What are the key success factors for implementing an effective and efficient Zero-Based Budgeting (ZBB) process...

Zero-Based Budgeting (ZBB) has been around for a while, but not all organisations use it. ZBB is used as a tool to reduce expenses significantly. Executing a zero-based budgeting program from a technical perspective is relatively simple; however, one should fully understand the amount of effort to implement correctly.

Zero-Based Budgeting (ZBB) has been around for a while, but not all organisations use it. ZBB is used as a tool to reduce expenses significantly. Executing a zero-based budgeting program from a technical perspective is relatively simple; however, one should fully understand the amount of effort to implement correctly.

What is Zero-Based Budgeting?

- forces all budgeting to start with no beginning base. Most budgeting just rolls last year's budget amounts to the new year's budget with an increase for inflation.

- assumes no spending last year and creates a budget from zero.

- aligns your future spending to your current strategies while ignoring historical spending levels.

Zero-based budgeting was developed by an accountant at Texas Instruments in the 1970s. The Federal Government under Jimmy Carter attempted to implement ZBB, but it didn't get very far. Today, the Brazilian private equity firm 3G has made ZBB famous with the purchase of Kraft Heinz.

I have led a zero-based budgeting program for a Fortune 500 company and have learned what works and what doesn't. Below I present a high-level overview of ZBB implementation and give some considerations.

Step 1: Determine objectives of the Zero-Based Budgeting program

Most likely, you're considering zero-based budgeting to reduce costs, so cost reduction is probably the only objective. Another objective might be visibility. Or, maybe to establish better controls overspending. Be clear as to the exact goal because it will influence other decisions regarding program design.

Some thought starters for your objectives:

- What is your total $ reduction goal, and what is the timeline? Do you want to slowly reduce costs over the next couple of years or reduce costs immediately?

- What is the scope of your ZBB program? Will you ZBB just SG&A (admin) dollars or other areas on the P&L? Are COGS in-scope or out of scope?

- How much influence will the broader organisation have? Do you want your ZBB program to be in command and control or allow many people to provide input? True ZBB would move decisions to the centre, but you could decide to have a more decentralised approach.

With your specific goals, you're ready to start designing the technical aspect of your ZBB program.

Step 2: Obtain spending visibility

Zero-based budgeting is about choices. It seems easy, but some decisions can be challenging. With limited resources, you must decide where to invest and where to constrict. For example, do you want to spend money on travel to grow your business via sales calls, or do you want to engage a consultant to develop a Long-Range Plan? Maybe you want to do both. Either way, you need to know how and where you spend your money. You need visibility.

There are two methods to obtain visibility: actual results or your plan. My experience is that with a solid ZBB program, your financial plan provides more insight into your spending. Actual dollars reveal your true spending, but it's backwards-looking and often in different systems making consolidation difficult.

If your budget will provide core visibility, ensure that budget owners complete their ZBB schedules to the appropriate level of detail. If actual spending provides your visibility, then you will need to spend time consolidating and cleaning data so that it's both meaningful and actionable.

Regardless of whether your visibility comes from actual spending or a budget, you should have this level of detail:

- Who controls the spending

- Where is the money spent, e.g. the vendor

- Purpose of the spending

- Non-financial activity tied to the spending, e.g. consulting engagement or an offsite pizza party.

Keep in mind that visibility should not just be financial information. Non-financial drivers are often easier to understand and influence. For example, for travel, you should understand how many trips your organisation takes and where the trips are to.

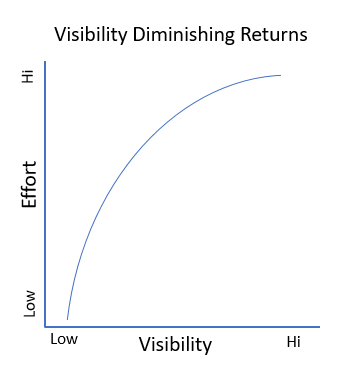

As depicted above, be aware that there is a tradeoff in gaining visibility against organisation effort. A way to reduce effort is to only ZBB certain parts of your spending, but not others, e.g. do ZBB for meeting spending but not educational assistance.

Step 3: Develop standard Zero-Based Budgeting templates

This step may become a lot of work for Finance. Again you are faced with a choice. Will you manage your ZBB budgets in Excel or a different vendor system? Excel brings flexibility but also brings headaches, including data control, consolidation issues, and ongoing maintenance. A system can eliminate the headaches but brings additional costs, potentially longer roll-outs, and a potential lack of flexibility. For a smaller organisation, it is probably best to start with Excel and move to a system once your ZBB process is stabilised. Larger organisations may want to just start with a system.

