I recently had the honor of moderating a global webinar focused on how Finance leaders can leverage FP&A business partnering to impact performance across the enterprise. The featured speakers delivered nothing short of compelling experiences and insights. Larysa Melnychuk, the founder and managing director of FP&A Trends Group, shared her insights and experiences in moderating International FP&A board seminars across the globe. I doubt anyone has had as much face time with FP&A leaders across the globe than Larysa over the past 4 years. Ander Liu-Linberg shared his experiences and insights relative to the ground-breaking finance transformation that has taken place at Maersk over the past ten years. I wanted to share just a few of the great insights and take-aways they offered to our webinar attendees.

I recently had the honor of moderating a global webinar focused on how Finance leaders can leverage FP&A business partnering to impact performance across the enterprise. The featured speakers delivered nothing short of compelling experiences and insights. Larysa Melnychuk, the founder and managing director of FP&A Trends Group, shared her insights and experiences in moderating International FP&A board seminars across the globe. I doubt anyone has had as much face time with FP&A leaders across the globe than Larysa over the past 4 years. Ander Liu-Linberg shared his experiences and insights relative to the ground-breaking finance transformation that has taken place at Maersk over the past ten years. I wanted to share just a few of the great insights and take-aways they offered to our webinar attendees.

In terms of the key attributes of an effective FP&A business partner Larysa offered the following:

- Good communication and stakeholder management skills

- Commercial curiosity and business acumen

- Strong leadership

- Good interpreter of data

- Ability to see both the big picture and the details

- Creativity: This is the paramount skill

- Personality types that thrive on new ideas and creative thinking, rather than just number crunching

Anders delivered very insightful content as he discussed how being an FP&A business partner is both a mindset and a role. The highlights of that discussion are as follows:

The Mindset:

- Purpose-driven

- Act as if company money is their own money

- They see it – they own it

- They think ”Customer First”

- They are role models

The Job Role:

- Participate in strategy meetings to understand company direction

- Participate in target setting

- Translate strategy into execution

- Performance management

- Own the numbers and communicate performance throughout company

- Share and implement best practices across the company

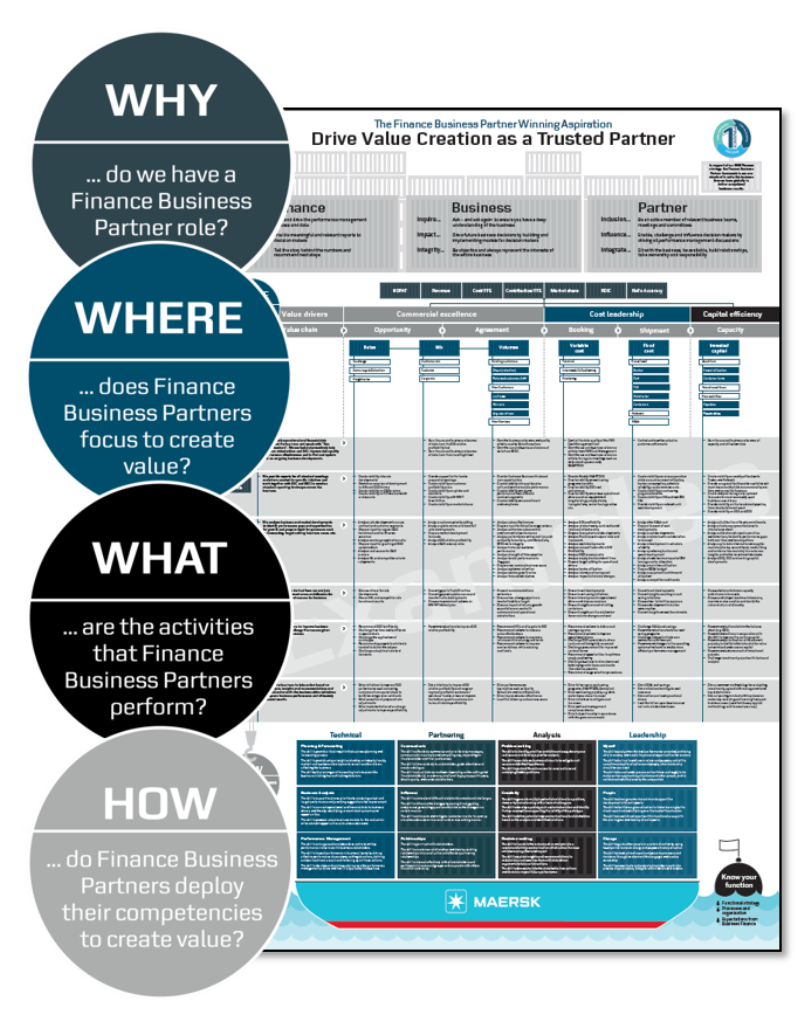

Anders also shared a framework for creating business partners that I believe can be leveraged by company leaders at companies of all sizes. A structured framework that is the WHY, WHERE, WHAT and HOW of what a finance business partner does; combines Business with Finance; offers six categories of activities: data, reports, analysis, insights, influence and impact; and leverages a competency model with four pillars: Technical, Partnering, Analysis and Leadership.

Larysa, shared the FP&A Business Partnering Maturity Model developed by the International FP&A Board. Any company can leverage this model to benchmark where they are at, determine where they want to be, and what it may take to get them there.

The conclusions and recommendations offered by Larysa and Anders are as follows:

- Do your Finance Transformation right and avoid short-cuts

- Be explicit about what Business Partnering is and what it's not

- Training is needed to be successful with Business Partnering

- Be patient as a Finance transformation takes longer time than expected to complete

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.