During the pandemic, we witnessed how quickly traditional budgeting and planning process become irrelevant. Traditional controlling does not work anymore. We need to ensure all our planning processes are integrated vertically and horizontally and ensure everyone that plans in the organisation work together.

During the pandemic, we witnessed how quickly traditional budgeting and planning process become irrelevant. Traditional controlling does not work anymore. We need to ensure all our planning processes are integrated vertically and horizontally and ensure everyone that plans in the organisation work together.

This where the concept of extended planning and analysis (xP&A) is crucial to the survival of an organisation especially in time of uncertainties.

In the Digital German FP&A Board held on the 4th March 2021, we take a look at the new concept, how we can make the move and the key skillset required for the change.

From Traditional Controlling to xP&A – Avira’s Journey

Our first speaker was Thomas Kogelberg, Head of Controlling and Finance at Avira.

Avira is an IT software security company that protects users against cyber threats and employs around 500 people.

When Thomas joined 4 years ago, Avira was already changing going through a massive transformation to an online business. Everything, including sales, supply chain and delivery were all moving online. This switch was, however, drowning the company, who were struggling to deal with over 500 million events per day.

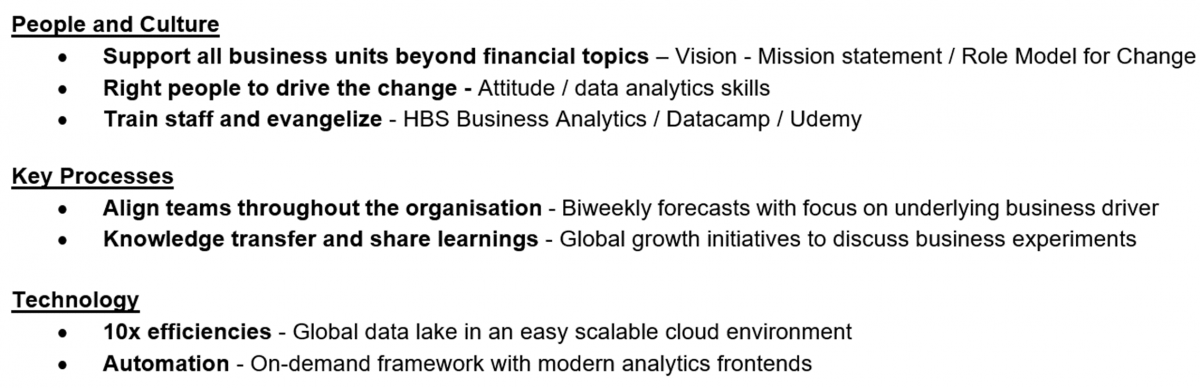

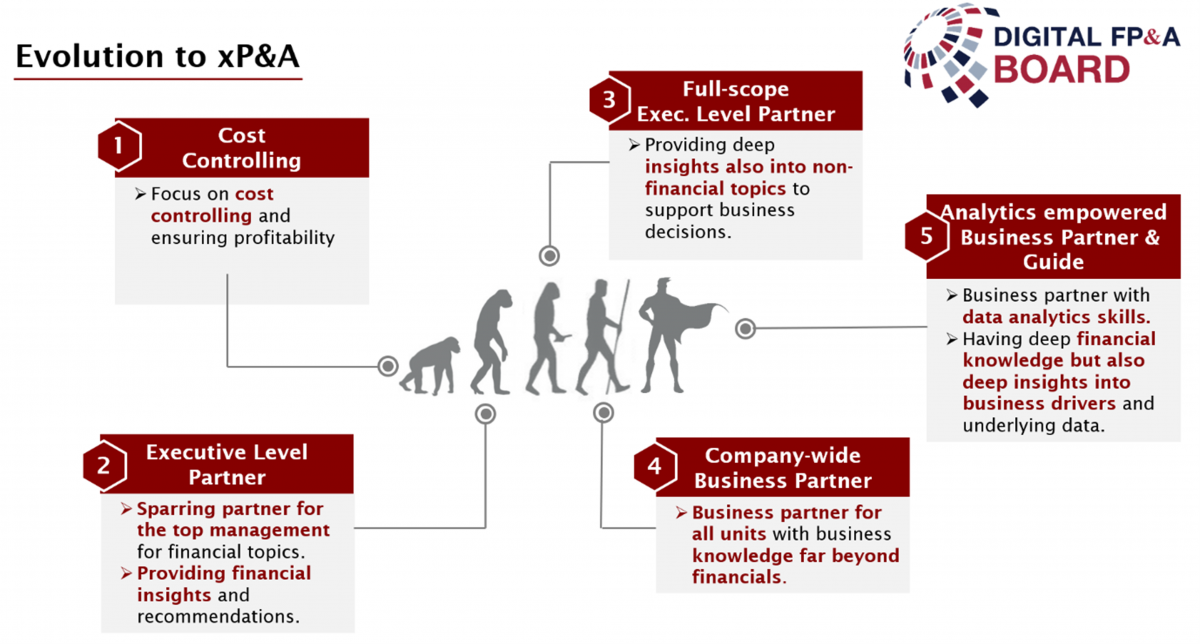

Traditional management accounting was not going to work. This is when they embarked on their xP&A journey. To be able to cope with these changes they looked at three different areas:

See below their 5 steps evolution towards the xP&A structure and the key components of each step:

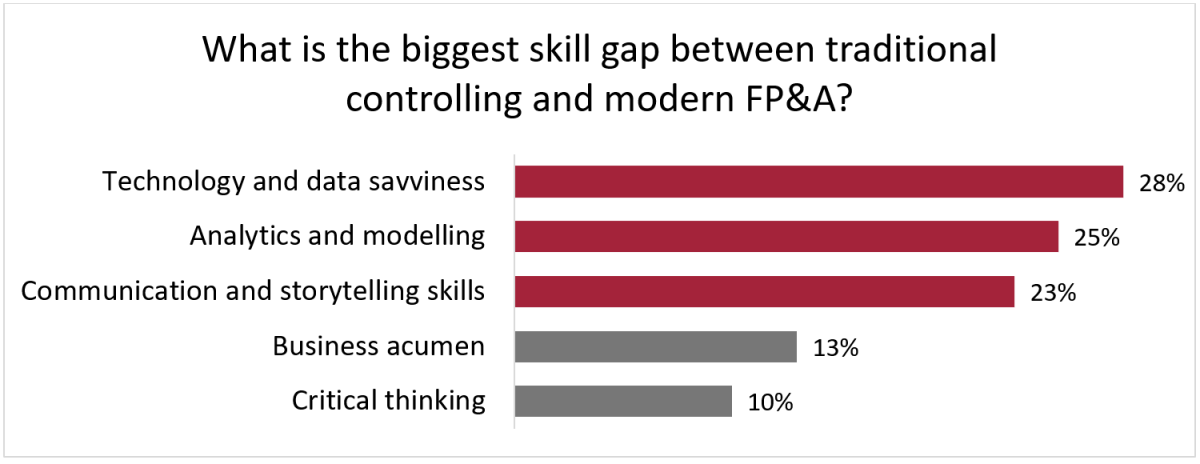

The results of our first poll showed a very even split between analytics & modelling, technology & data savviness and communication and storytelling skills, each receiving about 25% of the vote. The other two options, critical thinking, and business acumen were 10% and 13% respectively. These fairly even results could be from how modern FP&A has so many wide-ranging improvements over traditional controlling, all of which are essential to its functionality.

How to Manage the Cultural Shift

Abby Obomighie, Group FP&A Director at Spectris plc took us through the key steps of managing the cultural shift towards an xP&A organisation. Strategy is important ensuring we do the right things and making the right changes, but culture can be a powerful lever for maintaining, renewing and ensuring our people move with the organisation.

