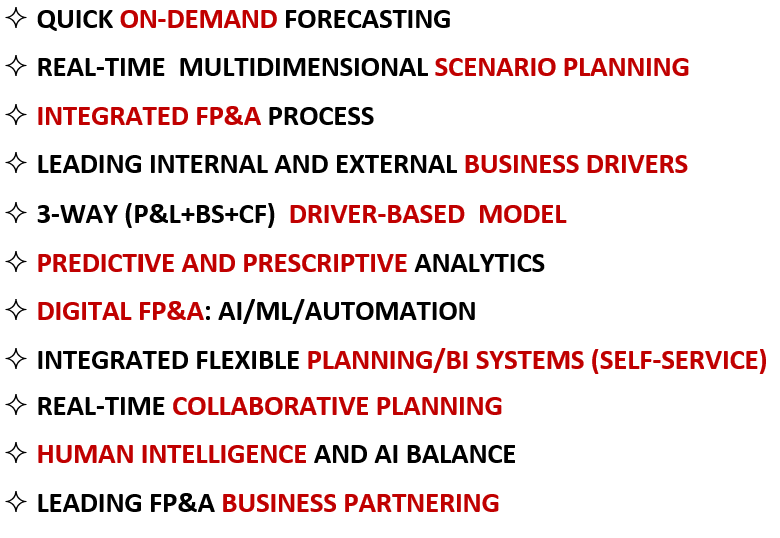

Most FP&A departments are on a journey to a place where they can cope with today’s ‘new normal’. From our experience, organisations that are in the Leading state of the FP&A Analytics Maturity Model exhibit the following characteristics:

The Digital UK & France FP&A Board looked at the following 5 facets of dealing with the “New Normal”:

Scenario Planning

Cash Flow Management

Digital FP&A

Technology

FP&A Skills & Recruitment

Scenario Planning

José Nazario, FP&A and CCAR Director - Global Consumer Banking at Citi

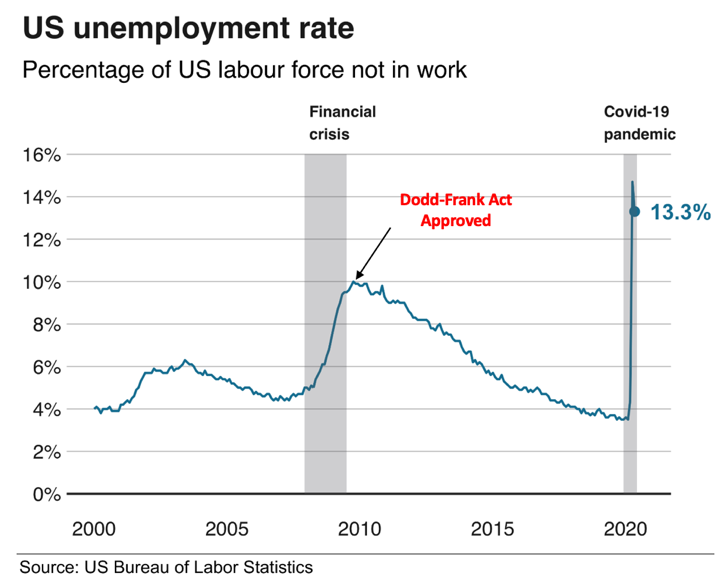

Scenario Planning is very important for all organisations and in particular banking.

Following the financial crisis of 2008, all banks in the US are mandated (Dodds-Franck Act) to perform stress testing/CCAR twice a year. This is so that Banks are better prepared for future recessions.

10 years later the new crisis hit – the pandemic!

US banks run 9 scenarios – 6 scenarios are for internal use and 3 scenarios are submitted to the authorities. These have defined levels of severity that need to be completed within 45 days along with the associated documentation.

How does Citi do it

There are 2 systems:

RUBY that forecasts the total Citi balance sheet (~$2 Trillion USD), Revenue and Expenses for the next 60 months. Ruby is a complex tool that produces its forecasts for the whole company in less than 1 hour, which previously would take more than a week to forecast for only a defined set of planning units. It is a single source of forecasted balance sheet and executes about 200 complex econometric models and 8600 products globally.

Citi Risk that looks at credit risk and potential costs to the bank.

These are fed by models that have assorted drivers such as consumer behaviour, unemployment, FX, which then produces the submissions to the regulator. Most important in this is the continuous engagement between FP&A, the Business, Treasury and Risk, who review and challenge both input and results.

