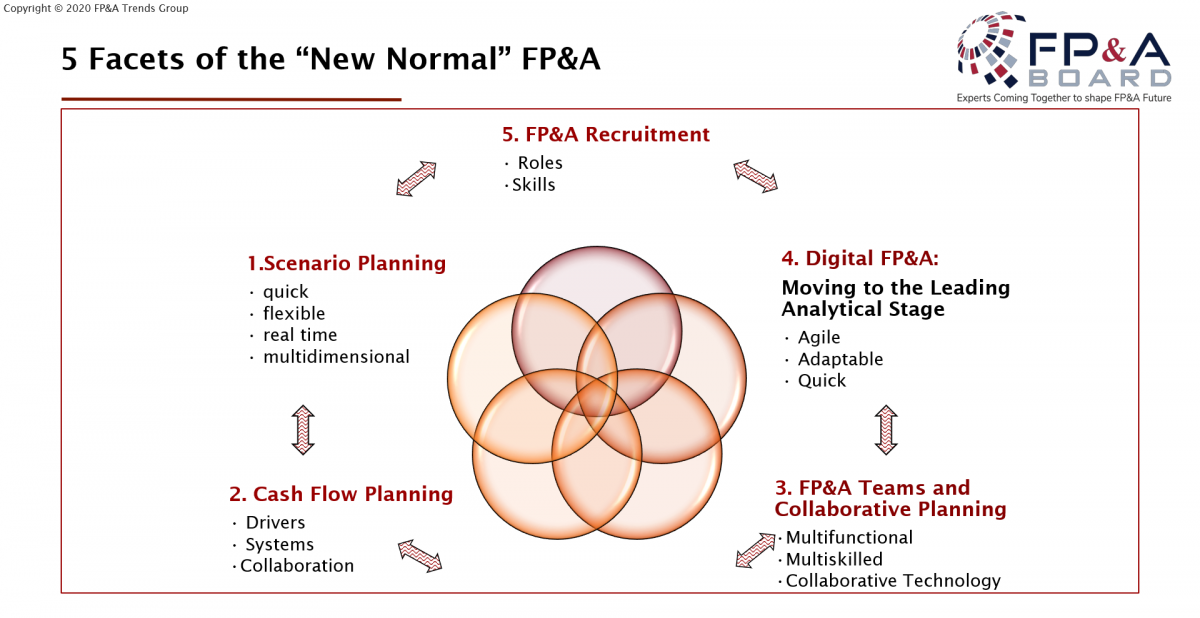

The First Digital Swiss FP&A Board took place on September 8th, 2020. About 400 finance practitioners from over 30 countries registered for this online event where senior professional panelists provided their views on 5 facets of the “New Normal” FP&A.

Facet #1. Scenario Planning: Diethelm Keller Management AG’s Case Study

By Denis Ranke, VP Finance in Diethelm Keller Management AG

According to Denis, due to the COVID-19 crisis, there were several changes for a company managing a diverse portfolio of operations:

new drivers have emerged.

both customers and suppliers have started behaving differently.

decisions related to resource allocation became critical.

emphasis on cash has increased confirming that “cash is king”.

need to quickly provide business alternatives triggered the search for new ways of efficiently handling scenario planning (weekly/monthly rolling forecasts).

The results of the changes in Diethelm Keller Management AG include an implementation of an agile approach, successful collaboration and sharing of best practices between individual teams. Outputs now include all 3 financial statements and offer scenarios with extreme magnitudes on short dimensions including corresponding sensitivities. Operational levels in the organisation play a critical role and factoring supply chain disruptions enables getting the realistic view on how the business is/can be performing.

