Within any organisation you’ll find some groups of people who are the most well-known and highly...

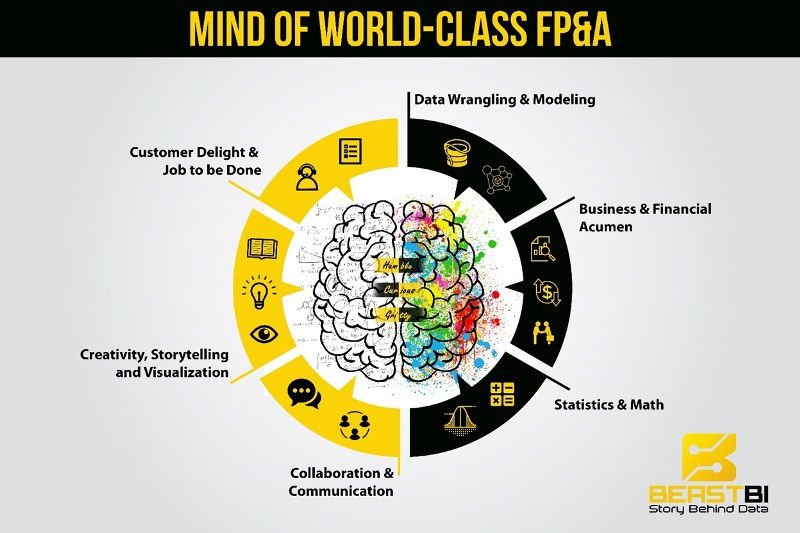

A twenty-nine-year-old newly minted FP&A manager for an NYSE listed public company sat in utter bewilderment across CEO and CFO, as the CFO said to CEO, “the most important position in his department is FP&A”. Five years later as I heard the same from another CFO that the most important hire he made was his new FP&A Director, I wasn’t so surprised. To be frankly honest, FP&A, the new crown jewel of Finance and Accounting is not exactly new but instead of focusing on compliance, controlling and non-negotiable, it focuses on value creation through business partnering and technology. However, have you ever stopped to figure out what makes someone world class FP&A?

As a world-class FP&A practitioner, what do you see in the mirror? you’ll see a problem solver who gets his/her hands dirty. You can see some characteristics outright:

1. Humble

- Knowing the limits of one’s knowledge, being able to humble oneself before a problem by looking at the forest with an open mind and not jumping to conclusions

2. Curious

- Hunger for knowing more, finding out a better way and more importantly, not afraid to go off on a beaten path

- Courage to ask stupid questions and challenge status quo

3. Grit

- If there is one trait that is universal among successful/leading figures, it’s Grit. The ability to pursue and be steadfast on a goal despite roadblocks and failures.

What if people wanted to see further into the brains that define the epitome of value creation in Finance? If they are looking for a Jack of All Trades, that is history. What they will find is Master of Many. A harmonious balance between the left and right brain.

Customer Delight & Job to be Done

Gone are the days of hiding behind monstrous spreadsheets, compliance and financial jargons, to be successful one must understand what job they are fulfilling for their customers all the while providing strategic partnership to add value not just provide dry spreadsheets. Think of themselves as the Starbucks of Finance who is a strategic advisor for the business, where C-Suite gets guidance, Commercial gets external customer financial portfolio, Procurement gets vendor exposure etc. A perfect blend of Business & Financial Acumen.

Business & Financial Acumen

An understanding of what value your business provides to the customers and how it profits from it. Strategy to tackle Porter’s five forces to keep it profitable. Understanding what external factors that drive the demand for product/service/experience your company provides and its exposure to factors that affect the supply chain. For example, a drought in India can impact the price of the raw materials the same way a competing industries adoption of the same product as both will cause an imbalance between demand and supply which determines the price.

Time tested and proven literacy in three financial statements (Income Statement, Balance Sheet, and Cash flow) along with specific metrics of business performance used to gauge success. At the end of the day, you want to bring in as much cash as possible (Revenue) and keep the outflow (Expenses) to a minimum, you apply financial management principles to ensure decisions are fiscally sound and responsible.

Creativity, Storytelling, and Visualization

Once only reserved for the artists and writers, but you must combine art and science of storytelling to go beyond numbers. A mastery of the visual arts can help get your points across more effectively and efficiently, an old saying, a picture speaks a thousand words. However, what are you trying to tell with your words and pictures, a story, right?

Did you know every story has a shape that can be illustrated on a graph with Y-axis being good fortune and ill fortune with time as X-axis (Kurt Vonnegut)?

As a master storyteller, the quality of your story will get people out of the narrating self and into their experiencing self, a place immersion, where they retain the gist of the story.

Data Wrangling, Modeling, and Statistics

Data has often been referred to as the lifeblood of the business. Who knows a company’s data more than FP&A? However, given the growth in scale, size and variety of data. Just using Excel’s old school data drudgery will be a detriment to growth. Understanding the different stages of data being versed in ETL (Extraction, Transformation, and Load), being proficient in data modeling (Financial modeling ≠ Data Modeling) to get the desired outcome.

A healthy understanding of statistics is very important to understand whether the findings are statistically significant and learning the difference between causation and correlation goes a long way. However, to make an impact with Predictive and Prescriptive analytics, one needs to be conversant in more advanced statistical techniques (MAPE, Regression, ARIMA etc.)

Collaboration & Communication

To be competitive in today’s market and connected communities, success is followed by raising engagement through high-quality, personalized relationships with their customers. Thus, you embrace your community to learn from the bests in their fields to keep your axe always sharp.

As the information gatekeeper of the organization being able to communicate effectively and efficiently at different levels of organization makes you the nervous system of the organization. One key skill to learn before one learns to speak is the mastery of listening.

Are you already there? If not, figure out what you are missing, and this was only meant to give you flavor and leave the rest to your CURIOSITY to invest in the most guaranteed asset, yourself.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.