What is the Holy Grail for any leader? For me, it is to create a high-performance...

In this FP&A Talks, we speak with Thomas Lundell, Finance Director and Chief of Staff for Enterprise Countries at NetApp. Thomas shares his story of how he took part in building and transforming the FP&A team at NetApp. FP&A Talks is a collaboration between FP&A Trends Group and Anders Liu-Lindberg.

In this FP&A Talks, we speak with Thomas Lundell, Finance Director and Chief of Staff for Enterprise Countries at NetApp. Thomas shares his story of how he took part in building and transforming the FP&A team at NetApp. FP&A Talks is a collaboration between FP&A Trends Group and Anders Liu-Lindberg.

FP&A can have many roles in the company (from transaction through controlling and to business partnering), but what role is needed when?

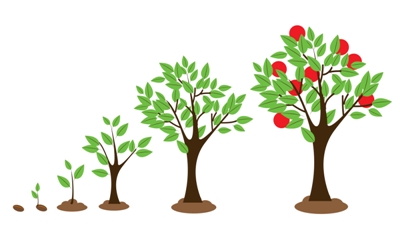

Three development stages of a company: start-up/growth (transactional FP&A), transitioning from growth to steady-state (controlling cost, governance, and more), transformation/profitability/growth boost to reach the next size level (business partnering).

Thomas, can you describe how you experienced this at NetApp when you arrived about twelve years after the company was founded?

I joined NetApp from Swedish multinational Electrolux about 15 years ago, where I most recently had worked in the FP&A department. At Electrolux, I would say that the FP&A department of the European Home Products division was already quite advanced. In addition to managing the P&L, Balance Sheet and Cash Flows using traditional accounting measurements and systems, we had also built our own contribution margin model, data warehouse and reporting system. This allowed us to work very close to the business leaders and supporting them in driving business performance. Business Intelligence and Analytics was definitely the responsibility of Finance at Electrolux when I was there.

When I joined NetApp, I didn’t join the Finance team, instead, I joined the Sales Operations department, where I rather quickly worked my way up to Director of EMEA. What I discovered at NetApp was that many of the things that the FP&A department was doing at Electrolux, Sales Operations was doing at NetApp. In the beginning, this was very confusing to me. I couldn’t really make sense of it, to be perfectly honest.

I think that one of the differences was that NetApp was a significantly smaller company than Electrolux. But maybe even more importantly it was also at a very early stage in its business lifecycle. NetApp was a teenager when I joined, whereas Electrolux was founded in 1919 and could have been the grand-parent.

What I learned was that in the early stages of a company, the core finance responsibilities are really about setting up a general ledger, figuring out how to do payroll, setting up AP and AR, defining the entity and tax structure and many other foundational financial controlling activities. Because Finance is so busy doing this, they are not really involved in driving business performance. So, in my view, this was the main focus of NetApp finance at the time when I joined, but we had already started to move into the Controlling stage.

It’s interesting that you started outside of Finance in the company. What was your first reaction when you moved to Finance?

After a few years in Sales Operations, I was asked if I would be interested in setting up a new FP&A function in EMEA Finance. I was indeed quite excited about moving back in to finance and taking on this the task – remembering all the things we used to do at Electrolux and how closely we worked with the CEO and the European board at the time, analyzing business performance, building strategic plans and doing advanced analytics. This should be great fun!

However, I was in for a bit of a shock in the beginning. Though NetApp finance had evolved from doing only the core finance activities mentioned earlier, we were still only in the Controlling stage. This means that most of the focus was on controlling expenses, headcount, and even performing transactional activities like accruals. Having been outside finance for a few years, I had quite a steep learning curve in the beginning, and the job was still quite interesting. But I knew that this is not what the top-performing finance departments spend their time on and I knew that NetApp had to evolve to the next stage of the FP&A maturity model.

The good thing was that I was in the lucky position to have the experience from Electrolux as well as having worked in the business at NetApp over the last few years – so I knew where we had to go and what competencies we had to build.

So, there was quite a task ahead of you and the leadership to transform the function. How did you go about it?

