Working in FP&A during a crisis is extremely challenging but it is also an opportunity to...

To unite the firm on a single planning foundation, FP&A must adopt the planning frame that drives value for its customers i.e. operations (a.k.a. activities, processes, flow).

To unite the firm on a single planning foundation, FP&A must adopt the planning frame that drives value for its customers i.e. operations (a.k.a. activities, processes, flow).

In so doing, FP&A must abandon its current planning platform of the traditional budget and its customer-meaningless details of the chart of accounts and departmental budgets.

A single planning platform eliminates the traditional wrangling over costs between Finance (i.e., budgeted costs) and Operations (i.e., actual costs) because the firm now has a cost “coin of the realm” those of its operations. According to the Beyond Budgeting Institute, this also allows the firm to “dedicate resources to processes and not the budget.”

That platform is the Operational Budget (OB) and it brings many benefits to the firm. They were explored in Part 2, 4 and 5 articles. Two additional benefits are described in this article include sales and marketing’s return on investment (ROI) and prescriptive financial what-if analysis.

- Part 1: How predictive and prescriptive analytics make the operational budget (OB).

- Part 2: OB’s benefits for the budgeting process

- Part 3: OB works: Test Case shows the firm left 50%-%150 more profit on the table last year

- Part 4: OB’s benefits for the rolling forecast process

- Part 5: OB’s support for the Beyond Budgeting Institute’s adaptive management model (BBM)

This article has four sections:

- operational data the OB provides Operations;

- Sales and Marketing’s ROI;

- prescriptive financial what-if analysis;

- conclusion.

Operational Budget’s Monthly Production Planning Benefits

In the specific case of Operations, the Operational Budget provides the following:

- Production Planning. A monthly production plan including making Q amount of product P for operation A in plant PL over the planning horizon T. Results cover all products for all operations in all plants for all time periods and associated costs (COGS) and all the OB’s SG&A costs.

- Capacity Planning: Since the Operational Budget develops a new forecast, there is no way of knowing, a priori, what the product volumes will be. Thus, where feasible, all the operations, plants and links for all time periods are appropriately capacitated. Further, when there is more than one option (e.g., second shift, outsource, build ahead, over time), they all are included, so the best one is chosen.

- Constraints Honoured: Examples include customer service level, raw material suppliers, distribution centres’ locations, energy or carbon implications, transportation links and procurement availability limits

It is important to remember two additional benefits of the Operational Budget (OB) model for these Operational data:

- In the Operational Budget, the volumes and costs are never obsolete. They are immediately updated when any of the OB’s underlying assumptions change (e.g., new forecast, new product slip, operational improvements). Or, when the OB’s variance analysis indicates the predictive analytics underpinning the model need to be changed.

- The monthly production planning forecast is the most profitable forecast as computed by the OB.

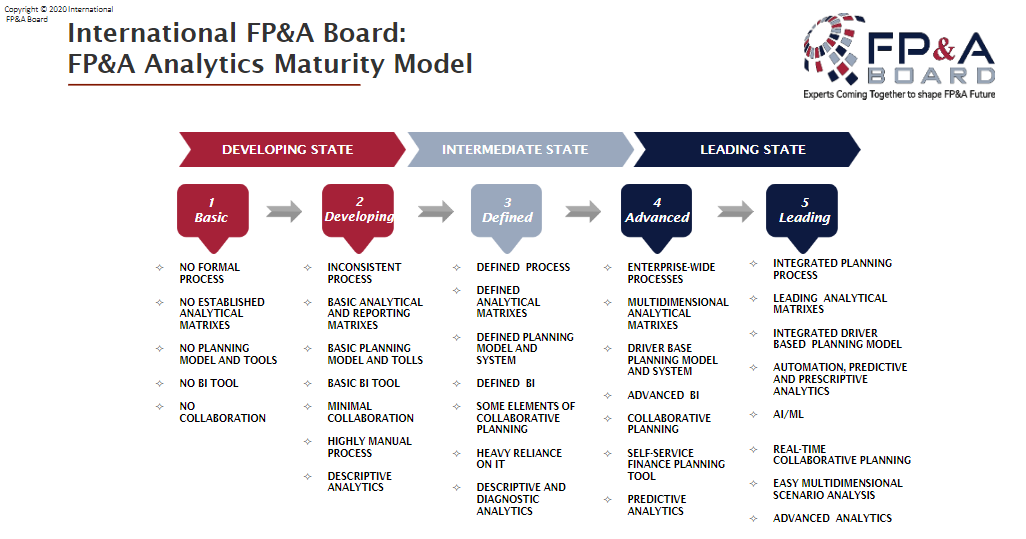

These specific production planning benefits and all the other OB benefits are made possible only because the OB is a i) model ii) that is loved prescriptively. According to the FP&A Analytics Maturity Model, the final analytical stage of a company requires prescriptive modelling. See Figure 1 below.

Figure 1. FP&A Analytics Maturity Model

Sales & Marketing Return on Investment (ROI)

For the purposes of this discussion, sales and marketing's ROI is defined as profit divided by total sales & marketing expenditures; the S of SG&A.

The Operational Budget model includes both

- the response functions (i.e., how the forecast varies as a function of total sales & marketing expenditures)

- cost functions (i.e., how COGS and G&A costs vary as a function of the forecast).

Thus, all costs of the income statement are in the model. This allows the Operational Budget model to solve for best possible profit (or contribution margin or revenue). For more details, please refer to the first article.

If increasing or decreasing sales or marketing expenditures (S) would have improved profit, the Operational Budget model would reflect this. Thus, the S in the solution is the specific total sales and marketing expenditures that created the best possible profit. Since both profit and S were considered simultaneously, the ratio of the two is the best possible.

For additional details, please see the article published in the Nov/December 2015 issue of Wiley's Journal of Corporate Accounting and Finance titled "Truly Maximize the ROI of Total Sales and Marketing's Expenditures with Demand Driven Planning."

Prescriptive What-if Financial Analysis

What-if analysis is not the same as scenario planning. The Operational Budget’s prescriptive what-if financial analysis is more focused and is distinguished from scenario planning as follows:

- OB has only one driver: the costs of the firm’s operations

- OB models COGS + SG&A and, thus, has only one financial parameter that it models: profit (or alternatively, contribution margin or revenue)

- The resulting profit is the best possible

The two techniques are complementary; the choice between the two depends on what problem(s), opportunity(s) or risk(s) is/are being assessed.

Conclusion

By abandoning traditional budgeting, FP&A can help businesses create more value for its customers. Operational Budget is one of the tools that can be useful on this journey. Another useful tool is being advocated by the Beyond Budgeting Institute. The relationship between the two was described in the Part 5 article, OB’s support for the Beyond Budgeting Institute’s adaptive management model (BBM).

The Operational Budget provides advanced analytical support to seven of the BBM’s twelve principles and processes. This is possible because the Operational Budget is a prescriptively quantitative model (see Part 1). It is not competitive with the BBM; rather the OB’s advanced analytics complements the BBM. This complementary support provides more value to the firm than either model can provide on its own.

The next two articles of the series will discuss how the Operational Budget can improve M&A/PE analytics and zero-based budgeting.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.