Sometimes, what you forecast needs to change dramatically, due to e.g. market disruption or internal changes...

Being critical of one’s own work, is even more important for the financial doing the forecast. A forecaster will undoubtedly have his or her bias and blind spots. However, some can be avoided by looking at the forecast itself, and some by looking at person doing the forecast. The aim here is to create deeper awareness of ‘forecasting’ by presenting some structural elements.

Being critical of one’s own work, is even more important for the financial doing the forecast. A forecaster will undoubtedly have his or her bias and blind spots. However, some can be avoided by looking at the forecast itself, and some by looking at person doing the forecast. The aim here is to create deeper awareness of ‘forecasting’ by presenting some structural elements.

The Forecast

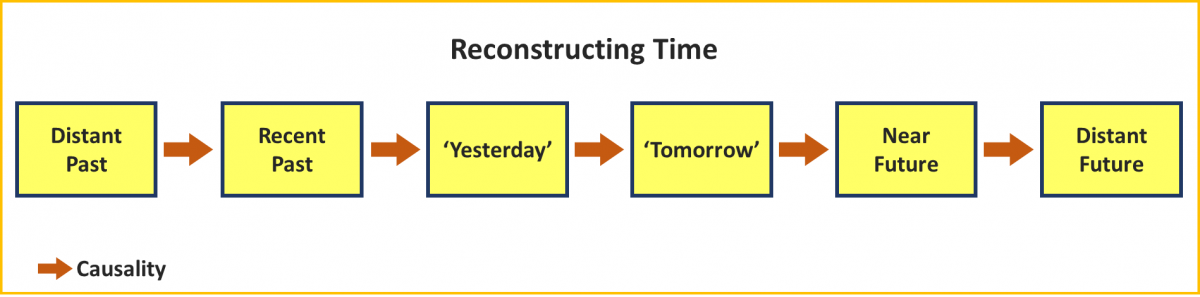

Forecasting is about understanding the past, to project the future. This process of ‘time’ can be reconstructed as follows:

This picture raises at least the following of questions:

- What is the causality between each stage?

- How significant is this relation?

- Which actions are planned or should be taken ‘today’?

- How far in time will these actions reach?

- What else will influence each future stage?

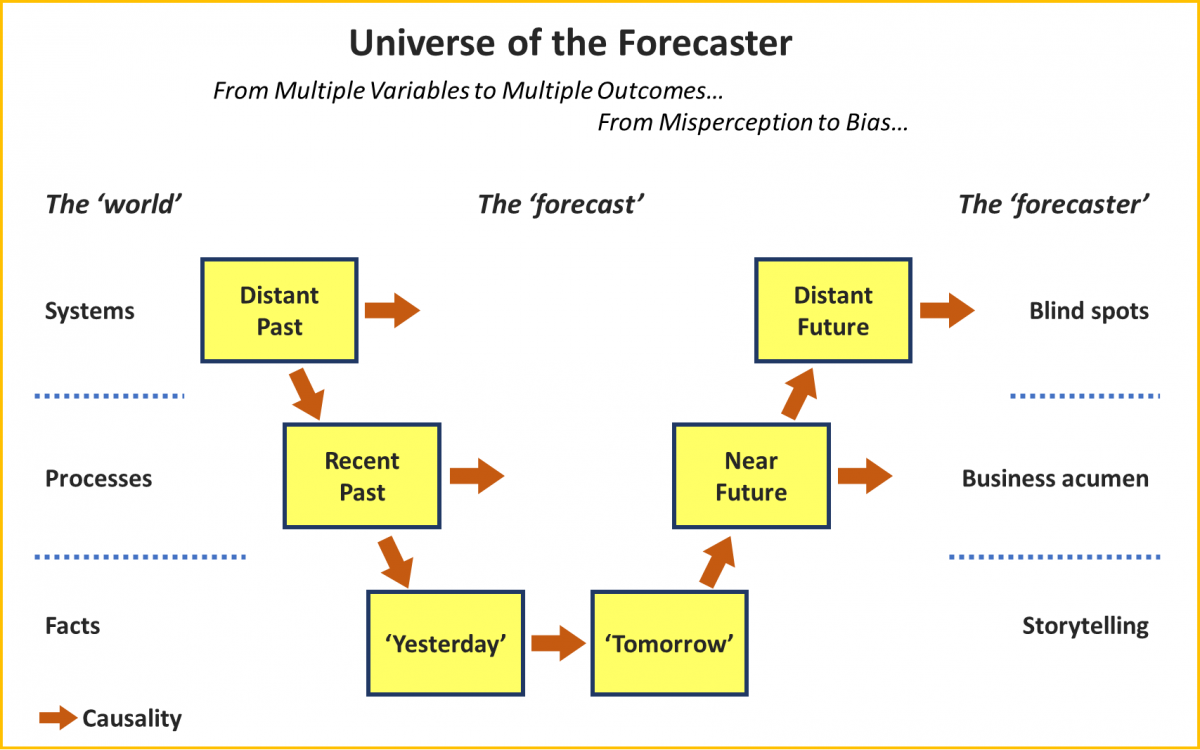

By layering this model of ‘time’, a comprehensive ‘universe of the forecaster’ is created.