We need to “culturally engineer the architecture” and we can do so in three steps:

Ensure that FP&A is linked to organisational strategy.

Promote cross integration - where we are connecting, communicating and challenging our business partners

Engage with others to create a Joint Vision

How do we make sure our culture allows FP&A to be are extended, agile and integrated into what we do? We need to stay connected to the business and have a forward-thinking mindset. You cannot sit back and hope the culture will change. If it is not you driving this change then who is, and if it’s not happening now then when will it?

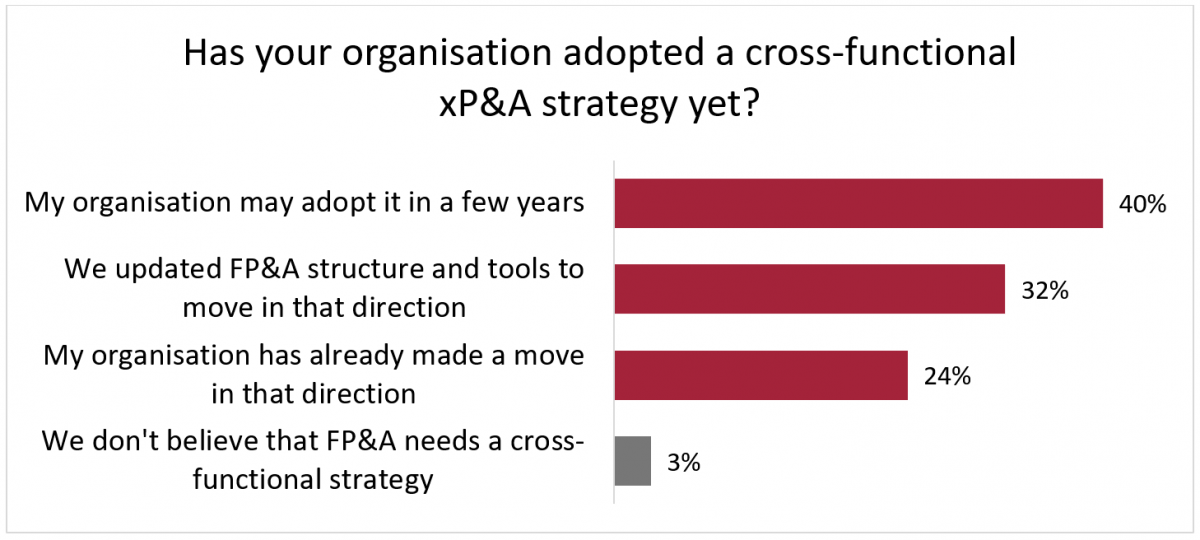

The results of our poll on xP&A adoption showed only 3% don’t believe they need cross-functionality, while 24% have already started moving in that direction. 32% have also already updated their FP&A structure & tools to move in that direction, with the rest looking to adopt it in the future. xP&A is the natural progression of FP&A so it is unsurprising that those who have FP&A functionality will be looking to move forward to xP&A.

What does that Next Generation xP&A Model look like?

Michel Haesendonckx, Global Solution Owner Financial Planning & Analysis at SAP, took us through his vision of that model.

