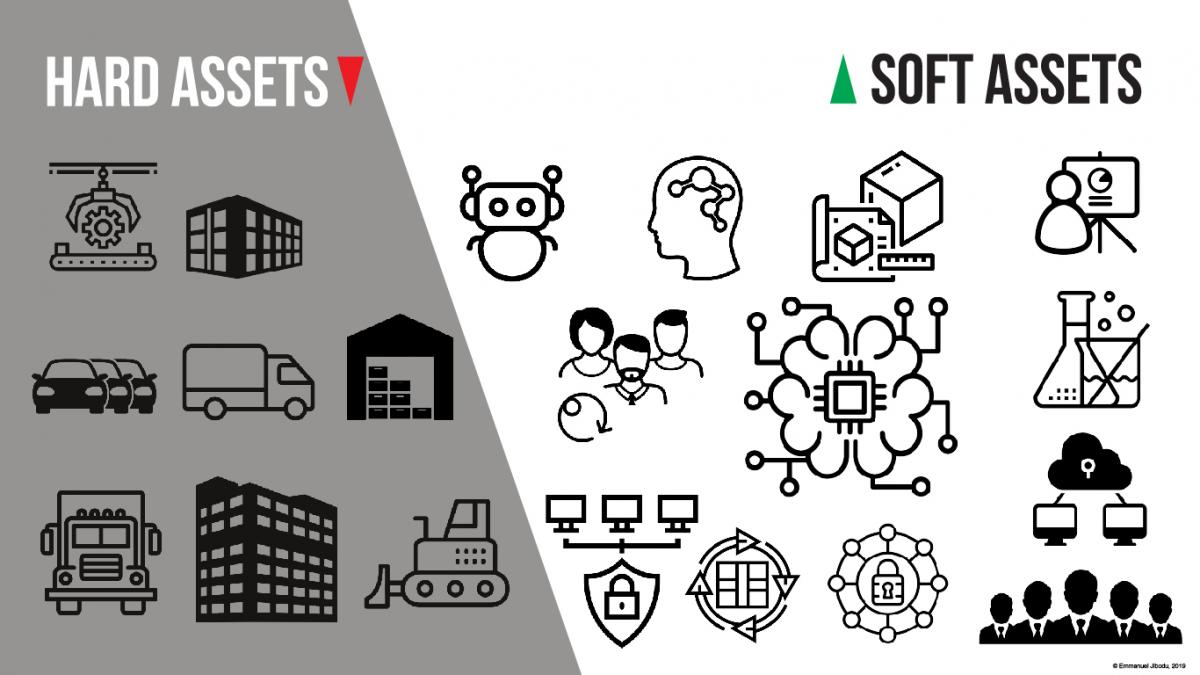

In my view, a critical factor that results in different financial outcomes across various enterprises is their capital allocation practices. In contrast to the 1950s and 1960s when capital investments involved new machinery, new plants and refineries; today's capital investments are likely to be in soft assets. Investments in soft assets are new product development and launches, scientific research & development (R&D), patents and intellectual property, sales team expansion, improved customer service efficiency projects, and enterprise network security.

The modeling process for capital investments involves deploying Prescriptive Analytics to determine whether a possible capital investment will increase or destroy enterprise value. Capital investments and their resultant impact on operational metrics can assist an organization to optimize decisions centered on a planned sales team expansion; plant capacity or extension; the optimal time of the year to release a product extension. Prescriptive analytics plays a major role in mergers & acquisition (M&A) modeling. Acquirers, most times, must pay a premium over the market value of the company to purchase it. It is often difficult for companies to generate the level of return on equity (ROE) on acquisitions that they generate from existing operations because of the premiums paid to control a majority stake in an enterprise.

Prescriptive analytics can play an integral role in M&A modeling by bridging the gap between valuation models, daily operations, and the timing of when key integration projects will be implemented. With prescriptive analytics — enterprises can identify the key operational metrics that will enable them to attain planned recurring revenue and cost synergies; devise tactics that influence operations and the resultant financial outcomes. For instance, the acquirer can model optimized staffing levels for customer-facing roles to achieve efficiencies in the daily operations of the combined company.

Prescriptive analytics can also be utilized in a myriad of other ways. For instance, whether to cancel or postpone hiring plans; model customer acquisition and retention scenarios; how to increase asset utilization; and how to capture synergies from cross-selling opportunities or improve pricing decisions.

How to Avoid M&A Failure

1. A successful M&A strategy should start and end with a best-in-class FP&A team. Due to FP&A being tasked with developing and activating long term growth of a company, its involvement with capital allocation decisions, FP&A is well-positioned to propose or oppose value-creating or value-destroying acquisitions respectively. Furthermore, FP&A, being the analytics hub for the organization, has a unique vantage point because it supports different internal groups—marketing, sales, product, human resources, customer success, operations, R&D, etc.; monitors the performance of peer companies; and scans for external opportunities and threats (e.g., legal, economic and geopolitical). As a result, FP&A can undertake detailed bottoms-up driver-based synergy estimations—that incorporate external and internal financial or non-financial metrics. Below I have delineated a three-pronged approach FP&A teams can leverage to avoid potentially value-destroying acquisitions.

