Cash Flow analysis, forecast, and performance indicator reporting are a natural part of the work for...

“We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching our speedometer, where in fact we were running out of gas” – Michael Dell (founder and CEO of Dell Technologies)

Cash flow seems to be generally ignored by larger companies as the focus lies in growing and optimising profit and loss (P&L) in the general course of business. Saul Mateos, CFO at Pure Watercraft, in his capacity as guest speaker at the Digital Central European FP&A Circle, opined that. That said, the COVID-19 pandemic has made companies rethink cash flow planning. He advised further that a crisis is a perfect time to take advantage to plan for the future and realign company goals.

Saul Mateos leveraged his start-up experience to exemplify his quick pointers on cash flow planning in a start-up:

- Simple is better – burn rate, cash position, cash positive

- Watch out for working capital, the uncertainty of business outcomes, and be prepared for worst-case scenario

- Cash flow planning is closely planned and tracked in start-ups, given the need to keep shareholders and other stakeholders informed of the cash health of the company.

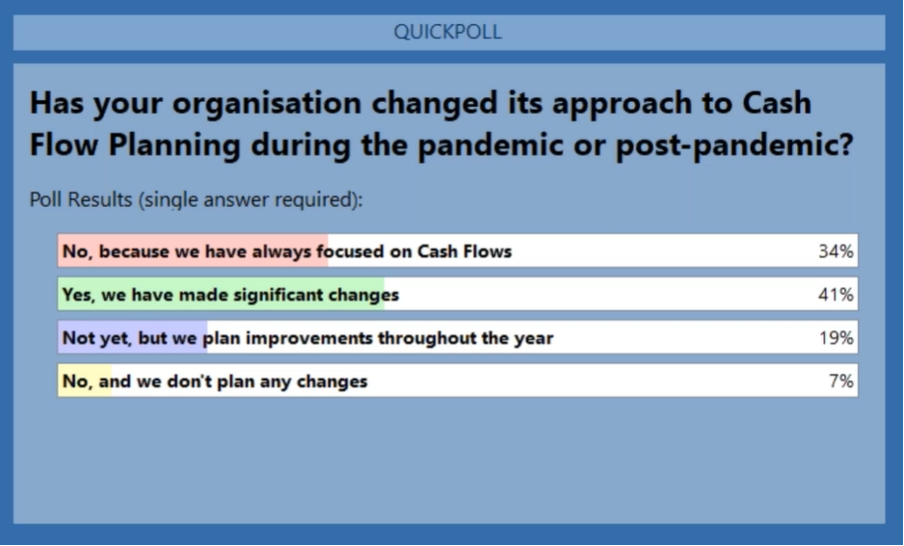

It was then very interesting to see the results of the poll amongst the audience, which showed that many companies had made significant changes to their approach to cash flow planning during- and post-pandemic.

