Being a business partner will increase your scope and you will be more dependent on others...

Today, software as a service (SaaS) businesses are popular with investors, lenders and customers. Many software companies have transmuted their pricing models from perpetual license models to subscription models.

As a result of subscription models, enterprises now possess vast troves of data (customer, operational and financial). Finance business partners, within the Office of the CFO, are charged with proactively interacting with different enterprise teams.

Finance business partners are important in subscription environments. A finance business partner’s role, in the Office of the CFO — is to be a consigliere to a leader of a function such as a sales leader, marketing leader, product leader, and, even, a business unit leader.

FP&A Business Partner needs to answer five questions

Finance is pivotal when making the right decisions in a SaaS company. Identified below are sample questions an FP&A business partner can help answer to accelerate the growth trajectory in a SaaS enterprise:

1. Is there a poor product-market fit?

Why is this important? It is common for SaaS companies to enter a new market with a product expansion targeted for that market. However, in some cases, product expansion might be ill-suited for the new market. For example, a SaaS company that provides data integration, data management, cloud storage and integration software for large enterprise customers releases a product offering targeted at mid-sized enterprises. If sales are flailing with higher than anticipated churn rates, poor renewal rates, a finance business partner can calculate the customer acquisition cost (CAC) to acquire mid-market customers and notice that these customers are churning out four months after break-even point. As a result, customer lifetime value below optimal levels.

Additionally, the finance business partner then triangulates with the go-to market organization or product team to assess if the reason for higher than expected churn is due to product functionality or design issues, service level agreements, pricing, or, simply poor product-market fit. By adopting a client services approach, the finance business partner provides visibility, from a unit economics standpoint, to support decisions on a go-forward basis.

2. What is an appropriate amount to charge a prospective customer for a 3-year contract?

Why is this important? With many software companies operating subscription models, the discount applied for SaaS deals in comparison to perpetual license deals are lower because software companies bear the burden for hosting in SaaS deals. Furthermore, discounts can vary based on deal size. As a result, pricing can vary based on contract lengths, product bundling and subscription levels.

The pricing model for SaaS companies is critical because the closure of the initial deal—provides an entry point for subsequent deals, expansions, renewals, and customer lifetime value maximization. Finance business partners are instrumental in deal structures and leverage their commercial acumen to develop pricing models with a discount factor based on a deal’s specifics.

3. How can we assess the strength of our customer relationships?

Why is this important? It is common for SaaS companies to periodically evaluate the net promoter score (NPS) to assess the strength of their current customer relationships. NPS is an important metric widely used in many industries. However, in my experience, it does not tell the comprehensive story when a SaaS or PaaS company wants to measure customer’s delight with their products.

