The second FP&A Board Connect will be dedicated to the topic of "Zero-Based Budgeting in Multinationals"...

Finance is facing specific challenges as far as multinational companies are concerned (i.e. versus pure national companies).

Finance is facing specific challenges as far as multinational companies are concerned (i.e. versus pure national companies).

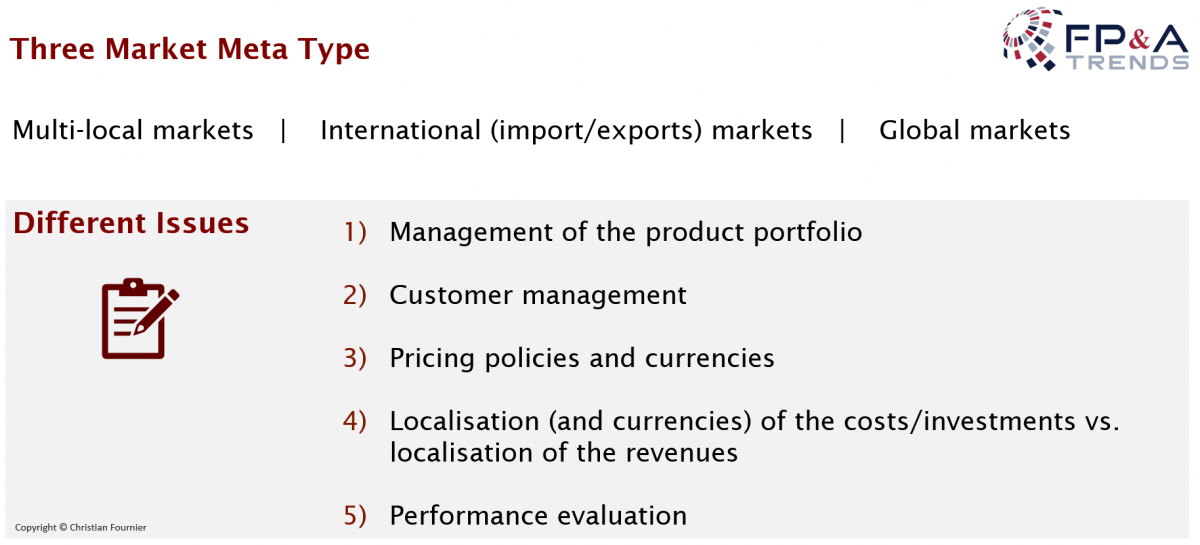

The first key specificity is the magnitude of the product/market reach targeted by the company. There are three market meta types that should be considered:

- Multi-local markets,

- International (import/exports) markets,

- Global markets,

(keeping in mind that some are transitioning from one meta type to another).

The second key specificity is the magnitude of the geographic reach.

These magnitudes need to be assessed, managed, planned and forecasted in a coherent way and as such relevant data and measurement must be put in place.

The market typologies bring specific issues for finance that can be either similar (potentially identical) or having different impacts across different market meta types. This article will describe these similar and different issues in more details and will provide some guidelines on how to resolve them.

I. The Activity Magnitudes: Market and Geographic Reach

As far as the two magnitudes are concerned you can find a detailed presentation, extracted from my book below. From slide 23, it describes the different logical combinations and what are the most efficient ones at a conceptual level. These correspond to different types of strategy.

When it comes to product/market reach, an international company can implement a range of possible strategies. Strategy choice is the major choice for the company and must be carefully managed. Strategy implementation needs to consider both local and central levels to get an efficient globalization of the product/market approach. The choice of the product strategy matrix is described on slide 25.

After considering the product/market reach magnitude (i.e. the nature of the markets that the company decides to address), the company needs to define and differentiate its approach by:

- assessing the local market maturity (investment versus renewal markets, growth rate, type of competition)

- setting the mode of presence (local production or assembly or not, marketing, representation or subsidiary or joint venture, ...)

- implementing a penetration policy adapted to the modus operandi of the countries concerned

These differentiation strategies bring us to another matrix that is described in more details on slides 26-28.

What do the magnitude characteristics mean for FP&A?

In practice, Finance, financial planning and analysis (FP&A) in particular, should be able to assess the effectiveness of the strategical choices made with respect to both magnitudes and promote alignment when necessary. It is a mix of internal and external data to collect, organize and assess.

FP&A should take in consideration magnitude characteristics when addressing new investments or existing organizations and management performances, new development (product or geographic), arbitrating on resources allocations and localization, etc.

FP&A should also be able to challenge any decision that will degrade the coherency of the strategic positioning of the company. It largely exceeds the complexity of purely home markets. It implies major differences in the way to organize and look at internal data and on the amount of business and competitive intelligence necessary.

Different magnitude choices will result in a different way of working (or at least different focus) when analyzing and forecasting the activity and profitability.

In the most globalized solutions, the focus will be on volume, costs and prices evolution and assessing competitors. In a multi-local configuration, each country (or small group of similar countries) will be considered on its own. Whereas intermediate configurations will focus on both costs and volume of the common elements, on the costs of adaptations and differentiation and how they reflect on the prices.

Finally, peace climate and political stability is a major factor in the balance of the choices made. It can be changed at any time by a war, a crisis or a climate of insecurity. These elements must, therefore, be reviewed regularly and carefully. Contingency and activity continuity plan should be ready for/when a crisis happens.