Figure 1

The Mindset, Cultural and Performance Management aspects of Cash Flow

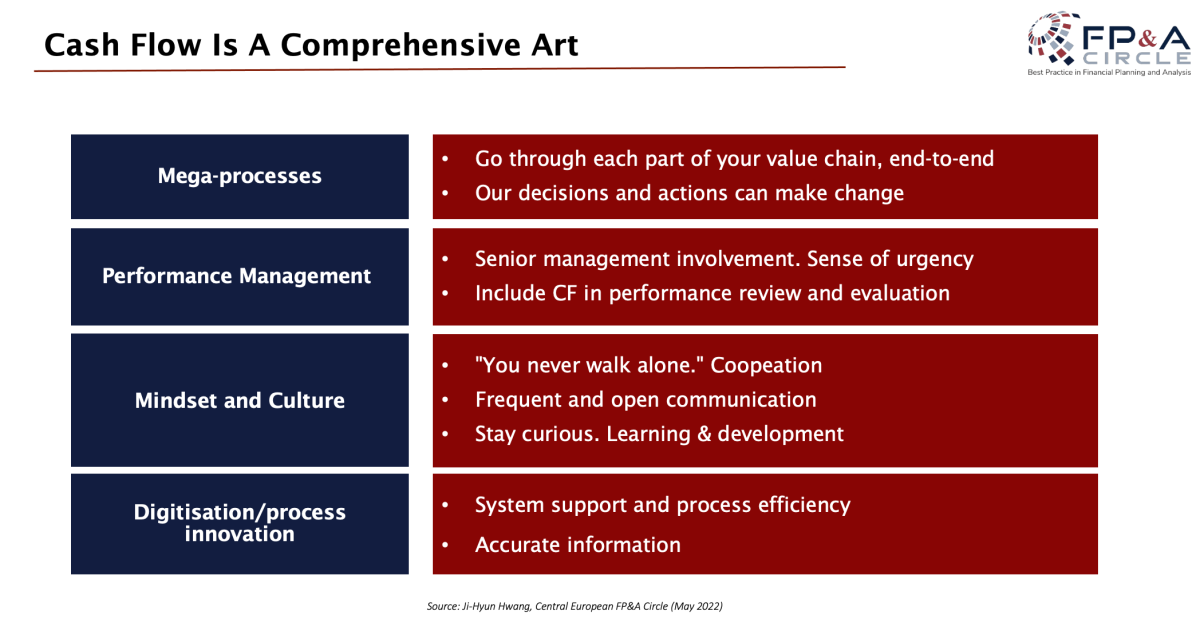

In the next part of the conversation, Ji-Hyun Hwang, Ph.D, Business Control at SEB explained that cash flow is a comprehensive art which involves:

Figure 2

Cash flow planning needs a hands-on deck on approach. The different business units need to be educated on the importance of such an exercise. This needs to result in a major mindset and cultural shift to obtain employees' buy-in for this.

Key Performance Indicators (KPIs) can be established for cash flow planning. This can enable the company to achieve “cash goals” rather than just “profit-oriented goals”. This can be very beneficial for especially larger listed companies to think like start-ups – to constantly plan a burn rate and improve on that.

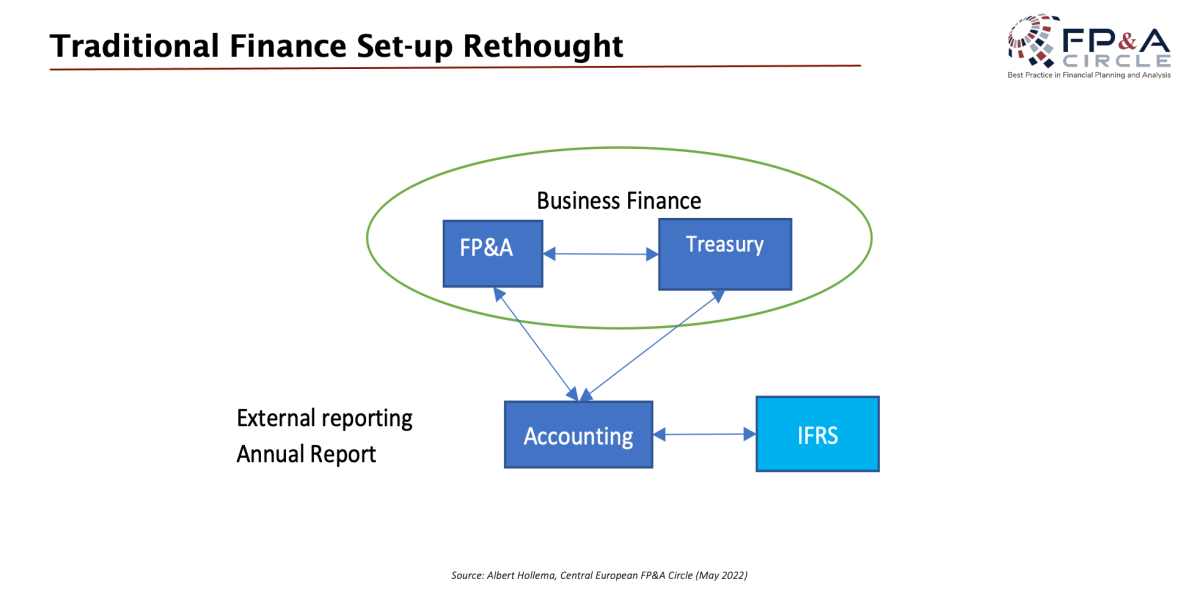

That said, it is easier said than done. This shift needs to be firmly supported by integrated systems and efficient consolidation tools. Furthermore, the traditional finance setup needs to be more accommodative to such systems. Cash flow planning would likely need to be a joint exercise between the FP&A and Treasury teams, given their correlated perspectives. They should join forces and effectively form a “Business Finance Team” as explained by Albert Hollema (Former Group Finance Director, Endemol Shine Group).