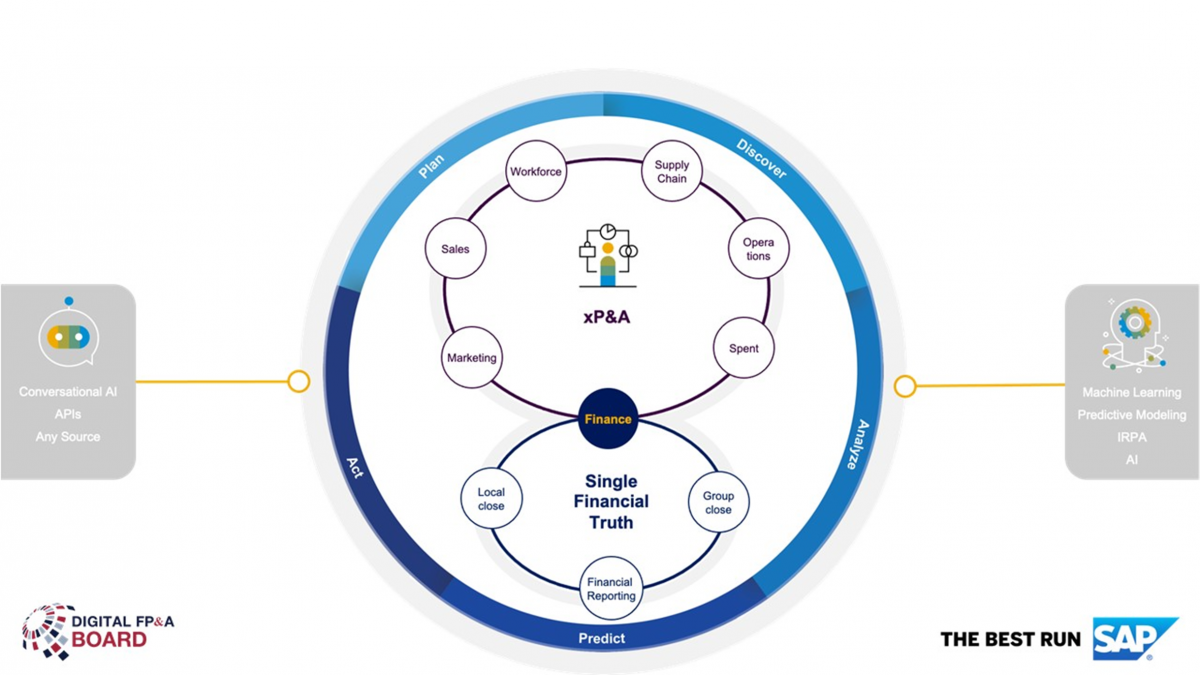

FP&A need to move to value-added activities and reduce the time spent on typical operational processes. From a technological perspective, there is a lot that is already possible.