II. Dealing with Finance Issues Similar Across Three Market Meta Types

Finance practitioners face issues that are similar across different types of markets (i.e. issues having the same source but with variable impacts or importance).

1) Multiple operating entities have their own booking currencies. There are different sets of books, banks, tax and legal requirements, suppliers, etc...

Ideally, this issue is resolved by having the same applications through all entities, using the same chart of account as well as the same accounting practices.

It also requires a policy coordinating the currency rate practices. Ideally, a central currency table will be communicated and applied for transaction booking (to local book currency).

2) Inter-company transfer pricing or cost allocations, more or less material depending on the company organisation, intercompany flows need to be acceptable from a tax point of view but also permit a profitable activity in both side of the transactions. This is a hot subject at global level and a subject to be kept under permanent review.

Tax optimisation temptation can be high still. An ethic practice is to avoid double taxation and non-recoverable VAT (or assimilated tax), still respecting the true added value of both sides.

Such transactions’ currencies are a point to manage carefully. Clear documentation needs to be put in place.

3) Data consolidation. The process is simplified a lot when all entities used the same chart of account and associated analysis coding. If not, then clear mapping needs to be maintained.

The currency policy will precise how currency translation will work (from the set of book currencies to consolidation currency but also for currency accounts re-valorisation).

The process should eliminate intercompany flows. In practice that may be more or less easy to achieved depending on a full visibility of both side of the bookings. Highly automated company needs to ensure that both sides of the transaction are booked at same date, same rate and keep track of both for month-end consolidation.

For analysis purpose, multiple values will be calculated for the consolidated data e.g. at the current rate, at last budget or forecast rate, at prior year rate. This will permit to isolate the currency effect from the variance analysis and focus on the business variances. Depending on the company activities, this might be a set of book currency to standard rates or a more complex initial transaction currency to standard rates.

Clear timetable needs to be put in place for both actual, forecasting and analysis,

4) Communication and Cultural bias. Managing activities over a (more or less) large number of countries means overseeing various cultures. National culture is the first to come to mind but it can also come from entity-specific cultures in particular after merger and acquisitions. Communication over different cultures is more challenging than in home culture, it particularly reflects on the way compensation schemes, target setting and performance evaluations are perceived.

5) Data referential management. Data referential can become a real nightmare if not managed centrally and with strict discipline. The chart of account itself is relatively easy to standardise but analysis coding can be more cumbersome to implement in particular for multi-local markets (product and customer analysis in particular)

III. Dealing with Finance Issues Different Across Three Market Meta Types

For finance, there are also issues that are different across three market meta types mentioned in the beginning of the article. These issues also need to be managed.

1) Management of the product portfolio. Where a global range permits a standard coding, standard way of analysing profitability, standard forecasting methods and timing etc., the multi-local operations lead to fragmented coding, potentially different approach to analyse and forecast activity and its profitability. Adapted and differentiated ranges will result in their own challenges.

Finance needs to ensure those issues are properly organised in order to be in a position to supply relevant management information. It should not be a dogmatic approach but adapted to each business situation. A global approach is best for global markets but is detrimental to international or multilocal markets.

2) Customer management. It is quite different depending on the market type.

A global B2B company working with large international customers may need to consolidate revenue and profitability analysis by customer on a global basis.

On the opposite, a company on a multilocal market with large customer base may keep that analysis local and only consolidate some high levels of customer type data.

3) Pricing policies and currencies. Multilocal markets will generally drive local pricing and currencies i.e. prices adapted to the local markets in local currencies. On the contrary, global markets will often be priced on a uniform basis and few global currencies. Intermediate markets may be a mix of solutions.

4) Localisation (and currencies) of the costs/investments vs. localisation of the revenues. Where multilocal markets will generally have a major part of the costs and investment currencies localisations corresponding to those of the revenues, global and international markets will have a more or less important part of the cost and investments localisations different from those of the revenues.

Centralised manufactures, centres of excellence, central purchasing or support organisations will develop along with the globalization of the activity. It offers economies of scales, better quality, improved efficiency and lower costs. But there is also a drawback: currencies exposures might largely increase. It will make analysing activity and profitability more complex.

Information (consolidated and by entity) should be largely available in order to perform those analyses. Organisations will need to have a central data repository system ensuring both one truth, standard reporting and detail analysis.

Localisation is the prime area of transfer pricing and cost distribution in order to map costs and revenues in order to avoid double taxation or over-taxations. It also brings the issue of natural edging i.e. how costs currency match with revenues currency and how this (un)balance is managed in order to minimize disturbance to the business and its profitability.

5) Performance evaluation. Evaluating and comparing performances become largely more complex than on a pure home market.

The potential of revenue growth and profitability, of cash needs and generation, etc … depends on the product/market reach and geographic reach combination with (potentially) different competition. The choices made will reflect in naturally different performances.

Whereas the way performances are targeted and calculated must be standardised and transparent, the references used to evaluate them shall be differentiated in order to take into consideration the reaches mix.

FP&A has a key role in rendering an objective evaluation and avoiding that human bias and power struggle get unfair and create management issues.

Conclusion

In summary, multinational companies embed a level of complexity that is much higher than home markets companies and present specific challenges for finance and FP&A in terms of:

- Business acumen and associated business and competitive intelligence needed

- Data management and analysis

- Currencies management

- Intercompany flows

- Cultural bias

Finance and FP&A management must be deeply involved in dealing with these challenges. They must keep in mind that the three markets meta types come with their own specificities.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.