Figure 3

He further elaborated that FP&A commonly has a big picture outlook, whereas else Treasury is more aligned with the daily liquidity needs. Communication and mutual understanding are required here for both teams to escape their departmental silos.

Moving forward, Finance organisations should start thinking to hone and train their finance employees to think as “businesspeople”.

The goal here is to make employees more responsive, proactive and business-oriented rather than just focus on their individual functional units.

The audience in the webinar was then asked which parties were involved in their respective cash flow planning process.

The results were quite surprising. It is interesting to note that while Treasury, FP&A and other departments cumulatively (82%) conduct cash flow planning, 16% of the respondents claimed just Treasury plans cash flow. It can be concluded that some companies simply leave cash issues (which include planning) to Treasury.

How does technology enable modern Cash Flow Planning

Cash flow planning is an extensive process involving multiple additional human and financial resources. Nonetheless, it is an investment in the financial health of any company. Cash flow planning is complex and needs particular attention to bank statements, supplier credit notes, tax subsidies, etc.

Dr Arif Esa, Director of Solution Management, SAP, noted that one solution to circumvent such complications is Machine Learning.

Figure 4

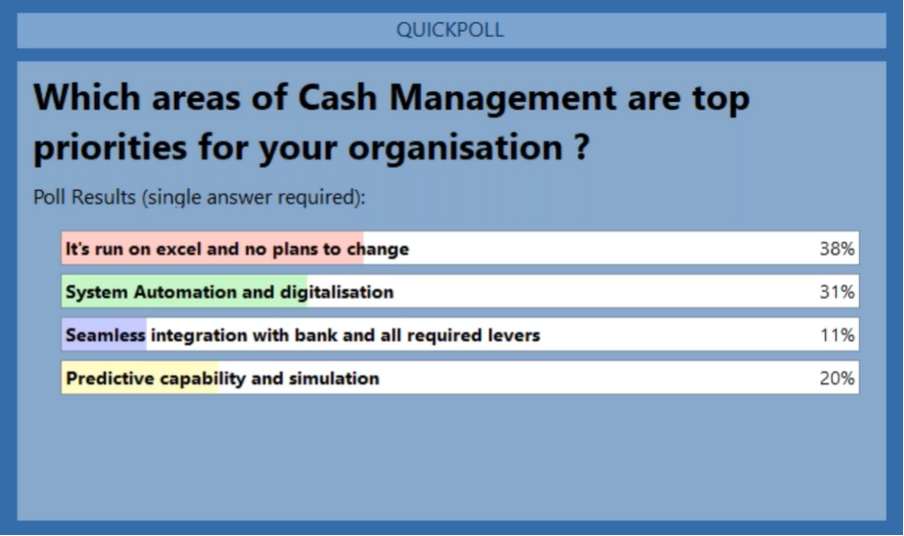

A final poll showed that the majority of the respondents unsurprisingly plan their cash flows in Excel. While this is great for the short term, the presumed simplicity of Excel may hinder future investment into cash flow planning systems. This, coupled with complex, impactful events such as sanctions and lockdowns, may render the cash flow plan on Excel ineffective. Hence, companies, depending on their size and life in the business cycle, should give serious thought to their planning systems.

Summary

The extreme need to have real-time reporting has been exemplified by recent big events, i.e. Pandemic, inflation rates increase, and supply shortages stemming from the war in Ukraine. Business leaders need to be provided with a constant flow of information to make informed decisions. Cash flow (aka bloodline of the company) is key here – a drastic change in cash has always been a traditional warning indicator of the financial health of a company.

Given the challenging current macroeconomic conditions, going back to financial basics (cash flow plan) will only strengthen a company’s foundation and allow it to weather the storm.

We would like to thank our global sponsor, SAP, for their great support with this Digital FP&A Board.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.