Businesses exist in order to improve the well-being of others. One approach businesses use for achieving...

Businesses exist in order to improve the well-being of others. One approach businesses use for achieving this goal is the concept of people/process/technology. In businesses the element of technology is the responsibility of information technology (IT) departments; information technology is responsible for the acquisition, maintenance, and enhancement of technology. How can information technology improve its ability to acquire, maintain, and enhance technology? An answer is financial planning, thinking about how businesses can accumulate wealth.

Businesses exist in order to improve the well-being of others. One approach businesses use for achieving this goal is the concept of people/process/technology. In businesses the element of technology is the responsibility of information technology (IT) departments; information technology is responsible for the acquisition, maintenance, and enhancement of technology. How can information technology improve its ability to acquire, maintain, and enhance technology? An answer is financial planning, thinking about how businesses can accumulate wealth.

The Visualization of Financial Planning

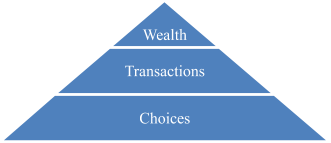

Financial planning can be seen through the following illustration:

To achieve greater clarity I am going to reorganize the illustration in the following manner:

Wealth

Q: Why is wealth at the top of the pyramid?

A: Wealth is the pinnacle for information technology.

The wealth accumulated from IT departments is not in the form of income, equity, and cash. The wealth accumulated from IT department is in the form of characteristics. Characteristics like accessibility, flexibility, and simplicity help those who use hardware and software accumulate wealth. For those in the production function hardware and software help this function accumulate wealth from what it creates. For those in the selling function hardware and software help this function accumulate wealth from what it promotes and distributes. For those in other administrative functions hardware and software help this function accumulate wealth from what it supports. People in IT departments therefore must look at wealth as the characteristics of the hardware and software it acquires, maintains, and enhances for others.

Financial planning helps IT departments look at wealth from the perspective of characteristics through thinking. Thinking about wealth from this perspective is the destination however the destination is reached by a previous step. The previous step, illustrated by the financial planning pyramid, is transactions.

Transactions

Q: Why are transactions in the middle of the pyramid?

A: Transactions are the connection from choices to wealth.

In order for IT departments to accumulate wealth in the form of characteristics it must conduct transactions. Transactions for IT departments are typically seen as the purchase, lease, or rental of hardware and software however transactions in the form of purchases, leases, or rentals represent the characteristics of hardware and software. If IT departments think about transactions in terms of characteristics, IT departments will accumulate the wealth necessary for other functions to create, promote, distribute, and support what companies sell.

Thinking about the purchase, lease, or rental of hardware and software in terms of characteristics helps IT departments improve the financial health of companies. The improvement of financial health will come from cash disbursements that help companies increase cash receipts and/or decrease cash disbursements in other functions of companies. As a support function IT departments can establish themselves as a helpful support function.

Establishing themselves as a helpful support function from the transactions they make occurs when IT departments make appropriate choices. As the financial planning pyramid illustrates wealth comes from transactions and transactions comes from choices. We now move to the base of the pyramid, choices.

Choices

Q: Why are choices at the bottom of the pyramid?

A: Choices are the foundation for accumulating wealth.

Information technology has many choices in its role and here are some examples:

- Should hardware be purchased or leased?

- Should software be purchased or developed?

- Should data be maintained in-house or outsourced?

- Should maintenance be performed inside or outside the business?

- Should human resources develop people through the use of consultants or its own staff?

- Should artificial intelligence or distributed ledger technologies represent enhancements?

The choices made by IT departments are influenced by the missions of the companies they support. Manufacturers that want to stand out from their competitors through timeliness require technology that helps them fulfill this proposition. Retailers that want to stand out from their competitors through accessibility require technology that helps them fulfill this proposition. Service providers that want to stand out from their competitors through courtesy require technology that helps them fulfill this proposition. As a result of how these types of companies want to stand out financial planning helps IT departments make choices that correspond to specific value propositions.

The common denominator in the financial planning pyramid is characteristics. Characteristics are the reasons manufacturers, retailers, and service providers stand out from their competitors. Being able to stand out allows companies to accumulate wealth in the forms of income, equity, and cash. The quality of wealth in these forms arise from the quality of fulfilling the characteristics that help companies stand out from their competitors. The quality of fulfilling these characteristics is improved by financial planning.

Financial planning can be used by IT departments to think about the choices they need to make. The choices that are ultimately made affect the purchase, lease, or rental of hardware and transactions described earlier as transactions. The transactions that are ultimately made affect the wealth accumulated by IT departments in the form of characteristics in hardware and software used by production, selling, and other administrative function. The process described in this paragraph and illustrated by the financial planning pyramid emphasize the importance of the choices made by IT departments, choices that should be thought out carefully and thoroughly in financial planning.

Conclusion

Wealth, the abundance of valuable possessions, is not limited to items on financial statements. The wealth of businesses includes the technology utilized in production, selling, and administration. Information technology is the role in businesses that helps these functions utilize technology in a manner that accumulates wealth. Accumulating wealth is a task suited for financial planning. As a result the reason information technology (IT) departments should use financial planning is to think about how

- Choices affect the

- Transactions that link their choices to the

- Wealth that benefits the stakeholders of businesses.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.