There are several key components in the FP&A role. The way profitability is analysed and used to improve the business results is one of them.

There are several key components in the FP&A role. The way profitability is analysed and used to improve the business results is one of them.

Profitability is obviously looked at through the company consolidated statutory figures and in the focus of both CFO and company management board. Yet, if it gives an essential view for the company as a whole, it does not explain the profitability build up in details. It probably includes a few Simpson paradox issues.

Understanding the build-up means far more detailed profitability analysis: “specific P&L’s”. In practice, this also concerns some of the key Balance sheet items associated with those areas (assets and investments, inventories, customer credit).

Which specific P&L?

Dependant on the type of business/company, it may be more relevant to have per product/product line, per project/production center or per customer/customer type P&L’s and associated BS elements.

Typically, a product line manager may like to follow the profitability of its product line, a project manager the profitability of its project, whereas a key account manager needs to follow its customer profitability.

In global markets, the geographic dimension may not be essential but the currency impacts will need to be understood, whereas for multi-local or local markets the geographic dimension will be key (as well as currency).

Complex conglomerates may need a mix of those different types or P&L’s that mix some of those dimensions (e.g. product line / customer P&L’s or product lines per region/country) whereas a more specialised company may only need one or a limited number of specific P&L’s types.

They are not only used to explain total profitability build up but also to support pricing.

They are far more relevant for the managers managing those areas and should permit more effective and more practical action plans (than the traditional departmental budgets).

Face the challenges!

Those “Specific P&L” brings several challenges to the finance community. Whereas the rules for statutory accounts are well established, those specific P&L are generally tailor made in each organisation. Even the reconciliation that the total of all P&L of a given type (e.g. product P&L’s) equal to the total statutory accounts may bring some challenges but remain fundamental. (By reconciliation I mean more than a column of figures that mathematically calculate the unexplained differences).

Whereas Revenues and direct cost of sales (variable costs) may be more or less straight forward (provided the data structures and processes are correctly organised), the other costs distributions are generally far more challenging … and challenged by the line management.

Similarly, making sure that the way pricing is build up is coherent/consistent with specific P&L approach is a challenge (except for the companies where the prices are essentially market driven).

Needless to say, strong data management in ALL functions is a key pre-requisite. Not just the data that will impacts the financial flows but also all the statistical quantitative and qualitative data (e.g. Usage or activity ratios, defects or other non quality costs, volume versus prices, etc…). This is essential to build confidence in the results.

Time and cost associated to time distribution is a whole chapter in itself (extremely sensitive in services industries). This is also enhanced with the generalisation of service or excellence centres which creates overall efficiencies / economies but may render more difficult the perception of the impacts on each individual P&L. Few generic methods exist, each with pro and cons (strong and weak points) that needs to be understood when choosing and customising the company rules. Activity Based Costing, standard costing, transfer pricing, other cost allocation methods have each their tenants and can generate passionate debates!

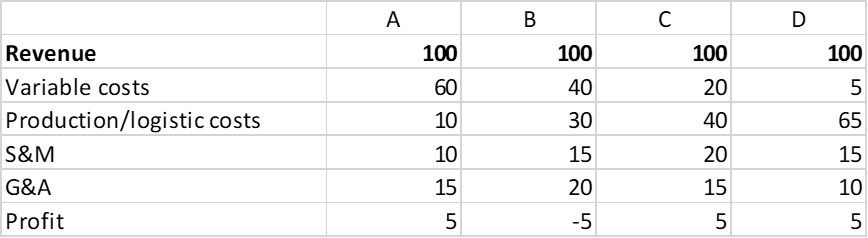

My advice would be to ensure you choose a design that fits both your business needs and your company culture. In other words, you would not manage the 4 below (oversimplified) business structure the same way.

Fixed costs distribution is largely dependent on the activity level. It means to master both the “normal / standard” and the actual activity level in order to measure the incidence of over/under activity on profitability. Expressed like this, it seems simple. In practice, this is the opposite. There are many individual pockets of fixed costs and thus many different aspects of activity to manage and integrate.

If/when allocating costs as per revenues you may want to exclude some revenues credit items such as penalties or general provision for customer debts.

Margins or profit?

Choosing a level of margin to reconcile specific to statutory figures is most probably the way. They are some central and exceptional costs that may not bring much-added value and can be excluded from distribution. Financial costs distribution may also be a sensitive subject.

Similarly, a project or production center manager will probably get uneasy with Sales and Marketing and G&A cost distribution (except if specific to its area of responsibility), a product manager will include specific marketing costs but not necessarily sales costs whereas a key account manager will include the specific sales costs.

As long as there is a strong and consistent way to reconcile the specifics and the statutory, I would advocate that it shall be a company choice based on the potential added value of bringing some costs within the distribution mechanism. It is more effective to demand a higher level of margin rather than adding costs level that is not directly relevant to the P&L’s manager. At end, those P&L’s shall permit to take actions when necessary, polluting them by costs layers on which the line management have no control may not be the most efficient way.

The periodicity of such P&L’s is dependant on business, more specifically on the way things changes in the specific markets. Quarterly is a good way to start with. The evolution quarter on the quarter will be looking at as well as the current level.

FP&A role is critical in those areas

Specific P&L are extremely effective tools that play a fundamental role in creating true added value to the business. They explain how the overall picture is achieved and will permit specific action plans that are far more effective than the traditional top-level cost cutting. Still, this is only achieved through a good level of confidence in the figures.

FP&A role is then essential in the building up and understanding of these P&L’s, in the explanation to business and in actively designing corrective/improvement plan with the business whereas necessary. It shall permit to understand the key elements that are impacting the profitability such as:

- Revenues prices versus volume variances (including currency impacts when relevant). It could be products specific or customers specific or a mix.

- Variable costs prices and volume variance (including currency impacts when relevant)

- Impacts of the activity level on the fixed cost allocations (in details).

- Impacts of non-quality.

- Impacts of S&M and G&A cost allocations (if any).

- … elements specific to each business type.

- It shall also permit to measure the impact of the improvement programs launched (revenue and cost wise).

It is also key for managing products and customers life cycle.

Whereas a high level of focus on forecasting activities (statutory view) is understandable, a lack of focus on detailed profitability is most probably a drawback. Detailed profitability analysis is a tremendous help in improving forecast, pricing and actuals thanks to a more detailed understanding of the overall profit genesis.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.