The statistics reveal that 60%-90% of strategy implementations fail and only 14% of executives are satisfied with the execution of a...

Over the past 15 years, I have had the amazing opportunity to work with numerous Corporate Finance teams from around the world in an effort to help them get the most out of their strategic modeling practices. Over this time, I have uncovered a common pattern of reoccurring misconceptions and pitfalls that I believe routinely inhibit companies from maximizing their strategic modeling capabilities.

In hopes of eliminating these common mistakes, I want to share with you a presentation that I often give to individuals looking to enhance their way of thinking about the very important area of Strategic Finance.

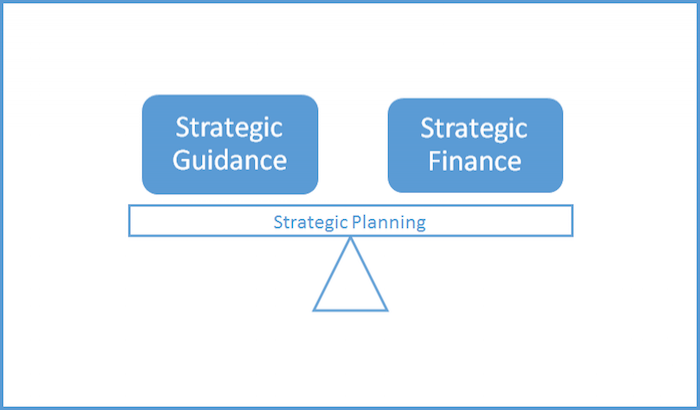

#1 — Why the strategy SHOULD hang in the balance

I tend to find that although most people can probably agree on a definition for “Strategic Planning”, agreeing on what form of analysis should be performed is often a bit more contentious.

That's because, for most people, Strategic Planning is characterized as a “Strategic Guidance” exercise, where the focus is on performing market research, evaluating benchmarks/comps, understanding competitive advantages and analyzing a business’s strengths and weaknesses. Typical owners of an organization’s Strategy Guidance document might be the Chief Strategy Officer (CSO) or even the CEO. These people tend to have deep knowledge in their industry and might use any number of tools or services to help them develop their guidance documents.

However, organizations that solely equate Strategic Guidance to Strategic Planning also run the likely chance of creating a “strategy gap”, where the content/context in the guidance documents don’t provide enough information to accurately set achievable targets for the Budgeting process or the guidance is ultimately deemed “pie-in the-sky” because it hasn’t been thoroughly tested. As a consequence, Strategic Guidance on its own can often just sit on the shelf, regardless of the amount of thought and skill that went into producing it.

To avoid a strategy gap, Finance departments need to take the lead in the parallel exercise of Strategic Finance. This is primarily a top-down financial modeling exercise where assumptions from the Strategic Guidance and elsewhere are used to drive integrated financial statements that (once agreed-upon) should act as a high-level target for the all-important Budgeting process.

The most common areas of analysis for Strategic Finance are long-range planning/target setting, acquisition/investment screening, treasury planning, executive compensation planning and valuation analysis.

One of the keys to successful Strategic Planning is to maintain both a good balance yet distinct separation of Strategic Guidance and Strategic Finance. This often requires strong communication and coordination between Finance and other internal/external industry experts responsible for producing the Strategic Guidance.

