I had the opportunity to attend the first-ever Digital Pan-Asian FP&A board held on the 21st July 2020 which focused on Adapting Financial Planning and Analysis to the "New Normal".

I had the opportunity to attend the first-ever Digital Pan-Asian FP&A board held on the 21st July 2020 which focused on Adapting Financial Planning and Analysis to the "New Normal".

In this article, I would like to summarise this insightful meeting filled with practical presentations, interactive polling questions and compelling discussions around the six facets of the “New Normal” FP&A.

So, according to the Pan-Asian FP&A Board, how can we adapt to the “New Normal”?

At the meeting, the FP&A Board speakers, senior leaders from a wide array of industries, shared their observations and practical recommendations on six topics:

Scenario Planning: quick, integrated and multidimensional

Optimized and Real-Time Cost Planning for "New Normal“

FP&A Teams: multifunctional and effective

Aligning Skills to the New Normal

Collaborative Planning. The Role of Modern Technology

Digital FP&A: moving to the leading analytical stage

Latest Trends in FP&A Recruitment

Each of these topics will be summarized below.

Cartier Case Study: Building Scenarios and Using Them Effectively

Laurent Claes, Global FP&A Director at Cartier, began the session explaining how scenario-based planning could be effectively used in the current environment. There are several steps involved:

Ensure overall macro commitment: The business as a whole should be committed towards the needs of the customer; their demands should be assessed at global levels which in turn form the basis of the cost-based assumptions that evolve as per the changing scenarios.

Use local inputs: It helps quantify the centrally defined drivers, as local regions define the customer flows and provide inputs for the investment opportunities.

Create scenarios: In order to assess the impact a high, low and crisis scenario should be taken into consideration which gives a realistic picture explaining the marginal impacts.

Roll into a forecast model: Based on the inputs build up a forecast model which can be refined as per the changing scenarios.

Based on the experience at Cartier, Laurence explained what other steps are important in the successful scenario planning process:

Stakeholders should be kept to the minimum.

Only decision-makers should be involved.

For the iteration process, it is important to determine the frequency, build up a rolling forecast.

Scope and accountability should be defined at the local level.

Ownership stays local with continuously refined global trends.

You also need to sustain momentum by incorporating most likely scenarios into the budgeting process.

To successfully implement the scenario planning processes, it was decided to use the integrated planning model which combines the top-down and bottom-up approaches. Although this required a heavier process to set up, but it enabled an early input for driver-based planning and a continuous review process.

How is Scenario Planning evolving in other organisations?

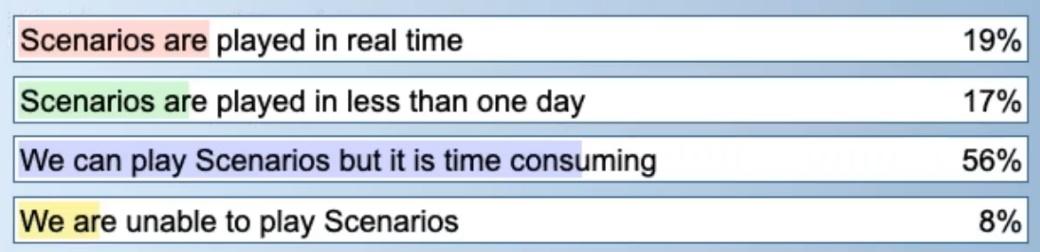

Laurent’s presentation led to a polling question on the usage of scenario planning. Majority of FP&A Board members agreed that developing scenarios is time-consuming and only a few respondents have played scenarios in less than a day. The scenarios should have a place in the system as they work in both short as well as long term.

AT&S Case Study: Planning Costs in Real-Time

The discussion then moved to real-time cost planning. Rainer Kern, Division CFO at AT&S, explained how the current scenario has drastically changed the behaviour of the customers.

How does the “New Normal” look like?

In a stable environment, the teams were able to accurately forecast the long term, especially in sectors like automotive. In the new normal the customer demands and schedules get updated almost every week. To accommodate the changes, companies should be more agile and understand what they have to offer to their customers whilst managing their costs to keep the competitive edge.

