Undertaken by FP&A Trends Group. Sponsored by prevero.

Undertaken by FP&A Trends Group. Sponsored by prevero.

1. Introduction

Organisations are finding it increasingly hard to plan or predict future performance due to the fast pace and complexity engendered by today's global, online business environment. And yet, within the vast quantities of data. available to management, there are tell-tale trends and correlations that reveal valuable insights to the direction they should take to maximise results. This revealed knowledge is generally known as 'Business Intelligence' and are discovered through a range of analytic tools typically embedded within business applications for planning and reporting.

For organisations to survive let alone grow, it's imperative that FP&A departments take advantage of the latest developments in business analytics. With them, they will be able to improve the transparency of their operations and subsequent organisational decision-making. Without them, they will be subject to the vagaries of market forces and an uncertain future.

Analytic applications have been around for over 40 years, but their adoption has often been slow and without their true potential being realised. Today, more than ever, FP&A staff are aware of the importance of understanding their organisation's business model and its predictability. They also realise that because of the development of analytic technologies which are available to the whole market, they dare not pause in their quest to increase efficiency and forecast accuracy. But just how mature is the current use of analytics?

In the summer of 2016, the FP&A Trends Group were asked to undertake a survey of users as to the adoption of analytics and the impact it was having on the organisation. The survey was sponsored by prevero, a global provider of FP&A analytics technology. This paper outlines the results.

For the purposes of this paper business analytics is defined as the systems used to support an organisation's planning, reporting and decision-support processes. This includes strategic and tactical planning, budgeting, forecasting, reporting and analysis.

The questions chosen for the survey were designed to reveal the types of tools used by organisations; how effective they are in improving efficiency; and the level of satisfaction there is in supporting the different management processes.

The authors would like to thank the many people who contributed to the survey and to the survey sponsor prevero who helped with the analysis and presentation using their business analytic tool.

2. Survey Insights

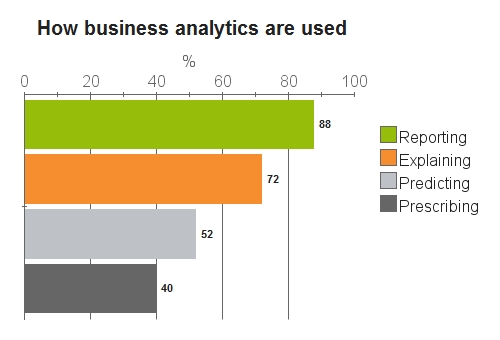

2.1 How business analytics are used

The majority of organisation's (88%) use analytics for reporting results in terms of 'what happened'. This isn't surprising given that the first FP&A decision-making tools to appear in the market were in the areas of management reporting. Perhaps what is surprising is that 12% do not appear to use any kind of analytic tool, relying purely on the reports that come out of the financial transaction systems.

The issue with this is that these systems are inward looking and focused on transactions with existing customers. As a consequence, they do not contain sufficient information for management to make effective decisions such as what's going on in the marketplace.

Business analytics can do far more than just report results. From the survey, 72% of organisation's use analytic systems for explaining the reason why results were as reported. This comes by producing insightful analyses that allow users to go beyond the basic financial numbers and to drill down into underlying detail, while allowing their own ad-hoc analyses.

But where business analytics really score is in predicting future results (52%) such as when developing a budget or a forecast; while the advanced use is in prescribing what actions should be taken (40%).

This initial overview would indicate that organisation's are quite mature in their use of analytic systems. But the survey reveals real issues that counter this view.

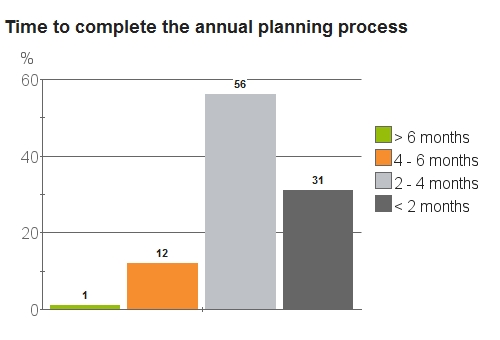

2.2 Responsiveness and effort

For an analytic system to be of any real use, it must be able to respond quickly to fast-changing market events, and not consume valuable resources in doing so. The evidence would say this isn't happening. From our survey almost 70% of businesses spend more than 2 months on their annual planning process with over 3% spend more than 6 months.