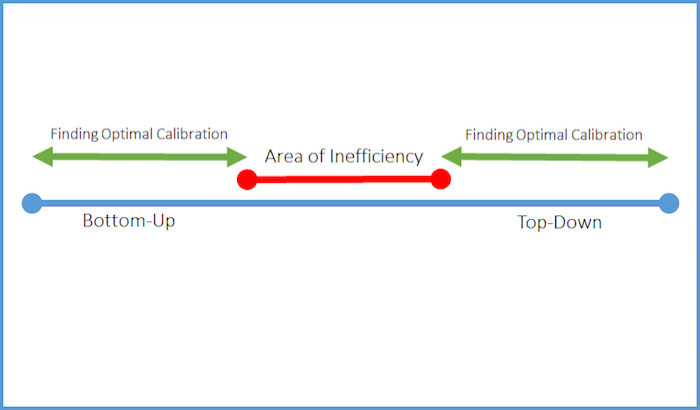

# 2 – Why Goldilocks got it all wrong

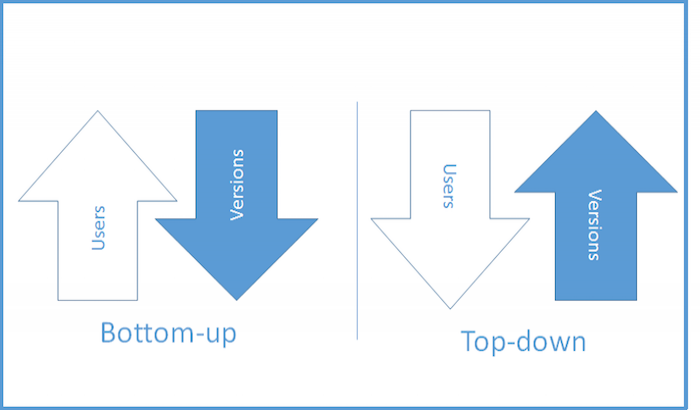

Bottom-up budgeting and top-down planning (Strategic Finance) sit at the opposite ends of the financial planning spectrum and serve two different yet necessary purposes.

The purpose of top-down planning is to set long-range operational targets that justify investment and capital needs. While bottom-up budgeting’s primary purpose is to increase the likelihood in the short-term that those targets are met or exceeded by establishing accountability at lower levels within the organization.

Taking a middle-of-the-road approach to planning sounds great, but in practice, it is often the worst approach to take. It’s not detailed enough to assign accountability and measurability to actuals yet too detailed to quickly set targets and become directionally correct when running scenario analysis.

It’s important to note that there should always be room to evaluate and optimize the level of precision of both bottom-up and top-down tools. Having agile tools in place that allow you to make changes over time is critical. In fact, I have never run into a company that got it right the first time.

However, one must always resist the temptation to compromise in the middle.

#3 – Christmas in July

There is often a great deal of confusion in the term “top-down” planning. It's not uncommon for people to think it’s an approach taken by management to enter numbers at a higher-level and then allocate them down the throats of the subject matter experts (SME) who are sitting at the Cost Center level. However, this is not the case and trying to do so would lead to disaster in the long-run.

It’s important to realize that top-down planning is done because the leaders at the top know that when they accept capital from shareholders and banks that they are beholden to providing a return that would increase Shareholder value in the long-term and would keep the company afloat. Therefore, it makes sense that top-down planning is about setting clear and measurable targets without providing restrictions on how the SME is going to reach that target.

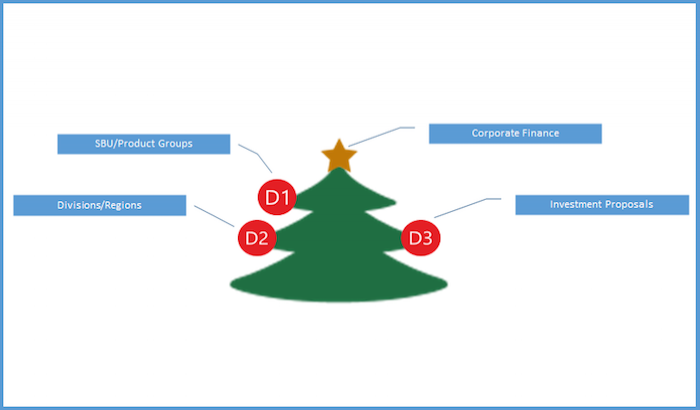

This is why it is important to realize that top-down planning must be a cascading exercise, where small teams discuss, debate and form consensus from the top and then hand off those targets to the next level down the management hierarchy where a new leadership team can discuss ways in which they could use their knowledge to reach those targets by setting their own targets for their LoBs.

I like to illustrate this point using a Christmas tree, where the star at the top is typically Corporate Finance and the bulbs below represent secondary cascading management units. It would be chaotic to have 40-50 people all running scenario analysis concurrently. Instead, it’s more often a case of 5-10 peers debating targets before it is cascaded to the next small team.

When it comes to new business ideas, investment proposals and acquisitions, it’s ok to have BUs submit their own ideas (as they are probably highly knowledgeable about the products and markets relating to the deal). However, I have also seen it many times where the cascading target includes additional acquisition placeholders that point out the size and shape of the business that should be acquired but don’t have a particular target in mind.

#4 – Why “Simple” does not mean “Simplistic”

Recently there has been a lot of buzz on making software “simple”. The term conveys a sense of efficiency and intuitiveness which is critical for busy users who don’t have the time to invest in becoming a super-user on day-one. In the minds of many business professionals, “simple” is now synonymous with “effortless”

However, the natural impulse is to also think that simple means simplistic (or less content). Yet, this is not the case. “Simple” is actually a design language that takes complex subject matter and makes the experience look effortless to the end-user. In fact, to accomplish this it actually requires more thought and effort on the part of the developers, usually resulting in more functionality or smarter usage patterns. As a result, “simple” actually means “smarter”.

