These notes were made during the 9th meeting of the FP&A Circle in London which was sponsored by Unit4 and Michael Page. The notes are a mixture of comments and thoughts made by those who presented the case studies.

These notes were made during the 9th meeting of the FP&A Circle in London which was sponsored by Unit4 and Michael Page. The notes are a mixture of comments and thoughts made by those who presented the case studies.

Introduction

This was the 9th FP&A circle event, and we discussed zero-based budgeting (ZBB), with a specific focus on what is new in this space, and how it is being used in non-traditional ways.

Key definitions

Zero-Based Budgeting is the method of developing a budget from scratch or "zero base" by examining every cost or P&L/BS item to see if they are essential to the company’s operations without regard to prior years’ activities.

At today’s meeting, around 40% of respondents say they use this technique. However, it was stressed that:

- ZBB is not about doing the same with fewer resources...

- ...it is about identifying activities that are vital to the business and focusing resources on those...

- ...and once we have identified vital activities, to then think about how to best deliver them for the stakeholders

ZBB has been used for over 50 years, and it is evolving [1]

- Originally, it was an expense reduction tool, Zero-Based approach can now cover pretty much all three financial statements

- A method to identify key internal drivers for ‘Driver Based Planning’

- It can help to reduce the planning and budgeting cycle as politics and emotion are taken out of the equation

- This is a collective exercise, it supports ‘Business Partnering’

ZBB was implemented at Kraft Heinz, following a private equity acquisition – (Tom Vanoverschelde, Portfolio Finance Director at Capita)

Tom is currently working as a Portfolio Finance Director at Capita. Prior to this, he was overseeing the implementation of ZBB, at Kraft Heinz. Tom joined Kraft Heinz, prior to its acquisition by 3G capital. ZBB is a key component of the private equity firm toolkit. It is often used as a blunt management instrument to control costs, not just as a budgeting tool.

ZBB requires granular detail of every cost item, overseen with ‘dual accountability’ and target setting. It also covers every component of the P&L. ZBB became part of the culture, and the cost was a discussion point in every meeting.

Standardisation and visibility of costs is the first foundation of effective ZBB

One of the largest issues is the inconsistency of the classification of costs. How do you understand the legal spend? There are lots of miscellaneous accounts which mask the spend type. Additionally, the detail if often held in Excel. In terms of classifying costs, all items were itemised and allocated to ‘packages’ (e.g. buildings, travel, marketing etc). Clear definitions were mandated to reduce ambiguity. Creating this live view was painful to set up, and the process to extract data directly from ledgers was painful to set up.

The organisation needs to be structured to drive savings from ZBB, through ‘dual accountability’

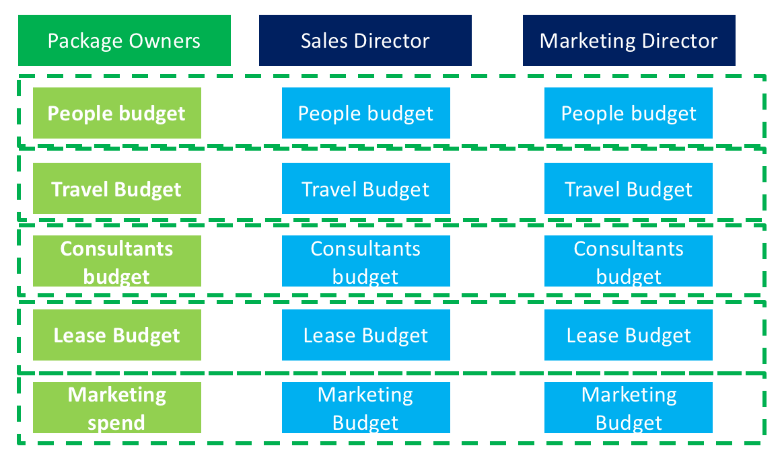

ZBB requires ‘dual accountability’ of every item of spend. Budget owners oversee their cost centres and will often control several cost categories, for their cost centres. Package owners will look at the total spend for that package across the who business, and they are incentivised to achieve spend targets. This model is based on conflict and created an interesting dynamic. Budget holders can no longer re-allocate spend between different cost categories.

Budgets are viewed by both functional managers AND by global package managers. Package manager targets are at total of all functional packages, less 2%

A number of initiatives were introduced to reduce spend:

- Non-variable costs overspend would result in disqualification from bonuses

- Preventative controls were introduced – they reduced the number of people who could spend by ensuring all POs were routed through procurement

- Embedded into culture via staff communications and newsletters. Global recognition was provided for achieving results. It became embedded in all senior management routines.

