These notes were made during the meeting of the FP&A Board on 6th February 2020 in London. They are a mixture of comments made by attendees and thoughts of those who presented case studies. These notes are the copyright of the FP&A Board and are for the attendees of the FP&A Board and their business colleagues. They are not to be used in publications unless authorized by the FP&A Board.

These notes were made during the meeting of the FP&A Board on 6th February 2020 in London. They are a mixture of comments made by attendees and thoughts of those who presented case studies. These notes are the copyright of the FP&A Board and are for the attendees of the FP&A Board and their business colleagues. They are not to be used in publications unless authorized by the FP&A Board.

Budgeting Today: Group Discussion

The Board met to explore the topic of ‘Better Budgeting’ and to listen to the experiences of those who are trying to improve the process. The meeting was sponsored by SAP, IWG and Page Executive.

How painful is the budgeting process?

The group scored around 7.5 out of 10, where 0 was not painful and 10 was extreme pain.

Causes of Bad experiences:

- Very emotional – particularly when tied into bonuses

- Out of date when completed and so irrelevant

- By the time the budget starts, the assumptions made are now wrong

- Not sure whether the budget is to be aspirational or reflecting what we can do

- Not aligned to Strategy

- Disconnection between departments - all are competing with different agendas

- Based around the Chart of Accounts which has no real link to the activities being resourced. As a result, we are unable to judge whether they are doing a good job

Budgeting is Good because:

- Chance to discuss what happened and where we want to go

Thoughts on Budgeting

“Making a budget is an exercise in minimization. You are always trying to get the lowest out of people because everyone is negotiating to get the lowest number” Jack Welch, former CEO at GE

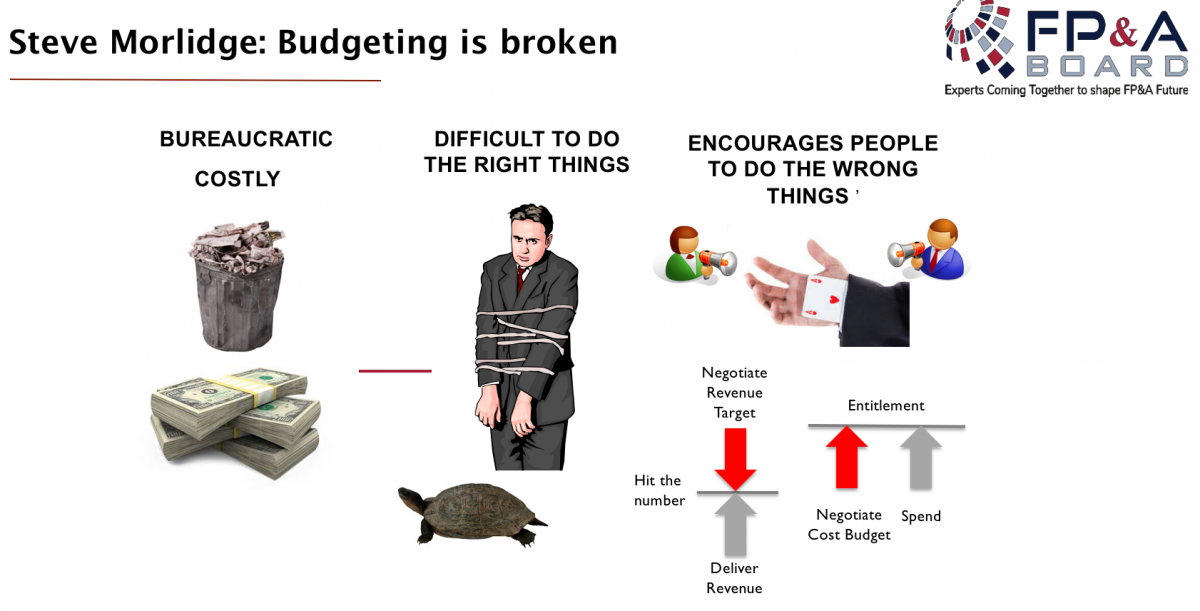

Problems of Traditional Budgeting:

- Forecasts and Targets often are the same...

