I recently had the honor of moderating a global webinar focused on how Finance leaders can...

Business partnering is something everyone is talking about right now. The premise is that the more low-value finance tasks are automated, the more time finance practitioners have to work with their “customers” in the business. The only problem is that many business leaders are far from satisfied with finance’s performance to date as a valued business partner.

Business partnering is something everyone is talking about right now. The premise is that the more low-value finance tasks are automated, the more time finance practitioners have to work with their “customers” in the business. The only problem is that many business leaders are far from satisfied with finance’s performance to date as a valued business partner.

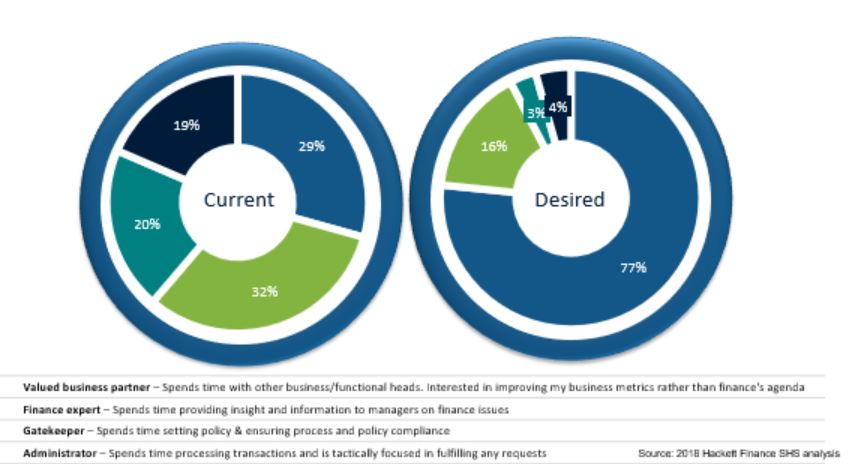

The Hackett Group data shows that only about a third of finance stakeholders in 2018 perceive it to be a valued business partner. The rest (see image below) see it as much more of a traditional finance function, setting policy, processing transactions and offering financial insight.

What’s more important is the pie on the right: what stakeholders would like to see – a 2.6X increase in finance’s business engagement. Clearly finance has a long way to go.

The data looks largely the same for 2016 and 2014. So, there’s no real improvement, despite digital transformation; the broad agreement that the real value finance offers is its collaboration with the business; and the fact that management is asking finance to play a bigger business advice role.

Changing Perceptions

Perception does not necessarily equal reality. It may well be that finance is a lot more engaged with the business today, but its stakeholders have failed to notice. Here are five steps finance can take to alter this perception:

- Become more customer-centric. Design-thinking and like techniques used to fall strictly within the purview of sales and marketing. But customer-centricity is now at the core of the new, digitally transformed finance delivery model. That means finance needs to review and revise processes and outcomes by looking at them through the eyes of its various customers; i.e., what information does each segment of stakeholders wants and needs to receive? How frequently, and in what format? For stakeholders to perceive finance’s expanding role, it must deliver its customers the information they need when they need it, and in a format they can easily digest. It may be that interactive visualization is a lot more effective way to communicate with business leaders. Or that business leaders want the information delivered directly to their mobile devices. Increasingly, it also means offering self-service analytics capabilities at the business level.

- Allocate more resources. When business partnering is a part time job, it shows in both the level of staff engagement and the corresponding perception on the business end. Assigning enough dedicated resources to partnering demonstrates finance’s commitment. One potential approach is for finance to assign a dedicated partner to each business or region, to ensure business managers know who to contact, and give finance the opportunity to build strong relationships with their peers.

- Visit the operations. Finance is moving more resources into service hubs, and away from the business units. That may create the perception that finance is “deserting” the business and turning inward. To counter that perception, it’s important not only to assign a point of contact but physically spend time with operations’ managers, participate in their meetings, listen to their concerns, and provide fit-for-purpose analysis and recommendations, framed within the business KPIs so its message resonates with its business colleagues.

- Integrate the business planning process. Integrated or collaborative planning can do a lot to promote finance profile as valued business partner. At leading FP&A organizations, according to The Hackett Group data, finance is the design authority of the integrated planning process; it combines and syncs the operations, marketing, logistics (etc.) planning process with its own, demonstrating its commitment to work closely with the business to set targets and optimize performance.

- Actively seek collaboration opportunities. Finance shouldn’t sit around and wait for the business to approach it with a question or a problem. It’s important that finance reaches out to the business frequently, offering its performance analysis and decision-support expertise. By being proactive, finance can add value and build credibility with the business, while demonstrating its commitment to collaborate with business partners.

The reality is that finance rarely measures its value contribution to the business. So, it cannot tell how and where it needs to improve to affect the reality, and perception, of its role as a valued business partner. Collecting metrics of value contribution is not easy. It’s much easier to measure process cost, or number of errors. But there are ways. One possible approach is to track the performance of business projects that have benefited from finance’s recommendations. Another is to track the business processes improvement achieved through finance recommendations. Finance must evangelize its value as a business partner by sharing tangible results and socializing its potential contribution throughout the enterprise.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.