What results did Citi achieved

The impact on Stress Testing/CCAR process:

Quick: Less than 1 hour to run the all process

Flexible: 9 scenarios running in parallel worldwide (+50 countries) for all lines of business

Real-time: All calculations are real-time

Multidimensional: Complex models using macroeconomic and business drivers

It has also allowed Citi to meet the enhanced regulatory framework, identify/be prepared for future recessions and has made the business more resilient. Scenario planning is not an exercise that they do twice a year but is now ingrained in their decision-making process.

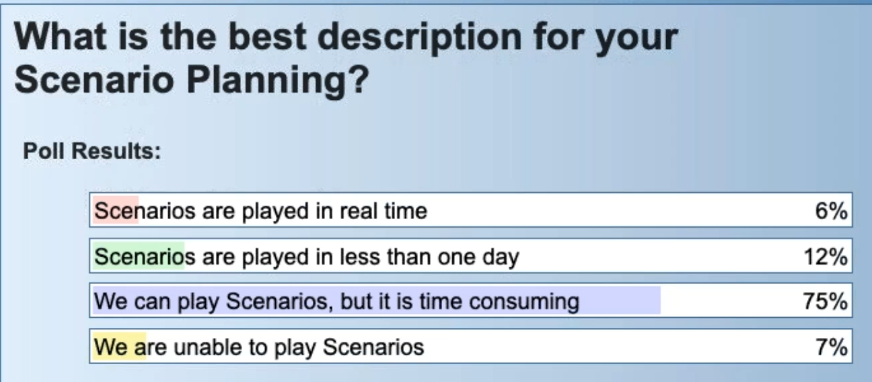

Polling Question: What best describes your scenario planning?

Digital Transformation for Cash Flow Management

Dr David Moreira, Chief Financial Officer at Motesque

David shared his experiences from his working at a number of companies, in reimagining cash flow management. In a crisis, cash usually disappears and does not have the focus it should have.

So far, at Motesque they have

Created an internal awareness of cash flow and linked it to employee incentives

Provided guidance on cash flow to external parties

Their next step is to digitize the processes and then re-assess what they are doing. Their main lessons learned for the ‘new normal’ are:

Automation = Cash Flow is the “champions league” of planning

Cash is King = cash liquidity targets are more important than the P&L

Ops Cash Flow = working capital slightly below 0

Invest Cash Flow = returns higher than hurdle or risk rate

Financing Cash Flow = debt-equity to maximize valuation

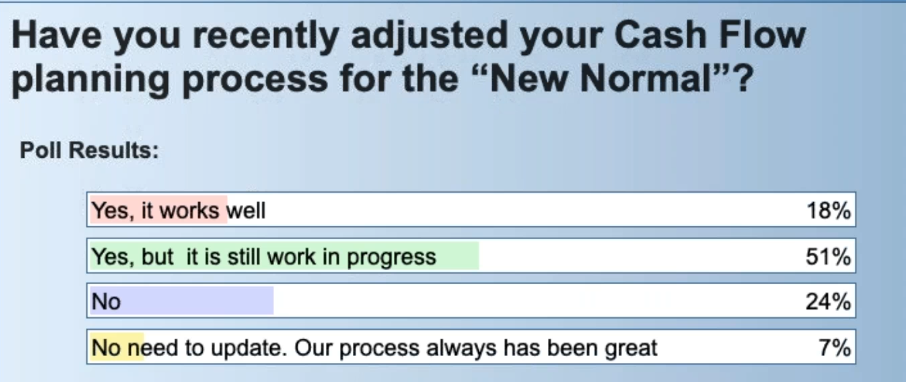

Polling Question: Have you adjusted cash flow planning for the ‘new normal’?

Digital FP&A: Moving to the Leading Analytical Stage

Med Ahmadoun, Director, Financial Analysis and Accountability at Government of Ontario

Med is responsible for the education portfolio in the province of Ontario, where funding (29 billion CAD per annum) is distributed across 72 organisations responsible for delivering educational services.

Big variances between different estimates

Over the years there has been increasing discrepancies between estimates:

their budget,

revised budget estimates that come in through the year

the financial statements in what they actually spend.

This can be as much as 300 million CAD. This causes a major problem which they tried to resolve through revised policies and procedures, but they still had issues that needed addressing.

