As I walk around various offices or even in social gatherings, I find many conversations about artificial...

Finance professionals need to make their plans trusted and accurate by conducting a detailed analysis of the available data. But the data deluge challenges their ability to maximize efficiency. So, finance departments are exploring self-service predictive planning techniques to help automate and speed up the routine.

Finance professionals need to make their plans trusted and accurate by conducting a detailed analysis of the available data. But the data deluge challenges their ability to maximize efficiency. So, finance departments are exploring self-service predictive planning techniques to help automate and speed up the routine.

This article details the main benefits and drawbacks of predictive planning. It provides recommendations on where to start your journey and how to avoid the most common mistakes.

What is the Business Value of Predictive Planning?

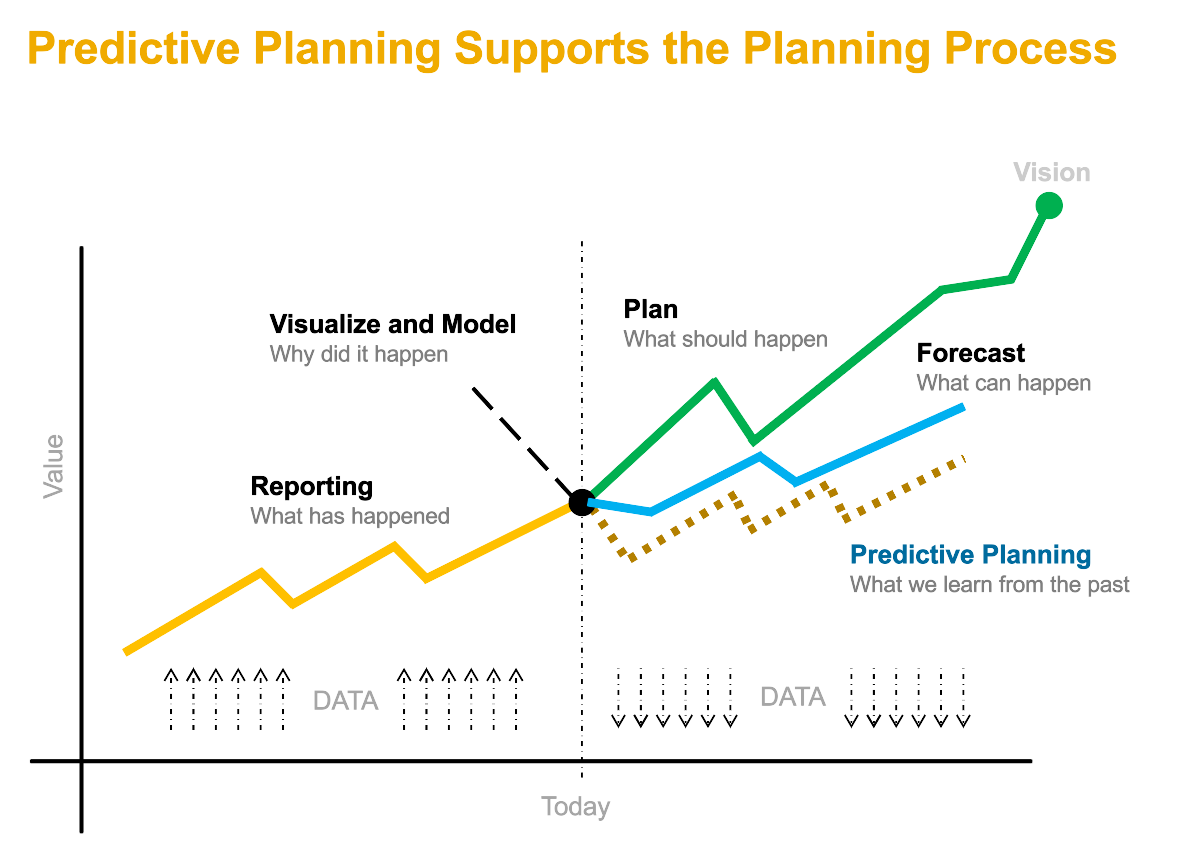

Predictive Planning brings an immediate benefit to the planning process. Based on past events, it can project the evolution of key financial indicators at scale, as illustrated in Figure 1. In case they do not use Predictive Planning, planners can only figure out the financial forecast from the manual analysis of past data, combined with business knowledge.

