In 1992 a professor named Robert Kaplan and a consultant named David Norton created a measurement...

During 2019 I have contributed articles to FP&A Trends that have addressed financial planning. The articles have addressed financial planning from the perspectives of financial statements, fields of study, and business functions. The purpose of addressing financial planning from these perspectives is to provide insights into usage. Usage of financial planning is important because it begins a process of improving financial health. Improving financial health can be achieved when finance professionals use financial planning.

During 2019 I have contributed articles to FP&A Trends that have addressed financial planning. The articles have addressed financial planning from the perspectives of financial statements, fields of study, and business functions. The purpose of addressing financial planning from these perspectives is to provide insights into usage. Usage of financial planning is important because it begins a process of improving financial health. Improving financial health can be achieved when finance professionals use financial planning.

The Role of Finance Professionals in Financial Planning

The role of finance professionals in financial planning begins with leadership. Leadership is about helping others. In companies helping others focuses on people in production, selling, and other administrative functions. Production, selling, and other administrative functions have an important task which is to improve the well-being of stakeholders. Improving the well-being of stakeholders can be achieved when finance professionals assume the role of leadership.

The role of finance professionals continues with education. Education is about enlightening others. In companies enlightening others focuses on processes in production, selling, and other administrative functions. Production, selling, and other administrative functions expand on their task to improve the well-being of stakeholders by creating, promoting, distributing, and supporting what companies sell. Improving the activities that comprise the expansion of improving the well-being of stakeholders can be achieved when finance professionals assume the role of education.

The role of finance professionals ends with communication. Communication is about sharing with others. In companies sharing with others focuses on information about production, selling, and other administrative functions. Production may know how it creates what companies sell, selling may know how it promotes and distributes what companies sell, other administrative functions may know how it supports what companies sell however their knowledge will not be complete. Improving the knowledge of production, selling, and other administrative functions can be achieved when finance professionals assume the role of communication.

Leadership

One way finance professionals can assume the role of leadership in financial planning is to incorporate methods from leaders in team sports; the keyword in the previous statement is team. Companies are teams in that a number of people in a number of departments work in unison. Working in unison is necessary because the task of improving the well-being of stakeholders will be more difficult to accomplish. Minimizing difficulty can occur when leadership is engaged. Engagement from finance professionals in financial planning can be developed by learning from leaders in team sports.

One leader in team sports whose methods should be incorporated is John Wooden. John Wooden was a college basketball coach who was considered the greatest coach of any sport at any level of the 20th century. His method of leadership should be incorporated due to how he viewed success. He viewed success not by winning but by effort. Here is a quote from John Wooden that should be incorporated in the leadership of financial planning:

“My bench never heard me mention winning. My whole emphasis was for each one of my players to tr to learn to execute the fundamentals to the best of their ability. Not to try to be better than somebody else, but to learn from others, and never cease trying to be the best they could be; that’s what I emphasized more than anything else”.

Another leader in team sports whose methods should be incorporated is Jurgen Klopp. Jurgen Klopp is the manager of the Liverpool Football Club (LFC). His method should be incorporated due to how he defines leadership. He defines leadership by five tenets: confidence, simplicity, energy, relationship, and example. Here is a video that expands on these tenets that should be incorporated in the leadership of financial planning:

https://www.youtube.com/watch?v=4jWZVtkJdC0

Another leader in team sports whose methods should be incorporated is Joe Maddon. Joe Maddon is the manager of the Los Angeles Angels, a major league baseball (MLB) team. Prior to becoming the manager of the Angels he was the manager of the Chicago Cubs where his leadership was instrumental in the team winning the World Series in 2016, the first time the team won the World Series since 1908. His method of leadership should be incorporated due to his emphasis on culture. Here is a video that expands on this emphasis:

https://www.youtube.com/watch?v=Ct_ge8ueMow

Education

One way finance professionals can assume the role of education in financial planning is variety of enlightenment. People are not the same so enlightenment cannot be achieved by the same method. In its role of education finance professionals should use various methods to enlighten people in production, selling, and other administrative functions. Since production is responsible for creating what is sold, selling is responsible for promoting as well distributing what is sold, and other administrative functions are responsible for supporting what is sold variety of enlightenment is critical. It is critical because these functions operate under different perspectives and the differences should be recognized when finance professionals assume the role of education.