For example, recall the netbook craze of a few years ago. These (often smaller) PCs were marketed as internet focused machines, but, in reality, were nothing more than low powered PCs. Along came the tablet, with touch screens and purpose-built apps and they blew away the netbook.

The pitfall I see all too often when dealing with Strategic Finance is that companies try to take bottom-up budgeting tools and simply apply less content to them in hopes of achieving an intuitive or effortless top-down model. Yet, bottom-up tools don’t provide additional intelligence to the top-down process. As a result, companies aren’t getting more with less, they are just getting less.

#5 – Why are we constantly “dealing” with ad hoc analysis

Anyone who has taken part in Strategic Finance knows that a large part of the analysis is looking at new deals (new business ideas, investments, acquisitions). These deals can come and go in rapid succession or they can sometimes languish around for months before either getting eliminated or green-lighted.

This issue poses a big challenge for server-based technology (technology used for most budgeting tools). That’s because server-based technology often centralizes the data forcing users to create placeholders for the data first prior to entering the data. That approach doesn’t make sense if the deal has a chance of being discarded quickly or if the people that need to review that deal are different from deal to deal. This form of agility is not what centralized budgeting tools were designed to do.

The reality is that when it comes to Strategic Finance, most companies still gravitate toward spreadsheets despite the well-known pain points. One of the few benefits to a spreadsheet is that it is a document-based technology. When dealing with a document, users are free to save and share with whomever they want or, of course, they can throw it away or archive it and recall it later. This approach is far more flexible for the needs of Strategic Finance.

#6 —The truth about “Single Version of the Truth”

In the business world, we hate the unknown. So in the short-run, we try to eliminate it by holding people accountable to certain expectations, all the while making sure we can drill down into the details to find out what’s not going to plan. Predictability and accountability are a good thing in Finance.

However, in the long run, it becomes more difficult to eliminate the unknown. As a result, we have to think more creatively and opportunistically and realize this environment creates more room for discussion, debate/influence, and consensus building. Paving over this basic communication requirement with rigid workflow management functionality and centralized data submissions is not helpful for Strategic Finance.

We need to embrace solutions that complement both our short-term and long-term requirements so that we can optimally plan for all time periods and stop continuing to apply a “short-term fix”.

#7 — Spend less time getting there and more time looking around

Many people think that Strategic Finance is an exercise that is typically performed either just before or just after the annual Budgeting process and that’s it, back on the shelf it goes.

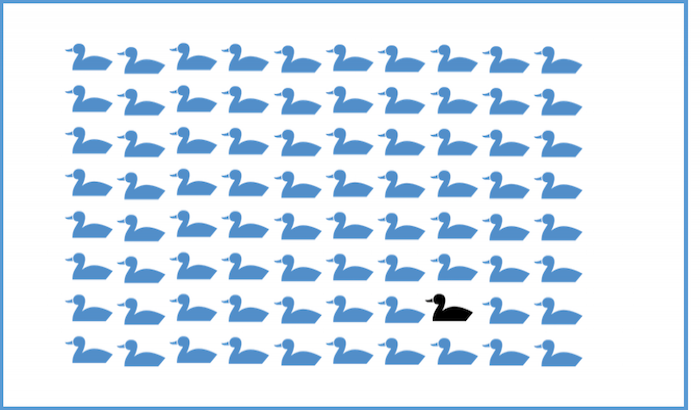

Although this can certainly be the case, successful Strategic Finance teams often benefit the most when they are able to continuously screen for opportunities and threats that are a result of fluid changes in market conditions. This is not to say that companies should be constantly updating their strategy, but instead they should be in a perpetual screening process, ready to take advantage of opportunities when they arise.

Black Swans are a perfect example of the need to screen for opportunity and risk. By definition, Black Swans cannot be detected by statistical software. Their likelihood would deem them an outlier and without any real context around the situation, they are either ignored or undetected. The only way to find a Black Swan is to look for it.

Sometimes we spend so much time focusing on climbing the mountain that we fail to spend the time looking around once we get to the top. In all likelihood, that vantage point might just be the competitive advantage we need.

Conclusion

I hope the topics covered in my article cause you to reflect on your own Strategic Finance activities. Is your Strategic Finance effort getting the level of attention it deserves? Or like many organizations, is it getting crowded-out and distorted by other adjacent activities?

If done correctly, Strategic Finance can represent an immense value-add to your organization while at the same time, reduce the costly time and effort of the Budgeting process. Make a conscious effort to consider these seven essential tips and I’m sure confident you will see the benefits.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.