This article summarises the presentations and discussions during the recent Digital FP&A Circle on how Artificial...

A Global FP&A Trends Webinar that was held on the 10th November 2020 focused on why predictive planning is so important, especially in the uncertain times that we are living in.

A Global FP&A Trends Webinar that was held on the 10th November 2020 focused on why predictive planning is so important, especially in the uncertain times that we are living in.

This article summarises this insightful meeting filled with practical presentations, interactive polling questions and compelling discussions on the below topics:

FP&A Evolution

Relevance of Driver based Planning during uncertain times

Power of Predictive and Prescriptive Analysis, along with practical insights

What is predictive planning and why is it so important?

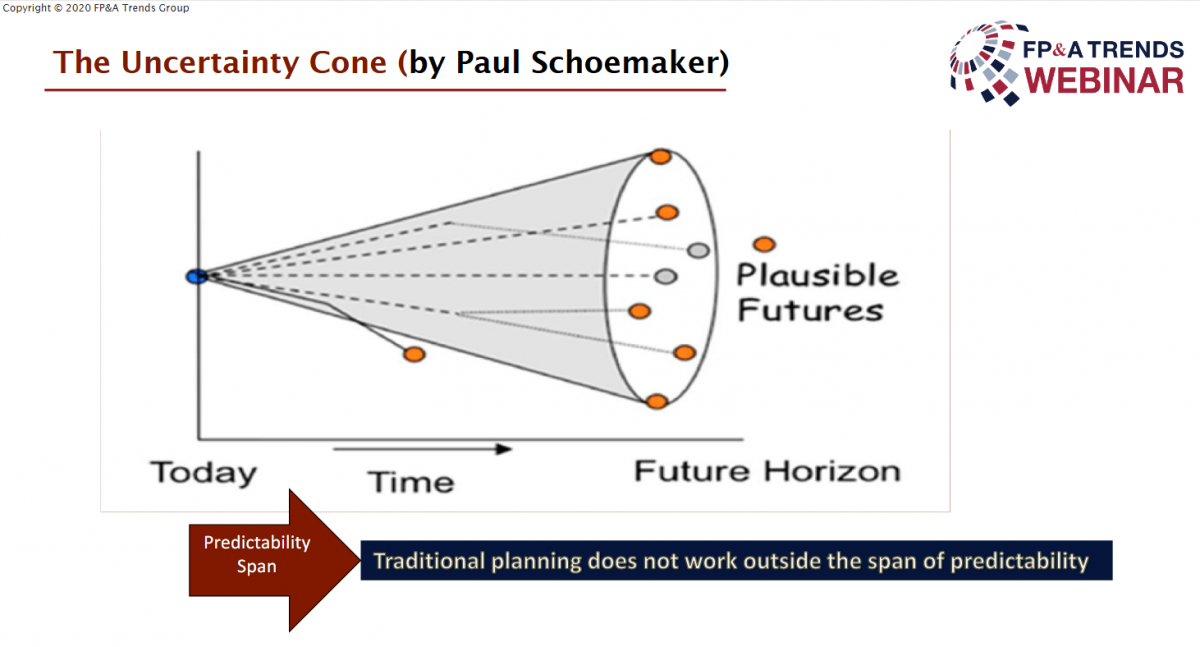

Larysa Melnychuk set the tone of the session by demonstrating the uncertainty cone, depicting the current unpredictable environment where the span of predictability is on a decline. This means we cannot afford to have only one scenario and need predictive planning to understand the risk and the opportunities.

Predictive planning is a decision-making platform which involves extensive use of data, statistical and quantitative analysis, to develop predictive models which in turn facilitate fact-based decisions and actions.

