The COVID crisis is significantly challenging companies’ resilience i.e. their ability to face the crisis. It...

“When the going gets tough, the tough get going” – this is the mantra that CFOs, FP&A and finance leaders are adopting to safeguard the business while anticipating business trends, quickly addressing volatility, strategically positioning assets, and proactively establishing long-term financial and operational viability across the business in the midst of COVID-19.

“When the going gets tough, the tough get going” – this is the mantra that CFOs, FP&A and finance leaders are adopting to safeguard the business while anticipating business trends, quickly addressing volatility, strategically positioning assets, and proactively establishing long-term financial and operational viability across the business in the midst of COVID-19.

Analysts are predicting that we are in a mild U / V / W-curve recovery for the economy with a possibility of re-occurrence of the virus that could lead to a vulnerability in the economy.

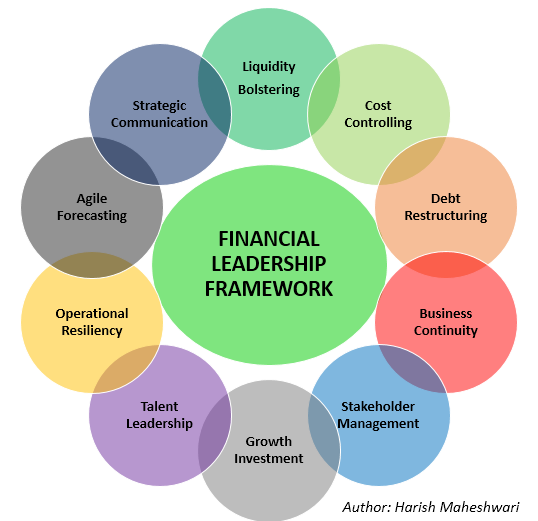

Considering the current pandemic situation, I am sharing a baseline financial framework to establish the organization’s longterm financial and operational resilience:

1. Liquidity Bolstering: examine the current cash flow condition and manage working capital through liquidity cycle.

- Attain sufficient liquidity to make the company ready for the future. Leaders who re-orient the company’s cash strategy will be the winners.

- Ensure high cash-resilience by periodically reviewing three critical financial ratios: interest cover ratio, debt-to-equity ratio and cash cover for fixed expenses.

- Maintain sufficient cash for debt service, capital expenditure and operations.

2. Cost Controlling: curtain discretionary expenses to improve the cash position.

- Insulate and protect necessary costs (digitization, tech costs, digital marketing, employee health etc.).

- Eliminate deferred costs (fancy office, unnecessary spending, traditional working methods, etc.).

- Be frugal – remove all the flab and be lean.

3. Debt Restructuring: revisit current debt arrangements considering whether there might be potential breaches of financial covenants and determine a short-term debt management plan.

- High debt low margin companies will face difficulties during this time.

- High debt high margin companies could be rewarded but caution needs to be taken.

- No debt high margin companies will be best rewarded.

4. Business and Finance Continuity: reshape strategy for business and finance continuity.

- Investigate into key financial and business risks, perform sensitivity analysis to test the company’s exposure to key risk factors and assess financial and operational readiness to deal with different distressed situations.

- Assess risk to review emergencies, crises, threats, and other incidents that can disturb the financial processes and/or operations and determine the contingency plans.

- Learn from the current situation – many new consumer habits will be ingrained. Agility will be needed to recognize new consumer behaviors, and a company should also be ready to adapt to meet the altered needs.

5. Stakeholder Management: embed stakeholder considerations in the company’s decision-making process.

- Promptly work with suppliers, vendors, distributors and other partners to evaluate existing contracts or agreements on a specific clause to force measures to include the pandemic situation.

- Plan progressive and bold conversations with all stakeholders and try to identify the path to maximize available value and find the middle ground to share the burden.

- Safeguard company with business continuity and backup plans. Arrange alternative sources of supply prepaying critical vendors or ensuring sufficient credit for the supplier to continue operations.

6. Organic and inorganic growth investment: reexamine the corporate-growth strategy.

- Reevaluate investment strategy and strengthen the balance sheet.

- Formulate the strategy and design a strong business case around that strategy.

- Focus on core business and conserve the free cash flow condition to fuel organic and/or inorganic growth in the future.

7. Talent Leadership: support people in difficult times.

- Spend additionally on employees’ health and safety. This cost could be subsidized with the reduction in other discretionary spending.

- Invest in technology and data security to enable employees to virtually connect from different locations.

- Engage continuously and strategize effectiveness to maintain a productive, engaged, healthy workforce.

8. Operational Resiliency: assess the impact of potential supply delays and guarantee operational strength.

- Define and review frameworks to ensure that company is able to remain within its operational resilience impact tolerances.

- Examine second-order impacts such as geographical supply-chain disruption as well as likely sources of cash leakages and customer-liquidity projections.

- Identify and protect vulnerable systems and detect, respond and recover from cyber-attacks.

9. Agile Forecasting: streamline the robust forecasting using stress tests.

- Run multiple scenarios to guide revenue and cash flow forecasts and protect the position of the company by eliminating, minimizing or mitigating the risk of impairments.

- Actively manage balance sheet through a consistent approach to forecasting, stress-testing, covering capital expenditure, liquidity, and leverage.

- Review tax planning and seek accelerated refund claims.

10. Strategic communication: address transparent and regular communication with the stakeholders.

- Expedite the sharing of transparent information on urgent topics with stakeholders.

- Establish appropriate technical and communications support to reduce the burdens of preparing for and executing this process.

- Communicate with investors during these times is also critical. Uncertainty is the last thing that investors want, so it is essential to provide them information within regulatory guidelines about what actions the company is taking to deal with the crisis and how this might impact performance.

Conclusion:

It’s hard to predict how long the pandemic impact will last but after a while business and daily life will find a new equilibrium. As the SWOT analysis tells us, there are not only threats but also opportunities. Finance leaders need to ensure a strong balance sheet with cash reserves to innovate, outdistance their competitors, and grow more quickly to transform challenging times into opportunities.

In conclusion, I quote Sam Cawthorn who once mentioned that “crisis moments create opportunity. Problems and crises ignite our greatest creativity and thought leadership as it forces us to focus on things outside the norm”.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.