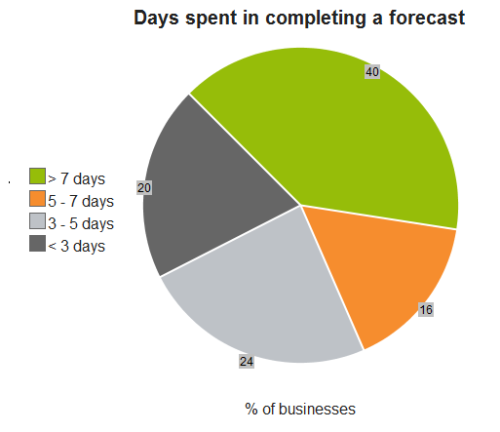

Similarly, less than 21% of organisation's can produce a forecast within 3 days, while 40% take more than 7 days.

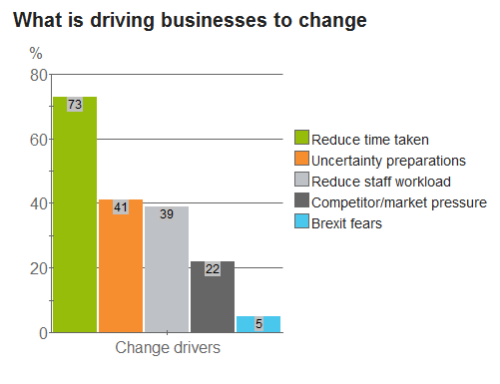

Assuming these processes generate accurate plans and forecasts (that is a big assumption if they are based entirely on internal data and subject to 'game playing'), this level of responsiveness means that organisations are unable to react to fast changing events. They are also, with annual planning, trying to 'guess' events 15-18 months out which is totally unrealistic in today's business environment. This is probably the reason why the No.1 quest for organisations (73%) is to reduce the time and effort required to create and monitor plans.

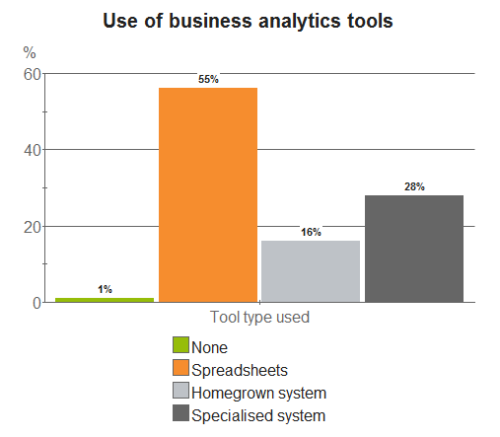

2.3 Use of tools

Our belief is that a major reason for a lack of responsiveness is the tools employed to help with planning and reporting. The survey shows (again unsurprisingly) that less than a third of businesses (28%) are making use of specialised planning tools whilst more than half still rely on spreadsheets (55%) for planning and analytics purposes.

It's been said before in many papers that spreadsheets are great personal productivity tools, but as corporate wide analytical systems they lack the essential capabilities (e.g. multi-dimensional analysis, automated selective viewing based on user role and security, alerts and exception reporting) to properly analyse data as well as control feedback to ongoing plans and forecasts.

2.4 Levels of Satisfaction

Overall, less than 5% of those surveyed were very satisfied with their planning and forecasting process, with almost 49% being very unsatisfied or unsatisfied. However, among the users of Specialised Planning Tools over 73% were very satisfied or satisfied, with just under 27% being unsatisfied or very unsatisfied.

2.5 Levels of Data Integration

Business analytics relies heavily on accurate, timely data. The majority of this data probably resides in existing operational systems such as the general ledger and customer relationship databases, and so the speed and ease as to how this data can be summarised and fed into the business analytic system are crucial to overall success. Only 4% or respondents, on average, enter less than 10% of data manually, while 43% enter more than 50% of their data manually.

2.6 Planning capabilities

For planning purposes, we advocate strongly the use of business drivers so that details can be generated automatically from a few key variables. This requires business systems that can model the different parts of the organisation, which are typically the preserve of specialised planning systems. Our survey shows that 33% do not derive data from business drivers, while only 26% generate more than 25% of their plans.

When it comes to forecasting, 28% are able to automatically generate forecasts from statistical trends. 35% say this capability is very important as it can greatly improve accuracy (or at last challenge assumptions made on predicted numbers) and can save a great deal of time and effort. However, 38% of organisations do not have access to these critical capabilities.

2.7 User access

The final area of note is in the use of communication technologies. We are all used to using multiple platforms when it comes to interacting with others. In electronic form, this includes things like email, web browsers, smart apps, and we use multiple connected devices according to our situation and what we are doing.

In this connected digital world, it's perhaps surprising that only 34% of users are able to directly access data and results via multiple methods e.g. the web, mobile, spreadsheet but without having to copy data. Perhaps this has more to do with perceived security breaches and yet we are quite happy to do online banking without a second thought.

