Victor Barnes, Global CFO, The McDonald’s Division at The Coca-Cola Company, shared their recent global digital...

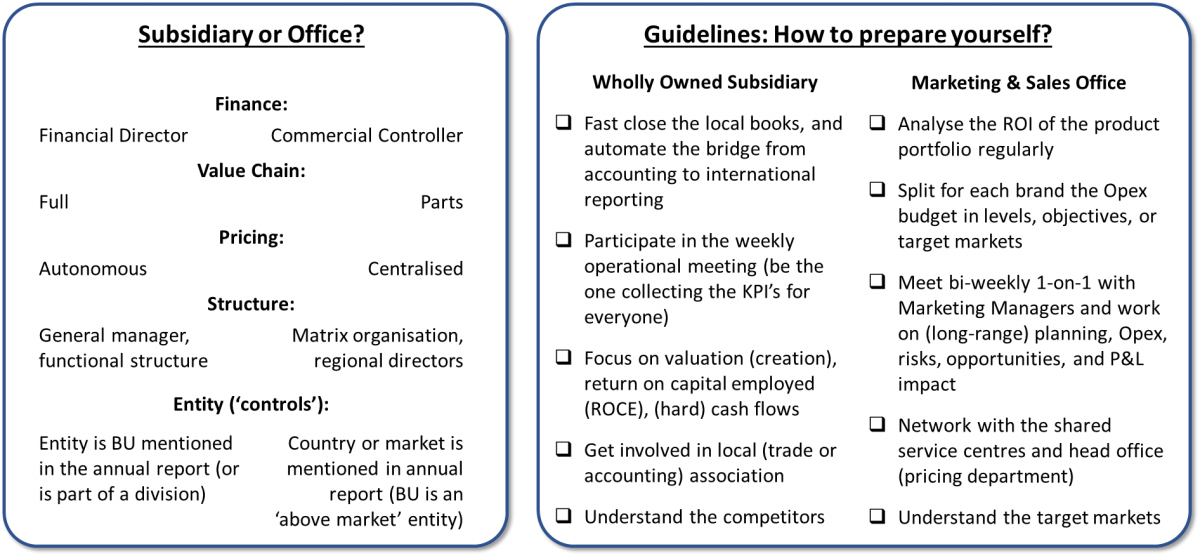

Every month the Managing Director or Country Manager has to report the business results to the CEO or internal board. Depending on the corporate structure, there are different narrative reports, each with a different focus. This defines the role of Financial Planning and Analysis (FP&A) and the information that needs to be collected for future growth. Two opposite cases will make the same point.

Every month the Managing Director or Country Manager has to report the business results to the CEO or internal board. Depending on the corporate structure, there are different narrative reports, each with a different focus. This defines the role of Financial Planning and Analysis (FP&A) and the information that needs to be collected for future growth. Two opposite cases will make the same point.

Narrative 1: The Wholly Owned Subsidiary

The first narrative is the traditional business. This is often an industrial business unit (BU) operating abroad, largely independent from head office. It can be considered a small or medium-sized enterprise (SME). Except for funding and investments, functions such as sales, marketing, services, accounting, human resources (HR), information technology (IT) or production are all based on site.

The 3-to-4-page narrative is divided into 4 parts:

1. General, green flags and red flags. This is a bullet point overview. The ‘general’ section will be about sales events, hiring, restructuring and a view of the revenue and operating profit (OP). The green flag section includes good things happening in the business such as new clients, positive exchange rate movements or contract extensions. Red flags indicate the opposite. For example, a competitor offering a very low price during a public bid, clients with payment problems, or concerns around a potential recession.