- ZBB teams were embedded in every region and business unit

- There was a quarterly session with the CEO to discuss progress

Why should we do ZBB?

- Better visibility on cost and cost drivers

- Transparency (also for compliance)

- Cost savings and cost control

- Ensure all managers in the organization know their budgets

Cost savings can go to the bottom line or be reinvested in e.g. working marketing.

ZBB is painful to implement but produces big results.

- Many packages saw reductions between 30% and 60% over 2 years

- Big impact on profit margins (Kraft Heinz and e.g AB InBev have amongst the highest margins in their industries)

- Enables increased investment in working marketing

- Above market bonuses awarded, if targets are met

Despite some bad press for Kraft Heinz in recent years, ZBB has had an overall positive impact on the organisation

Kraft Heinz has underperformed, relative to the market, over the last two years, and many analysts highlight ZBB as a reason for this. However, the organization still has one of the highest profit margins in the industry and has been increasing it’s cash flows.

In Tom’s view, ZBB is a cost management system which delivered huge benefits. However, he felt that it was deployed too aggressively in some areas and also led to too greater management focus on cost savings, at the expense of the top line.

ZBB was not the only contributor towards the cited underperformance:

- Change of culture, including ZBB, led to significant attrition.

- Disruption was coming anyway (many historic brands which high market shares, which are challenged in the market by competitors and changing consumer preferences.

- Underperformance is mainly in Kraft brands in North America, not a new problem.

- At the same time, there is a shift of power from suppliers to retailers which puts pressure on trade margins.

The link between ZBB and Driver-Based Planning - William Howell. Head of FP&A Honda UK Manufacturing

ZBB must become part of corporate culture to succeed and not just a strategy

Keys to success are:

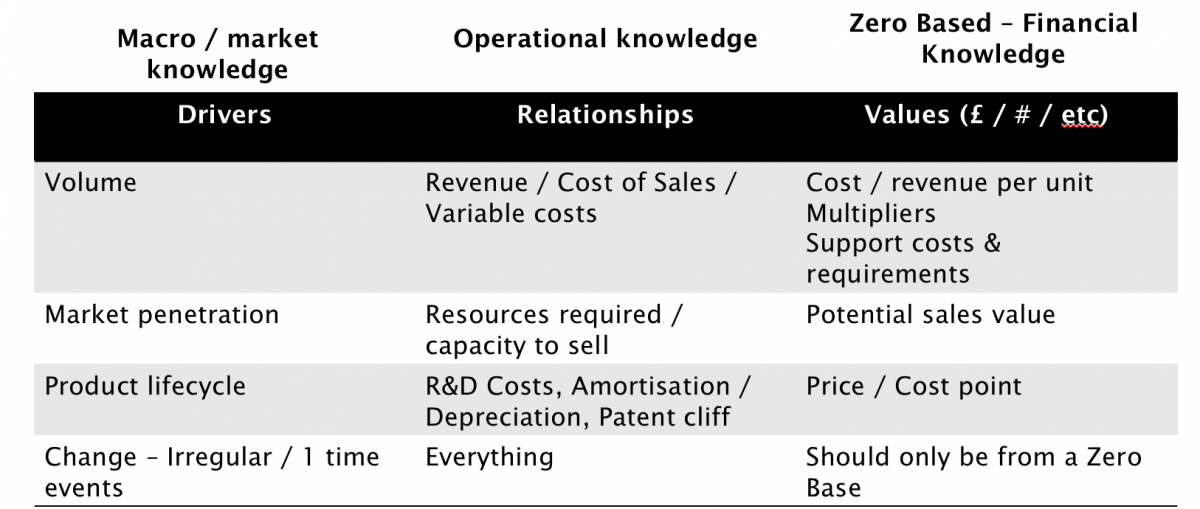

Understand your Drivers, you do not have many

- How many cars are you going to build? Everything else flows from that number, therefore, channel energies in that direction

Use the right vehicle, Excel will not work

- Kill dead time, you need to gather, consolidate, analyse and review all of this information (with the right technology platform)

- What do you give back – what is in it for them?