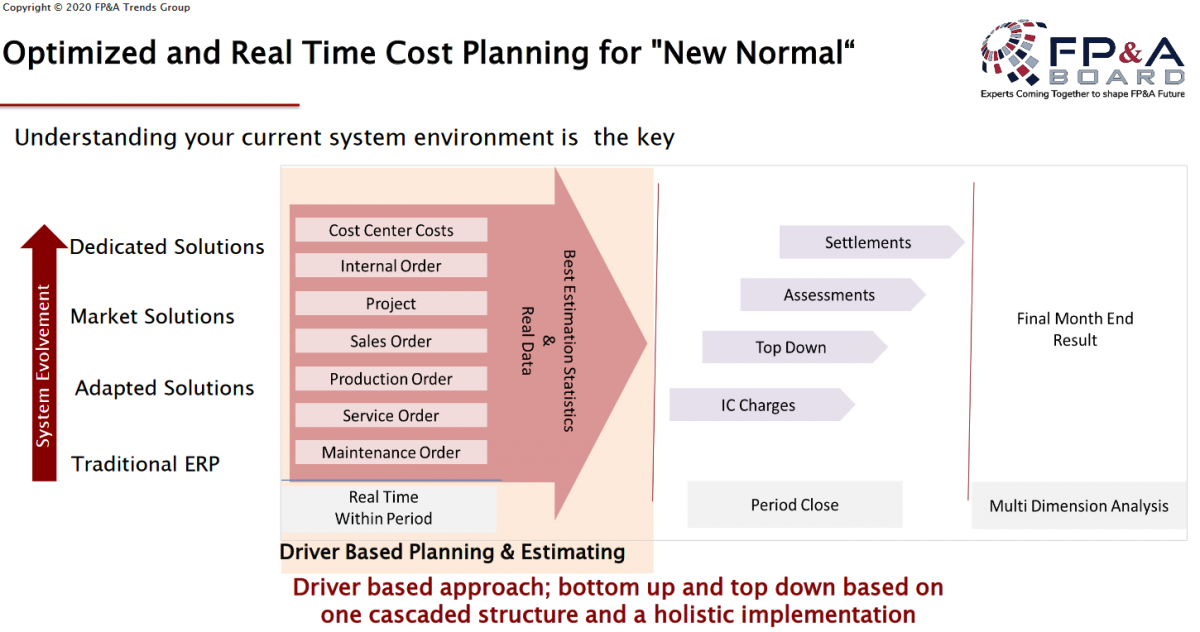

In order to plan costs in real-time, one should understand the system that is operative including the cost drivers and how it can be evolved into a system that supports the driver-based planning and offers dedicated solutions in the real-time which is explained as per below:

How did AT&S face the challenges of the “New Normal” cost planning?

In his presentation, Rainer explained how at AT&S real-time cost planning was implemented. They followed several steps:

Create Model: This can be done in Excel to understand the concept of real-time costing.

Identify quick wins for implementation: It is important to check whether the model is working as per expectations.

Develop prototype: In AT&S, the prototype was shared on a server so that a wider audience could have access to it. Employees were able to see the results and manage costs in the real-time.

Change to Holistic Operational planning, identify drivers: It is necessary to evaluate all the drivers and identify the key ones for the Business.

Evolve from intermediary step to own solution: Rainer’s team did this by developing a dashboard that supported the company’s needs.

Integrate with your different strategic planning scenarios: The model should be customised as per the requirements.

The key point from the presentation: to stay ahead in these competitive times real-time analysis and prediction is relevant for every corporation!

Advice on Building FP&A Teams in Uncertainty

Bhavesh Shah, VP Finance at ConvaTec, shared his views on building effective, cross-cultural and virtual teams which are essential in the current business situation.

What are the “must-haves”?

Data: One source of data along with the effective use of external data while forming the forecasts.

Artificial Intelligence Leverage: Use of reports developed by Data scientists so that the Business partners can use the data for decision making.

Storytelling: Ability to convert graphs and tables into meaningful stories is something that should be the focus for the teams.

Tech-agnostic attitude: Usage of multiple tools and technologies.

Demographics: Make your communication meaningful for the market.

Academics: An effective FP&A team is the right mix of resources, involving people with non-accounting skills.

Adaptability: The role of FP&A professional doesn’t end after providing reports, they should move towards becoming business partners.

How can you manage remote FP&A teams?

The focus should be on the issues like

staying connected,

handling data privacy,

ensuring compliance,

keeping adequate interaction with the Business Partners.

What are the necessary skills for a modern FP&A professional?

Apart from possessing core financial knowledge, FP&A professional should have

digital skills (skills needed to accelerate)

problem-solving & communication skills (skills needed to deliver and win)

All three skills together can help you become a business leader.

