Imagine you have 3 minutes to explain to a six year old what FP&A is and what place it takes in a business ecosystem. Tough, isn’t it? What are things that a six year old would understand? For example, animals, right?

FP&A Insights

FP&A Insights is a collection of useful case studies from leading international companies and thought leadership insights from FP&A experts. We aim to help you keep track of the best practices in modern FP&A, recognise changes in the ever-evolving world of financial planning and analysis and be well equipped to deal with them.

Stay tuned for more blogs and articles from great authors.

A twenty nine year old newly minted FP&A manager for an NYSE listed public company sat in utter bewilderment across CEO and CFO, as the CFO said to CEO, “the most important position in his department is FP&A”.

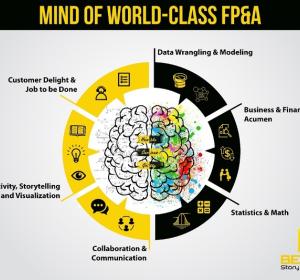

At a high level, the best-performing organisations take a more rigorous approach to FP&A. They have tightly integrated all the components of FP&A, merged operational and financial planning, and have a deep understanding of how operational metrics drive their financial results.

Over the last month, the Brexit weather becomes more overcast, with the House of Commons vote on Theresa May’s deal suspended due to evident lack of support from MPs. Almost every day has seen a storm, with the deal being attacked from all sides and the EU leadership maintaining a hard line.

Pagination

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.