If using Excel, put thought into how you will consolidate the budgets. Likely each budget owner will complete their own budget, and you'll need a consolidation process. You may end up with hundreds of Excel files so think through the design early. Some thought starters regarding your template:

- Who will populate the template? The budget owner or someone in Finance?

- What level of detail do you want from budget owners? The purpose of zero-based budgeting is to gain visibility into spending - the more detail, the better. For example, for Travel do you want budget owners just to plan the number of trips? Do you want to distinguish between domestic and international travel? How about meals? Will you leave it up to the user to determine meal spending or develop a standard meal rate? Think about all of the different nuances for the various cost categories.

- What are your different cost categories? E.g., travel, software, employee development, salaries, etc. Each category will require a different amount of rigour. You may not need Travel detail, but you want a lot of detail on Professional Services. Keep in mind the first time you do your ZBB. It will be new to the end-user. You don't want the ZBB budget process to take a ridiculous amount of time. My advice is to go deep into categories with the most opportunity and stay high-level in categories with limited cost savings potential.

- Will you pre-populate with historical data? In a true zero-based budgeting fashion, you would not provide any history (you are trying to build a budget from a zero-base). However, often budget owners need a starting point so that historical spending may provide the best grounding.

Step 4: Change management for an organisation

This actually isn't step 4. Change management is ongoing communication to the organisation and should be embedded into the entire zero-based budgeting journey. The earlier change management begins, the better the organisation will embrace ZBB.

One could skip change management, but the organisation could reject the program without good communication and understanding. Here are critical change management steps:

- Obtain buy-in from the broader organisation that you will implement ZBB

- Align senior leadership on the ZBB methodology as well as the expected savings targets - prepare them for the workload associated with completing templates and making choices on where to spend vs cut.

- Specific cost savings initiatives should have their own communication strategy. For example, if you are updating your travel policy to be more restrictive, you must develop communication with travellers, so they are aware of the changes.

- Communicate who is the decision-maker for reductions. Align early in the process, which will make decisions on which savings are generated and which activities to reduce

Step 5: Make strategic choices

What makes zero-based budgeting successful is forcing choices on where to spend, or maybe more accurately, where not to spend. Making the actual spending decision is the hardest part of ZBB. After completing ZBB, you may realise there are several different cost savings, initiatives all of which have merit. Someone must decide which projects to fund vs which projects to delay or re-scope.

Early in the process, pressure test decision making authority. The ultimate decider needs to be senior enough so that the organisation will respect and follow the decision...easier said than done.

To help with choosing where to focus spending and reductions, it is helpful to put cost savings into two buckets: volume and rate.

Volume decisions are choices of less (or more) activity. For example, in travel, you could choose to travel 10% less. With less travel volume, the underlying activity tied to travel will not occur (customer visits, employee training, etc.) Volume choices are often harder than rate choices.

Rate decisions are choices to continue an activity but at a lower cost. The activity continues (hopefully in the same manner), but the organisation pays a lower cost. Continuing the travel example, you might negotiate a preferred status with an airline lowering the cost of each trip. Therefore, the volume of trips continues at a lower cost. The more rate savings initiatives, the better since the organisation doesn't have to reduce activity. Often rate decisions become new corporate policies. For example, you may create a policy that all airline tickets must be purchased within 14 days of travel to secure the lowest fare.

![]()

Step 6: Monitor and control changes

After budget completion and decisions on volume & rate, implement strong monitoring and control. The obvious control is tracking the budget throughout the year. As negative variances begin to materialise, they should be understood and rectified.

Track non-financial measures as well in your control monitoring. For example, you may have a list of preferred vendors for consulting engagements. Consider tracking compliance to the preferred vendors and take corrective action as needed.

Done correctly, monitoring & control feedback to the next budget, allowing repeating iterations. Some areas of the organisation may have fully embraced the changes, while others have not. Monitoring will highlight the opportunity areas which will inform of opportunities for next year.

Step 7: Repeat the processes ... or not

Zero-Based Budgeting could be executed once, or you could execute it on an ongoing basis. The initial implementation is the most painful. The second and third year becomes easier for everyone once bugs are worked out of the process and people are used to the level of rigour. Ultimately you should continue to refine steps in the process to improve it. Debrief the processes and course correct to reflect your organisation's culture.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.