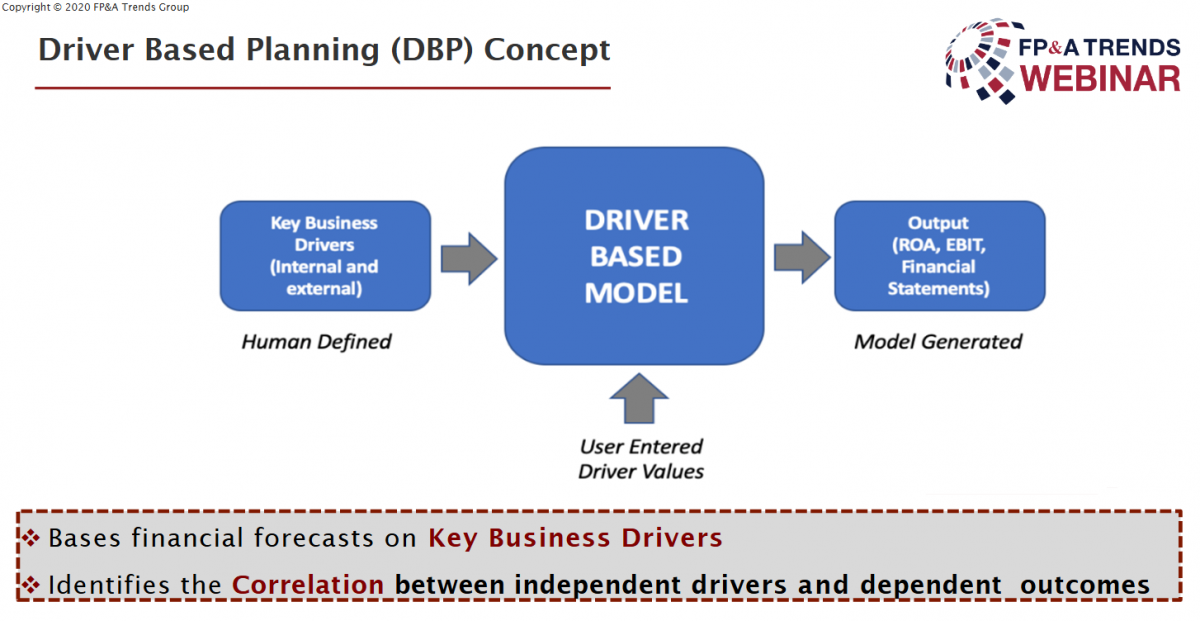

What is meant by Driver Based Planning?

The three pillars below represent the concept of Driver based planning:

Business Drivers: These are both external and internal factors, which are defined by humans but influenced by harnessing the power of Machine learning.

Driver Based Model: In this model, the values are entered by users as well as generated by the driver in the form of Algorithms based on the key business drivers.

Output: The model generated could be in the form be financial statements, Return on equity, Earnings before tax which is dependent on the values entered.