Figure 1: Predictive Planning Supports the Planning Process

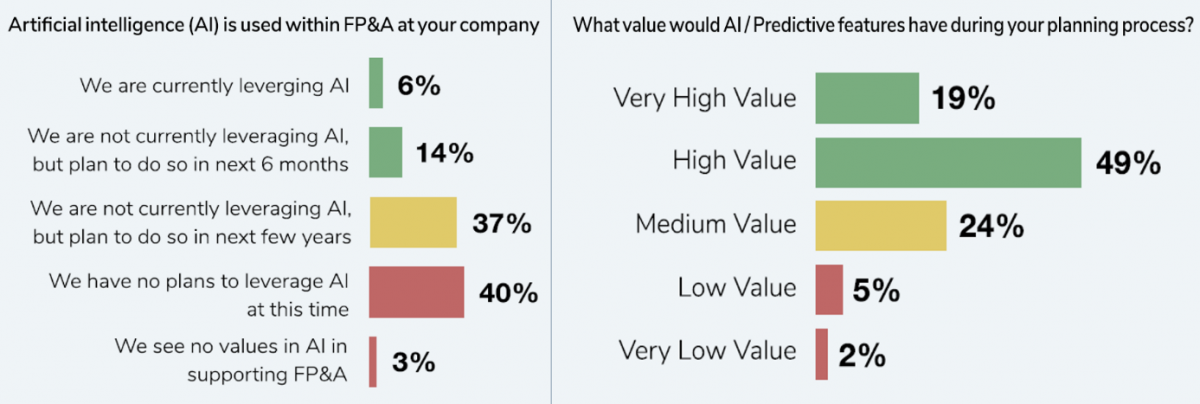

The FP&A Trends Survey 2020 found tangible adoption potential for Predictive Planning, as illustrated by two survey highlights:

- 50% of all surveyed companies are planning to leverage Artificial intelligence (AI) in the coming years.

- 70% of these companies are rating the value delivered by AI/Predictive feature during the planning process as Very High or High.

I think 2021 will be a breakthrough year for Predictive Planning.

Predictive Planning is Ready for Prime Time

Predictive Analytics is a technique for making predictions about future events, behaviours, and outcomes by using advanced analytics methods. Predictive Planning is the specific use of predictive analytics for planning purposes.

Forecasting in Financial Planning and Analysis (FP&A) terms means projecting the evolution of major financial key performance indicators (KPIs).

Predictive Planning can also quickly create forecasts of the most likely outcomes. For this, it requires historical data. This historical data corresponds to the evolution of these major financial KPIs. Organizations can apply Predictive Planning to every relevant business activity if they record historical data.

Finance departments have increased interest for predictive planning use cases. Several factors explain this:

- Planners have an ever-increasing appetite for data-driven planning, to speed up and ease their work.

- Software vendors democratized Predictive Planning techniques. Business users can use Predictive Planning by themselves and gain accurate and trusted predictive forecasts.

- Data is available and abundant.