What role do FP&A teams play in other organisations?

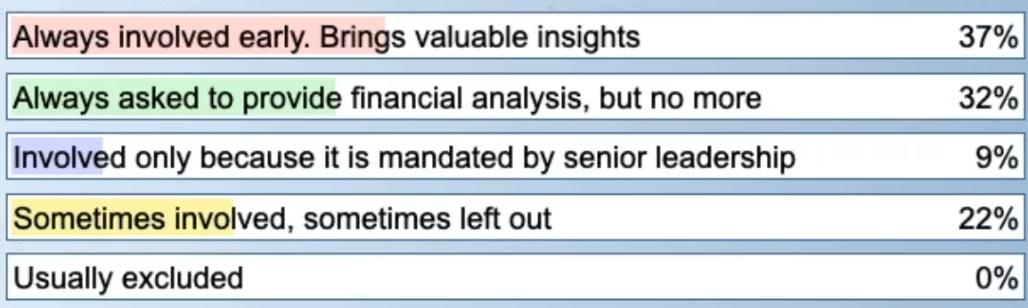

A poll regarding involvement of FP&A team’s engagement in the organisations showed the below results. FP&A Board panellists agreed that it is a good sign that almost 37% are involved in early providing insights and none of the teams are fully excluded in the decision making process.

How to Align FP&A Skills to The New Normal

Bryan Lapidus, FP&A Director at Association for Finance Professionals, shared his views on aligning skills of the FP&A teams with the capabilities required by the “New Normal” which are as follows:

Integrated Planning: translating the strategic plan into an operational one by accurate forecasting and budgeting. This requires business acumen skills.

Performance Management: Delivering the right information to the right person at the right time in the right format. This capability is driven by technology and data analysis skills.

Analytics: Insights based on the constructed model and data requires an FP&A professional to understand data, its approach, computation and visualization.

Mapping growth of FP&A: Finance should be working closely with the business to add value in developing strategic and operational decisions with the help of interpersonal, clear communication and team-building skills.

Empowering FP&A Teams Through Collaboration

The next discussion was on the technology and collaborative planning by David Upton, Director of Strategic Partnership and Alliances APAC at Jedox.

In order to translate strategy into execution, teams need to collaborate with different parts of the organisation to achieve the desired outcome. It involves not only the people and teams but also collaborating around numbers which requires technology to give agility and governance in the process.

How Did a Health Care Industry Company Transform Its Planning Process?