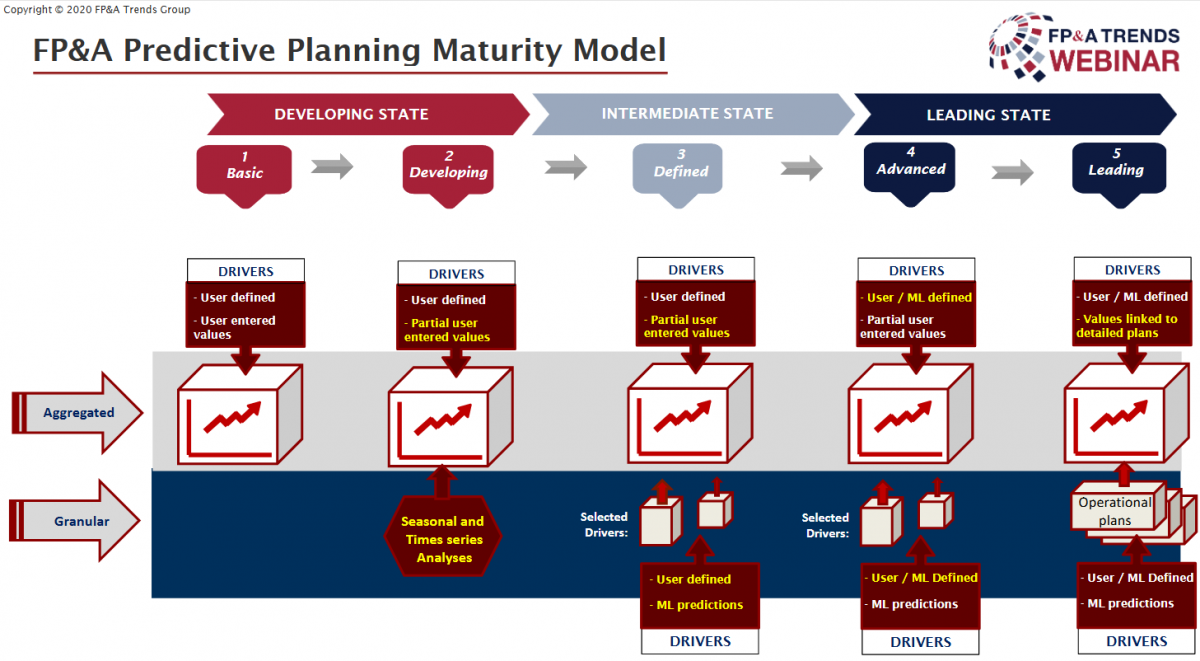

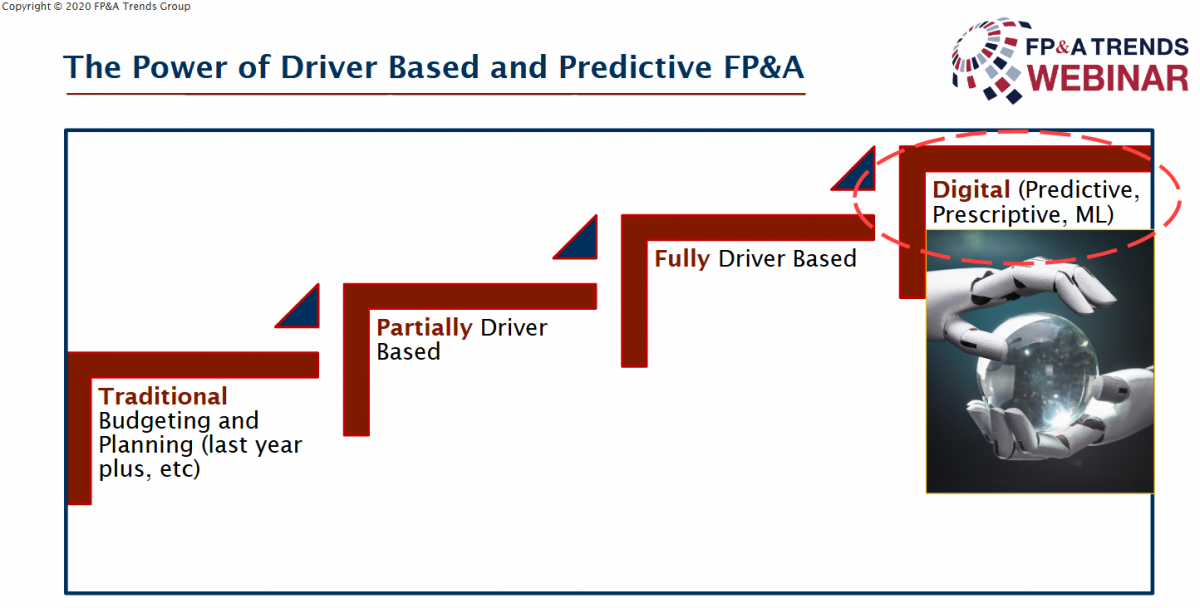

How does the Predictive Planning Maturity Model look like?

The framework represents the three stages of the maturity model as per below:

Developing: the drivers and values entered are user-defined at an aggregate level, which are further analysed at a granular level in a developing state.

Intermediate: the values entered are partially defined by users and partially based on Machine learning predictions.

Leading: the values are linked to detailed plans, which are derived using Machine learning predictions.

Maersk Case study: How did the FP&A teams become Scenario Planners and Strategists?