The Drivers

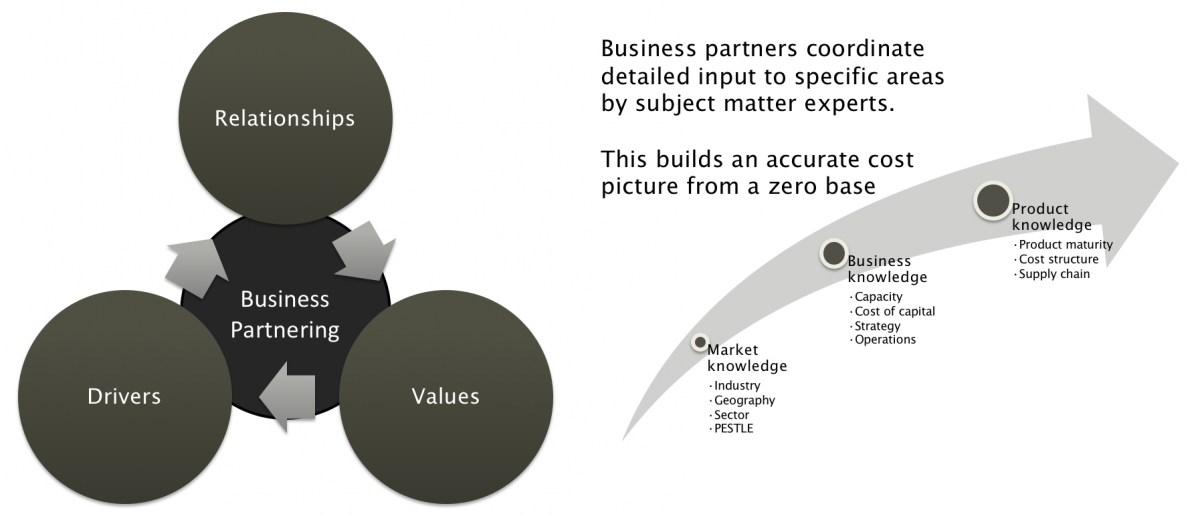

A strong business partner is required to bring drivers, relationships and values together. Business partners coordinate detailed input to specific areas by subject matter experts. This builds an accurate cost picture from a zero base.

The Vehicle – Technology

Integrated:

- Driver based, all parts of the planning process are included (e.g. changes in CapEx reflected accordingly in OpEx)

- Easy to use & understand (business users probably used to Excel…)

Efficient:

- Takes some of the pain out of the budget process

- Business focussed on where they are needed (knowledge, controllable items)

Relevant:

- The link between Strategy and Operation

- Ensure that changes in strategy flow seamlessly to operational impact

Flexible:

- Allows different items to be planned in the most appropriate way

- Scenario Planning, Modelling, Allows for “Known Unknowns

Transparent:

- Gives back to stakeholders

- Clearly shows how a budget has been built (no more “not my number”)

- Insight - makes financial management more visible, highlights the accuracy

- Reduces non-value add activity

Next level?

- Does “Zero Based” need to mean “Human built”?

Centralisation – Example of successful practice

At Honda there is only one driver - how many cars are we going to build. This is then broken down into the different categories of cost depending on volume and associated cost:

Central buying team work on groups of components depending on value.

- Secondary material - ~40 in each car >300 in total

- Different usage at different stages

- Prices can vary extensively

Consumable materials

- What is the actual driver gloves Vs Waffles

- Who is responsible – is it material

This can involve Activity Based Costing when it comes to determining production costs, but not for things like overheads as ZBB is not concerned with apportioning costs across the organisation.

