True Business Partnering starts when the FP&A community fully owns the numbers, completely agrees with them...

An omnipresent foe in business case development is the Premature Conclusion: glomming onto an early idea before all the information is in and the situation well understood. An idea appears attractive, but in reality, may be a second-rate solution that wastes precious capital.

An omnipresent foe in business case development is the Premature Conclusion: glomming onto an early idea before all the information is in and the situation well understood. An idea appears attractive, but in reality, may be a second-rate solution that wastes precious capital.

This article explores overcoming our own misconceptions of barriers to partnering, identifying the true cause in any specific situation, and establishing financial planning and analysis (FP&A) as indispensable partners to the business leaders we serve.

Lessons from CapEx: Dangers of Premature Conclusions

When facilitating business case development for major capital expenditures or other strategic decisions, I arrest the rush to a conclusion with proven Root Cause disciplines such as the “5 Why’s” to reveal deeper insights, provoke greater innovation, and generate higher returns using fewer resources.

Despite this wonderful value proposition, I am not always welcomed by business teams as an indispensable partner for big decisions. I usually overcome initial hesitation of resistance, developing deep mutual respect and rapport… but not always. In such situations, it is easy to assure yourself that you had made the best of an impossible situation and hope the next business team would be “more open-minded”.

But our perception that the business team is not open-minded is a superficial diagnosis; further, our instinctive response of asking leadership to enforce our involvement is likely a second rate solution. We are in danger of succumbing to that foe: the premature conclusion.

Good Business Partnering Starts with a “Why”

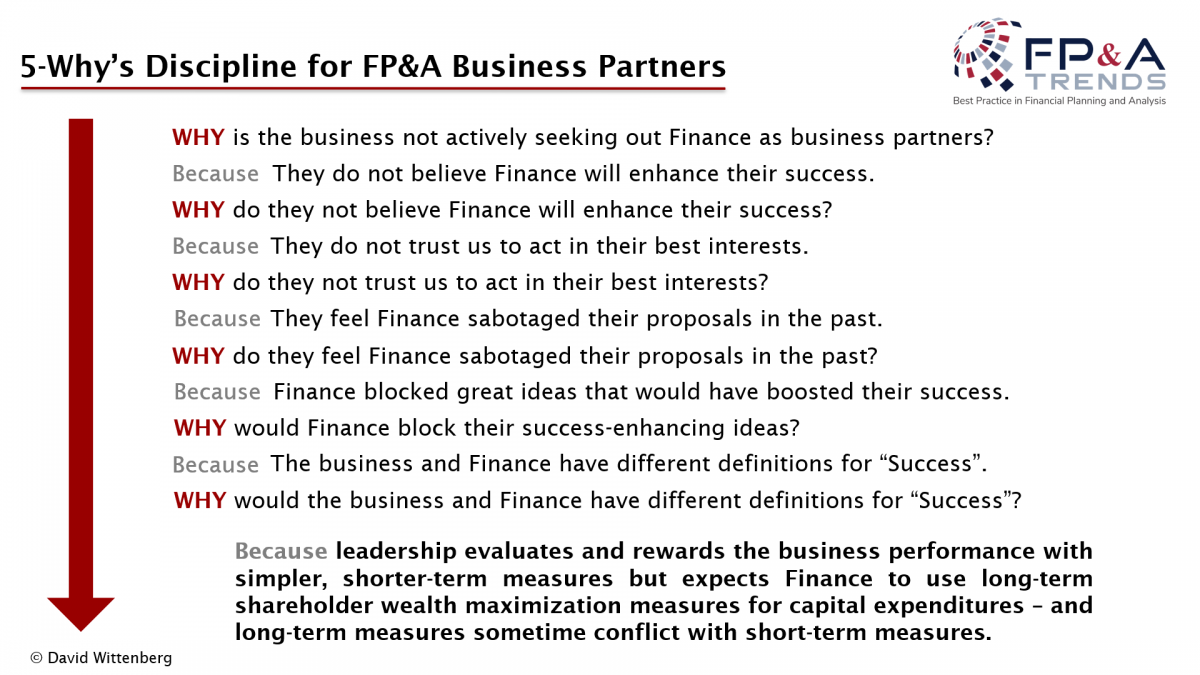

When working together with business teams, Finance needs to perform the same Root Cause Analysis we employ in capital expenditure problem-solving. To overcome business resistance to partnering, Finance must understand why businesses resist or minimise Finance’s involvement.

It is as simple as asking “Why?” Why are businesses not engaging Finance as indispensable business partners? We rarely take quality time with this question because, as our business team clients, we think we already understand the cause – but every situation is unique.

Bringing it back to the question before us: “Why are businesses not engaging Finance indispensable as business partners?” Well, in the starkest term: Because they do not believe Finance will enhance their success.

Self-Impose 5-Why’s Discipline

We might chuckle at such a baby step in answering this question, but we need to use baby steps for effective root cause analysis. At each level, I may generate more than one “why” to the prior answer and then continue the Why’s along separate branches. If I leap too far ahead, I could miss valuable insights into causes and then miss effective solutions.

I self-imposed the 5 Why’s several times with different conclusions and solutions as each situation varied, but one particularly memorable session stands out.

A Finance team was frustrated from the business holding them at arm’s length and the version below is streamlined to illustrate just one branch of discovery. While it might now appear an uninterrupted flow of logic, it evolved during multiple sessions with time for the finance team members to ruminate between sessions.

How Does It Work in Real Life?

What follows is a real-life example of a manufacturing plant I supported.

A business team developed a $14M equipment replacement and upgrade proposal that both maintained production volume and also improved several performance metrics impacting their bonuses.

It looked like it promised a good return, but our capital approval process required we back up and perform the 5-Why’s exercise (the team had skipped this exercise) and perhaps discover innovative new solutions.

The team dove into the exercise with genuine effort and, sure enough, their creativity spawned a new solution that promised 80% of the benefit for almost no capital – generating a much higher NPV and IRR than the original solution. Unfortunately, short-term operating metrics improved only a fraction compared to the improvements promised by their original solution.

The team’s exemplary 5-Why’s work and re-brainstorming clawed back operating metrics (their definition of success) because Finance was using different definitions of success: NPV and IRR. In the words of a team member, “You’re punishing us for doing what you told us to do!” – and they were right!

Very fortunately I successfully lobbied leadership to change the team’s bonus targets and reward them for scrubbing millions of excess capital out of their solution. They no longer felt Finance had sabotaged their success (and their wallets). Otherwise, they would understandably distrust Finance, and especially me, in the future.

What are the Main Principles to Follow?

The best 5 Why’s business partnering results happen when I follow a few principles:

- Give the process ample time, preferably over multiple sessions with time to percolate between sessions.

- Assume the business teams are rational – never fall into the trap of writing off different experiences and perspectives as irrationality or mental feebleness.

- Involve a trusted, informed outsider who can challenge our own biases and blind spots.

Conclusion

Business leaders will never be more receptive to high-quality finance support than they are today. The COVID-19 pandemic created resource shortages in most organisations and Finance’s central value proposition is helping to guide scarce resources to where they generate the greatest success.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.