Finance is tasked with delivering better Business Intelligence and more importantly better insights to influence decision-making...

At a recent FSN webinar “Why are some originations more insightful than others1?”, I heard about an illustration of possibly the earliest example of what FP&A is about - forecasting, planning and providing actionable information. Most of us are familiar with the biblical story of Joseph’s interpretation of the Pharaoh’s dream. The Pharaoh dreamt of seven fat cows being swallowed by seven thin cows and seven ears plump corn swallowed by seven ears of thin and blighted corn. Joseph, the data scientist of Ancient Egypt, provided an insight and forecast to the Pharaoh: the seven fat cows and the seven ears of plump grains represented seven years of good harvest which was followed by seven years of famine. Joseph used the “data” (loosely applied in this case) based on Pharaoh’s dream to forecast over a 14-year period (seven years of good harvest plus seven years of famine). The actionable information (interpretation of the dreams) led the Pharaoh to take corrective action and put in store harvest from the good years to be used during the famine years.

At a recent FSN webinar “Why are some originations more insightful than others1?”, I heard about an illustration of possibly the earliest example of what FP&A is about - forecasting, planning and providing actionable information. Most of us are familiar with the biblical story of Joseph’s interpretation of the Pharaoh’s dream. The Pharaoh dreamt of seven fat cows being swallowed by seven thin cows and seven ears plump corn swallowed by seven ears of thin and blighted corn. Joseph, the data scientist of Ancient Egypt, provided an insight and forecast to the Pharaoh: the seven fat cows and the seven ears of plump grains represented seven years of good harvest which was followed by seven years of famine. Joseph used the “data” (loosely applied in this case) based on Pharaoh’s dream to forecast over a 14-year period (seven years of good harvest plus seven years of famine). The actionable information (interpretation of the dreams) led the Pharaoh to take corrective action and put in store harvest from the good years to be used during the famine years.

However, when we talk about FP&A, the focus sometimes weights more on the planning than the analysis – weekly forecast, monthly forecast, quarterly re-forecast and annual budgeting. The provision of insight and be a strategic partner to the business can sometimes become a “by-product”. I believe that FP&A goes beyond just planning and analysis. FP&A professionals are the intelligent satnav of the business. As it was quoted by AFP, “FP&A is evolving from an offshoot of the accounting organisation into a forward-looking, strategic function”.

However, before I embark as to why that FP&A involvement goes beyond planning, I’d like to answer a question that I often get asked when I tell people I work in FP&A – what does an FP&A do?

In its most basic form, FP&A analysts collect and consolidate data and prepare some form of management reports. In recent years the profession has become more of a business partner: they do not only churn reports or process transaction data. They help drive business forward with sound advice from a finance perspective. This distinguishes FP&A professionals from the traditional analysts. To expand this further, let’s first look at an academic definition of the word “partner”.

Oxford Dictionaries defines “partner”2 as

- Either of a pair of people engaged together in the same activity

- A person or group that takes part with another or others in doing something

- Any of a number of individuals with interests and investments in a business or enterprise, profits and losses are shared

First Eureka! moment - shared the interest in a business. In general, everyone has a common interest with respect to the performance of the company in which they work. They want the company to perform well. From a financial perspective, this usually means profits, cash surplus, a share price that reflects the company’s intrinsic value (which also allows the shareholders to generate wealth when holding and/or trading in them). With this shared interest, technically each employee is a partner to the business: each contributes to the performance of the business. Some companies refrain from the term employee but refer to the term partner or associate to reflect this philosophy.

Armed with this basic understanding of business partner, we can look at what an FP&A business partner does.

FP&A gather data and apply their analytical expertise to provide insightful information to operational and organisational partners. They take a keen interest in the well being of the business from a finance perspective. They engage with stakeholder to understand their need for actionable information. They concentrate more about what is likely to happen as opposed to what has happened. FP&A use their expertise to provide sound advice to management. FP&A takes a large volume of data and use analytics to derive insightful correlations and trends as well as anomalies. This helps to generate actionable information that management can use to drive performance. It is about providing the right “ammunition” for the business to “defend itself” against the ever-changing environment. FP&A acts as the intelligent satnav. The organisation knows the path they need to take to succeed. FP&A walks this road together with the business and along the way take into account updated “road and traffic conditions” to provide advice and recommendations of corrective actions. FP&A insights tend to have two purposes: a holistic view that promotes collaboration between departments and helps management drive performance to achieve their strategic goal. They help the company to be agile.