COVID-19 only made this worse as they now had to do rapid iterations of the budget to put money into COVID safety initiatives. This led to more problems as the money given, e.g. to spend on supply teachers, contracts to make places safer, etc. couldn’t be spent as the supply resources were not there. All this will lead to even bigger variances, so they wanted a way to help them be more accurate in their forecasts. If they could do this, then cash could be deployed where it was needed rather than where people thought it would be needed.

Developing a model to address the issue of the variance

The first step was to do a ‘proof of concept’ where they used simple linear regression model as the baseline and then compared it with the various budget lines one by one to see what the results would be.

This then led to the use of machine learning (ML) algorithms which was able to predict results to between 1 and 5%, so it’s still work in progress. However, it has given them additional insight and helps them not to rely on manual assumptions or interventions, but to have the model look at the data and revise itself without them having to do it.

The next stage is to extend the dataset to 9 years which is around 133,000 data points, investigate other correlations, and have different models for the different areas. They also plan to separate out the impact of COVID-19 to help them deal with other crises that may happen in the future.

Key take-aways

Med finished his presentation by saying that many people think that the technology involved will be the biggest challenge, however, these will probably be the least of their problems. Most of the challenges will be strategic and those that relate to people. These are his key take-ways:

Need alignment (of technology) with overall strategy, commitment and support during implementation.

Address job-security concerns early. Artificial Intelligence (AI) will not replace human staff. The best strategy combines ML/AI for what machines do better and human for what humans do better.

Policy changes that will change behaviour or outcome can be modelled with additional layers and manual override.

Apply business insight but avoid confirmation bias. There must be a balance supervised ML and human influence on model performance.

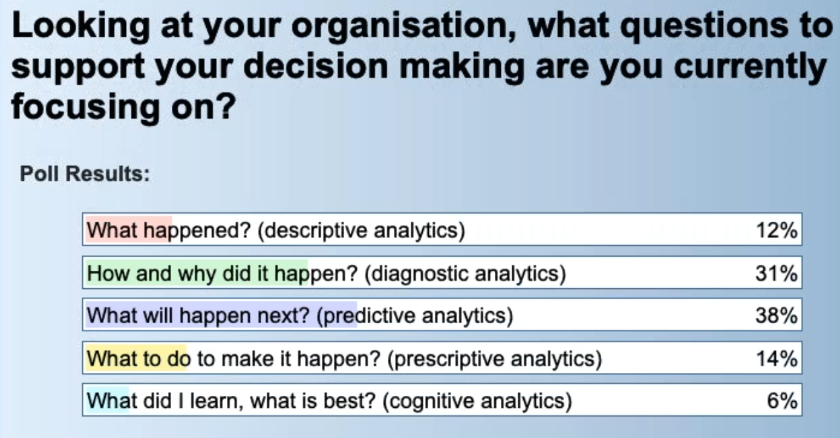

Polling Question: What questions to support decision making are you focusing on?

The Role of Modern Technology

Chris Grundy, Director Product Marketing at SAP

Combining technology with the building blocks of efficient business systems – people and processes – can help improve organisations ability to be more competitive and agile.

COVID-19 and the pace of change has sent many businesses into survival mode with an emphasis on cash flow, planning and profitability. This requires systems and processes to be improved so that CFOs, planners, controllers can minimize the impact of economic uncertainty, maintain business continuity, and emerge from uncertain times even stronger. A key enabler of this change is technology.

However, the reality is that many organizations have disconnected planning processes and still use spreadsheets, which just are not good enough. According to the FP&A Trends survey 2020:

Spreadsheets still remains the most popular FP&A tool, on average being used 72% of the time.

48% of participants said that spreadsheets make it difficult to manage the planning processes.

Today’s Modern Technologies

For FP&A there are 3 key technologies:

Machine Learning / AI that allow:

The ability to build Predictive planning models

Streamline and reduce planning cycles

Access to rapid simulations in real-time

Analytics

Real-time analysis of large amounts of data revealing insights

Embed analytics and experience data into planning cycles

Tell the story behind the numbers

Collaboration

Align plans across the organization

Improve responsiveness to disruptive events

Make faster, more informed and confident decisions

In practical terms:

Airbus: Through the use of cloud-based planning processes experienced a 90% time reduction in reporting times.

Graphic Packaging International: Using real-time advanced analytics saw a reduction in sales forecasting from 25 days to 5 days.

Furst McNess Company: Moved from spreadsheets to could-based planning solution streamlined their Financial reporting package from 40+ pages to 15 pages.