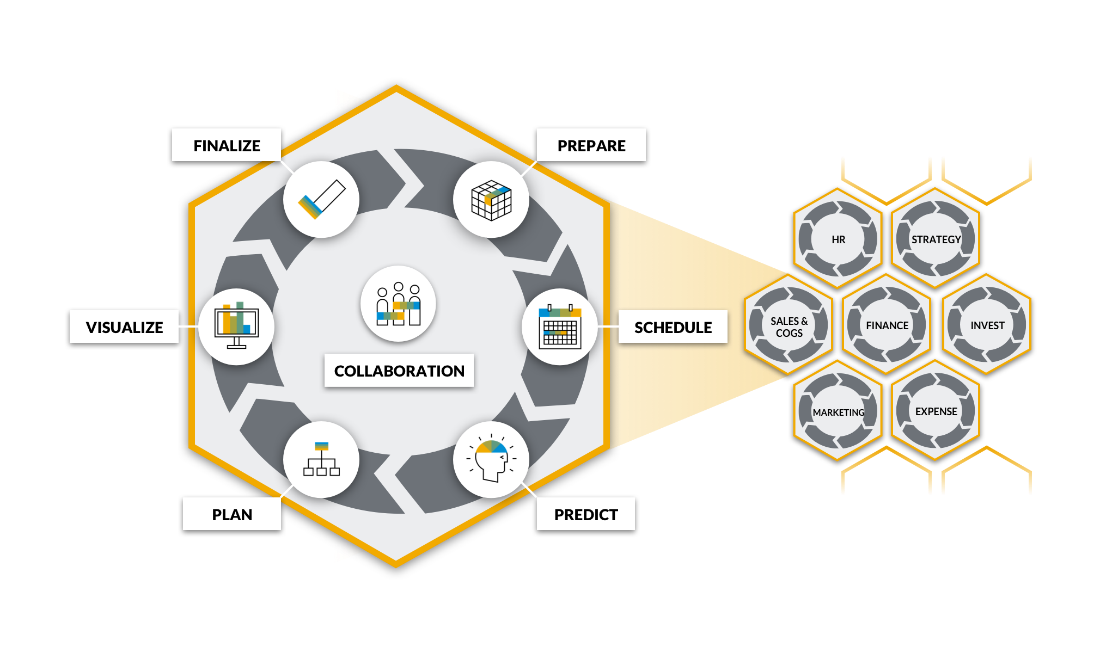

Predictive Planning technology is ready for accurate and trusted FP&A use. At the same time, one should not think about it as a separate activity from planning. Predictive Planning is part of an end-to-end process where planners already need to prepare the data, schedule their activities, predict the forecasts, plan, visualize, and collaborate in teams to keep their plans up to date (see Figure 2).

Figure 2: Predictive Planning is part of the Planning Process

Benefits and Pitfalls

Predictive Planning is a powerful addition to the modern planner’s toolbox. It brings several business benefits:

- The acceleration of planning cycles and improved decision support. This is crucial to take the best action in a challenging and fast-moving business context.

- Planning automation. Planners prefer to handle some planning activities low-touch or no-touch. This will enable finance practitioners to focus on value-adding activities.

- An unbiased and accurate forecast. Predictive Planning complements the forecasting processes in place, driven by business experts. Business experts get a data-driven perspective. It helps them confirm, enhance, or revisit their judgments and assumptions. Combining human intelligence and predictive technology is powerful. It leads to improved accuracy for the planning process.

Still, organizations should also be aware of potential predictive planning pitfalls and how to avoid them:

- The “Harry Potter” pitfall. Predictive Planning is not a magic wand or a silver bullet. It will deliver as satisfactory results as the data it gets. It is critical to pay attention to the quality and to the availability of the data. It is also critical to provide the right level of information on the predictions to end-users. It is about data and prediction quality.

- The “Tenet” pitfall is about doing things in the reverse order. It consists of putting the technology first without thinking of business end-users. The most accurate predictions mean nothing if they are not consumed, trusted, and acted upon. As part of your projects, think about the end-users, how you will involve them and give them trust and control. Plan the change management ahead.

- The “Matrix” pitfall corresponds to the temptation to let the machine have full control with no human in the loop and no supervision. Automated processes need human supervision and monitoring. Automation is a journey which requires incremental steps to reach the required maturity. Move gradually from the first proof of concept (PoC) towards a more automated process. Make sure to check the process outcomes on the go. This is an area where analytics can help, making sure that the envisioned goals (accuracy, speed… etc.) are being met.

How to Start with Predictive Planning

Applying Predictive Planning to your organization requires vision and thorough execution.

The vision is about transforming the processes in place. Select the processes with most business value and automation potential. It could be the expense forecasting process, the sales planning process etc.

Execution can start small, even as a proof of concept. All you need is historical data to prove the value. Later, you can evolve this to a rock-solid data foundation.

The end-users working with predictive planning techniques needs some skills:

- They need to be data-savvy.

- They need some basic understanding of predictive concepts.

- They need knowledge of the business.

Stakeholders and project leads need to share the value of Predictive Planning with the entire organization. They need to engage the planners and prove how Predictive Planning can help their work. Briefly, they need to tackle change management from the start.

The future of Planning is Predictive Planning

The future of Planning is predictive planning.

Planning cycles are accelerating. Stakeholders expect high planning accuracy. Data is abundant. The technology is ready for prime time. Business users can leverage it for their own needs.

I predict that 2021 will be a breakthrough year for Predictive Planning. Organizations will embrace it and gain high benefit for their financial process. Do not wait - now is the time for you to experience Predictive Planning to help serve your financial use cases.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.