Data management is a business function that, in my opinion, every company should have. Still, often...

Market Overview and why leverage technologies

Market Overview and why leverage technologies

The data we need to handle is increasing dramatically. Autonomous vehicles, Smart city, Connected factory, Smart office and the list goes on.

It is said that by the year 2020, the digital universe will be 44 zettabytes — that's a 10-fold increase from 2013. The size of the digital universe will double every two years at least. Even 4-5 years ago in Microsoft, Cloud business was a small portion of the overall business, but now is the key business for the company, with new and diverse purchase options like subscription model on office 365, pay as you go model on Azure cloud platform.. boosting and creating an avalanche of data every day.

Given the environment, we believe that being a winner or a loser in the market will heavily depend on how well we manage data and leverage technologies. With ever-increasing data and more usage of technologies, new opportunities represented by newly emerged companies and services like Uber, Amazon Go, Alipay accelerating their growth, traditional companies are overwhelmed by data and will be challenged by these new competitors.

The new big data can provide you with insights you were never able to create before, leveraging Twitter, Instagram data posted in SNS for demand generation and for providing marketing analytics and insights. On the other hands, if not having technologies and process to manage ever increasing big data, you will be spending most of your time on collecting data and will be forced to spend most of your time on manual work, which will potentially lead to human errors, generate bigger problems like governance and internal control risks.

Just as a reference, Japanese Government, MITI (Ministry of economy, trade and industry), also released a report called 2025 Digital Cliff, sending alert and concerns to the companies ignoring these facts.

http://www.meti.go.jp/english/press/2018/0907_004.html

So again, we believe how well you manage and leverage your data by technology is the critical factor to be successful as an enterprise as well as being successful as a finance professional.

Our digital transformation journey

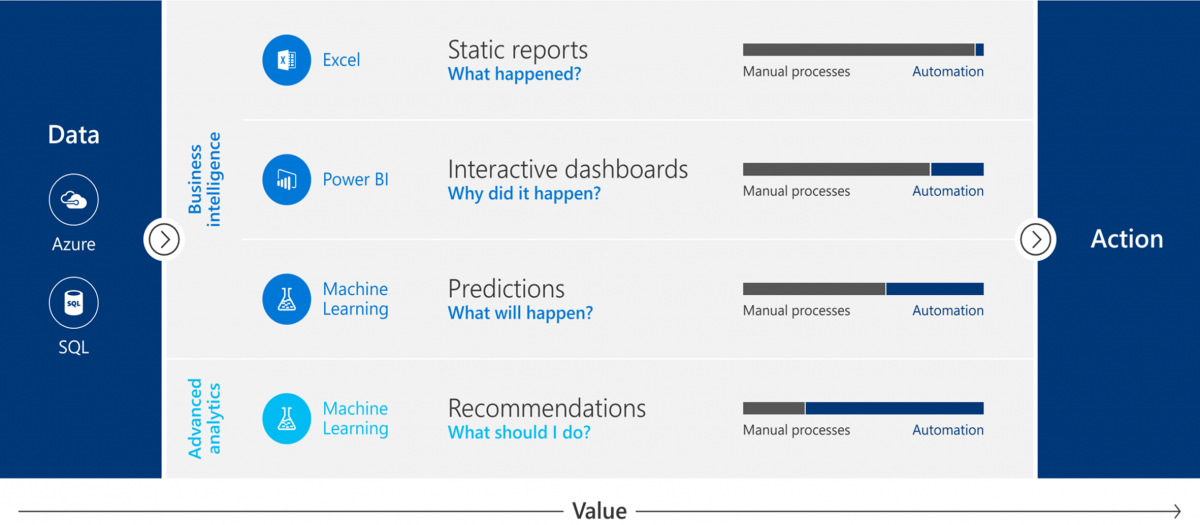

In Microsoft, we have been making great progress on digitally transformation. We leverage technologies in a daily job like never before. Below chart represents our journey, and is about managing DATA and turning into ACTION, adding VALUE to the Business in the fastest and most relevant way.

BUSINESS INTELLIGENCE

- EXCEL: is STATIC REPORTS, that could only tell WHAT HAPPENED. They didn’t allow the drill down capability and didn’t produce insights for our Business. Furthermore, the amount of MANUAL PROCESSES and work that we had to put together to build these reports and then produce insights was huge and time consuming.

- POWER BI: is an interactive report, making meetings much more dynamic, helping us understand WHY IT HAPPENED on the spot, reducing the amount of Manual Processes in the daily reporting and analytics. One of the examples of how powerful BI use in Japan finance team is represented in the phrase "Don't bring back any homework" - i.e. solve questions at the meeting. The typical case in the past is where we are reviewing Segment A number, but managements ask the same look and feel figure for Segment B and for C products. In this case, in the past, you do not have the info and needed to take it back and prepare in a day or two, which was postponing our next step decision-making process. But with BI you could immediately respond the such ad hoc requests and deep dive and drill down into the data. It eventually enabled us to take the next step action immediately and to drive business.

ADVANCED ANALYTICS

There was a lot of efficiency improvement with BI but still, we could only look at the past and didn’t have the tools to help predict the future. So as our next step we leverage technologies and start looking at the future with ADVANCED ANALYTICS.