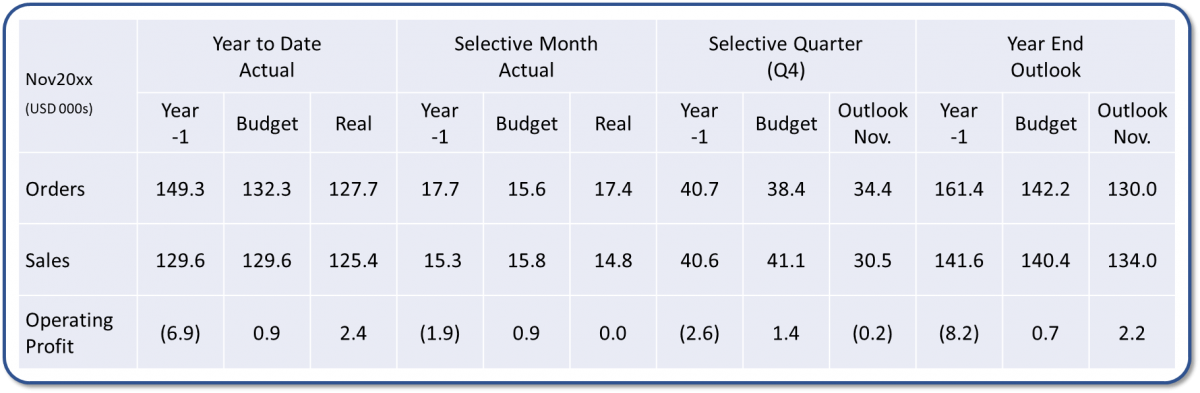

2. Financial summary. The key things to be included: Orders, Sales and Operation Profit (OP).

3. Explanation of the financial summary. Normally, for each item you can expect several paragraphs explaining each number:

4. Other relevant items. Additional items are covered here, such as headcount or full-time equivalent (FTE), inventory, purchases, debtors and overdue debts, delivery performance and other key performance indicators (KPI’s).

The narrative report comes with all the other reports. This information package goes to head office, where the CEO and CFO analyse them before having a conference call with the Managing Director or Country Manager. If there is a divisional structure the treasury function and FP&A team may firstly carry out some further analysis or company consolidation. Other reports might include rolling forecasts, that include sales, Operational Expenses (Opex) and OP, cost reports or KPI overviews.

In short, the focus of the narrative will be on the health of the local business and future sales opportunities.

Narrative 2: Marketing & Sales Office

The second narrative relates to corporations where functions like production, services, accounting, HR, and IT are mostly centralised at a regional level and outsourced. The BU can be considered a marketing and sales office, dependent on products from a shared services centre (SSC) or centre of excellence (CoE).

The narrative is divided into 6 parts:

1. Highlights summary. Here you can expect short statements on predefined corporate key success factors (KSF) such as sustainable growth, account-based marketing, innovative change or collaborative culture.

