The biggest business issue in the UK is Brexit - and has been since the people’s...

Planning assumptions

Planning assumptions

In compiling the Brexometer, certain political factors are assessed. This month these factors are moving around considerably, even on a daily basis. For your interest though, here are some of the key political assumptions used for the January 2019 Brexometer reading:

- Likelihood of hard Brexit - 50%

- Likelihood of change of date to Article 50 (delay from 29th March 2019) - 80%

- Likelihood of imminent General Election - 70%

These assumptions were recorded after the Commons vote to reject Theresa May’s Brexit deal but before the Vote of no confidence. Readers of this article are invited to provide their opinions!

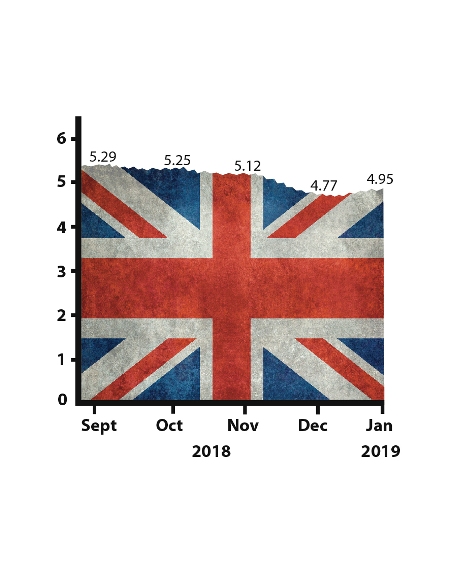

Paradoxically, economic good news has prevailed over parliamentary perplexity

The utter rout of Theresa May's Brexit deal has been the big news of the moment. So you might expect the tumult and confusion in the Houses of parliament to be driving the Accountagility Index (AAX) down this month. But the Brexometer is a blend of political and economic factors, giving a balanced measure of the UK's health. And over the past month, seven economic factors have risen, pushing the Index up 18 basis points from December's reading of 4.77 to the current level of 4.95

The Accountagility Index (AAX) records UK political and economic health in a score out of ten. Any score below 5.00 is negative.

The very idea of good news at the current moment is shocking in itself. Whilst the political factors have been falling, the underlying economy remains resilient. If the Index was just based on economic factors alone, it would be standing at 5.61 today, well ahead of the pre-vote benchmark of 5.45.

What caused the fall this month?

Although the impact of both the lack of leadership and the possibility of a no deal Brexit (now factored in at 70%) depressed the Index by ten basis points, there were seven reasons to be cheerful. A further drop in inflation, a sharp uptick in inward investment, and an increase in the FTSE 250 Index were the leading factors behind the economic improvement. But there were also modest increases in debt, growth and sterling. Lastly, sentiment increased in two of the three sectors, Services and Manufacturing. It is worth drilling down into the January sentiment picture. In Manufacturing, fear of a no deal Brexit was behind a sizeable increase in stockholding, but there were some good export wins seen, partly as a result of the weaker pound. Despite a small fall in sentiment, Construction experienced greater optimism due to expectations of some big-ticket infrastructure programmes this year, mainly in transport and energy. The bright spots in Construction were civil engineering and residential building. Across all sectors, cost pressures are easing, which is better news for hard-pressed businesses’ trying to restore profit margins.

Overall, this is a far better picture that you might imagine from the news. Looking forward, should we celebrate?

What happens next?

Last month we feared that the Index would continue to suffer whilst the political uncertainty prevailed. Since there is no short term light at the end of the particular tunnel, what will happen in February? Will Brexit fears bring the economic factors lower? Or will a possible deferment of the Brexit date beyond the 29th March 2019 move sentiment, markets and investment upwards? What about the possibility of a General Election? What impact would that have on the Index? Perhaps our celebrations of this month's good news should be muted?

Keep following the Brexometer to find out.

The Brexometer was calculated 16 January 2019.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.