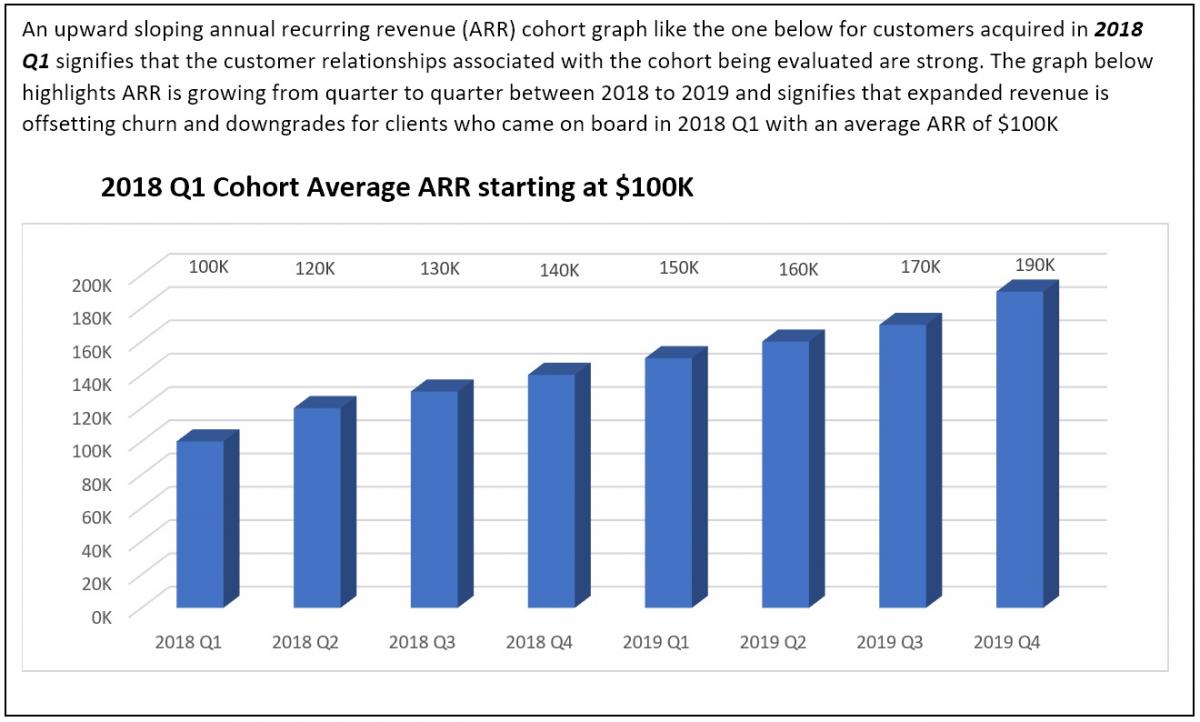

A better indicator of the stickiness of a customer relationship is the evaluation of Cohort curves. A finance business partner proactively provides insights to sales and go-to-market leaders by leveraging cohort analysis. Upward sloping revenue cohort curves—annual recurring revenue for customer cohort in year 1 versus annual recurring revenue for the same customer cohort in year 2.

Recurring revenue cohort increases from one year to another represents an excellent indicator of — great product-market fit, healthy return on investment (ROI) for sales/marketing investments and sticky customer relationships.

It is more expensive to acquire a new customer than to, upsell or cross-sell a current customer. Furthermore, from a unit economics standpoint, every incremental dollar of revenue expansion from a current customer is more profitable than incremental revenue from a newly acquired customer because of the costs (sales/marketing) incurred to acquire a new customer.

These sales and marketing costs comprise costs to identify potential customers, nurture prospective customers through various stages in the sales funnel—from marketing qualified leads to sales qualified leads, and, finally, to deal close. For a SaaS company to circumvent making significant sales/marketing incremental investments to acquire new customers, it needs to develop a robust program that enables current customers to refer new customers.

4. Who is the ideal customer for our product?

Why is this important? From a unit economics perspective, it is imperative that sales and marketing investments be optimally allocated to maximize customer lifetime value. That’s why I’m a big fan of identifying an ideal customer profile for a SaaS business.

You can always deploy qualitative frameworks for identifying an ideal customer, however, quantitative measures provide justification to this process as well. I’m passionate about leveraging data to help drive capital efficiency in this area and utilizing associative analysis, cluster analysis and other statistical methodologies to uncover the profile of an ideal customer. By leveraging data on current customers in enterprise systems and employing cohort analysis, we can perform the following:

- Product purchases of current customers—for example, how many products did customer purchase: 1,2,3 or 5 products?

- Product utilization—are customers using the products they purchased? If not, this provides early warning signs about renewal rates

- Payment history of customers

- Support tickets generated by customers—profile and volume

- Segmentation by ARR bands

5. How do we assess the productivity of our salespeople?

Why is this important? After the identification of strong product-market fit, SaaS enterprises employ salespeople, or account executives (AE) to facilitate the acquisition of new customers. An enterprise’s ability to predictably determine its ability to grow and scale efficiently is inextricably tied to how quickly newly hired account executives ramp. The ramp period could be 3 months, 6 months, or 9 months, after which the new salesperson is expected to be at a certain ramp attainment rate or success point.

If new sales hires are consistently achieving an expected ramp attainment point, it provides a feedback loop that—the product meets the need of its market better than the competition, sales enablement and marketing are working well, and hiring criteria for new sales hires is excellent. A finance business partner who is supporting the SaaS enterprise’s Head of Sales or Chief Revenue Officer (CRO) harnesses this data and provides recommendations on sales efficiency.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.