A few days ago, I was looking through some blogs on LinkedIn when I came across...

Among the difficult subjects for FP&A and management, there is the very “sensitive” relation between budget or forecast and managers compensation scheme.

Among the difficult subjects for FP&A and management, there is the very “sensitive” relation between budget or forecast and managers compensation scheme.

The central issue resides in the way the targets set for the compensation scheme are linked to the budget and forecast tools. Depending on industry and business type, on company size and situation, on company culture, … there are different settings possible:

- Strict link to budget,

- Strict link to budget for 1st part of the year than on a reforecast for the second part,

- Different logic between budget (consistent synthesis of the engagement taken by the managers) and the forecast (best estimate of the situation based on actual trends and circumstances),

- Compensation targets different from budget and forecasts,

- Flexible targets,

- …

But there is a constraint, the managers' behaviour will be strongly influenced by the target set and setting process. In turn, it will impact the way budget and forecast are prepared. Furthermore, this may impact the relationship between managers.

I do not pretend to have a solution resolving those issues and applicable in all circumstances.

I will just give 2 examples that I successfully implemented.

Context

A global company selling global products and services to multinational large companies. Sales teams based in major countries responsible for the orders and revenues generated by their country customers on a global basis. Time from Order to Revenue 3 to 6 months depending on product lines. Two “channels” (direct sale but also indirect through a few key partnerships). Prior implementing this new method, we had in place a process by which each country was proposing and negotiating the number of resources during the budget or reforecast process then those would be the target for the compensation scheme.

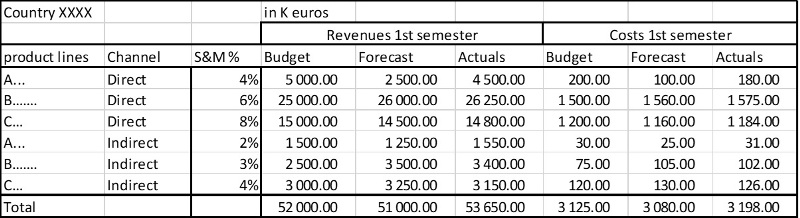

Through analysis, we gained a clear idea of what level of sales and marketing cost we could afford per product/service lines as well for direct and indirect channel. We then move to a standard target-setting method where a percentage was allocated to each product/channel type such as:

| Product/service lines | Direct | Indirect |

| A... | 4% | 2% |

| B... | 6% | 3% |

| C... | 8% | 4% |

This set of sales and marketing ratio were then applied to actual/ budget/reforecast revenues in order to define and evaluate target, budget, reforecast. Countries within the target would have autonomy in the way they engage their resources whether those over the target would be put under stronger control/monitoring from headquarter.

Depending on its product and channel mix and evolution, each country had then a flexible target in terms of sales and marketing expenses (instead of fix amounts of Euros and Headcounts). Although measured each month, the target was by semester. The below table shows the evolution of the target within a semester. At the time of the budget the S&M expenses had to be contained within 3 125k€, the forecast at mid-semester would only give an envelope of 3 080 K€ whereas the final semester revenue achievement gives 3 198 k € target. The actual S&M expenses were then compared to this final amount.

This way to fix target gave (i) a better way to compare countries performances in terms of S&M effectiveness (ii) More autonomy and better ownership at country level (ii) lower effort in managing resources and budget/forecast.

This type of target setting can be applied to another type of divisional expenses.

It can also be applied in the context of balance sheet items.

The following example is for customer debts. We were defining targets in terms of customers accounts. We had a customer debt aging report showing

- Not yet due at month end

- Due since less than 30 days

- Due since 30 to 60 days

- Etc

We set percentage applying to the 0-30 days (10%), 30-60 days (5%), 60- 90 days (2%) and more than 90 days (0%). Those percentages were based on the last two months revenues. This insured that attention was given to rapidly resolve any billing/delivery issues and more generally to the billing quality as well as ensuring that the sales teams keep putting reasonable pressure on customers to respect contractual payment terms.

This type of target setting focuses the managers' attention on adjusting their resources to the level of activity in real time (rather than spending a budget) as well as on the effectiveness of their processes.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.