3. Stages of Analytic Maturity

For its 10th meeting, held in mid-March 2016, the London FP&A Board embarked on developing the FP&A Analytics Maturity Model to help organisation's assess their 'next steps' in utilising business analytics. It recognises that there are combinations of capabilities that are essential if business as to achieve success in supporting the organisation. After all, what's the value in having fast, responsive management systems if the data is unreliable or incomplete?

In determining this level of combinations, the following five stages of analytic maturity were identified.

3.1 Basic Stage of Maturity

This first stage is described by organisations having the following characteristics:

- No formal analytical processes

- No established analytical matrixes and business drivers.

- The financial model is in the basic or non-existent state

- No BI tool and dedicated planning system

- No business collaboration

An example of organisation at this stage would be a business start-up, where the processes, models, systems and measures are not yet defined. It can also happen within a mature organisation, when it decides to spin off one of its operations.

3.2 Developing Stage of Maturity

This second stage is characterised by the following:

- Inconsistent planning and forecasting processes

- Basic analytical matrixes and drivers.

- Basic planning model and tools (most likely excel-based)

- Basic BI tool

- Minimal and inadequate planning collaboration

- Analytics is mostly descriptive and backward-looking

All organisations will pass this stage in the process of developing their FP&A framework. This is a necessary step of development. The desired outcome is for an organisation to progress into the defined and advanced stages of the development process.

Sometimes, an organisation can find themselves stuck in this “developing” state. It happens for reasons of poor management, dysfunctional business culture and inadequate investment in analytics. Such a stall can prevent an organisation from unlocking its full potential and competing in the modern world.

3.3 Defined Stage of Maturity

It is characterised by the following:

- Defined Planning processes

- Defined analytical matrixes and drivers

- Defined planning model and system

- Defined, but disconnected from planning BI-type solution

- Some elements of collaborative planning is present

- There is heavy reliance on IT support

- The analytics types are descriptive (What?) and Diagnostic (Why?)

This Intermediate state of analytical transformation is characterised by relative stability: companies are able to stay in this stage for many years. The processes are stable, but not “best in class”, they are adequate for the traditional budgeting, planning and forecasting process. However, they are arguably highly inadequate for “new world” planning.

3.4 Advanced Stage of Maturity

'Best in class' modern planning processes reside at this stage, who typically have:

- Enterprise-Wide planning processes

- Multidimensional analytical matrixes, leading KPI’s and business drivers

- Driver based planning process and flexible planning system

- Advanced BI solution: it is partly connected with the planning process

- Collaborative planning process

- Self-service planning system and process, low reliance on IT

- Predictive analytics (What will happen?)

3.5 Leading Stage of Maturity

This final stage is the ultimate goal for which organisations should aim. Their FP&A analytics includes:

- Integrated Planning Process (IPP)

- Leading Analytical matrixes and drivers.

- Integrated driver based planning process (both horizontal and vertical)

- Planning system is fully integrated with BI

- Real-time collaborative planning process

- Advanced (Proactive) analytics

4. Analytic Maturity of Surveyed organisations

We took the data from the survey and mapped individual responses onto the FP&A Analytics Maturity Model (see Appendix II for the criteria used). We then analysed organisations within each maturity stage to see how satisfied they were with their planning and reporting processes. This produced the following results:

The detail behind this table has some interesting findings:

- The majority of organisations are still at the basic stage of analytic maturity – very few are at the advanced or leading edge.

- The more advanced in maturity, the more satisfied organisations are with their management processes.

- There seems to be no correlation between large and small organisations in terms of their analytic maturity.

The results from the maturity model were a surprise for us. We took a look at the criteria used and wondered whether we should adjust them so that more organisations were at the ‘Advanced’ and ‘Leading’ stages. Part of the issue we found is that many excel at one discipline, eg annual planning, only to then slip back when it comes to forecasting or in their use of analytic tools such as scenario planning.

In the end we decided to keep the criteria as this combination provides the best set of capabilities whereby organisations can cope with today's unpredictable business world.

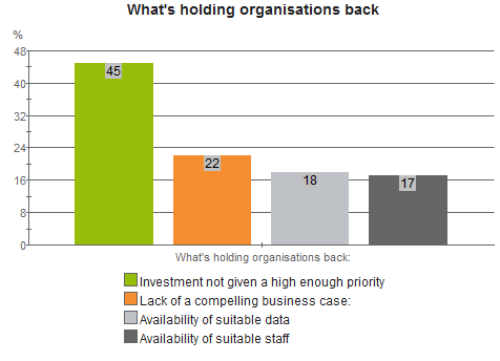

So the question to be asked is why organisations find themselves in such a lack of analytic maturity? Some of the reason is found in the answer to our question of ‘What holds an FP&A department back?’. Here, 45% of respondents cited a lack of investment, which is probably not helped by there not being ‘a compelling business case’ (22%).

The business case for analytic maturity needs to be made and communicated to senior management as a matter of urgency.