One way to incorporate variety is through definitions. Definitions that finance professionals can use are in the book The Goal by Eliyahu Goldratt. The Goal is a novel that describes the story of a manufacturing facility struggling to remain in existence. In the novel Eliyahu Goldratt assumes the role of Jonah, a consultant to manufacturing companies. As a consultant he presented three definitions that can help finance professionals assume the role of education:

- The goal of a manufacturing company is to make money.

- A manufacturing company makes money when it simultaneously increases sales, reduces inventory, and reduces operating expenses.

- Activities are productive when they move the company closer to the goal.

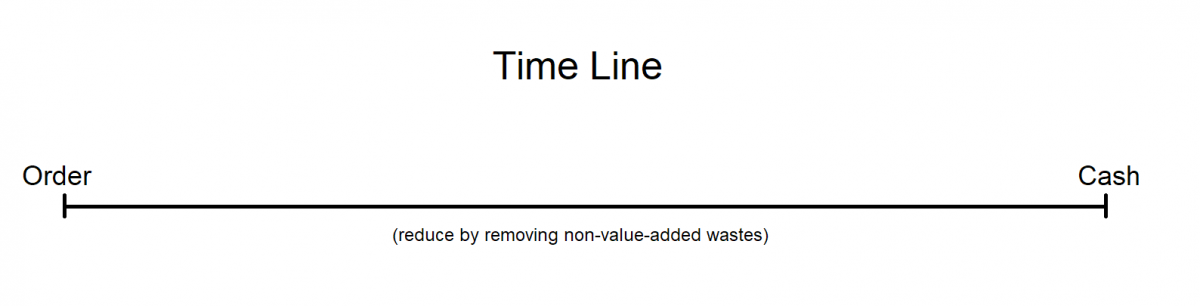

Another way to incorporate variety is through visuals. A visual finance professionals can use is a timeline created by Taiichi Ohno. Taiichi Ohno developed the Toyota Production System, a precursor to lean thinking. The timeline represents a basic tenet of the system but finance can use the timeline to indicate the end result of effort. The end result of effort is cash flow, the most critical element of a company’s financial planning process, which is indicated in the following timeline:

Another way to incorporate variety is through lecture. A lecture finance professionals can use is a presentation by Tom Peters. Tom Peters is a management consultant who is the co-author of In Search of Excellence, considered one of the greatest books on management. The presentation addresses a number of topics but one topic stands out and that is benchmarking. How Tom Peters addresses benchmarking is in this video:

https://www.youtube.com/watch?v=ADNuqkGcmZ8

Communication

One way finance professionals can assume the role of communication in financial planning is clarity. Clarity is about being logical and understood. Being logical in financial planning emphasizes the reasons for thinking about how companies can improve the well-being of stakeholders. Being understood in financial planning emphasizes the interpretation of thinking about how companies can improve the well-being of stakeholders. Finance professionals enjoy a unique position to help companies improve the well-being of stakeholders by assuming the role of communication.

Being logical in communication focuses on the process of financial planning. Financial planning begins with choices to be made in production, selling, and other administrative functions. Financial planning continues with transactions from the choices made. Financial planning ends with wealth from the transactions made. The logic is illustrated by the following visual:

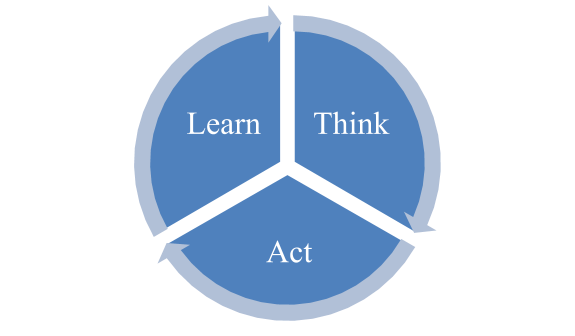

Being understood in financial planning focuses on the system of companies. Companies think about how they are going to deliver products, provide services, and acquire resources which are communicated through financial planning. Companies act upon their thoughts on delivering products, providing services, and acquiring resources which are communicated through financial reporting. Companies learn about how they deliver products, provide services, and acquire resources which is communicated through financial analysis. The system, which exists in order to not only maintain but also enhance the existence of companies, is illustrated by the following visual:

Conclusion

I dedicated my articles for FP&A Trends during 2019 to help people not only understand but also improve financial planning. My attempt to help people understand financial planning was to focus on fields of study like economics, accounting, and finance. My attempt to help people improve financial planning was to focus on functions like production, selling, and administration. What brings these attempts together is describing how finance professionals should use financial planning. Finance professionals should use financial planning that goes beyond budgets and forecasts by assuming the roles of leadership, education, and communication.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.