It has three levels:

- A system level. E.g. events like economic trends, social changes, geopolitical forces or disruption generating a similar impact on competitor and related companies.

- A process level. E.g. changes in the supply chain, marketing or organisational directly changing the (financial) numbers.

- A ‘factual’ level. E.g. events occur, changing the future, and management makes decisions trying to manage this ‘future’.

Now the previous questions become more meaningful. The forecaster can bring add content from these of these levels. However, the forecaster must now acknowledge, that what management decides, impacts the forecast directly. Understanding management and interpreting the decisions they make become a significant influence on the forecast… and the forecaster.

Management

Management holds a pivotal point, between ‘yesterday’ and ‘tomorrow’. Management is there to make sure profit is made. However, when over time a business is not making a profit, it is either in the wrong business, or it is suffering from poor management. In both cases, management didn’t change its business focus on time. Keeping this extreme case in mind helps to at least classify the decision management makes ‘today’, e.g.:

- ‘Head in the sand’ and hope ‘it’ will disappear.

- Evasive action: e.g. delay reporting to higher management, delegate to other department, organise ‘around’ the problem, putting out fires.

- Short term solution: e.g. discounts, returns, spending cuts, management change.

- Initiate business change: e.g. market research, product development, change business focus, M&A, divest.

There are libraries full on failed and successful business decisions and strategic choices. It is up to the forecaster to judge the impact of these decisions and choices. Too much ‘imagination’, and the forecast becomes speculative. Too much copying management expectation, and ‘an unknown’ risk is created.

The Forecaster

Last, but surely not least, the forecaster. The three levels of the ‘universe of the forecaster’ also relate directly to the person doing the forecast:

- Is there the ability to tell the story: from processing data (factual level) and generating information (process level), to providing knowledge and insights (system level)?

- Is there enough business acumen into the understanding of the organisational impact, including the impact from unrelated industries and markets, both being potential sources of competition and disruption?

- Is one self-aware of limits and blind spots, e.g. from the personal background and professional experience?

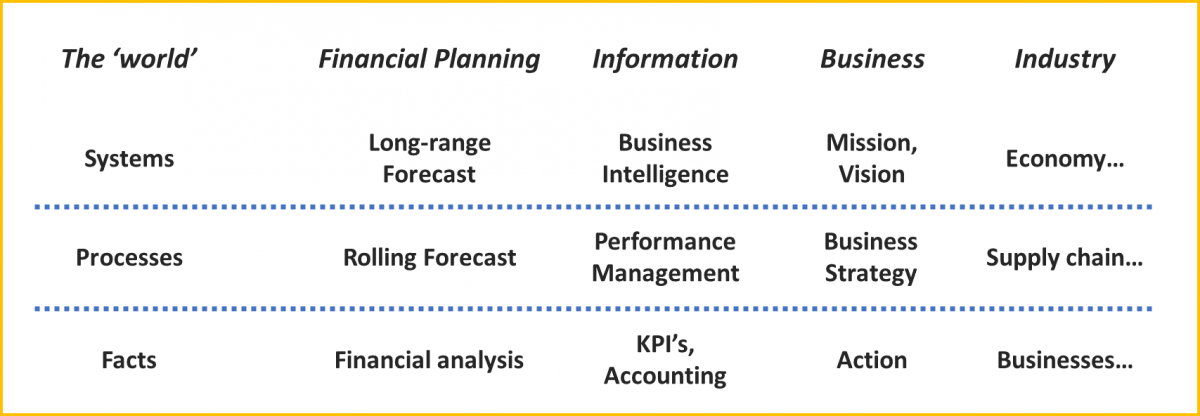

Forecasting is an iterative process, and the forecaster is continuously learning from ‘mistakes’. Experience from working in various industries, companies, or cultures accelerates this learning curve. The following overview might inspire to improve the forecasting.

Bias can have many sources, e.g. education, upbringing, professional drive, peer pressure. These elements also create (mis)perceptions. Where bias often cannot be solved, misperception can. Using the ‘universe of the forecaster’ can help identify possible misperceptions. Open communication, like (cross-functional) teamwork and discussions, and fact-finding, like root-cause analysis, BI or statistical models, can take away many misperceptions and improve the quality of the story behind the numbers.

The article was first published in Unit4 Prevero Blog

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.