“Control” is an interesting word in the management vocabulary. It is a word many managers struggle...

The inspiration for this article stems from a recent conversation on a Financial Planning & Analysis (FP&A) LinkedIn group that I'm a member of. A highly regarded FP&A professional suggested to discuss the differences between the controllership function and FP&A. This article will highlight a couple of differences from an FP&A practitioner's perspective.

The inspiration for this article stems from a recent conversation on a Financial Planning & Analysis (FP&A) LinkedIn group that I'm a member of. A highly regarded FP&A professional suggested to discuss the differences between the controllership function and FP&A. This article will highlight a couple of differences from an FP&A practitioner's perspective.

Two main differences between Controllership and FP&A

CFOs, historically, cut their teeth in Controllership, FP&A, and Treasury before their ascension to the CFO role.

Today, in most large corporations, the controllership function and FP&A have been divided into two separate teams with different mandates.

The controllership function, nowadays, reports to the Chief Accounting Officer, while the FP&A function reports to the Chief Financial Officer (CFO).

There are two main differences between Controllership and FP&A that you can notice in most world-class organizations:

- Three guiding principles

- Data usage practices

Guiding Principles of Two Functions

The guiding principles of Controllership and FP&A functions can be subdivided into three categories:

Historical vs. Forward-Looking

Controllership involves the accurate preparation of financial statements based on past periodic, quarterly, and annual financial performance. Financial reports are used by senior leadership to evaluate the performance of an enterprise or business unit. Investors use financial statements to gauge the performance of senior executives and whether the strategy adopted by a company's C-suite is successful. Creditors use financial statements to determine whether an enterprise can take on additional financing or has violated debt covenants.

Although the FP&A function sometimes gets involved in the historical analysis and reporting of trends in key performance indicators (KPIs), the bread and butter of FP&A work are predictive (forward-looking).

FP&A offers senior leaders insight into the future financial position of an organization and forecast its operational and financial performance. This is done by leveraging

- statistical/data analysis - for example, multiple regression, moving average methods, what-if analysis, etc.,

- performance indicators,

- macroeconomic indicators,

- and business intelligence systems.

The forecasts that FP&A teams provide to senior leaders help:

- guide resource allocation (personnel, capital allocations, and investments)

- manage the Wall Street expectations.

Compliance vs. Exploration

Financial statements must be in compliance with tax laws, IFRS, US GAAP, Sarbanes-Oxley (SOX). The remit of the controllership function is to capture the economic reality of the company's performance to the last cent (or dollar). When capturing items such as depreciation, amortization, impairment, pension obligations, revenue, leases, research & development costs, the controllership function cannot deviate from the guidelines or rules that IFRS or US GAAP provide them.

There are certainly best practices that are adopted by most FP&A teams, however, FP&A practitioners can explore different analytics methodologies and procedures for their assignments in the areas of planning, forecasting, budgeting, and ad hoc analytics.

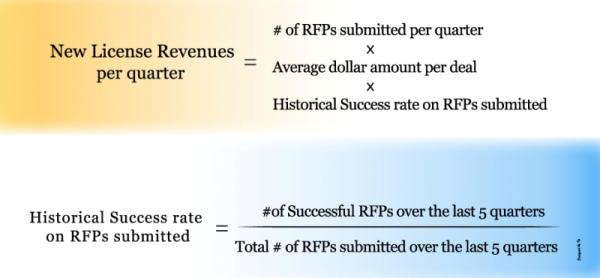

For example, there are a couple of methods an FP&A professional can deploy when tasked with forecasting sales for a software company.

Traditionally, software companies have significant forecasting risk due to their inherent high operating leverage as a result of their significant personnel costs. To forecast revenues for the next 5 quarters, FP&A professional could analyze the number of request for proposals (RFPs) submitted per quarter

- per line of business (licenses, consulting),

- by product line,

- by geography,

- by target market (government, health care).

Then this metric is forecasted for the next 5 quarters. See formulas below to determine: New License Revenues per quarter.

Hence, FP&A professional has to explore several dimensions during the course of the analysis. It would also be a good idea for FP&A to model different scenarios for the sales forecast. For example, competitive pressures could cause the company to lower prices on their products and services - causing the average dollar amount per deal to decrease in future quarters. Alternatively, to produce a sales forecast, the FP&A professional can use historical data to forecast total sales using an exponential smoothing model.

Cost Control vs. Top Line Growth

An FP&A function that does not deliver financial insights that lead to enterprise sales growth is likely not delivering the return on investment (ROI) that senior leadership expects.

Sales growth, among other financial indicators, is a sign that the Wall Street examines when analyzing a company's performance. I imagine the conversation between a Controller and an FP&A Director at a cocktail event would go something like this:

FP&A Director: Hi! What a great event, isn't it? How was your year at work?

Controller: Excellent! Our team saved the company a lot of money by controlling our expenses in admin and direct costs as well. Our expenses came under budget for the first time in 3 years. How was your year?

FP&A Director: We had a great year as well. We provided the CFO with insight into a market entry opportunity for our company by acquiring the No. 3 company in Europe in our industry. We are expecting this deal to be accretive to cash earnings per share (EPS) by at least 12.3% over the next 3 years. Also, we're anticipating revenue synergies that will enable us to be the No. 2 company in our industry in the next 2-4 years in terms of global market share.

2. Data Usage Practices

To accomplish their tasks, the Controllership function mainly uses internal financial data that stems from the Enterprise Resource Planning systems (ERP). Journal entries are posted to the General ledger system, the trial balance is prepared, adjusting entries are recorded (if needed), accounts are closed, and financial statements are prepared.

On the contrary, FP&A teams use both external and internal data. For example, to develop a sales forecast for a software company whose clients are large corporations, FP&A would have to consider external macroeconomic indicators (i.e. leading indicators) that impact sales performance as a variable. These indicators could be GDP growth and durable goods orders.

Conclusion

The Controllership and FP&A functions are two important components of any high performing organization. Although they have different mandates, they speak the same language, the language of numbers.

Comment below if you are a controller, member of an FP&A team, or treasurer and please feel free to share your own professional experiences.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.