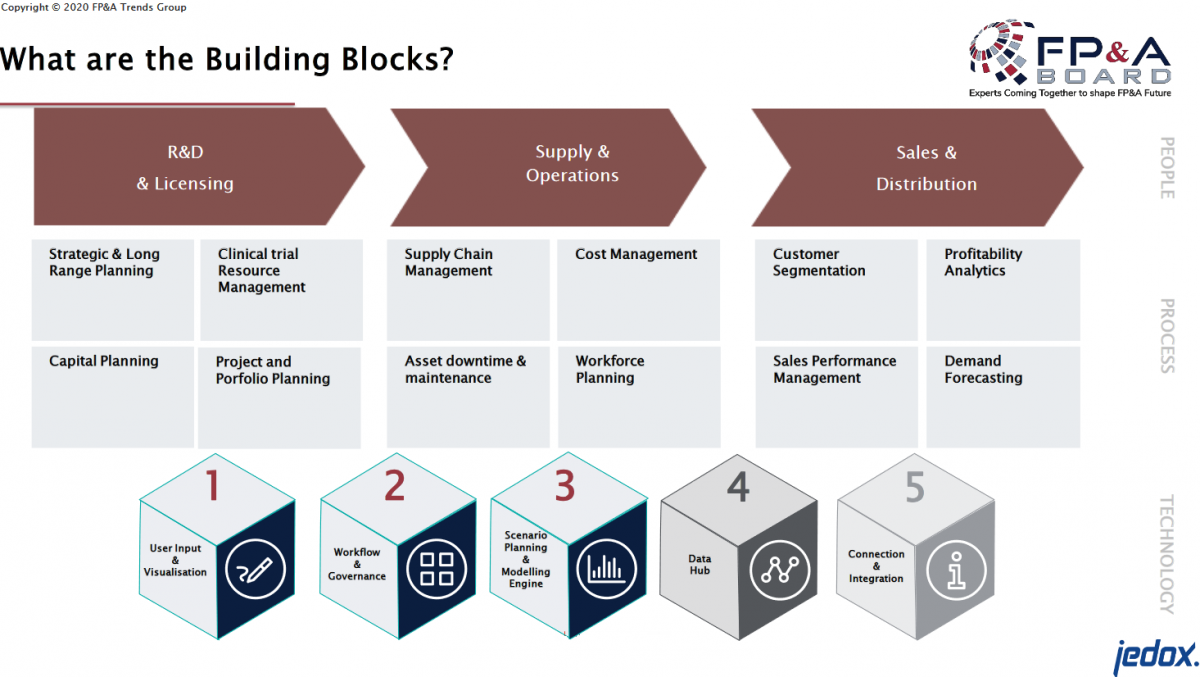

The building blocks at the bottom are the enabling tools that make collaborative planning possible. David explained this with the example of an organisation from a health care industry.

There were three main departments in this organisation:

R&D and Licensing: Involves processes for researching vaccine or drug.

Supply and Operations: Involves the competitive margins and generics.

Sales and Operations: Medical sales, and meeting the health care professionals.

The planning processes in the organisation were not integrated with each other. Standalone tools like spreadsheets, access databases were used in different teams. Therefore, the first necessary step was to integrate this into a data hub in order to have a consistent basis for the plan.

The output of one process should flow into the other, the forecasting process which was static was changed to predictive using the AI technology and workforce planning was driver based in order to enable the process owners to be responsible for their plan.

In order to make these plans available to stakeholders, the critical success factors were to make familiar and low changes, make the model versatile and be available in a short span of time to drive operational value in the business.

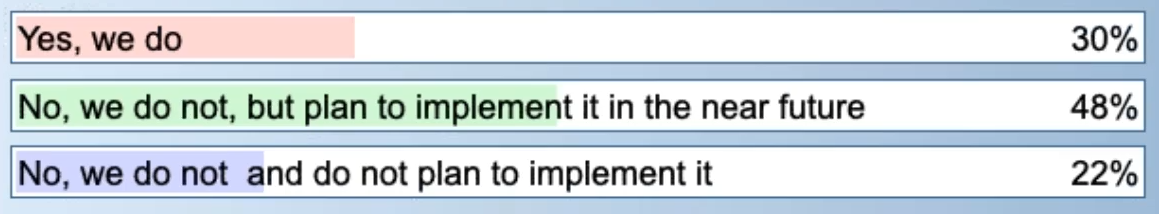

Are there many organisations using the benefits of collaborative planning?

The next polling question on the current use of modern collaborative technology for FP&A revealed some interesting insights with almost 48% organisations agreed to implement collaborative planning in the near future but 22% didn’t plan to implement which could be due to lack of funds, and might not be the priority at the moment though this does not give away the need to collaborate in the near future as it helps drive greater operational efficiency.

Digital FP&A: What Is It and Where to Start?

