Imagine you have 3 minutes to explain to a six year old what FP&A is and...

Companies reducing the size of their Financial Planning & Analysis (FP&A) finance teams are cutting valuable resources in the misbelief that is not a priority. That’s untrue.

Companies reducing the size of their Financial Planning & Analysis (FP&A) finance teams are cutting valuable resources in the misbelief that is not a priority. That’s untrue.

So, what’s the role of FP&A in today’s company anyway?

Our worlds are moving at hyper-speed, so to be successful we need to focus on our core mission. In FP&A this mission is to help organizations accumulate new knowledge faster than their competition.

“In the information-age the organization that can most effectively accumulate new knowledge and leverage that insight to make better decisions wins.” Barry O’Reilly

FP&A is the winning strategic player for fast-moving companies. In reality, this mission has become obscured, so first, you must take time for reflection and then re-evaluate your direction. More than surviving the downturn, it is time for action.

FP&A can lead when you focus on the three principles of FP&A.

Three Principles of FP&A

- ACTIVE PARTNERSHIPS: Take a more active business partner advisor role when converting your company’s strategy into an action plan.

- PROACTIVE RESOLUTIONS: Answer business problems that are aligned to the plan and that action can be taken on, don’t focus on solutions looking for a problem.

- CHANGE THE GAME TO WIN: Use the insight and data to help change the course of your company by influencing the strategy to a winning one based on factual data.

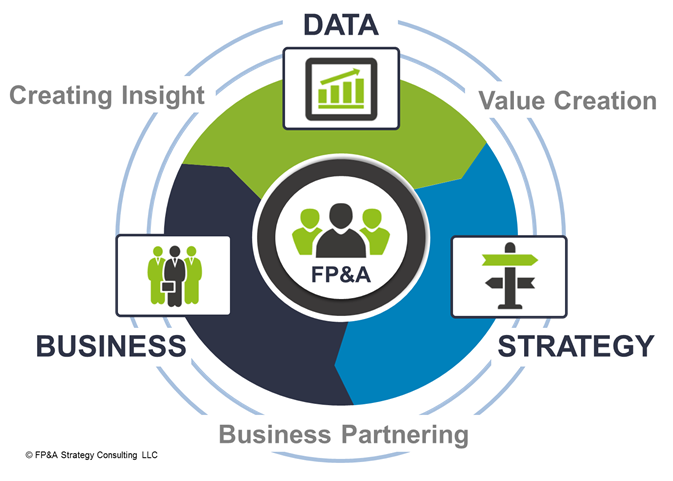

The winning FP&A Value Cycle© is a framework to create huge value within your organization. Your FP&A team are the intersection of 3 key elements: Strategy, Business and Data. They create momentum between each intersection, driving the cycle forward.

To win in today’s economy, a company must learn and take action faster than their competitors! FP&A is truly a forward-looking part of the organization. Together, we will drive the cycle.

1. ACTIVE PARTNERSHIPS

“A strategy that fails to define a variety of plausible and feasible immediate actions is missing a critical component” Richard P. Rumelt (Good Strategy Bad Strategy: The Difference and Why It Matters)

FP&A is a consulting support function to the organization’s business leaders. Being a business partner and building a plan is not new; being a leader is.

The first step in planning is to start with strategy and translate it into actions vs. sending out a slew of excel spreadsheets! Being able to translate the vision of the company’s direction with FP&A is often difficult, but rewarding. Not building a plan that is aligned to it will be disastrous.

Think of the strategy as a beacon and the plan is the instructions on how to get there. For FP&A having a deep understanding of the strategy and vision and translating that into a plan that is aligned to all the aspirations of the company is critical.

2. PROACTIVE RESOLUTIONS

Deep understanding of the business problem is time well invested – i.e. what is the problem, who has this problem and the value that will be gained from solving it (this last one is often left off). The VALUE is the key to getting the resolution!

Once the strategy has been translated into clear instructions, it’s time to get to work solving some of the known unknows – the things we know we don’t know. Techniques like design thinking, customer discovery interviews and 5 Why's, are all great tools to gain a deeper understanding of organizational problems and their associated value. This will be seen as proactive by leadership and embraced as a solution.

Unfortunately, what I often see is teams creating endless reams of data and dashboards with no real understanding of the business problem they are trying to solve or the value they are generating from this insight.

EXAMPLE: Target, a US retailer. In early 2012 their strategy was to provide long-term value to guests. This strategy was translated into goals and targets and through that process, the business asked the question, who are Target’s loyalist long term guests. Through analytics, it was found that parents to be were the most loyal long-term guests.

Notice the direction of the data – we started with the strategy and moved into business questions, not from the data. Often when people have too much data, they start from the data to figure out the answer and generate reams of reports that solve no problems.

Target has reams of data on their customers, and it turns out, through predictive analytics they can predict with 80% certainty what trimester you are in. Armed with this information it becomes very easy to target certain customers with coupons, and they were able to grow from $44 billion in 2002 to $67 billion in 2010 3.

3. CHANGE THE GAME TO WIN

Armed with the new insights we have an opportunity to influence and drive the winning strategy. Generating insight that drives the business is great, however to make a longer-term impact we need to complete the cycle. These insights must be fed into the strategy - this is the most critical part.

Once the insights are generated, the only way to incorporate that knowledge back into the cycle is to influence the strategy that in turn influences the plan and in turn influences the insight. For Target we can see how the strategy evolved over time as they realized the power of driving customer insight and in 2015, their strategy evolved to: Target will create a more guest-centric experience. For a company to grow smarter, FP&A must become more forward looking.

In order to survive and thrive, FP&A must begin to leverage the FP&A Value Cycle© for continued growth!

References:

1. The most important metric you’ll ever need – Barry O’Reilly

2. Good Strategy Bad Strategy: The Difference and Why It Matters

3. Forbes - How Target Figured Out A Teen Girl Was Pregnant Before Her Father Did

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.

James Myers is the founder and CEO of FP&A Strategy Consulting, helping to accelerate finance transformation resulting in smarter organizations that focus their talent on issues that matter.

James Myers is the founder and CEO of FP&A Strategy Consulting, helping to accelerate finance transformation resulting in smarter organizations that focus their talent on issues that matter.