In this article, the author explores top 3 impacts of AI & ML on FP&A people, processes and...

Much has been written about the preponderance of data that enterprises have access to in today's business landscape. This is the first part of a three-part series on the business value that data science and analytics can provide to enterprises.

Much has been written about the preponderance of data that enterprises have access to in today's business landscape. This is the first part of a three-part series on the business value that data science and analytics can provide to enterprises.

In today's uncertain macroeconomic, geopolitical, legal, and competitive landscape, where 100-year old business models have become defunct, data represents a veritable goldmine to enterprises in their quest to grow revenues and manage their costs. Some posit that all enterprises, today, are in the technology industry because digitization is disrupting every industry whether it's retailers, taxis, tractor manufacturers, banks, insurance companies, or other staid industries.

Autophagy, a metabolic process in mammals — whereby cells dissemble and remove their dysfunctional components. As a result, it yields anti-aging effects and reduction in inflammation for the human body. This is analogous to enterprises with poorly executed strategies; ill-conceived product extensions and launches; ill-considered business models that face shakeouts in today's business environment.

Today, the Office of the Chief Financial Officer (CFO) is commonly at the forefront of leveraging the treasure trove — that is data to enable an enterprise to thrive in today's globally-linked business environment. Under this remit, within the Office of the CFO, lies the Financial Planning & Analysis (FP&A) team, which emerged in the last few years to link the executive team's strategy to financial outcomes; act as the analytics hub for the enterprise due its unique vantage point — it supports different internal groups — marketing, sales, operations, R&D, etc.; operate as a sounding board on decision making across the organization in order to ensure an enterprise follows a disciplined capital allocation strategy. In various countries across the globe, FP&A is known as corporate performance management, business performance management, finance business partnering and even business controlling.

The skill of an organization's leaders at investing the capital of its owners (shareholders or private-equity investors) can have as much influence on future returns as the economics of its assets (patents, plants, equipment, customer data). Do the leaders of an enterprise have a track record of delivering best-in-class returns from its assets, or are acquisitions, research and development activities, product launches hit-or-miss?

Data science & analytics lies at the crux of a disciplined capital allocation strategy whereby data can be harnessed to ensure that leaders execute initiatives that increase enterprise value. For publicly traded companies, it is commonplace for activist investors to have opposing ideas regarding the strategy deployed by the C-suite. A disciplined capital allocation strategy corroborated by best-in-class data science & analytics initiatives will enable CXOs confidently defend their strategies, business models, or ideas when they are questioned, or even lampooned by activist investors.

A study by MIT showed that enterprises with data-driven decision-making environments had 4% higher productivity and 6% higher profits than the competition. Over the short-term, 4% higher productivity might not appear to be significant. But over the medium-term and long-term, this productivity gains would cause significant disparities between industry participants due to the power of compounding.

Data Science and analytics involves, but is not limited to, the sub-branches identified below:

- Core Business Analytics

- Machine Learning (ML)

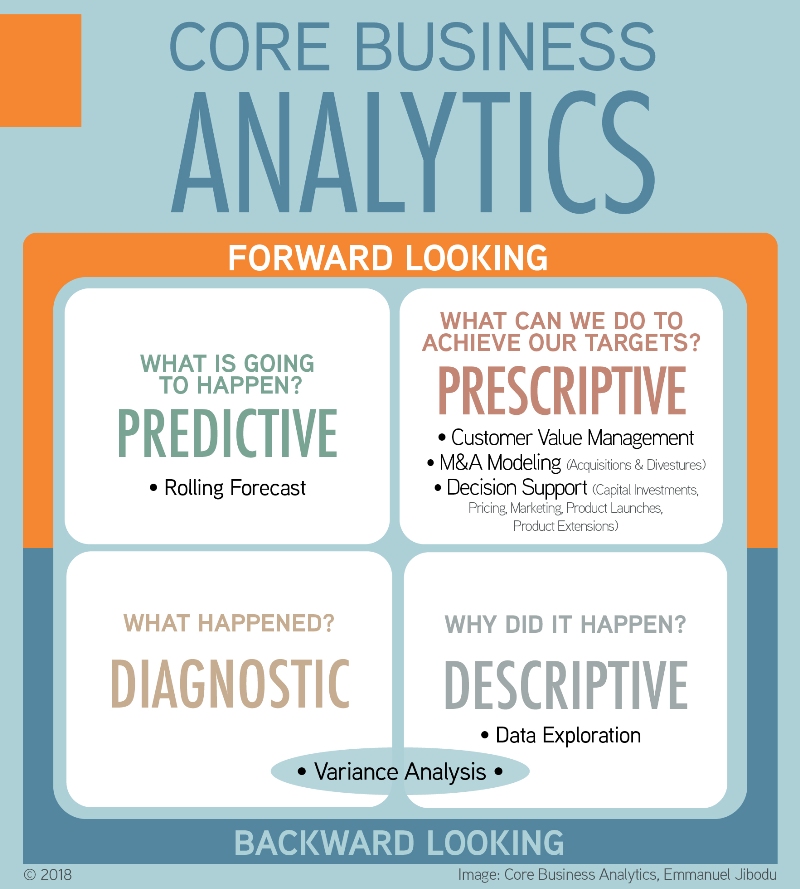

Core Business Analytics: This has its origins in business intelligence (BI), the use of online analytical processing (OLAP) software tools, data mining, and the analysis of multidimensional data. Analytics, simply, involves leveraging mathematical equations and algorithms, or even statistical models to understand, explain, monitor, forecast, and influence business performance. The four core areas of business analytics include:

- Diagnostic analytics - what happened?

- Descriptive analytics - why did it happen?

- Predictive analytics - what is going to happen?

- Prescriptive analytics - what can we do to achieve our targets or course correct?

Machine Learning (ML). This is not a new concept — the term has been around since 1959. It involves software applications that can recognize patterns. Based on data, and algorithms, the software application recognizes patterns and produces an outcome.

Eventually, the application gets to a point where there is enough information and history that it makes changes to the algorithms automatically, without being programmed by humans. At this point, the application can infer new knowledge. That is, the ML model leverages statistical models to infer correlations, anomalies, and trends in data. Within the finance function, it can be as simple as processing things in a back office — for example, telling you whether a billing error has occurred.

When an organization decides to apply machine learning tools in its business processes, first and foremost, it is important that process owners develop stringent evaluation criteria about how performance will be measured. Examples of machine learning tools that can be applied include regression analysis, classification, clustering algorithms and similarity algorithms.

Today, machine learning tools have become commercialized to a greater degree and can be deployed speedily by enterprises because they are available as software-as-a-service (SaaS). An example of a machine learning solution is IBM's Watson Machine Learning.

Critics of machine learning will posit the instances of false positives that ML algorithms could provide. Of course, the larger the historical data fed into an ML model, as a sample set, initially, the lesser the chance the model will produce false positives.

Sampling data is still very important today. Because the storage of data is not free — we cannot save and process all the data relevant to a subject matter. Memory and computing power are also not free. The combination and convergence of these factors ensure that data sampling is relevant today.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.