One important skill finance professionals are never taught during their formal education is the power of...

Companies are constantly looking for ways to improve their performance and there’s no doubt it’s easier if different functions work together on finding improvement ideas. It’s clear that certain functions execute the ideas while others support on the sideline and manage the outcomes of the ideas. FP&A is such a support function that typically works at the corporate or HQ level with strategic concepts ideally supporting senior leaders or top management even with driving their agenda. So, how can FP&A teams most effectively help their stakeholders improve performance? The answer is Business Partnering and let us expand on that.

Companies are constantly looking for ways to improve their performance and there’s no doubt it’s easier if different functions work together on finding improvement ideas. It’s clear that certain functions execute the ideas while others support on the sideline and manage the outcomes of the ideas. FP&A is such a support function that typically works at the corporate or HQ level with strategic concepts ideally supporting senior leaders or top management even with driving their agenda. So, how can FP&A teams most effectively help their stakeholders improve performance? The answer is Business Partnering and let us expand on that.

Business partners help drive company performance

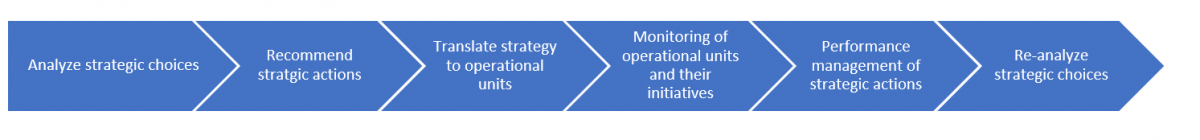

As a business partner, the job of the FP&A team is to participate in strategy meetings where different options are discussed to drive the company forward. The FP&A team should help qualify each option so that the best choice can be made. The team should even give a recommendation based on what the analysis of the options shows. Once a decision is made it filters down to the operational units for execution and the FP&A team will keep track of the overall performance. To really drive the performance, however, the FP&A team should stay in close dialogue with the operational units and help the line managers as well as the local finance teams better understand the strategic choices made and how to translate them into execution. In this case, Business Partnering goes both up and down in the company hierarchy where first the FP&A team helps senior management make the right strategic choices and later assists the operational units to understand the choices and translate them into local initiatives. Without this link, there’s a very high likelihood that the translation of strategic choices is misinterpreted and company performance suffers. To visualize how FP&A can use Business Partnering to improve company performance we can look at below flowchart.

This chain of actions can essentially be repeated over and over as a continuous improvement cycle of company performance. It “only” requires that the FP&A team is treated as a trusted partner by both senior management and the operational units.

How is this different from what FP&A has always done?

Surely, there are pockets of excellence here and there where a FP&A team has always been involved in making strategic decisions and translating them to the frontline. However, FP&A has been focused on getting strategic choices handed over to them to forecast the effect of same and prepare a budget that would show the total outcome. Then a message was sent to operational units to hit those budgets and every time they would fall short the line manager would receive an e-mail (not even a phone call) to explain what actions (s)he would take to improve performance. Not a lot of team-work or collaboration is involved here and often the FP&A team would fail to understand why the operational units didn’t just follow the plan! In simple terms, they never understood the plan (and you must wonder if the FP&A team did either) hence no wonder why performance didn’t follow.

One example could be that due to a bad year management decides to tell all units to cut 10% from their spending. No direction is given as to what actions should be taken. No patience is given to non-performance. Perhaps an initiative to cut 10% might not be a strategic action but still, the FP&A team needs to act as a partner to management here and help them make some smarter choices. FP&A should know where there are improvement opportunities both on revenue and costs to reach the same impact as a 10% cut on costs across all units would yield. At the same time, FP&A can easily help translate the strategic action to operational units because they have been deeply involved in the decision. Instead of a one-sentence order to cut 10% FP&A can pass on suggestions as to initiatives the operational units can take to reach the desired results. This will make it easier for everyone to deliver and FP&A is at the center of this.

In conclusion, Business Partnering is what will make not only the FP&A team more successful but more importantly also improve the overall company performance. So, what’s stopping you from getting started right away?

The article was first published in prevero Blog

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.