- ML (MACHINE LEARNING) enables us to learn from the past to predict the future, we can know WHAT WILL HAPPEN. The distance between DATA and ACTION is now shorter , the amount of MANUAL PROCESSES and human errors is lower. In the past in Japan forecast preparation, roughly 60 employees plus management and stakeholders worked on quarterly forecast spending 2 - 3 weeks, plus a couple of executive reviews. But with this model today, we can run it with just a 1 or 2 employee and is in almost real time because the ML is linked directly to our database. And with all the efforts Microsoft Corporate and data scientists spent on adjusting the model and improving the accuracy, ML forecasting model is now more accurate than the number created by human. Still, we run both in parallel, but gradually shifting to the ML model. The key message here is not only the accuracy but also freeing up all those employees involved. Now they can shift their time on more value-added work and drive executions.

- RECOMMENDATION. Finally with a combination of MACHINE LEARNING + BOTS we get to the position that we can say WHAT TO DO, automating the decision making process and moving really fast from DATA to DECISION. One of the examples is Compliance predictive analytics where AI/ML will flag the unusual sales transaction in the system and raise alert, then notify finance controller to check the background of the deal, discount given, partners involved etc. So we are at the stage now where Machine tells controllers what to do, this immediately leads us to take ACTION.

MODERN FINANCE

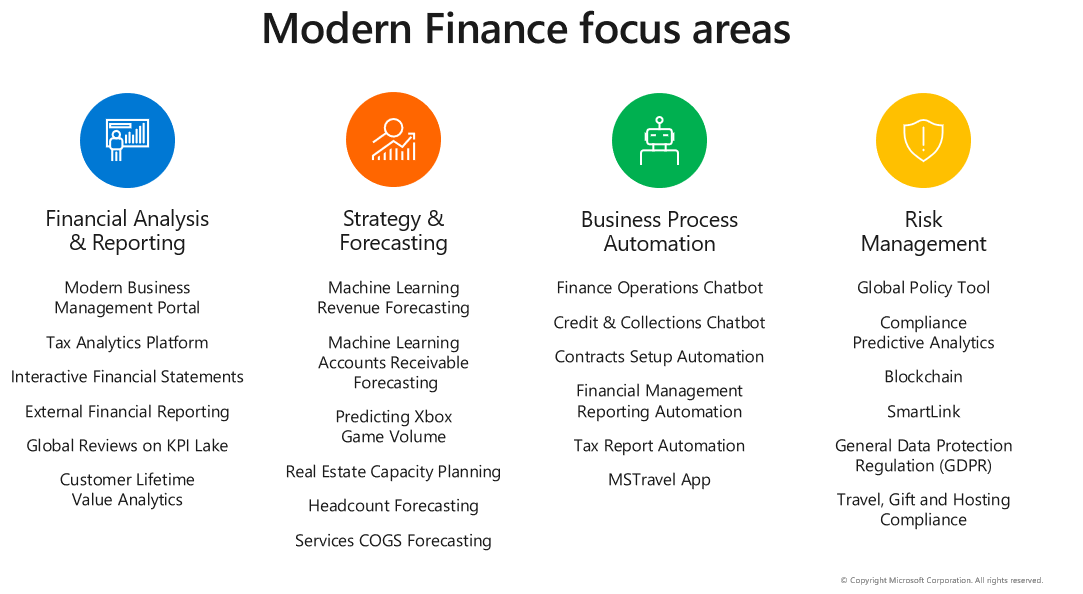

Listed below are some of the examples of Microsoft finance digital transformation - Modern finance focus areas. These are enablers for us to spend more time on data insights, analytics, turning DATA into ACTION and execution. It is about spending more time on value-added insights and analysis, deeper analysis on customer lifetime value, recovery actions, driving company initiatives, more time going out to customer to meet customer BDMs (business decision makers) to showcase our best practices, creating positive DX IMPACT to the customers as well to our company... and so on...

THE KEY TRIANGLE TO MAKE IT HAPPEN

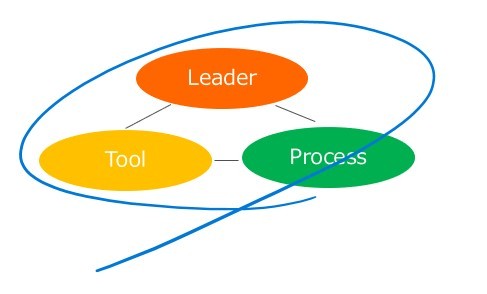

Some think you just need technologies to make digital transformation happen. Yes, technologies and tools are the enabler to make this happen, and without it, data handling and reporting will still be manual and you will not be able to manage data effectively and efficiently.

But, based off from our experience, more important and also critical is a "LEADER/Strong managements" and an "organized PROCESS" to run it with success.

"LEADER" who drives this initiative with commitment. The one who leads the team not to give up. Even though the quality is low at the beginning, the team is encouraged to continue trial and error, continue to fine-tune, adjust and improve, until it starts to create positive outcome and impact. Without such LEADER, this will not be successful.

Also, a robust "PROCESS" and business rhythm are critical to make this whole digital transformation a success. Even there are strong "LEADER" and “Technology/TOOLS”, if there is no "PROCESS" set up to run and execute, it will not be successful.

As a conclusion, based off our learnings, all these three has to come close together to make digital transformation possible and enable us to digitally transform, enable us to turn DATA into solid ACTION and executions.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.