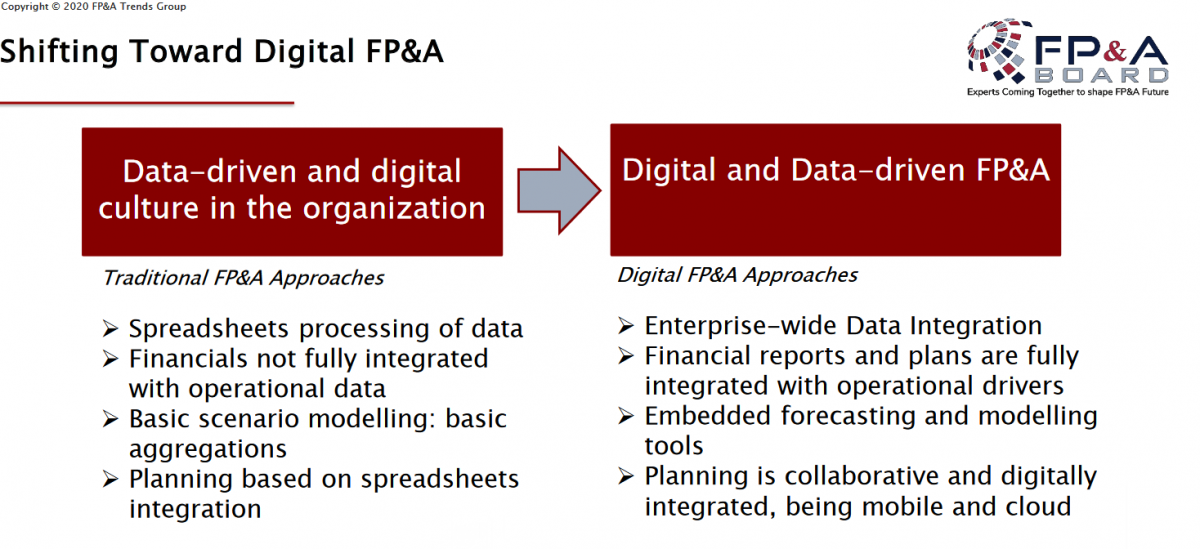

The next session facilitated by Igor Panivko, Managing Director at Konica Minolta Ukraine was about the shift towards the Digital FP&A that can be successful only if the organisation achieves a high level of digital maturity.

Traditional vs. Digital FP&A

What does “going digital” entail?

Digital FP&A enables organisations to make decisions using real-time data and provide valuable insights to the business partners.

FP&A teams become champions of the data-driven culture as it cannot evolve on its own.

It is not a one-day activity as it involves investing in training teams and interacting with tools and technologies.

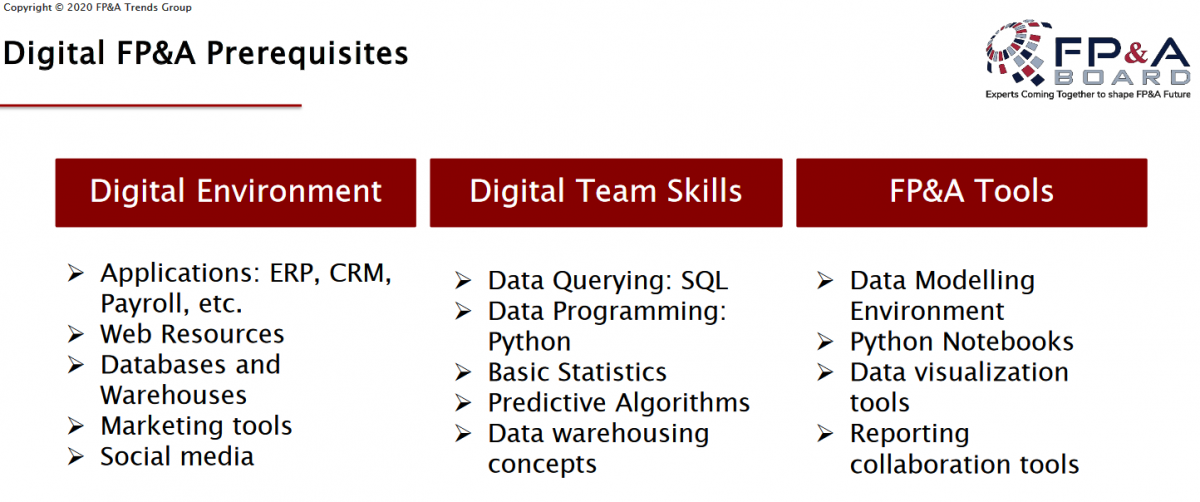

What is needed to “go digital” in terms of environment, skills and tools?

Below table explains the applications used in a digital environment, desired skill set for the teams and the tools that are used to go digital.

What benefits does Digital FP&A bring?

FP&A can become a company’s centre of analytical excellence by being fully equipped from a technological point of view and providing valuable insights to decision-makers in the real-time.

Teams begin to lead the demand and not be fully dependent on technology and present scenarios which are agile in nature for the organisation as a whole.

How is Digital FP&A evolving in Asia?

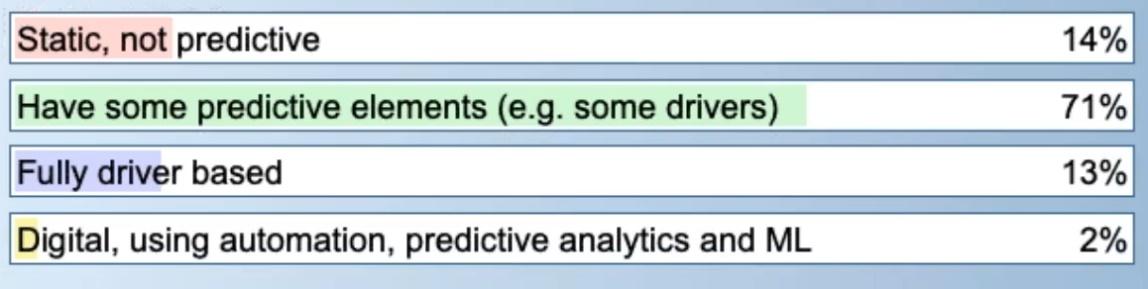

The last polling question was based on the current FP&A process of the organisations, which showed the shift to a predictive FP&A as most of the companies have some digital elements but there is a long way to go for a fully driver based and automotive process.