Based on Rex Gu’s, CFO at Maersk, presentation

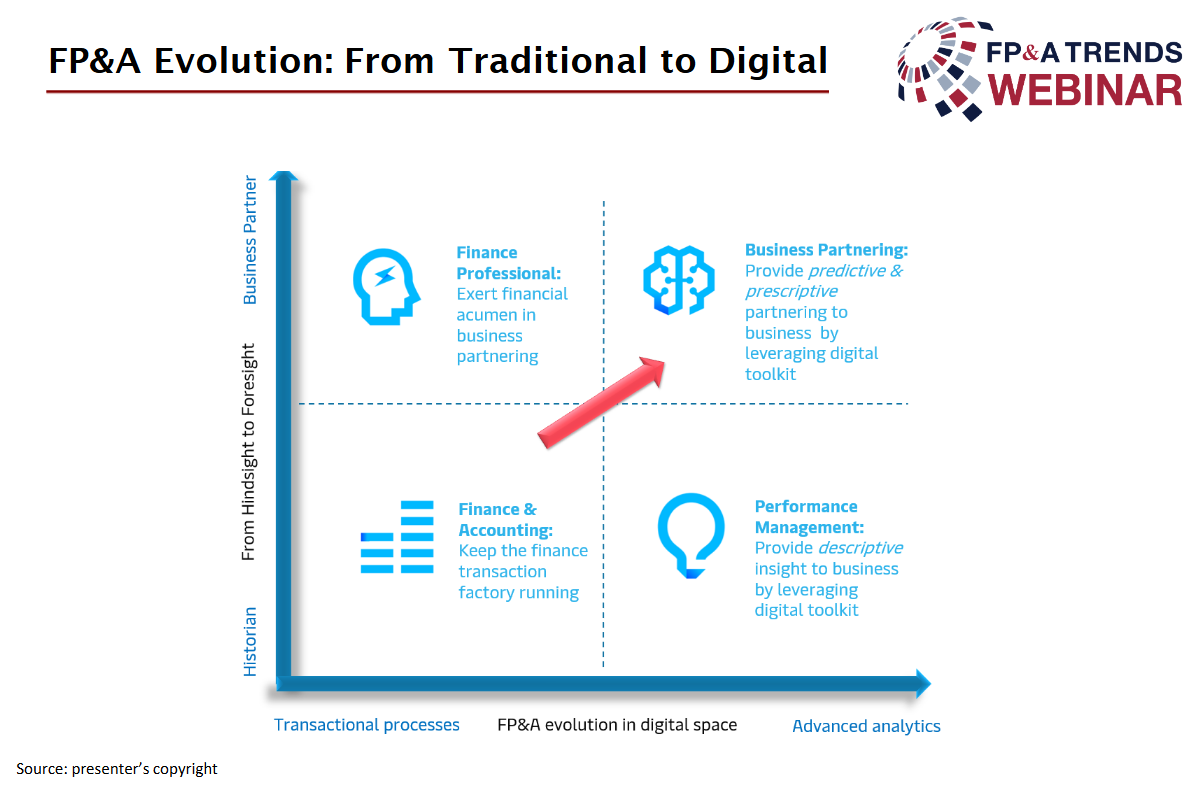

Historically the role of FP&A was restricted to maintaining accounts to keep the business running, but with the help of evolving technology finance professional is expected to provide predictive and prescriptive insights to business partnering by leveraging digital toolkit and exerting financial acumen.

There are three emerging roles in the FP&A landscape:

Data Scientist: Ability to understand and manipulate massive volumes of data from internal and external sources. Detailed business and industry knowledge to pose the right questions and ability to combine financial and operational data in a rich data set.

Scenario Planner: Ability to determine likely scenarios, the triggers for each scenario and business impact to model outcomes using statistical analysis to derive recommendations to the business.

AI/Trend Strategist: Ability to identify trends or indicators of customer and competitor behaviour, analyse output from learning algorithms and to devise strategy and tactics.