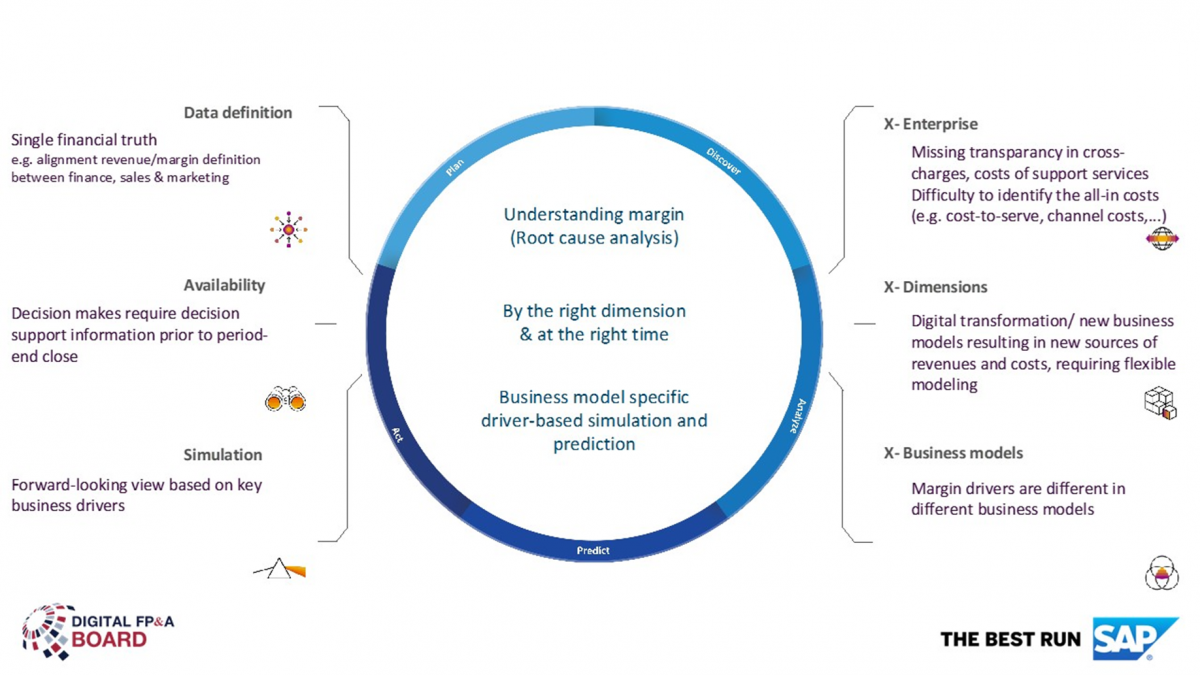

The key aspects of such a model are shown in the slides below. We need to ensure we answer all of these questions in the first picture and then build our model as per the second one.

With a forward-looking system, we can receive automatic alerts. These alerts can take you straight to your operational environment insights. The system detects the issue, shares it visually (e.g., gap analysis to your margin), gives you a proposal as to how this may be fixed and how things would look like if it were fixed – 3-way planning too (P&L, B/S and CF). It also includes artificial intelligence (AI) capabilities.

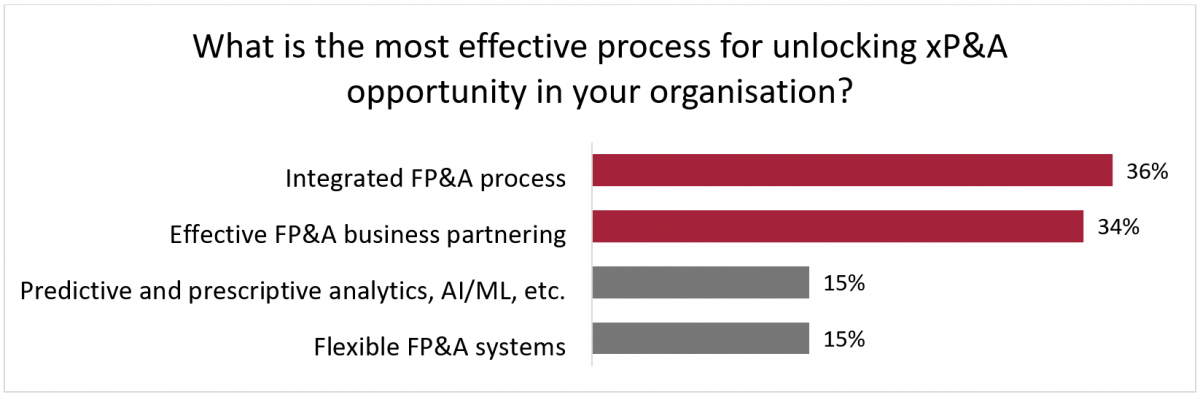

When asked about what they believed the most effective process for unlocking xP&A opportunities, about 35% said effective FP&A business partnering and Integrated FP&A process, with the other 30% split evenly between flexible FP&A systems and predictive and prescriptive analytics, AI/ML, etc. I would agree that everything starts with the people and the process behind the culture and then systems and advanced technology are enablers to speed up and to further xP&A.

Skills for Agile Planning and Analysis

Marie-Luise Lehmann, Founder at Finance Goes Agile, shared with us the important skills needed for Agile Planning. “It is neither the strongest nor the most intelligent that survives, it is the one that is most adaptable to change,” said Charles Darwin. This applies very well to the concept of xP&A, business agility and skills adaptability to be able to stay relevant and in business.