Facet #2. Cash Flow Forecasting at Cartier

By Laurent Claes, Global FP&A Director in Cartier

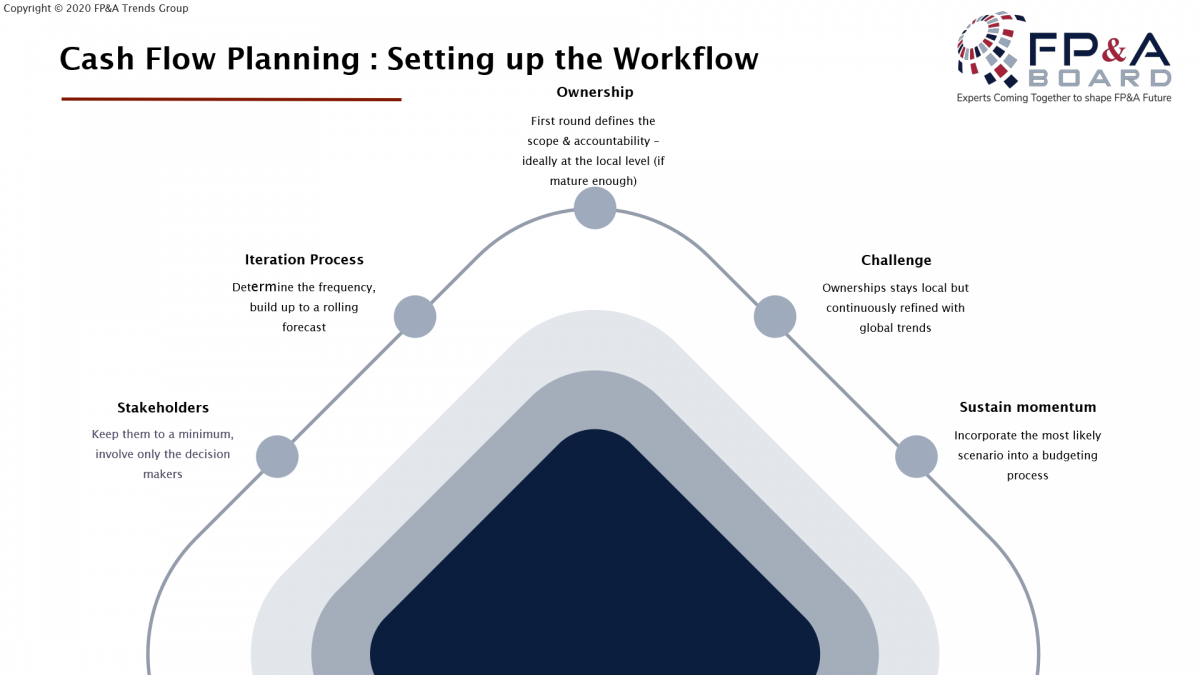

Referring to his company case study, Laurent deep-dived into the key building blocks of the top-down cash flow planning process. The company is factoring the events on a macro level combining global sales demand with internal manufacturing planning. Drivers are defined centrally, and local operations are quantifying the impact those drivers have, and are also providing input on required investments.

At Cartier, traditionally applied breakeven approach for P&L was expanded to assessing breakeven Cash Flow, giving visibility of increased volatility of the operations. Ownership of the planning remains on the local level, but the figures are complemented with input from the corporate where appropriate (e.g. HQ might have a better visibility of the price of precious metals and tourist inflow).

Facet #3. FP&A Teams and Collaborative Planning

By James Halley, VP Finance & European CFO, Nidec - ACIM Division

In his presentation, James pointed several learnings from the COVID-19 period that the companies can leverage in the future. The increased frequency of planning calls for

Highly skilled professionals

Use of new technologies

Prioritization

Having regular online meetings as well as individual calls with team members and colleagues help stay focused and connected. Also, automation enables quick responses to the needs of the business.

