So, you are a C-suite executive, Vice President, Director, Manager, Senior, or Staff financial professional and...

Financial Planning and Analysis (FP&A) Centers of Excellence (CoEs) are an increasingly potent solution to a very timely challenge: How to improve the analytics and decision support capabilities of FP&A, when finance is under continued pressure to do more with less. According to The Hackett Group 2017 Key Issues Study, finance’s major enterprise objective is now to help formulate strategy through delivering better analytics and reporting. That’s right up FP&A’s alley. Yet the study also found the finance budget is expected to contract by 3.8% and its headcount by 4.4%.

Financial Planning and Analysis (FP&A) Centers of Excellence (CoEs) are an increasingly potent solution to a very timely challenge: How to improve the analytics and decision support capabilities of FP&A, when finance is under continued pressure to do more with less. According to The Hackett Group 2017 Key Issues Study, finance’s major enterprise objective is now to help formulate strategy through delivering better analytics and reporting. That’s right up FP&A’s alley. Yet the study also found the finance budget is expected to contract by 3.8% and its headcount by 4.4%.

A Two-Part Answer

That means FP&A must find new ways to improve the quality of its service to internal customers but keep costs down. There are two interrelated ways it can achieve this goal:

Approach #1: It can leverage new technologies to speed up its ROI on EPM tools and improve the quality of analytics and efficiency of core processes execution. Our 2017 Key Issues Study shows finance expects digital transformation to bring about step improvement in its performance as well as significant changes in its service delivery model; although it also shows the function is way behind on its digital execution capabilities. At the same time, the study predicts big adoption jumps in technologies like cloud-based tools and predictive analytics. Wider adoption of new technologies will help FP&A improve the quality of its reporting while making it more efficient by reducing the data-to-insight cycle time.

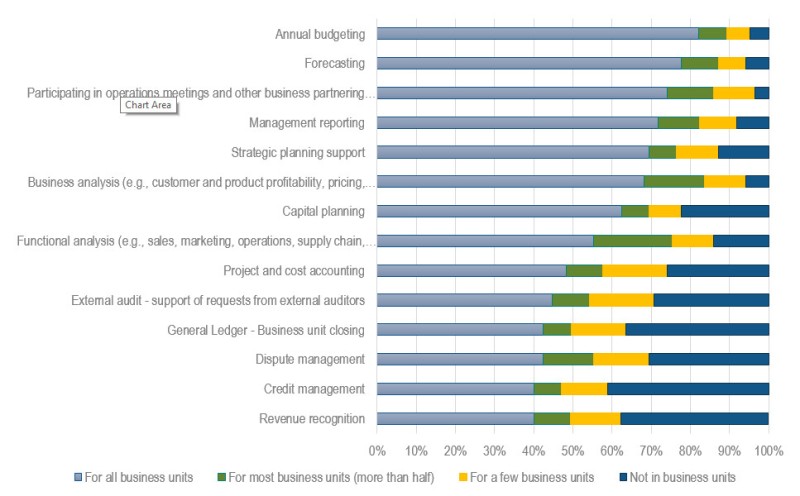

Approach #2: Concurrently, FP&A can pull together the execution of these analytics and core processes into a central entity to help develop the talent and expertise to more efficiently and effectively serve internal customers. By pulling its resources from activities often performed piecemeal at business unit finance organizations (see image below), FP&A can reduce headcount; but more so, it can develop better expertise to improve the quality of its service.

Activities still performed at the Business Unit Level.

Source: The Hackett Group 2016 BU Finance Study

What’s in a CoE?

A CoE is an organizational entity, physical or virtual, that consolidates activities requiring critical and/or specialized skills, with a focus on developing a core competency. CoEs are typically established for processes requiring knowledge-based skills that are of higher value to the function rather than commodity-type, transactional tasks that are often pulled into a global business services (GBS) entity. A lot of the high-value activities that are currently handled by business units (see image above) can be more effectively handled by a CoE, leveraging the analytical capabilities of a core group of experts.

If activities like forecasting and management reporting are pulled into the CoE, along with business intelligence (BI) and analytics, the CoE can reduce overall headcount. More importantly, it can free up business unit (BU) finance staff to focus on a core mission of working closely with business, developing a strong understanding of the operations and solving business problems in real time, all the while interacting with the CoE to supplement advice with sophisticated analytics.

How to Design a CoE?

FP&A teams looking to create a CoE should consider the four following steps:

- Establish the purpose and case for a future-state CoE. Articulate why a CoE is needed to support FP&A, as well as the overall purpose of this construct in executing and delivering against finance’s strategic objectives and those of the broader enterprise; make sure to identify improvement opportunities for cost, service, value and/or use of technology.

- Determine the scope and activities to be performed. Decide which FP&A services to offer through the CoE vs. BU-based FP&A teams. This includes evaluating the current state of FP&A and identifying the barriers prohibiting the function from delivering higher-value services. In many cases, the efforts will require a progressive build-out over time before advancing to more complex areas.

- Align on organizational design and reporting relationships. Re-architect finance for value creation, while delivering on core planning and reporting activities in a consistent and reliable way. That means fulfilling current FP&A demands, while considering how needs differ between BUs and/or regions, as well as the role of a GBS if it exists.

- Determine the interaction model. Articulate how the CoE will support and interact with the business, by delineating its intended role and how involved it’s going to get within its scope of activities. CoEs evolve over time as their experience and credibility grow. Depending on its starting point, CoEs may begin in a “reporter” role, and progress into an “advisor” role.

- Define the skill set. Finally, FP&A should figure out what is the talent profile (profiles) required to staff the CoE in order to deliver on its improved service promise. It needs to begin to inventory its existing skill set to assess readiness. It then must come up with a hiring and development plan to build the capabilities to offer services to support the CoE’s defined scope and activities.

The CoE can create a center of expertise that can feed internal constituents with key analytical and core services, like forecasting and budgeting support; it reduces the need for multiple FTEs at the BU level and brings together subject matter experts and centralizes activities in one location. That model simplifies the interaction with business units, other parts of finance and senior management. It becomes a one-stop shop for providing high value-add services to internal customers and the new part of the finance operating model, enabled by digital technologies.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.