By using digitised decision-making framework, the FP&A team at Maersk successfully created various scenarios for each possible outcome in terms of price and customer impact. This allowed them to crystallise the decision-making process by pairing cost consciousness and non-financial factors. As a result, the company was able to reduce its costs significantly.

The FP&A team were able to evaluate contracts, with the help of a toolkit and identify patterns for negotiation and strategize the benefits by applying advanced analytics to win contracts.

How are FP&A roles emerging in other organisations?

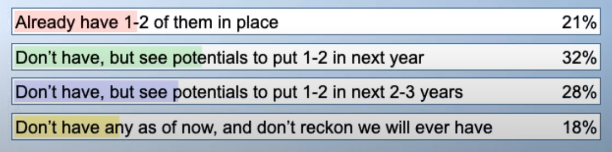

Majority of the FP&A Board members agreed that they do not have the three above-mentioned roles but see some of them emerging in the next one year. Few respondents said that it was not possible to have such kind of roles in their organisations.

How is “Driver based” planning relevant during uncertain times?

Based on Gordon Stuart’s, CFO at Unit4, presentation

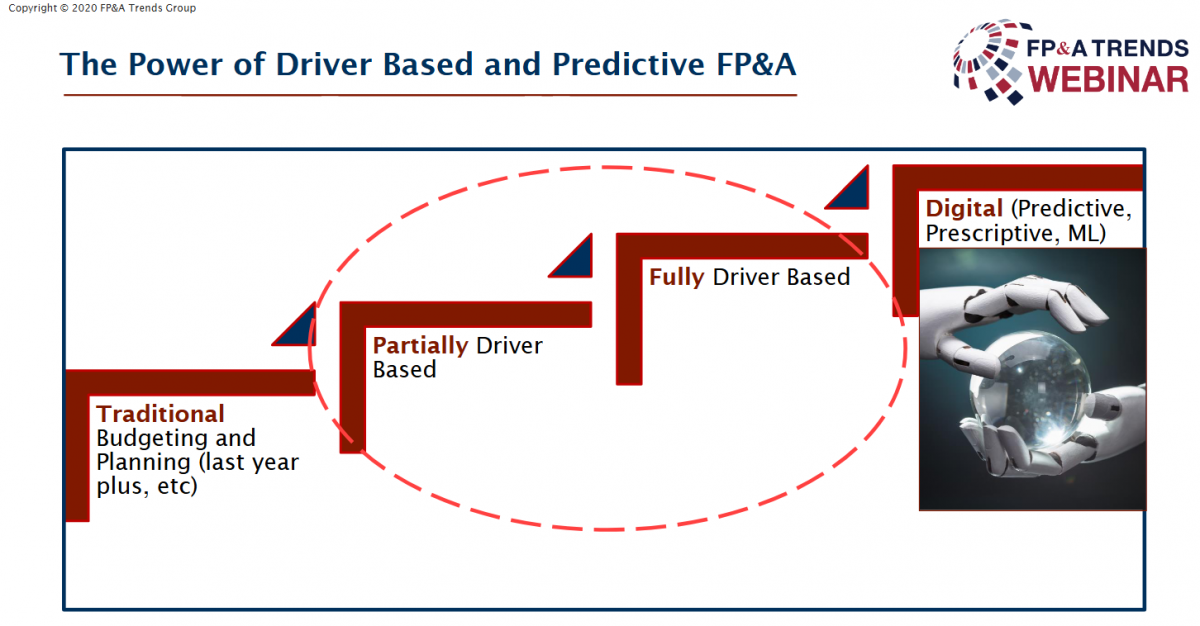

Some organisations have partially driver-based model and some of them have fully driver-based models.

Our approach towards businesses has completely changed due to the present times. This has impacted the way we plan and also placed emphasis on the fact that we need to be flexible, adaptable along with having a learning mindset to navigate through uncertainty.

There are five problems with high uncertainty:

Optimism Bias: A lot of organisations are very positive in their approach and build scenarios which are not farfetched.

Informational instability: the economic data that we rely on is not always reliable, since there is no one likely scenario or outcome.

