Many businesses have yet to discover the full benefits of evolving their planning process to include...

A rolling forecast is not only about seeing the future unravel, but a constant evaluation of the management team to see if they are able to adjust their operations on time. Without it, any form of strategic planning becomes useless.

A rolling forecast is not only about seeing the future unravel, but a constant evaluation of the management team to see if they are able to adjust their operations on time. Without it, any form of strategic planning becomes useless.

Below you find a real-life case. Step-by-step each question will be briefly discussed. It is about a foreign business unit, which was part of a large European corporation, on the brink of a crisis.

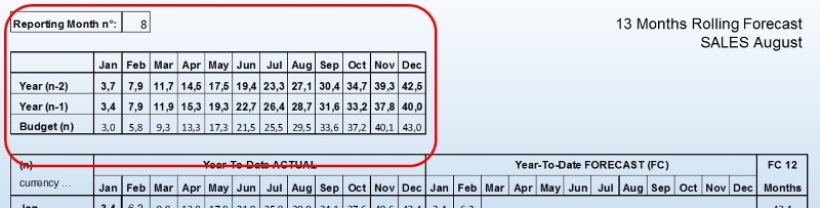

1. What is expected for the year to come?

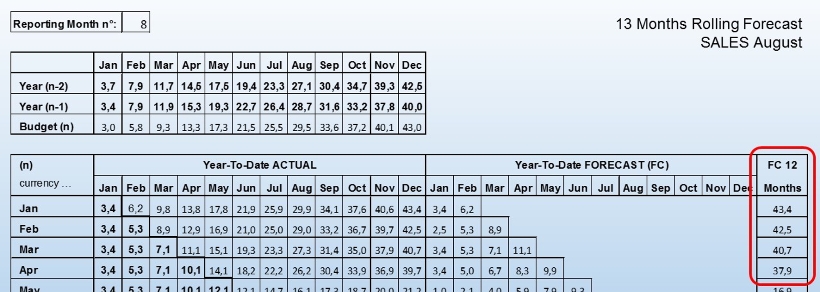

You want the rolling forecast to have the basics. This means there should be an overview of the budget: Budget (n), where “(n)” is the actual year, next to the actuals of previous years, Year (n-1) and (n-2).

In this overview, you see that the “year-to-date” numbers by management are optimistic. The plan was approved (sales target 43,0 million), meaning that the executive team knows how the management team will realise this growth scenario, in the last 2 quarters of the year.

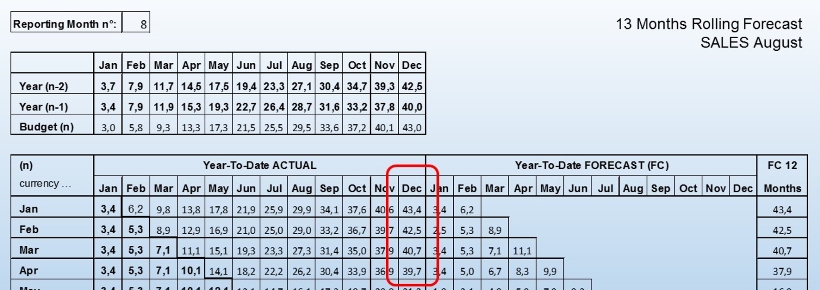

2. Will they hit the target?

Next, you have the “year-to-date actuals” forecast. The local management team might want to see month-by-month numbers, to manage the sales force/sales division. As an executive team, you don’t want to start micro-managing a local business (you hired a country manager, remember). That’s why the budget consists of YTD numbers.

The first month was better than budget, pushing the YE (December) up to 43,4 million. Yet, the following months the business turned sour. What has been happening?

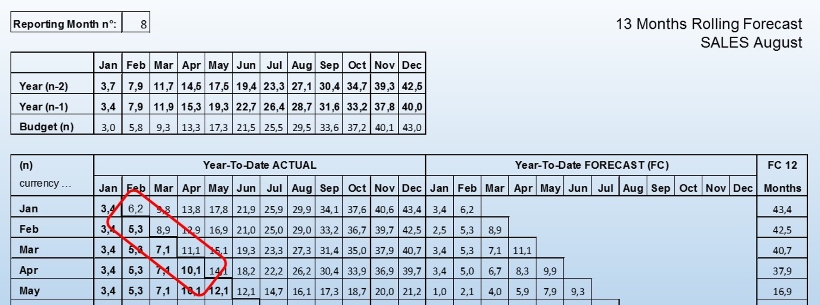

3. What is management expecting, short term?

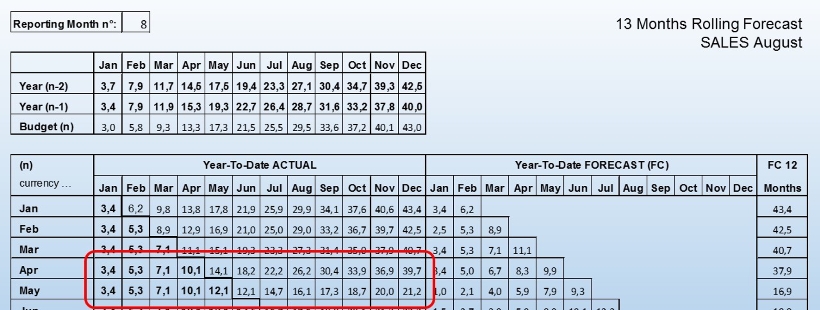

You want to know if the management team is focussed and if the quality of the forecast is adequate, to achieve the quarterly results.

