The 7th meeting of the Brussels FP&A Board took place on 13 February 2020 at the Robert Half Offices in Groot-Bijgaarden. Hans Gobin, International FP&A Board Ambassador, facilitated the meeting for the first time in Brussels. The meeting was sponsored by SAP and Robert Half.

The 7th meeting of the Brussels FP&A Board took place on 13 February 2020 at the Robert Half Offices in Groot-Bijgaarden. Hans Gobin, International FP&A Board Ambassador, facilitated the meeting for the first time in Brussels. The meeting was sponsored by SAP and Robert Half.

More than 30 senior financial professionals from companies such as Allianz Benelux SA, Ansell, Astra Zeneca, Bekaert, Cargill NV - Mechelen, Glaxosmithkline Vaccines, Ingersoll Rand, IQVIA, Janssen-Cilag Benelux, ORANGE, ROCKWELL Automation and UNISYS gathered to discuss FP&A Team Building, the subject on the agenda.

What are the key features of a successful FP&A Professional?

The meeting started with defining the biggest attribute of an FP&A professional, wondering what skillset makes a person a successful FP&A professional.

Curiosity was one of the key underlying characteristics that came out. Intellectual curiosity will trigger other features, such as business acumen, business insights, action-oriented…

It was noted that the need for technology was not specifically mentioned. Research carried out by the Carnegie Institute of Technology shows that 85% of your financial success is due to skills in “human engineering”, your personality and ability to communicate, negotiate and lead. Shockingly only 15% is due to technical knowledge.

We arrived finally at the following top 10 skills:

- Analytical skills

- Good communication and stakeholder management skills

- Understanding of technology

- Good Business Partner

- Commercial curiosity and business acumen

- Strong leadership

- Good interpreter of data

- Ability to see both the big picture and the details

- Creativity: This is the paramount skill

- Personality types that thrive on new ideas and creative thinking, rather than just number crunching

FP&A Team Roles

We then looked at the “Five Critical FP&A team roles” required in an effective team.

- The Architect – defines & builds driver-based models / links between IT & Finance

- Data Scientist – mix of Data Scientist, Data Manager & Finance

- Analyst – analyse & interpret, scenarios planning, understand drivers and impact

- Storyteller – turns complex into simple / leaves us wanting more

- Influencer – to be able to bring change influencing through analysis & storytelling

It was astonishing to find that the Data Scientist role was only being used by one company in the room. Companies do tend to use them, but they normally sit in silos and do not interact with finance. More and more companies internationally are bringing this role into finance.

Much of the board were involved in the remaining four roles of the architect, analyst, storyteller and influencer.