Wrong Answer: the data we used could be incorrect which will lead to a wrong answer.

Paralysis by analysis: There may be times when we are unable to get the right answer since the data is unreliable or changing rapidly.

Organisational exhaustion: Remote working scenario has increased the average number of hours an employee has to put in every day. The management has to find ways to deal with the exhaustion in a manner that does not compromise the quality of the work.

Before defining the drivers, organizations need to consider the below questions:

What drives value

How do we make drivers mutually exclusive and collectively exhaustive

How do we place bets/prioritise

Where does leverage exist and what makes a difference

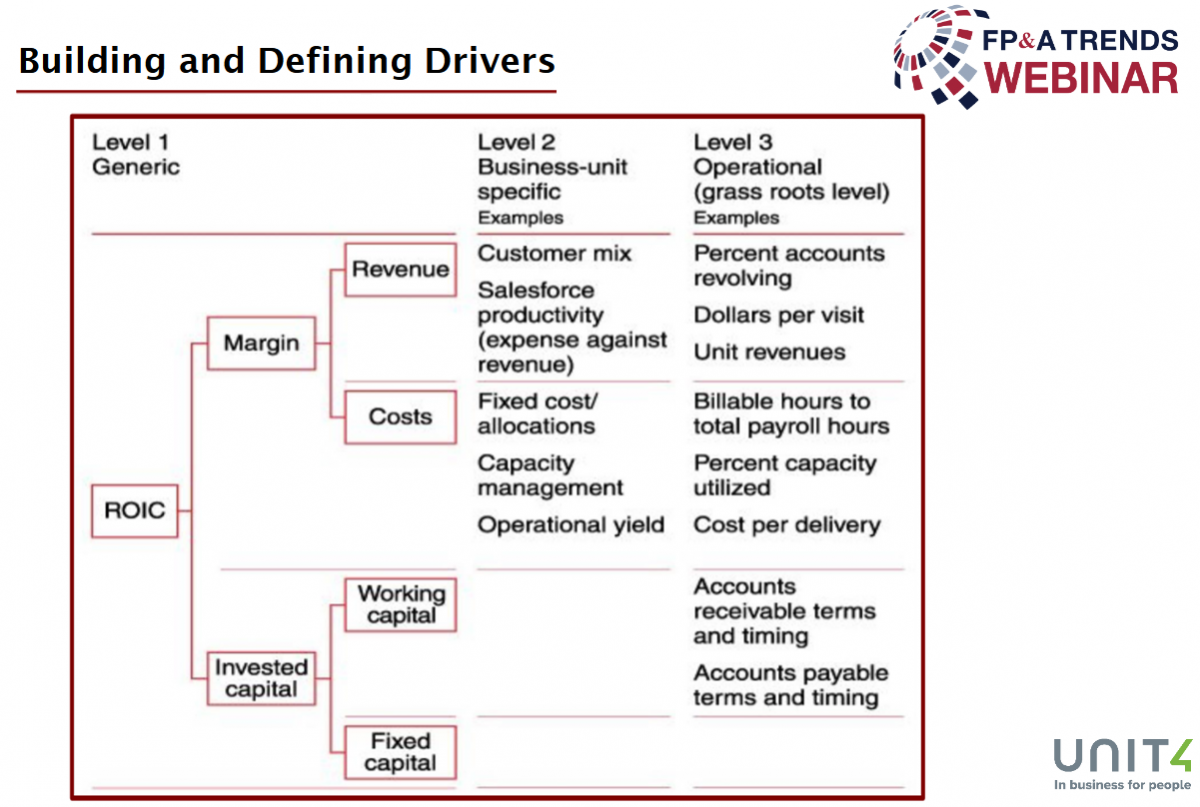

One should have a good understanding of the business, in order to be able to define the drivers appropriately. The drivers should be exhaustive, mutually exclusive and should focus on a discreet part of the business in order to make an impact.

Drivers can be categorised into three levels depending on whether they are generic, business-specific or operation-specific:

FP&A needs to be aware of the importance of developing fire drill, which essentially means being prepared to combat a tough situation knowing how to react quickly and not when something happens. Driver based planning helps to understand the key drivers which enables the businesses to sail through crisis.