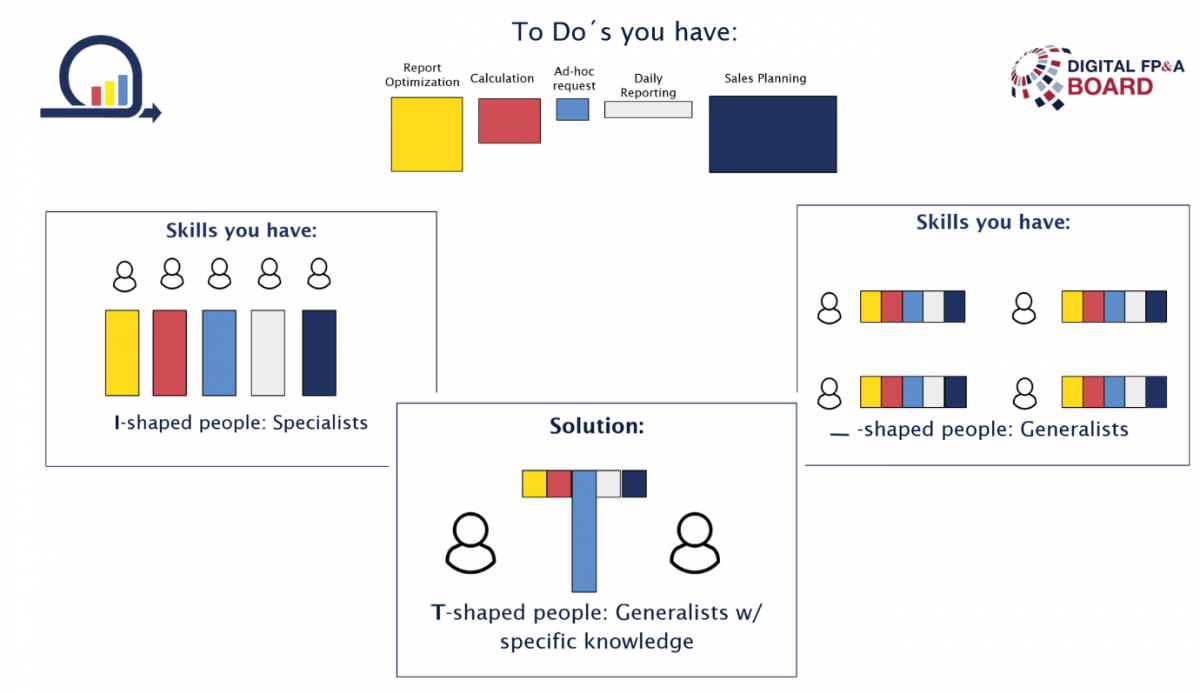

Marie–Luise shared a way of making this step forward into business agility without the need for a whole transformative process within the organisation. The solution lies in how we assign tasks to resources.

Tasks we usually find in FP&A vary in content and in scope. Usually, FP&A assigns single tasks to individual team members. There are two types of people, specialists who have lots of knowledge in single fields, and generalists, who have smaller bits of knowledge in more areas.

As finance departments start their agile journey, they make tasks more transparent and one of the biggest and quickest learnings they get is that specific knowledge is not always needed. There is a much higher percentage of general tasks than specialised tasks, and as a result, what is needed are T shaped people.