FP&A Recruitment for The “New Normal”

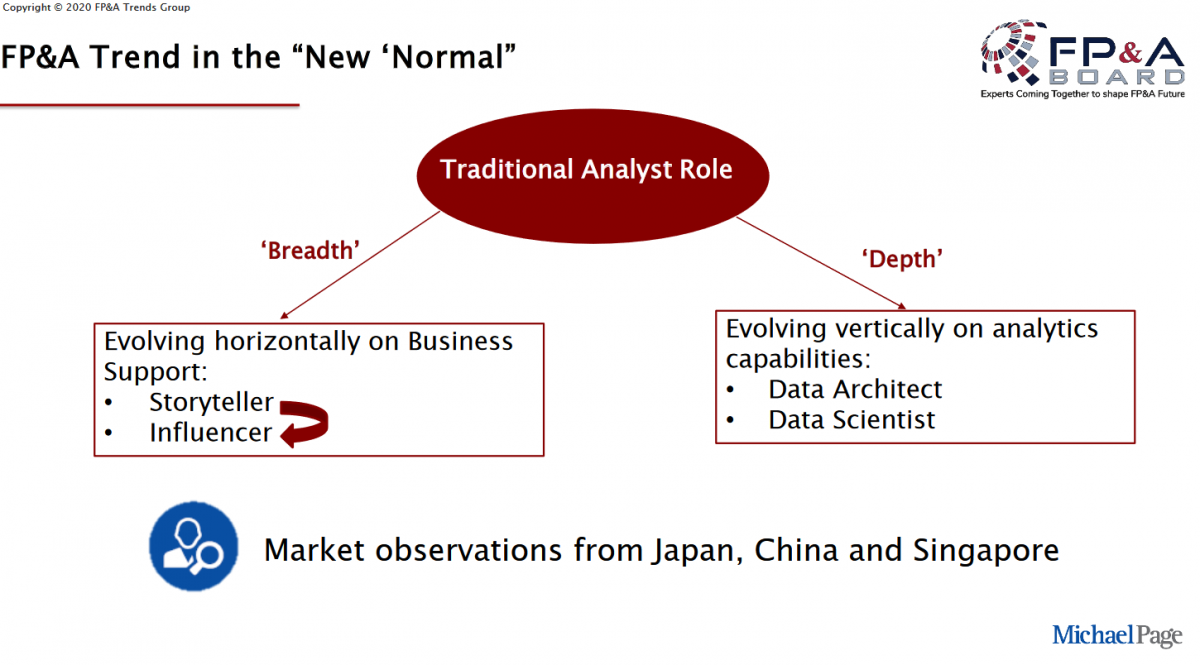

The last session was on the recruitment process in the current business situation. WeiWei Cao, Director at Michael Page Finance, explained how the traditional analyst role has been evolving horizontally on the Business Support and vertically on the capabilities as seen below.

The traditional analyst was expected to have technical and analytical skills, whereas in today’s reality one should be able to explain the numbers in the form of a story which is simple to understand and has the ability to influence business decisions.

FP&A professionals are expected to be Data Architects and Data Scientists, who bridge the gap between IT and Finance function paving the way for digital transformation in the organisation whereas Data scientists should be able to manage and manipulate data with the help of technical knowledge and turn it into insights. These roles are evolving in the companies based on their maturity level.

As per the market observations, there is a huge demand for the FP&A resources in the organisations, but many professionals lack the desired skillset and one should continue to polish their skills in order to be a desirable candidate.

Key Takeaways

At the end of the meeting, all the speakers shared their takeaways from the session. The panellists agreed that change is a process and that we need to continuously evolve ourselves, upgrade our skills to be relevant at all times.

Sponsors

We are very grateful to our sponsors Jedox, Michael Page and Association of Financial Professionals (AFP) for their support.