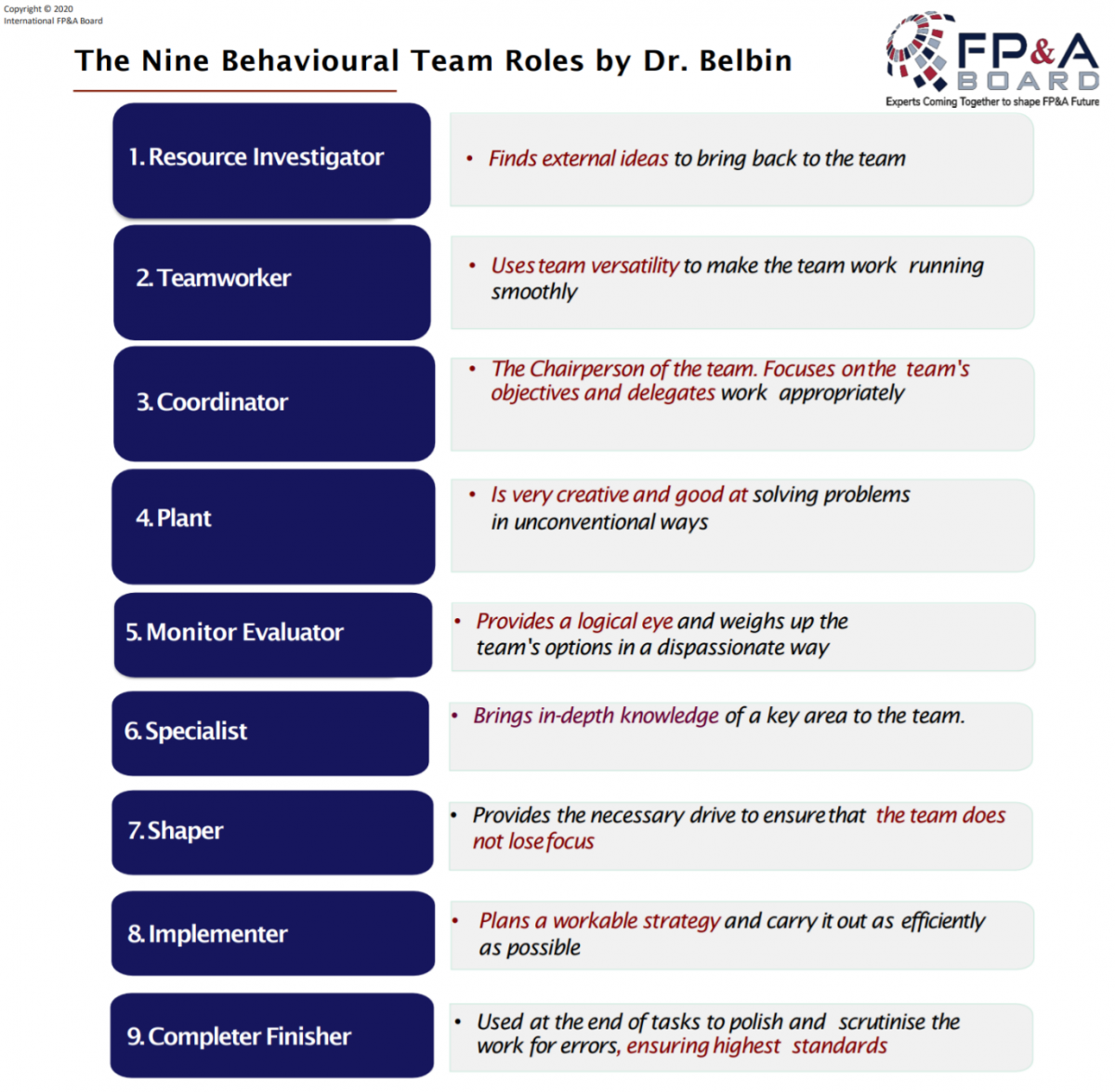

We also looked at team synergy and explored Dr. Belbin’s 9 key behavioural roles.

Case studies and the best practices from the field

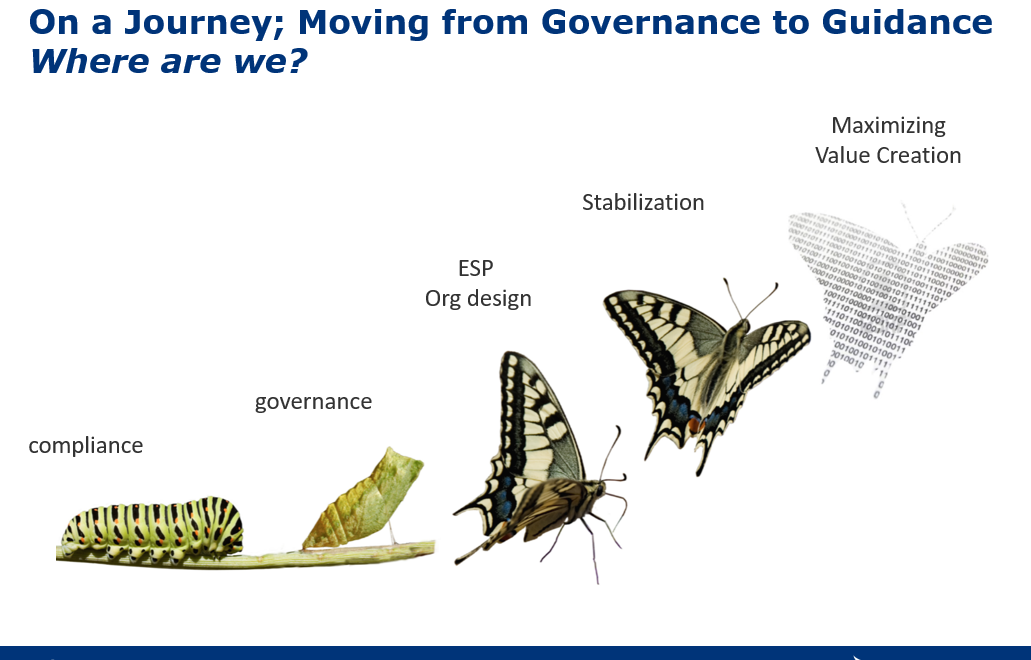

Wim De Vos, Finance Director at Janssen-Cilag, presented the journey of change in the finance function for the last 3 years. He described it as “caterpillar to butterfly”.