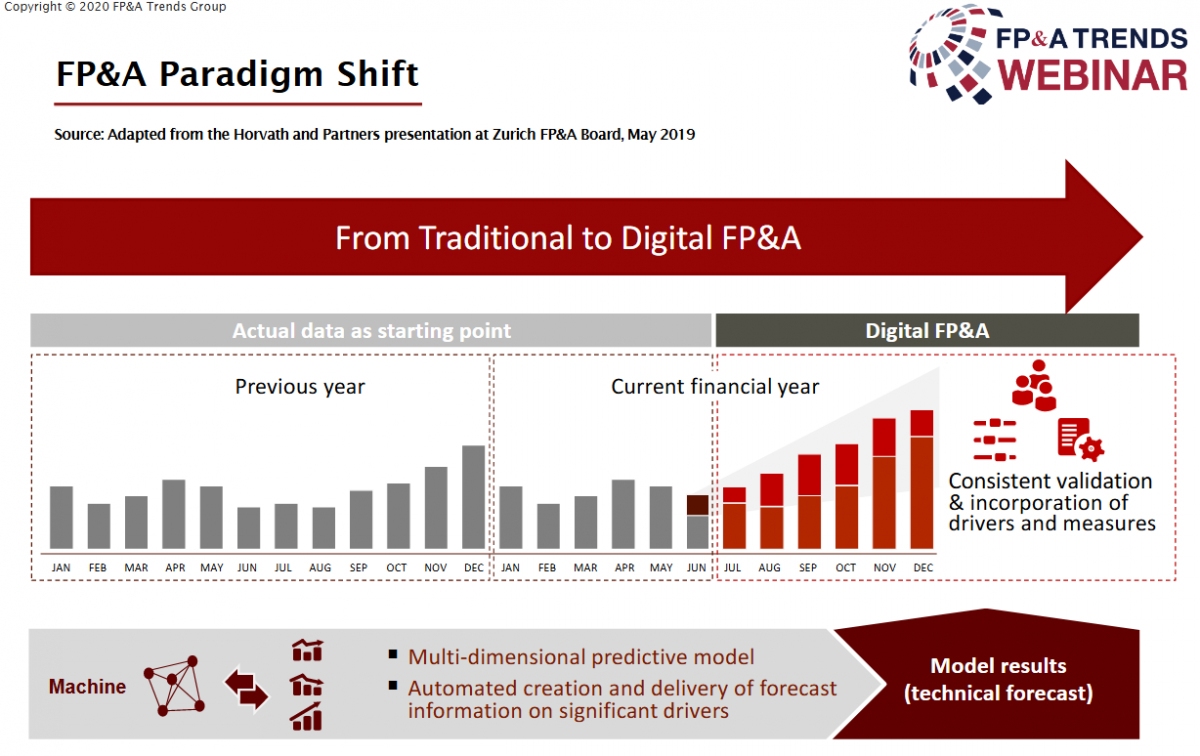

FP&A Paradigm shift

The comparison from the previous year to the current year as per below shows a gradual shift from traditional to digital FP&A with the help of a predictive model that drives advantages into the business. The FP&A teams have also moved from a historic role in helping the business in identifying what happens next.

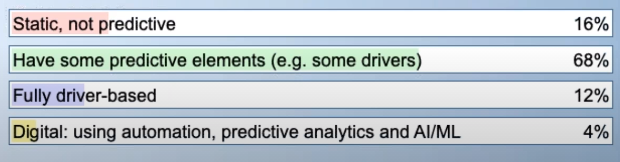

The next polling question revealed some interesting insights. Almost 68% of organisations agreed to have some predictive elements in their process, while only 4% of the organisations agreed to have fully implemented digital FP&A using predictive analysis.