I think the entire EMEA finance department underwent a rather significant transformation at the time, but if I limit my answer to EMEA FP&A, this certainly wasn’t easy. At first, you must set out the vision of where you want to be as an FP&A organization and do the usual gap analysis, in terms of processes, people and systems. But more importantly, you also need the buy-in from business leaders to start the journey. This is probably the most difficult and challenging part, actually.

If your business leaders are used to having FP&A controlling OPEX and headcount, and suddenly FP&A is talking about investment allocation, strategic planning, and wanting to “influence” business decisions…that can be quite confrontational. So, you will likely have to invest time in convincing and explaining the unique selling point and value add as an FP&A organization to the business leaders. You must explain that you are there to help the business to achieve financial targets and key sales objectives, not to be a road blocker and slow things down. You are not there to manage their expense budget; you are there to help them drive business performance and gain market share. This change in mindset in business leaders is not something that is achieved by the flip of a switch. So be prepared to invest a lot of time and resources here, in selling the change to business leadership.

Many companies struggle with turning their FP&A teams into business partners. How did you succeed at NetApp?

There really is no quick and easy way to do this, because at the end of the day it is about people. You can build the most fantastic business intelligence systems and dashboards, you can automate processes and off-shore transactional activities, you can build standardized reporting and implement robotic process automation. All of this will free up time for your people and allow them to become business partners and add more value to the business. But if the employees don’t know how to be business partners, all that investment in standardizing and automation will only lead to cost savings in the finance department. It will not lead to a finance department that can use their unique position in the company to drive better and more rational decision making and improve overall business performance. So the foundation for success is people and proper change management.

Prior to embarking on our transformation journey, I already had a very strong FP&A team, with a good mix of long-term employees and people with external experience. However, unfortunately, it was clear that not all our employees could make the journey we were embarking on. I had to make some very tough decisions with some very wonderful people. But they were just not the right people for NetApp at that stage in our life-cycle.

Of course, I also needed to train and improve the skillset of my remaining team members. In particular, they needed to better understand the commercial aspects of our business, our entire Go To Market and business model, as well as our product and solutions. In my view, you cannot be a finance business partner if you don’t know the products you’re selling – and in IT that can be quite difficult. Some of my staff had a natural interest in IT, and needless to say, they transitioned the easiest. For others, this was more of a challenge.

I also hired external top-talent from companies further ahead in the maturity model than we, like General Electric and Unilever. I knew that these guys were very smart and flexible enough to learn a different business model, and I could use their experience from working in more mature companies and industries.

After all the transformation how do you see the FP&A team at NetApp today?

I see that we have made a lot of progress in FP&A, but we are not there yet. We need to continue to invest in people development, to think about what we can do differently, and to find areas where we really can add even more value to the business. In any case, FP&A transformation is not a finite game, it is an infinite journey that we have embarked on.

Even though FP&A transformation is not a finite game, I think you can still talk about “wins” along the way. Certainly, we have had some great wins, in particular, in strategic planning, investment allocation, forecasting processes, and predictive analytics.

I also think that the relative position of FP&A in the company has changed a lot, as we are much more present throughout the organization and have more influence on the strategic direction of the company. And when speaking to FP&A professionals from other companies I do get the feeling that we are quite advanced at NetApp today.

What learnings can you share with other FP&A professionals looking to do a similar transformation i.e. what went well and what could you have done better?

I think that we could have done a better job “selling” the FP&A transformation to the business leaders to get their buy-in. We struggled a bit in the beginning to convince the business of the value-add of a more commercially and strategically focused FP&A department. We could have invested more time and energy here.

In terms of what went well…we did make some great hires into the company. We purposely looked for the right team composition, both in terms of technical profiles and personality profiles. We used DISC profiles to make sure we have a good and complementary mix where we could drive synergies of the differences. I also think the change management of existing FP&A staff to take on that more market-focused business partnering role went very well as well.

Today, there are many companies that could need an FP&A team like the one they have at NetApp. For one, companies live shorter and will transition faster through the various stages and add to that many companies are undergoing transformations as we speak. Now, more than ever, it’s time for FP&A to step up!

It’s no easy task to do a full-scale transformation of a finance function and eventually turn the FP&A team into business partners. However, it’s great to hear about success stories like NetApp’s that can be found out there!

Where are you on the journey and what are you struggling with? Tell us and we’ll see how we can help you!

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.