The goal of the change is to continue having a competitive advantage as a finance organization. Finance should deliver business leaders with a finance background instead of finance leaders with business acumen.

The interaction model focuses on a collaborative mindset supporting the business. The wheel of capabilities has several dimensions:

- External Lens to business decisions

- Razor-sharp focus on value creation

- One Team

- Process excellence

- Proactively delivering Insights

- Through partnering asking challenging questions

To deliver on these dimensions the organization promotes leadership behaviors such as curiosity, perspective (personal opinion), influence business decision and test-adapt-learn.

Mario Fernandez Pasarin, Global Head of Finance Marine, Rail and Air Business at Ingersoll Rand then shared with us his presentation.

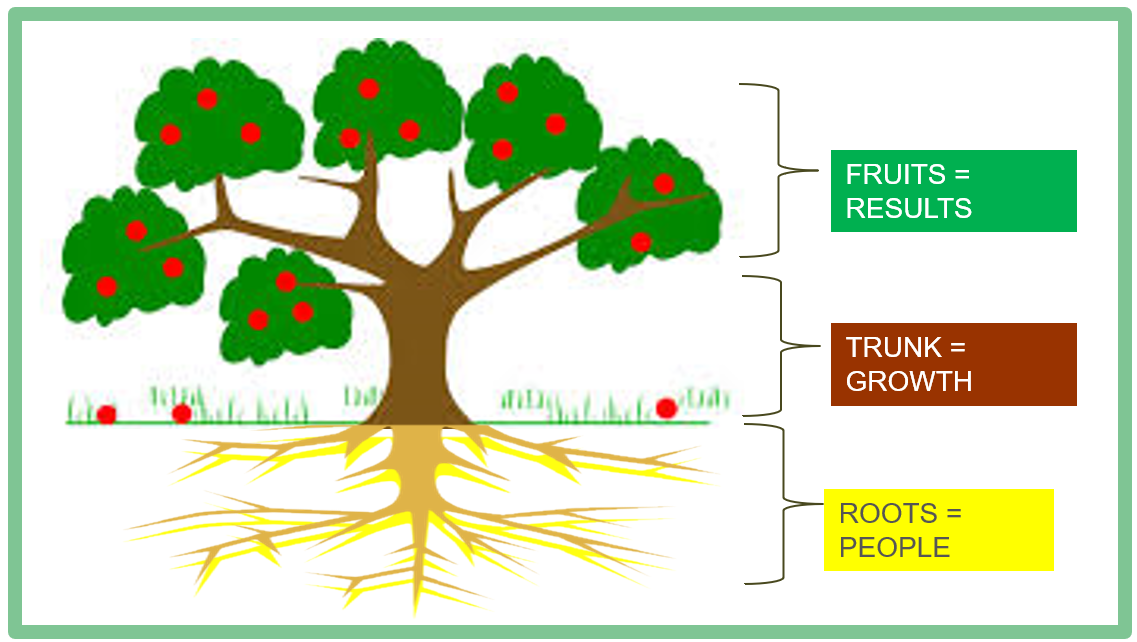

He is a believer in people and talent management. The people, represented by roots, are the foundations for growth bearing fruit. The path to premier performance is to create a winning culture and operational and growth excellence. Embracing change and being open-minded are key behaviors.

Small groups discussion on FP&A Teams Evolution

The group discussion was on “What are the key steps are in building an effective FP&A team” and the outcome is shared below:

One should consider the mission and expectations of FP&A, business needs, assessment of the current finance operating module (process and systems), defined roles, identify gaps (training) and install a mindset of continuous improvement.

An effective FP&A team should contain the following recipe or as we Belgians call it with a local expression the “Mayonnaise Building”:

- diversity of skillset

- transparency and trust

- curiosity

- communication

- strategy alignment

- feedback culture

- positive mindset

- leadership & initiative

- inspire innovation

Moreover, the group mentioned the importance of having finance and accounting basic knowledge.