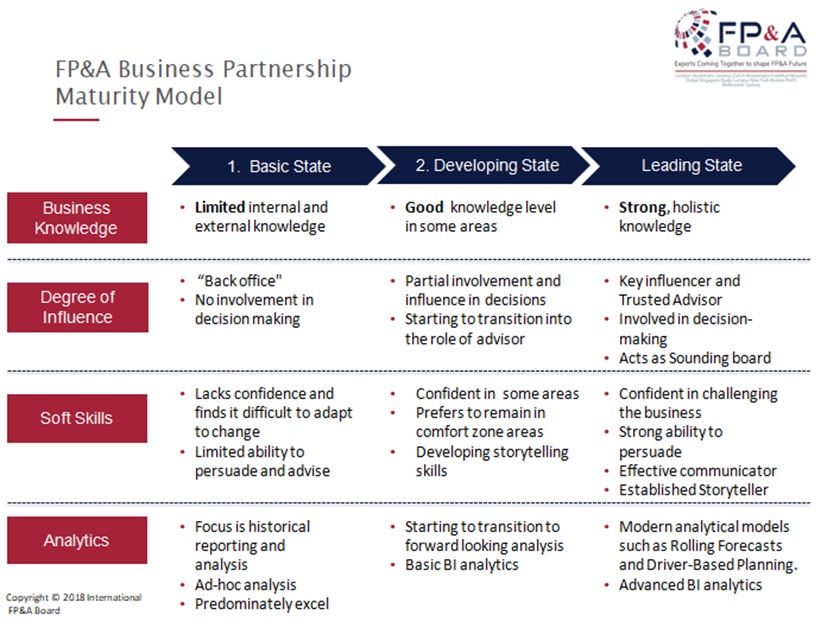

FP&A Business Partnership Maturity Model

At their FP&A Circle meeting in London on 25th January 2018, the International FP&A Board presented the FP&A business partner maturity model. The 3 stages of Basic, Developing and Leading echoes the role of FP&A business partner – a trusted advisor and key influencer who acts as the sounding board through the use good analytics in challenging the business.

How does FP&A go about providing insight for the business? This model provides 4 areas of development. Apart from the essential technical knowledge of their area and gather necessary data, FP&A professionals make use of analytics as well as soft skills to gain business knowledge and provide forward-looking insights of the business. At the Leading State, FP&A move away from traditional budgeting models and go beyond budgeting. This enables FP&A to focus on developing analytics which helps management be more agile and proactive to the ever-changing environment.

A brief encounter with an FP&A

I’d also like to mention a few words on what makes a good FP&A. There are a string of qualities that FP&A business partner posses which promote them as a strategic partner. Amrish Shah lists these qualities in his recent article “I hear you want to be an FP&A professional. Well, then you need….”3. I’d like to add to this list

- Good communicator – This is not just about the verbal signals and exchanges between the speaker and their audience but also all the non-verbal signals. It also means promoting knowledge share and not fall into the trap of becoming a rigid gatekeeper of knowledge.

- Collaborator – it is important that different parts of the organisation work together toward a common goal. It sounds cliché but this is critical in developing cohesive working practices and promotes value-added analytics and smarter decision making. You can read more on this topic from an article by Nilly Essaides “10 Ways to Enhance FP&A and Business Collaboration”4

So, to where does this all lead us?

FP&A does not work in the finance silo of providing backward looking analysis of what has happened. They arm themselves and their operational and departmental leaders with the “why” of the performances and develop insights on trends. FP&A uses available technology and big data to their advantage. In the leading state of the FP&A Business Partnering Maturity model, FP&A is a credible partner that the business leaders can rely on when developing a sound strategy.

Disclaimer

Any views or opinions expressed are solely those of the author and do not necessarily represent those of The Warranty Group.

Credits

1 Why are some organisations more insightful than others?

3 I hear you want to be an FP&A professional. Well, then you need…. by Amrish Shah

4 10 Ways to Enhance FP&A and Business Collaboration by Nilly Essaides

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.