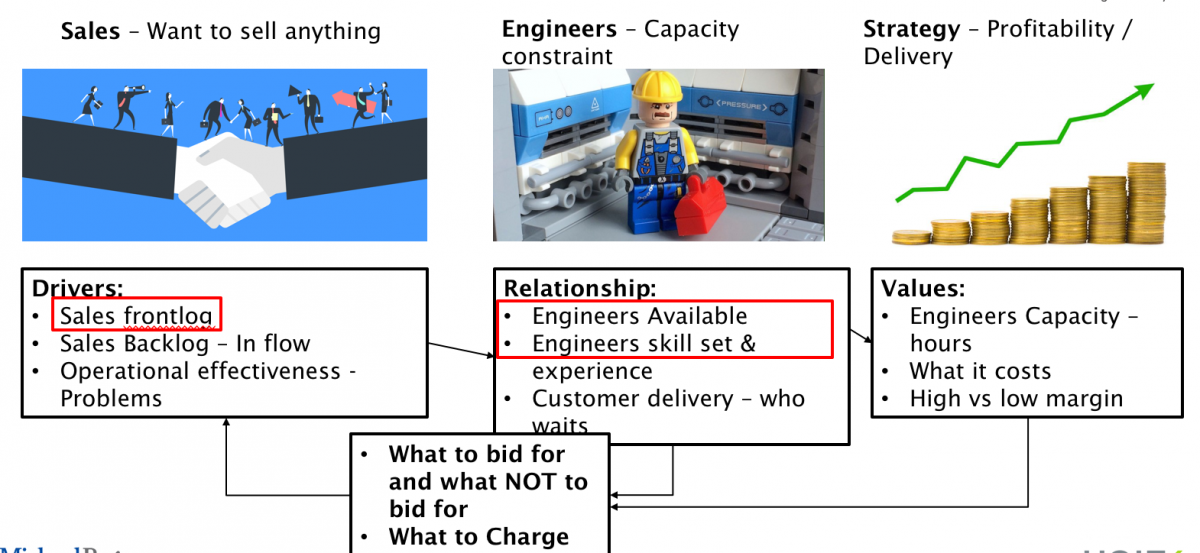

ZBB is also used to work out costs when bidding for contracts to tells us what NOT to bid for in sales.

- Zero-based approach to Engineer capacity, availability & skill set

- Aligned sales to revised strategy – don’t chase everything – Zero-based review of opportunities!

- Cost of getting it wrong – LDs unhappy customers, etc – Zero-based review of liabilities and how to reduce/avoid them

Summary

ZBB is not just a cost-cutting tool. Using a blend of Driver based and zero-based techniques can increase budget accuracy. It also helps reduce the time it takes.

Plan for success:

- Understand the culture vs strategy gap – buy-in and tone at the top is important – feedback to strategy

- Know your drivers – Clearly, understand what the primary drivers are for your business/project/situation

- Distinguish between Drivers and relationships – sometimes the true driver can be hidden

- Build values that count – Business partners to consolidate and coordinate knowledge

- Have the right vehicle - prepare the right tools for the process – continue to build and refine

Centralise where possible:

- Only ask the business to forecast what it can control – reduce time and increase the effectiveness in budget input

- Who is actually accountable / can make a difference

- Business partners need to understand the interdependencies that managers in siloes can’t see

Be clear about the future:

- How will this help

- What are you going to give back & what is the incentive

Zero Based Everything - Tanbir Jasimuddin. Head Shared Services. Slater and Gordon

So far we have seen how ZBB has been deployed in a classical manner at Kraft Heinz. We have also seen it being used for new uses at Honda. The latter is an emerging trend. Increasingly, organisations are trying to leverage more value out of the ZBB method, not just for overhead costs. A quick search among the major consultancies show offerings that include zero based redesign (Bain), zero based supply chain (Accenture) and zero based marketing (McKinsey)

The popularity of ZBB for specific areas and functions has arisen to take into account the nuances of those areas. Often these are deployed as part of a second phase, to get more value out of specific functions. Tanbir then used IT as an example of how greater savings can be achieved by adapting the method.