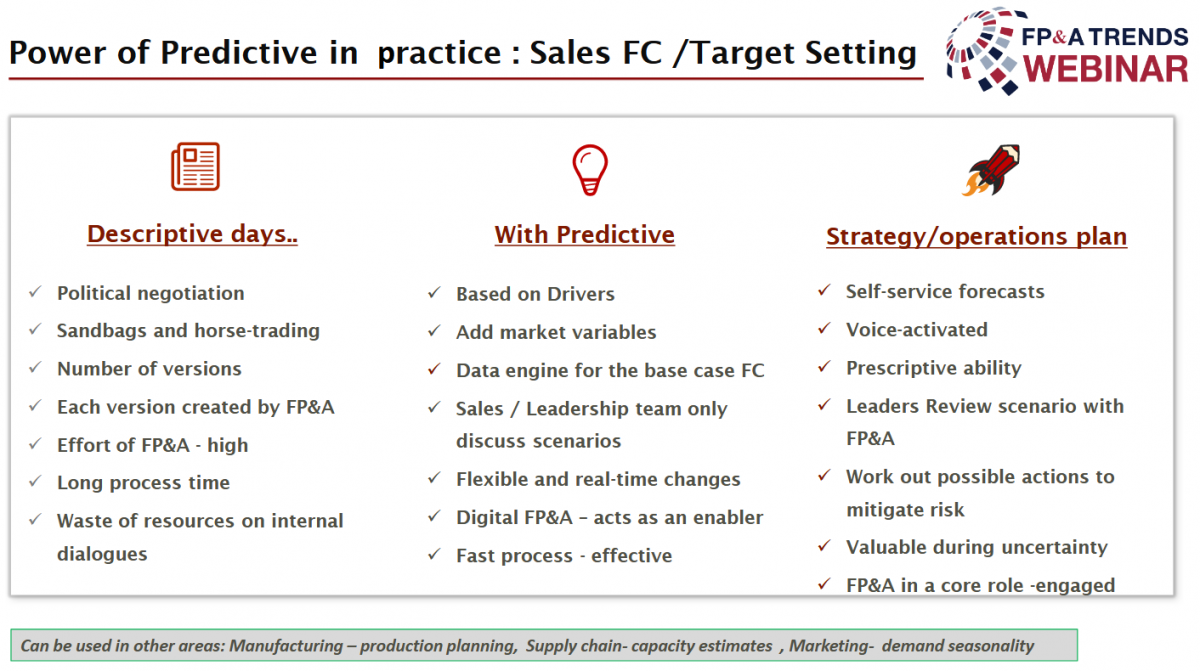

How can predictive planning be used for Sales Forecast and Target setting?

Based on Rohan Liyanage’s, CFO Pacific at Signify, presentation

Digital FP&A which entails optimising the power of analytics into foresight and focussing on what can be done.

To get to Digital FP&A, organizations need to take several steps:

Address the quality of data by collecting it through various sources and use of multiple versions of spreadsheets which is traditional FP&A.

Invest time in organising the data in a standardised structure, since data is the currency of the future.

Use the cleaned data to build scenarios, using predictive planning involving FP&A teams in value-added work that help drive decisions.

Add predictive analysis. It is forward-looking and empowers the teams to go out and execute plans with AI/ML in place.

Predictive planning can be used to develop a forecast based on drivers which is flexible with real-time changes in which FP&A teams acts as an enabler. This process is fast and effective, unlike the descriptive process which is long and involves high efforts.

To start the process towards predictive planning, organizations need to consider the following steps:

Improve the quality – Build the foundation.

Start somewhere-start small don’t wait for a big investment.

Make small step improvements-Celebrate small wins.

Introduce driver-based planning: use a flexible approach at work.

Add AI: machines can study and understand data behaviours better.

Predictive-digital capability: will help review possible outcomes.

Support FP&A team to add value-driven decisions.

Key Takeaways

At the end of the meeting, all the speakers shared their takeaways from the session. The panellists agreed that the driver model needs to be integrated across all business functions and the use of integrated models greatly facilitates the speed of response to driver changes in this dynamic environment.

We are very grateful to our sponsor Unit4 for their support.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.