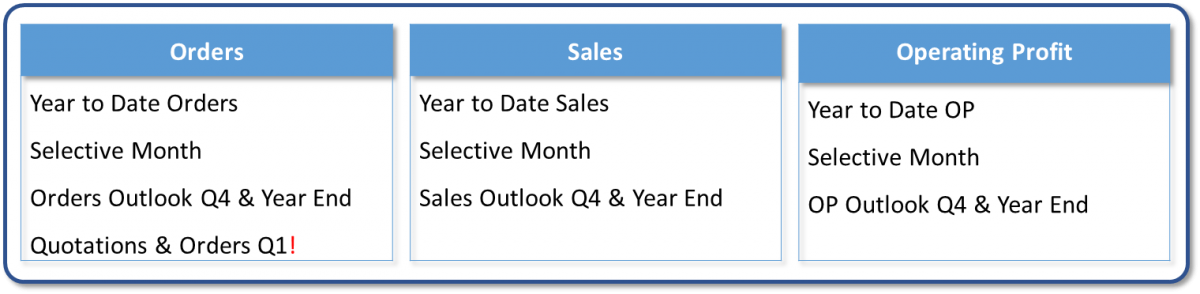

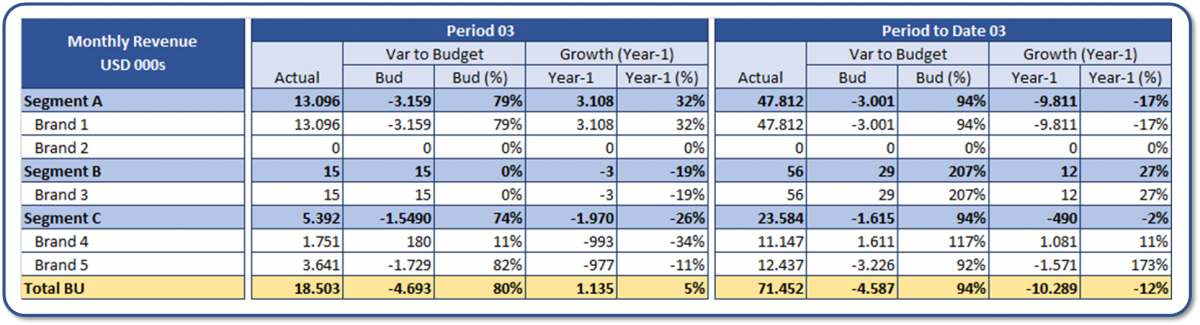

2. Financial summary. This is all about the brands.

3. Business environment (social, economic, regulatory). This will describe the local trends that are having an impact on the BU results, while possibly discussing any initiatives that are being pursued to offset them.

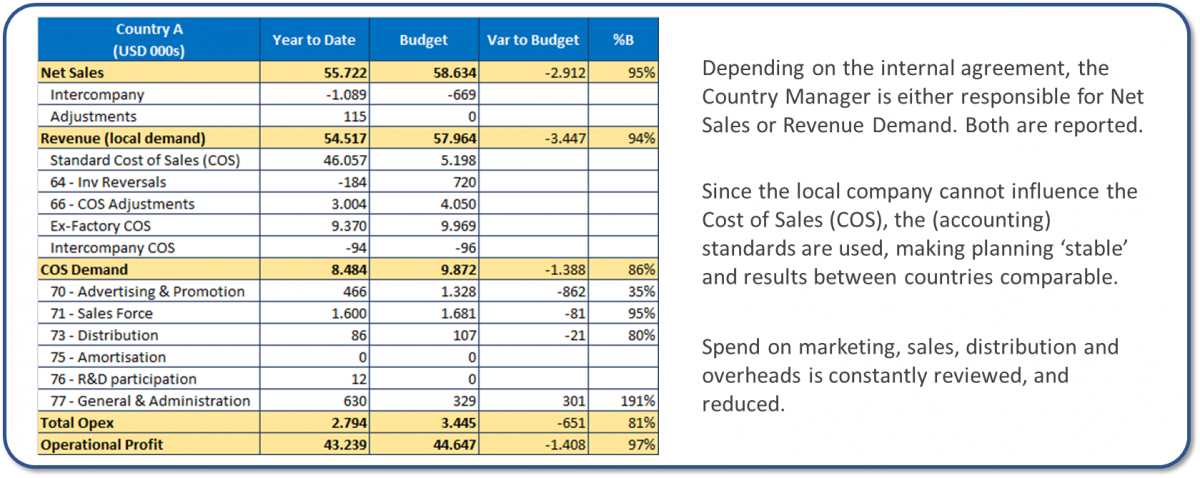

4. Financial statements. The profit and loss (P&L) of the BU will be presented with small notes from the local FP&A team explaining any reasons behind variances like product, (cost) accounting, planning.

5. Explanation of the financial summary. For each brand, the growth percentage will be explained in detail. This will include factors such as seasonality, pricing, delivery issues (out-of-stock), demand change, competitor actions and regulations. The marketing managers will provide the commercial information to support the variances. This part can often be several pages long.

6. Other relevant items. Next to a detailed headcount overview, other KPI’s or market research data might be mentioned here.

Again, the information package contains other reports such as a detailed headcount report, a rolling forecast, the long-range forecast, brand P&L’s, brand risks and opportunities (R&Os) and financial bridges. It is the local FP&A professional who will be preparing these reports for local, regional and head office usage.

In short, the narrative is about brand performance, growth and growth potential.

How to Make it Work?

For each narrative, some specific characteristics can be identified. These can differ for each business and will evolve over time. Based on two real cases, some guidelines are presented below on how to get started as a finance business partner.

Future Agenda: Collaborative Planning

Where is the business going? What are the brands doing? To answer either question the FP&A professional needs to business partner with all department heads in the BU, treasury, the CFO. Alternatively, business partner with all of the marketing managers, regional brand directors, and shared service centres around the globe. Each situation calls for collaborative planning, systems and skills. The right information needs to be collected and processed. The FP&A professional who also has business acumen that has been gained through different industries, or perhaps knowledge of competitive information gained through years of experience, will be considered an asset for the business and its future transition.

The article was first published in Unit 4 Prevero Blog

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.