T-shaped teams can:

Prevent bottlenecks or resolve them quicker

Adapt better to changing priorities

Have a broader understanding and wider skillsets that enhance problem-solving

Accomplish more in less time

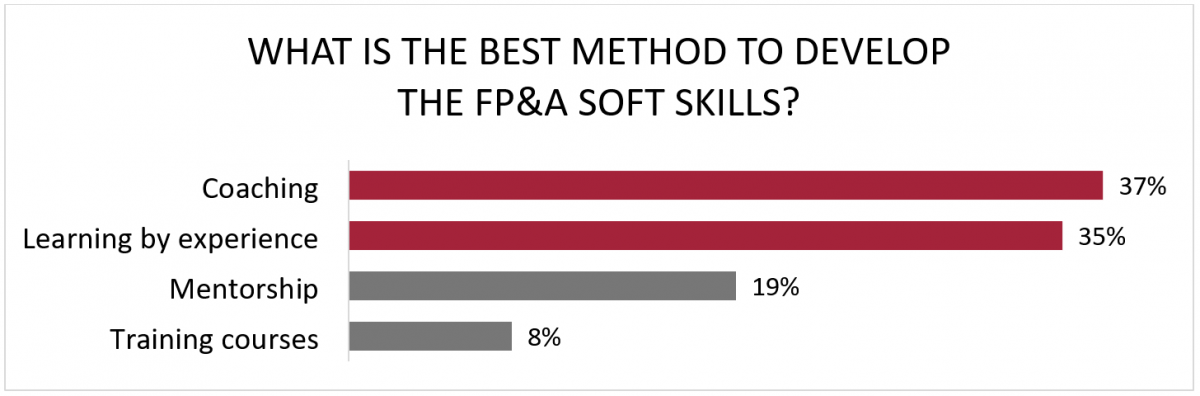

Our final poll was about the best method to develop FP&A soft skills was. 37% thought coaching and 35% said learning by experience. 19% think of mentorship as the best and 8% see training courses as the way to go. From experience coaching and learning experience really are large parts of this development. Training courses would also need to be bought, while the others can be done in house for less money.

Finance Priorities for Next 12 Months – 2020 Global Survey

Matthias Heintke, Managing Director at Protiviti, took us through the finance priorities for the next 12 months from a recruiters' and organisational perspective.

Below is the result from the Robert Half & Protiviti annual survey carried out in the second half of last year (pandemic impact including). The top 5 global priorities of CFOs and VPs are:

Security and privacy of data (80% ↓)

Enhanced data analytics (78% ↓)

Changing demands and expectations of internal customers (74% ↑)

Financial planning and analysis (72% ↑)

Cloud-based applications (72% ↑)

Due to the current environment, priorities such as agility to changing demands, proper FP&A and cloud-based applications have climbed the ranks compared to previous years.

For CFO’s and finance leaders, a clear trend can be seen in focusing on the core competencies and value-adding analytical components while setting the right efficiency leavers using technology in daily business. We saw it in the presentation by Michel and also in the opening comments from Thomas, and the value-adding component is a stress turn but has again been confirmed here in the study results.

It appears that there is an increased appetite for next-generation and technology-driven topics. 2 out of 3 German respondents report that they are building on technologies and concepts, such as blockchain, smart contracts, RPA, mobile applications, process mining and so forth.

2/3 of the respondents expect remote work on a regular basis and even outsourcing non-core activities goes together with emphasising leadership and staff skills working effectively with outside parties, which ties perfectly with what we discussed in Marie’s presentation.

So, in a nutshell, the technology and people components are the springboards for the finance organisation of the future.

Conclusions

FP&A is much more than traditional management controlling. In an era of unknown unknowns, traditional planning and budgeting are not enough. We need to ensure that strategic, business and operational plans need to work hand in hand. Any changes in one should affect the other and the results should flow through seamlessly. Now is the time for extended planning and analysis. Now is the time for our plans to be horizontally and vertically integrated.

Our FP&A teams need to ensure they have the relevant skillset to support such an organisation. Technology is the key enabler and will play a huge part in ensuring we spend 80% of our time adding value.

If you have not yet adopted Extended Planning, now is the time!

We would like to thank our global sponsors and partners SAP and Robert Half for their great support with this Digital FP&A Board. Also, we are incredibly grateful to our panel of experts for sharing with us their thought-leading insights and to the FP&A Board attendees for their valued presence and participation.