You see repeatedly the first month being overly optimistic forecasted by the management team: YTD 6,2 expected in February, YTD 5,3 realised; YTD 8,9 expected in March, YTD 7,1 realised; YTD 11,1 expected in April, YTD 10,1 realised. Is this just a bad quarter and what are their plans to recover lost sales? Or are they ‘wishing’ things will turn out for the best?

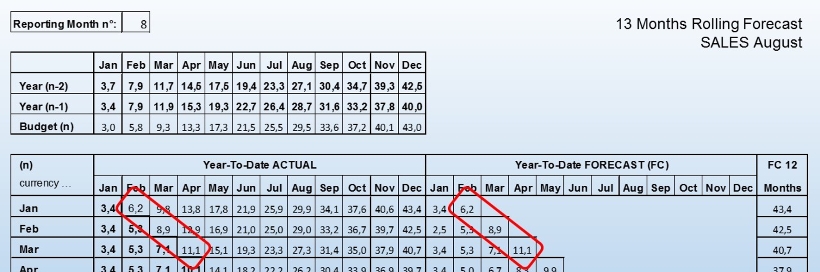

4. What is management expecting, long term?

A strategist looks just a little bit further. With a 13 months(!) rolling forecast you can get the next month projected twice! Near the monthly close, the management team has to forecast coming month revenues, based on their order book or some kind of sales projection. In addition, the same people should forecast the same coming month, but 1 year ahead. “Business-as-usual” or is there a something on the horizon?

YTD Februari, March and April of the actual year are the same as the YTD months of the forecasted year, 6,2, 8,9 and 11,1 million. The management team is thinking “business-as-usual”.

(Note: The YTD Actual of January (3,4), changed in the forecasted year to 2,5 million. This was an unwitting mistake, yet explained because actual YTD sales had dropped 0,9 million in February (from 6,2 to 5,3 million). This kind of planning should actually always occur, but some executives don’t want to see reality, that quickly.)

5. How will the business evolve?

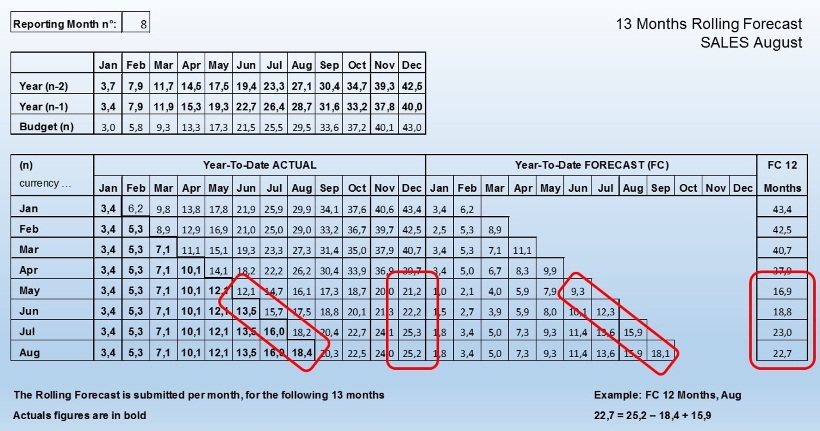

Any trend should appear here, the forecasted 12 months (FC12). It shows the expectations the management team has about the evolution of the industry and/or the commercial impact of operational problems, eg. out-of-stock, recall, strikes. It presents the foundation for the next business plan, hence no surprises anymore.

Each month the business is loosing a million or more in sales and the local management team isn’t seeing any improvement, thus not acting. This confirms that the management team is ‘wishing’ for a better future. Is the business loosing market share? Or is there another crisis?

6. If action is required, can management do it?

The rolling forecast gives the executive team the opportunity to discuss with the management team what is happening and to decide on the best way forward. They can coach the management team through strategic choices and financial decision making.

In this case, there was another crisis and the executive team intervened. The country manager was effectively ousted and the thirty-something finance director and sales manager were put in charge. The executive team (approving their monthly purchase orders, of course) accepted the turnaround plan writing overnight by the finance director, and their re-forecast of May to YTD (Decembre) 21,2, down from 39,7 million.

7. Is the problem being solved?

The decisions of the executive team and the actions of the management team will appear in the rolling forecast. Again, short term predictions, YE (December) stability, and solid long term outlook (FC12).

The YTD monthly sales now are higher than forecasted, several months in a row. The YE improved too. Also the FC12 in August seemed more realistic (22,7, from 16,9 million), supported with 1 year ahead forecasts justifiably being lower. This gave the executive team the option to sell the business.

Lessons learned: Look outside the reporting deck!

The local finance director foresaw the downturn. He had been looking at the local accounting numbers, without all the reporting contingencies and reserves. In addition, he saw that inventory of their (worldwide) suppliers was growing fast, according to Bloomberg. This indicated a general slowdown in the segment. Fueled with ‘bad’ management, it was a crisis in the making. The turnaround plan focussed on expanding into another segment: fewer volume sales, yet solid profits.

Above were the key-questions related to Sales. You should also have a rolling forecast of the Operational Profit (OP). This allows the executive team to monitor what management is doing to improve operations (from COGS to overhead). Depending on the industry, add an Order book rolling forecast. To complete the monthly forecast executive deck, add a quarterly overview. In this way, you can have OP/Sales (%), which is relevant to all publicly held companies.

Even with the best forecast at hand, always look outside the reporting deck. Each step generates different questions. Talk to the management team. Remember, a rolling forecast means continually reviewing the (non-)actions of the management team and adjust operations in accordance with the business focus. A rolling forecast is one of the best first steps towards having an agile business culture.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.