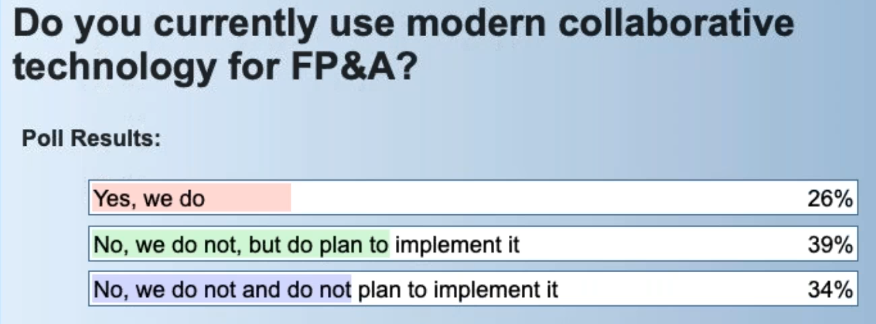

Polling Question: Do you use modern collaborative technology for FP&A

Latest Trends in FP&A Recruitment

Mikaël Deiller, Director - Finance & Accounting at Page Group - Michael Page

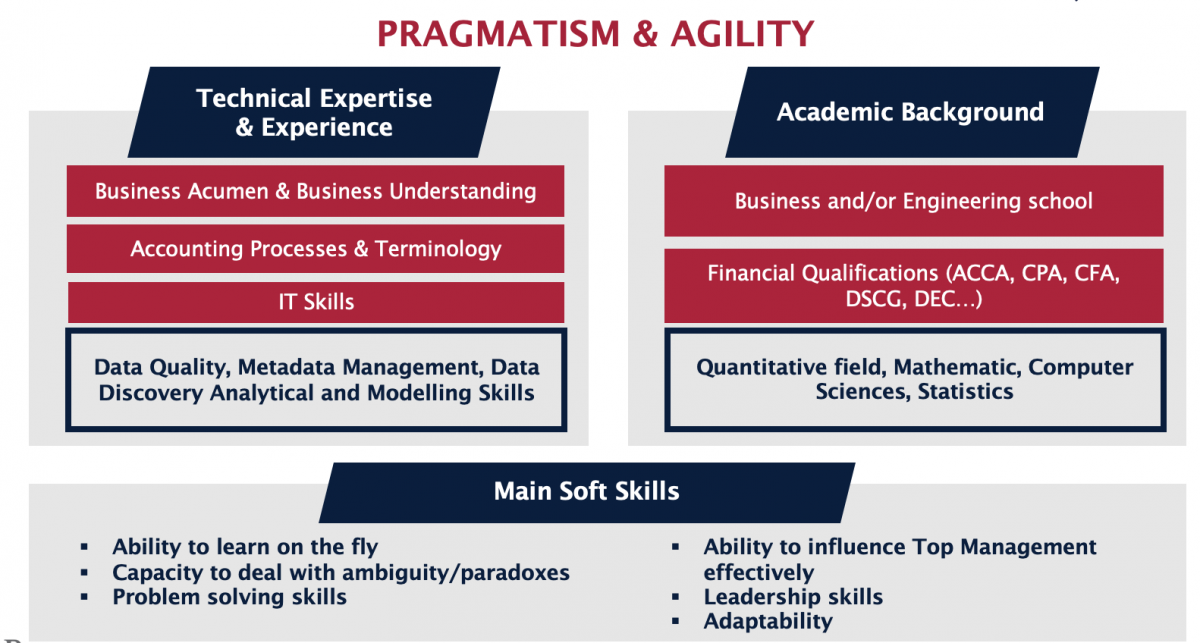

In today’s uncertain world, FP&A is becoming the leader in Finance transformation. They are a key player in liaising and interacting with the different internal disciplines within an organisation, to be the leader and conductor of business.

FP&A is interconnected with a number of disciplines ranging from finance, technology, control, project manager and how the business operates. Some of these are new to FP&A. FP&A staff need to know how to use and exploit them.

Typical skills include:

The new generation of FP&A staff is different from the older generation and have different expectations. They will not be interested in using older technologies and processes, and it takes time to train existing staff in these. Put yourself in their position and note what would attract you today to work where you work. It’s also important to have a vision of where the FP&A is going.

Conclusion

The Digital UK & France FP&A Board was sponsored by SAP and Michael Page. We are very grateful for their continued support.