- Compensation targets are fixed

- The budget for the year is fixed. This is your department’s annual allowance

- The capital budget is set during the budgeting process

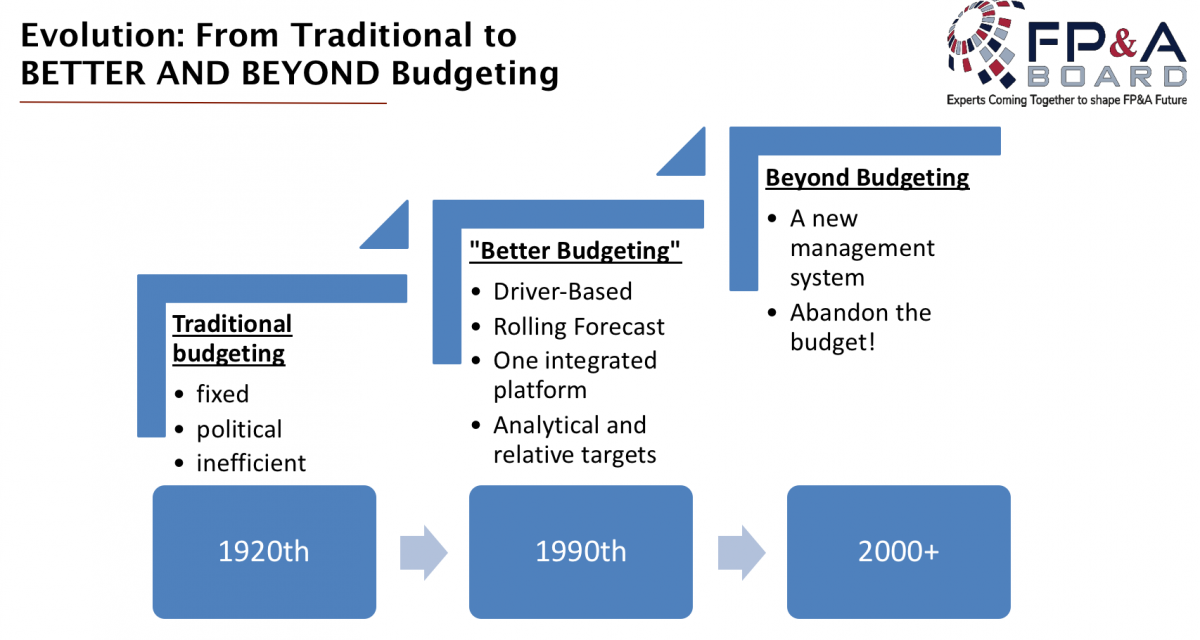

Evolution of the Budget

Group Discussion

Why do we still keep the budget?

- Opportunity to think about the market which we wouldn’t do otherwise

- Chance to think about what returns we can get in the future

Other comments:

- We often Budget things we can’t control e.g. revenue when perhaps we should budget margins. Otherwise, we’re dependent on a big contract which may or may not come off

- Budgeting fosters the wrong behaviours. E.g. cutting expenditure to stay within budget may be the wrong action

- Stakeholder and external pressures can often lead to bad decisions being taken when setting budgets

- No point having better tools if you can’t change behaviour

- Budgets can soon get out of date with what is going on in the outside world “The recent Coronavirus outbreak has made our current budget irrelevant”

What is Better Budgeting?

- There are not 4 clear cut types of budgeting (as shown in the slide above) but a merging of all of them.

- It requires a different mindset over the purpose of the budget - requires a culture change

- Being more flexible on the budget time horizon

- Less detail

- Collective ownership

Case Study: American Express Global Business Travel

Finance Transformation - The Journey So Far

Simon Reed, VP Corporate Planning

Planning Process

We first set our ‘Strategic pillars’ that go across the business. From this, we develop a long-range 3-5 year plan plus investments that are to be made at that time. We then turn this into the operational plan driven by priorities for the year - these drive the detail in the chart of accounts in the operational plan. We then into 4 quarterly forecasts that have different moving horizons.

Issues with the process

Our biggest issue is that compensation is still tied to budgets. We can hit the budget but if the market has grown more, then it’s a rubbish performance and yet people still get their bonuses. Similarly, we can miss the budget and yet the market performed even worse but no one gets a payment.

Need to try and tie bonuses to external market measures.

Current development plan

- Driver Based Forecasting

- Predictive Analytics

- Linked Board Reports

- Self-service Reporting

- Rolling Forecasts

Keys to ‘Better Budgeting’

- Compensation/ target setting

- Go Beyond the year-end

- Mixed timescales - some plans need to go out 3 years while others just 6 months

- Agile investment planning – we review capital expenditure every quarter

- Appropriate levels of detail.

Case Study: State Street Global Advisors

Overview of Planning Process for Better Budgeting

Himal Kakad, Vice President Finance

Still in the mind-set of traditional budgeting:

- Top-down - control and command approach

- Need to recognise that some of the costs are uncontrollable

- We are driver based but heavily reliant in excel

- Results are not credible with the business managers

- Inflexible approach and therefore unable to change with the markets, which for us changes rapidly.

- The whole process takes 5 months

Developments

- Increasing use of drivers and constantly updated market guidance supporting the move towards rolling forecasts plus creation of sensitivity analysis / What-if scenarios around key drivers

- Driving education and understanding within the business of underlying drivers of business profitability

Small Group Work:

What are the key steps in transforming the traditional budget into a flexible planning process?

- Understandings drivers essential for getting buy-in from business

- Real-time data

- Get the right people with the right skill sets up with the business

- Get the systems in place with high-quality data to reveal insights

- Create a hybrid budget model split into the ‘Stable business’, and a range of agile, innovative project that can be invested in. This way you can take risks without negative consequences if they fail.

- Get rid of inequalities in how people are rewarded. Need to reward people for achieving corporate goals

- Aligning internal and external KPIs so we are all driving towards the same future

- Needs strong, stable and directional leadership

- Lose the word budget

- Decouple controllable and external performance drivers

- Decouple exec compensation

- Identify drivers and establish a dictionary of terms

- Automate everything

Will the corporate budget be mostly abandoned by 2030?

- Depends what is meant by budget

- Yes will still have budgets: They are a comfort blanket, the North Star to guide the organisation

Other Thoughts

The term budgeting is often used to describe three different activities: Target Setting, Forecasting and Resource Allocation. A ‘Better Practice’ is to separate these out and then improve each part.

Conclusions

Better budgeting is a journey. So it’s important to understand where we are now.

In the 2019 FP&A survey we saw:

- 59% rate their current systems as being difficult to use

- Less than 2% saying their systems allow them to easily perform scenario analysis

- Data validation and collection accounts for 54% of the time spent

- Over 60% of organisations are concerned with the accuracy of forecast results they generate

- 36% use DBP and only 12% use predictive modelling

- Only 5% of organisations are currently using any form of AI, but 44% plan to do so over the next few years

About the FP&A Board

The mission of the International FP&A Board is to guide the development and promotion of better practices in global FP&A, identify and support new trends, skillsets and innovations. For more information on the board and to view our other events, visit www.fpa-trends.com/fpa-board.