- Quantify risk to recurring revenue synergies. Acquisitions of companies in a complementary market are underpinned, mainly, on the revenue synergies the combined enterprise is expected to generate. However, it is common for customer churn of the target firm to occur after the acquisition is concluded. FP&A, based on experience and comparable deals should be well-versed at identifying the potential revenue that will be lost from the acquired firm’s revenue base. Extensive sensitivity analysis can be run to highlight to the C-suite and the board the likelihood of untenable pre-acquisition revenue synergies not being realized. Acquisitions often lead to the elimination of product extensions, merging of product/service lines, or reduction in product capabilities which could irk certain customer segments—and result in the loss of profitable customers. (See article: Unlocking the Value in FP&A Data Science & Analytics – Section Customer Value Management)

- Evaluation of cost synergies (magnitude and timing). Acquisitions, whereby cost synergies are the main focus, are common when the acquirer is planning to mitigate the effects of declining year-over-year revenue growth rates. In such an environment, acquisitions represent a speedy boost to the bottom-line. In order to achieve cost synergies, FP&A, for example, partners with Human resources-, IT, Legal and Operations, early in the deal process to accurately model the magnitude and timing of general and administrative (G&A) costs that are likely to occur during the integration stage. It is imperative to accurately model integration costs, whether they are one-time in nature and include—severance payments, pension liabilities, retention bonuses; ongoing costs—costs saved due to headcount reductions of customer-facing personnel, consolidated sales organizations, combined procurement, marketing spend and research/development costs.

For global companies, there are, commonly, complexities with the magnitude and timing of cost synergies—such as headcount reductions in countries with stringent employment laws where work councils are typical. It is not advisable to leave the estimation of synergies to the M&A department or external advisers—such as investments banks alone. M&A departments and external advisers can accurately model cost synergies, however, it is likely to be a high-level, financial analysis which could potentially underestimate integration costs

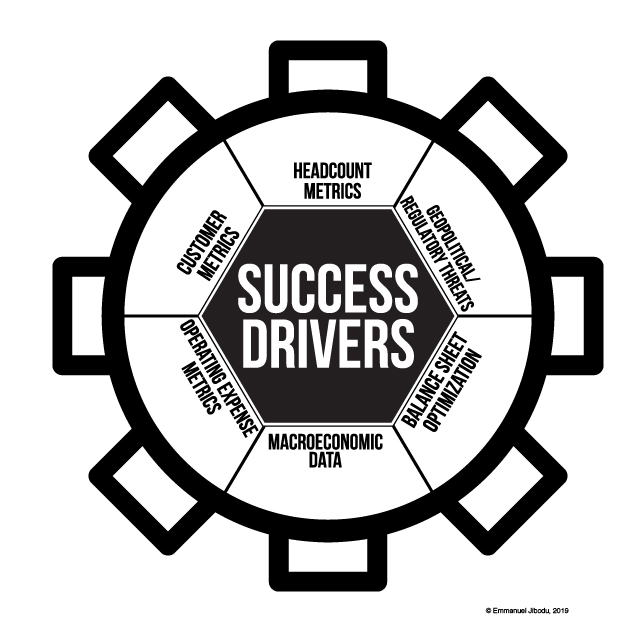

- Identify 4-6 business drivers that signal deal success. Business drivers should be internal or external in nature and should be managed to ensure the success of the acquisition. This process, facilitated by FP&A, should occur during the pre-acquisition stage and monitored until post-acquisition (24 - 36 months after the closing date). Lessons garnered from previous acquisitions, peers, benchmarks and comparable transactions can be applied here. These business drivers include, but are not limited:

- Customer metrics (e.g., customer churn rate)

- Economic metrics (e.g., price elasticity of product/service)

- Operating expense metrics (e.g., marketing spend as a percentage of revenue or R&D-to-sales ratio)

- Headcount metrics (staffing levels and productivity metrics of front-line employees, for example)

- Balance Sheet optimization through tax optimization or better financing terms

- Geopolitical, regulatory or competitive threats.

2. One way to avoid overpaying for a target is not to proceed with the purchase. However, transactions are never quite so simple and a competitor, with a stronger balance sheet, who is more nimble or accustomed to a shorter due diligence time frame could purchase the target firm. Acquirers are sometimes embroiled in bidding wars for targets, which could potentially lead them to overpay. A publicly traded SaaS company, named XY Inc, for example, looking to purchase a target could encounter a situation where a target is valued at a rich valuation of—9x EV/NTM subscription revenue or it could be based on 20x NTM subscription revenue. If XY Inc. is trading at a relatively high multiple compared to historical levels, XY Inc. can purchase the target with equity rather than making a 100% cash deal—by issuing new shares and using the cash to proceed with the acquisition.

Another approach XY Inc. can deploy to avoid overpaying for a target is to undertake M&A deals with earn-outs. Earn-outs are used when acquirers do not want to pay 100% of the purchase price up front—acquirers will pay a portion of the purchase price upfront and the remainder at a future date when certain conditions are met. Earnouts are common when privately-held tech start-ups are being acquired. XY Inc., for example, in a bid to purchase a SaaS startup, may offer $850M in cash, $130M in stock, and a multi-year earn-out bonus (e.g., based on the attainment of adjusted EBITDA of $157M by 2021, the target firm’s shareholders will receive an additional $176M). By using well-structured earnouts, acquirers can mitigate purchase price risk associated with overpriced acquisitions.

Organizations, whether publicly listed, PE sponsored or venture capital backed are pursuing M&A deals for varied reasons. The fact is, with Central Banks increasing interest rates and volatile capital markets, organizations are likely to continue undeterred in the foreseeable future to pursue acquisitions, whether they are smaller transactions (<$100M), mid-cap ($100M-$1B) or large (>$1B). The question is, will they be value creating or value-destroying acquisitions?

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.