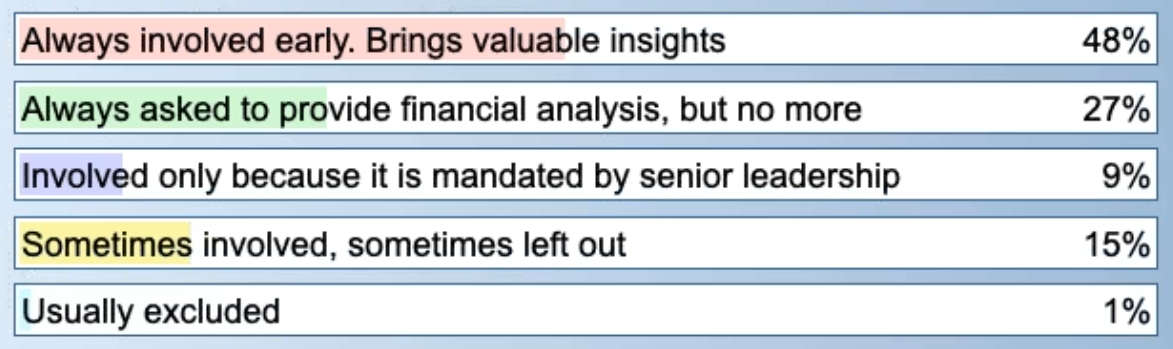

Quick Poll: “Which statement best describes your FP&A teams’ engagement?”

After James’ presentation we conducted a quick poll to see how engaged FP&A teams are in the business. It is excellent that business partnering is a modus operandi for almost half of the participants, and we can see that there still is room for improvement in certain organizations.

Facet #4. Digital FP&A: Achieving Maturity in FP&A

By Patrick Jung, Senior Manager Horváth & Partners Management Consultants

Organisations should strive to achieve maturity in FP&A. The higher the maturity, the lower the human input should be.

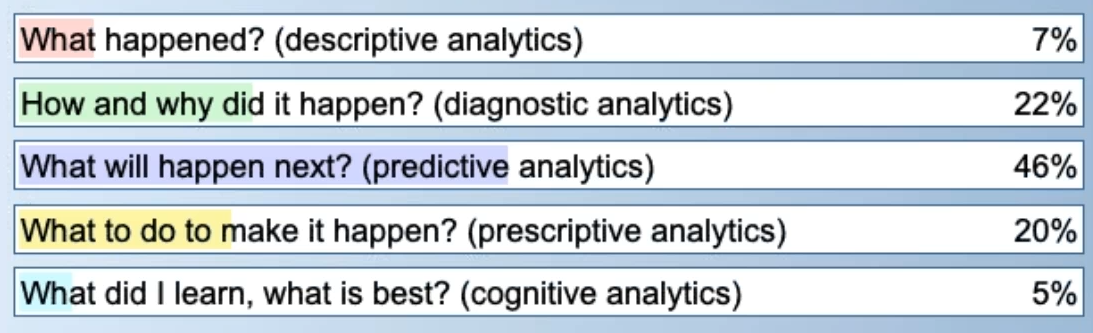

Quick Poll: “What questions do you focus on to support the decision making process?”

It is a positive surprise that already one-fifth of the Swiss FP&A Board members focuses on prescriptive analytics (i.e. “what to do to make things happen”). Good news that almost half of the group has reached the stage of predictive analytics and questions about what will happen next.

According to Patrick, analytical leadership requires multiple sets of skills:

Business acumen and business partnering

Analytical skills, such as math, modelling and statistics along with the capacity to define the right questions, choose relevant data, perform the analysis and translate findings into clear business actions

Creativity and problem solving

Technology skills

Dynamic environment calls for new ways of working. Finance professionals need to remember that an agile approach enables achieving results quickly through :

Demand management, focusing on features which bring value to the company

Managing the resources accordingly - split the work into individual tasks, deliver on those specific tasks, take the learning, cross correct if required and move to the next question

In the COVID-19 environment, most companies need to identify new business drivers and early indicators, and use those to make predictions. Scenario planning can support identification of early indicators. Machine learning can then test those early indicators/new drivers and help with arriving at high-quality forecasts. New drivers become the base for storytelling.

So, what are the principles of working in the new normal?