We also believe that Business Analytic software providers have a role to play by ensuring their systems are not used just to automate existing management reports. Using their expertise, vendors should introduce their customers to modern practices and challenge current assumptions on the measures used to plan and manage the business model.

5. Business Analytics Development Plans

According to our survey, most organisations plan to extend or improve their use of analytics. The main areas for development over the next 12 months are:

This result shows that despite the considerable investment in analytic technologies over the past decade, organisations are still trying to develop systems that meet their needs. Our experience leads us to believe that organisations should look closely at their management processes when investing in technology, rather than just implementing their old, quite often, failing processes.

In trying to understand this continued level of development, respondents cited the following reasons:

The first and third drivers of change have been the same for many, many years. Reducing time and effort in both planning and reporting allows organisations more time to consider alternative courses of action. To do this, modern analytic systems are essential as well as a critical view of the data used by management to make decisions. Both these factors are well known and yet the key issues that hold organisations back are shown as:

Something is going wrong. It seems that FP&A departments struggle to make the business case for modern systems along with a review of what management require and will bring the whole organisation great benefits. Or, maybe, these benefits have not been worked out or articulated in ways that senior management understand.

6. Next Steps

Analytical transformation is an ongoing process, which requires FP&A departments to increase their sophistication in the use of analytic tools. Ultimately, the analytical transformation is an integral part of the goal in making FP&A more proactive and more valuable to the business. Senior level sponsorship will be secured that much more easily if FP&A’s proponents can clearly demonstrate what it can provide – this could, for example, be via a series of static benchmarks or alternatively through a dynamic model.

Currently, the majority of organizations are stuck at the Basic and Developing stage, while a few are reaching the advanced stage for the best in class companies. Yet the challenges should not be underestimated – there is always the danger that instead of progressing from one stage of development to the next, the process can lose momentum and move backwards if the energy and proactivity are not maintained. FP&A now routinely uses predictive and prescriptive analytics but few have arrived at the stage where it also employs Big Data analytics.

In suggesting the 'next step' to help increase business analytic maturity we would recommend that using our criteria, map your organisation to see where it 'fits' within the maturity model. Then depending where you are, investigate taking the following actions to move up to the next level of maturity:

a) Review your existing use of business analytic models. Do they cover the key questions for the business, e.g.:

- Where are we heading if we continue at our current pace and direction (Forecasting)?

- Where should we be aiming given where the market is heading (Strategic planning)?

- What could we do differently to get there and how much would it cost (Operational planning)?

- What choices do we face and what’s the impact on corporate goals (Scenario Planning)?

- How much cash do we need and how would this be funded (Cash Planning)?

- How efficient and effective are our business processes?

There may be other key questions for your organisations. Find out which areas are weak or non-existent.

b) Take a look at the characteristics of the ‘next’ stage.

- What benefits would the organisation gain if these were in place? Would it save time, money, improve competitive advantage?

- What would be the cost of implementing each characteristic and what would be the priority if you could only choose 1?

c) Gain experience in using a modern BI/Analytics system

- Try out a specialised system using a sample set of data

- Ask the chosen vendor what ‘added’ value their solution would give FP&A and any ‘stories’ they may have where other clients have gained.

d) Discuss internally with colleagues/peers

- Senior Management commitment is essential – start building the business case from responses to the above points.

- Get agreement on what can be gained for the business

- Set priorities.

- Consider setting up a BI/Analytics ‘expert’ group to help departments

e) Don’t delay ….

- The market will continue to move at a fast pace even if you don’t. Delay will cost your organisation – it’s not a ‘cheap’ option.

We hope you have found this white paper challenging as well as informative as to where your FP&A department should be heading.

Analytical transformation is an ongoing process. We will definitely see more transformation in the future: system implementations, restructuring of processes, re-defining and simplifications of the models, automation of the routine tasks and applying proactive advanced analytics.

At the leading stage, all planning processes will be fully integrated, allowing for the multidimensional advanced analytical process. This is where FP&A will be able to use big data analytics and fully transform organizational corporate performance management and decision-making process.

APPENDIX I: About the Survey Respondents

The survey was conducted internationally during the period July- August 2016. 268 Responses were received, with almost 93% were in a Finance role, 3% in Commercial roles, 2% in an IT role and 1 or 2 respondents with roles in Customer Services, Sales or Marketing.

Over 40% worked for an organisation with more than 500million USD in turnover, with just over 25% turning over 100-500millions, 23% 5-100million, and 11% of respondents turning over under 5million.

Almost 11% held a C-Level Role, just under 34% were a VP or Director, with 26% Senior Managers, 22% Managers and just over 7% as Executives.

APPENDIX II: Analytics Maturity Model Criteria

The following survey criteria were used to position each organisation in terms of analytic maturity:

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.