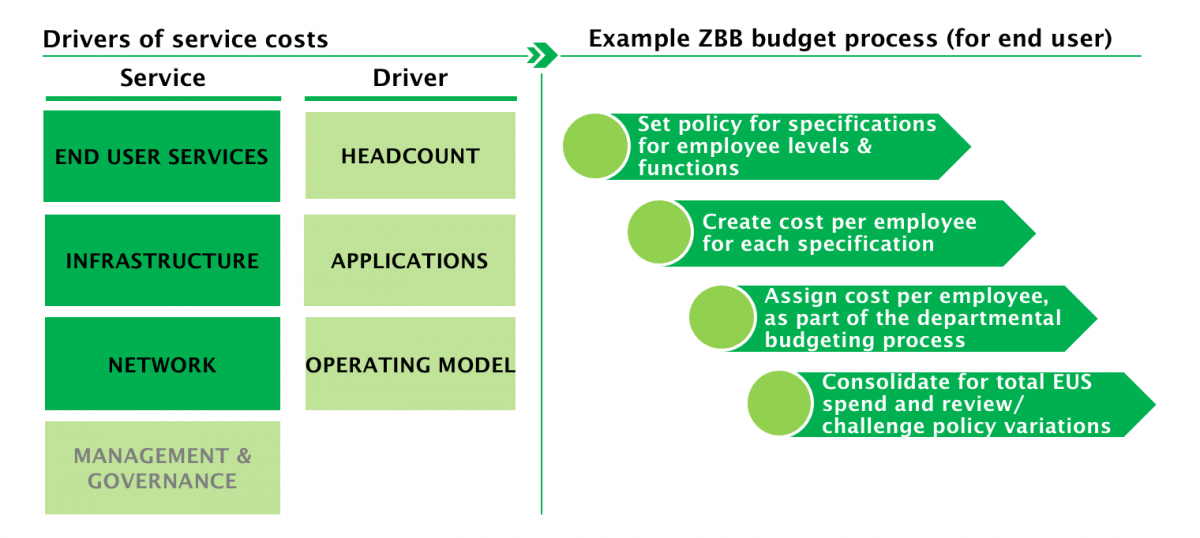

IT was chosen as the example. It's one of the largest areas of back-office spend in most organisations, however, the traditional cost centre – cost category structure is not effective:

Cost categories can cut across several service lines, e.g. hardware can form part of ‘End User’ (laptops) and infrastructure (servers). However, end user costs are driven by the number of employees, whereas infrastructure costs are being driven by the number of applications.

Tanbir then described the step by step approach towards creating a zero based budget for end-user services:

A policy sets out which user gets what type of laptop. When a cost centre manager creates their budget, the default laptop cost is applied. If they require a different specification, they have to justify it and get approval.

IT management can view the number of devices required by the whole organisation and ensure correct procurement levels.

Tanbir then shared some key learnings from ZBB-IT projects, and the areas where savings are usually found:

Savings in order of timescales required to achieve them:

- Ensuring the right spend on end-user devices is the first quick win

- You can then start to look at prioritising maintenance and development resources towards the most critical applications

- Longer term… many organisations have business functions who demand high server specifications, if these are under-utilised – can you share? Cloud is a way of breaking down these siloes, but beware as the unit price is not always cheaper – savings have to be found by reducing purchased volumes

Panel Discussion Notes

- The new approach to ZBB is to understand drivers and have central teams working on cost packages.

- Where costs are the focus and open to scrutiny throughout the organisation

- Costs savings using ZBB are usually between 15-25%, although other benefits can be achieved

- ZBB can help preserve or increase budgets if those costs are really needed as the costs and drivers are better understood.

Cultural aspects of ZBB

- It takes time for managers to really understand their costs. It can be quite painful at first; managers lose flexibility on padding out their costs and their costs are exposed.

- Having substantial bonuses can help sweeten its introduction, although they cost savings need to be balanced with quality, market share, and other areas that are important to ensure that these are not affected.

Conclusions

Organisations have always wanted to take costs out (at a stock price changing level); but it’s always been too difficult. ZBB offers a new approach.

ZBB revival is being driven, in part, by technology [2]

The process is much faster as we have greater analysis and insights into spend; we can also facilitate the workflows without the limitations of spreadsheets

ZBB is evolving

We are finding new applications (e.g. driver-based planning; IT) by modifying the methodologies, to consider the nuances of specific business activities. The classical ZBB approach is a great way to start and make dramatic changes, however, one size doesn’t fit all.

ZBB still requires to focus on culture and a mindset shift

Survey of blockers by Accenture found 61% cited culture; 40% cited change management [3]. When talking about ZBB, don’t talk about cost reduction; talk about the value created. ZBB should be seen as reallocating cash to fuel growth, not a drastic spend reduction exercise

ZBB ownership and governance is a key driver of sustainability

Dual-ownership of costs is powerful, and in my experience, one of the tools that continue to challenge costs and drive efficiencies in the long run

Recommendations

- Focus on sustainability – you need to win the hearts and minds, and create an ‘ownership’ mindset amongst employees

- Position this as a way to fuel growth and to simplify the organisation, not just a cost reduction exercise (Bain: you are 2x more likely to succeed) [4]

- ZBB is a tough process for employees, engage them as early as possible

- In addition to bottom-up employee engagement, this needs to have top-level sponsorship and visibility

About the FP&A Board

The mission of the International FP&A Board is to guide the development and promotion of better practices in global FP&A, identify and support new trends, skillsets and innovations. For more information on the board and to view our other events, visit www.fpa-trends.com/fpa-board.

Footnotes

[1] The return of Zero-Based Budgeting: https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-return-of-zero-base-budgeting

[2] 5 Myths of zero-based budget (see myth 4) https://www.mckinsey.com/business-functions/operations/our-insights/five-new-truths-about-zero-based-budgeting

[3] Beyond the Buzz https://www.accenture.com/gb-en/insight-beyond-zbb-buzz

[4] Beyond Zero-Based Budgeting https://www.bain.com/insights/beyond-zero-based-budgeting-infographic/