Starting small, and scaling up after taking the initial learnings and refining to secure success

One source of truth for everyone, with access to data to who needs to have it

Clear processes of translating findings into business decisions, while staying consumer/customer centric

Facet #5. FP&A Recruitment: Closer look at the Swiss job market

By Anthony Caffon, Director at Michael Page Finance

According to Anthony, there are several latest trends in FP&A job market in Switzerland:

Executives expect both organizational and technological transformation.

Remote working is to continue at least partially in the near future for around half of the workforce.

Candidates are looking for the long-term career in Switzerland and the possibility of having a job security became No.1 driver to join a company, and they expect flexibility in the ways of working.

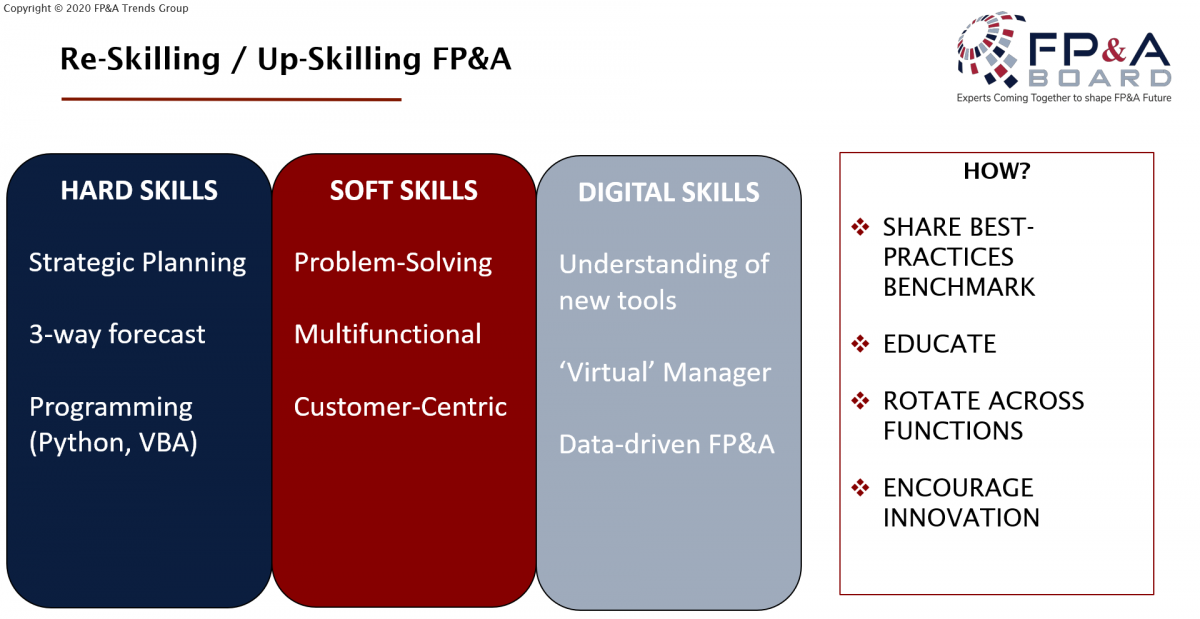

In terms of the profile, requirements are towards upscaling, as illustrated in the overview below.

Larysa Melnychuk, CEO and Managing Director at FP&A Trends Group, added that data scientists and FP&A architects are already in demand across the world.

In summary

There are several main conclusions from the First Digital Swiss FP&A Board. The “new normal” FP&A requires:

Balance between top-down and bottom-up approach.

Identification of the right drivers, which are shared between the headquarters and markets.

System solutions which enable collaboration, scenario planning by using multiple dimensions and providing simulations in an automated way. Various offerings already exist in the market, but most require adaptation to specific customer needs.

Continuous learning and development of new skills.

Flexible organizational set-up and culture which supports team members individually while fostering cooperation.

Consumer-centric and agile approach.

FP&A maturity models can help companies both with evaluating at which stage they are and planning how to develop further.

The Swiss FP&A Board was sponsored by CCH Tagetik and Page Executive / Michael Page. We are very grateful for their continuous support.