The biggest business issue in the UK is Brexit - and has been since the people’s...

Coronavirus has struck down people, and now the UK economy may be catching a cold

Coronavirus has struck down people, and now the UK economy may be catching a cold

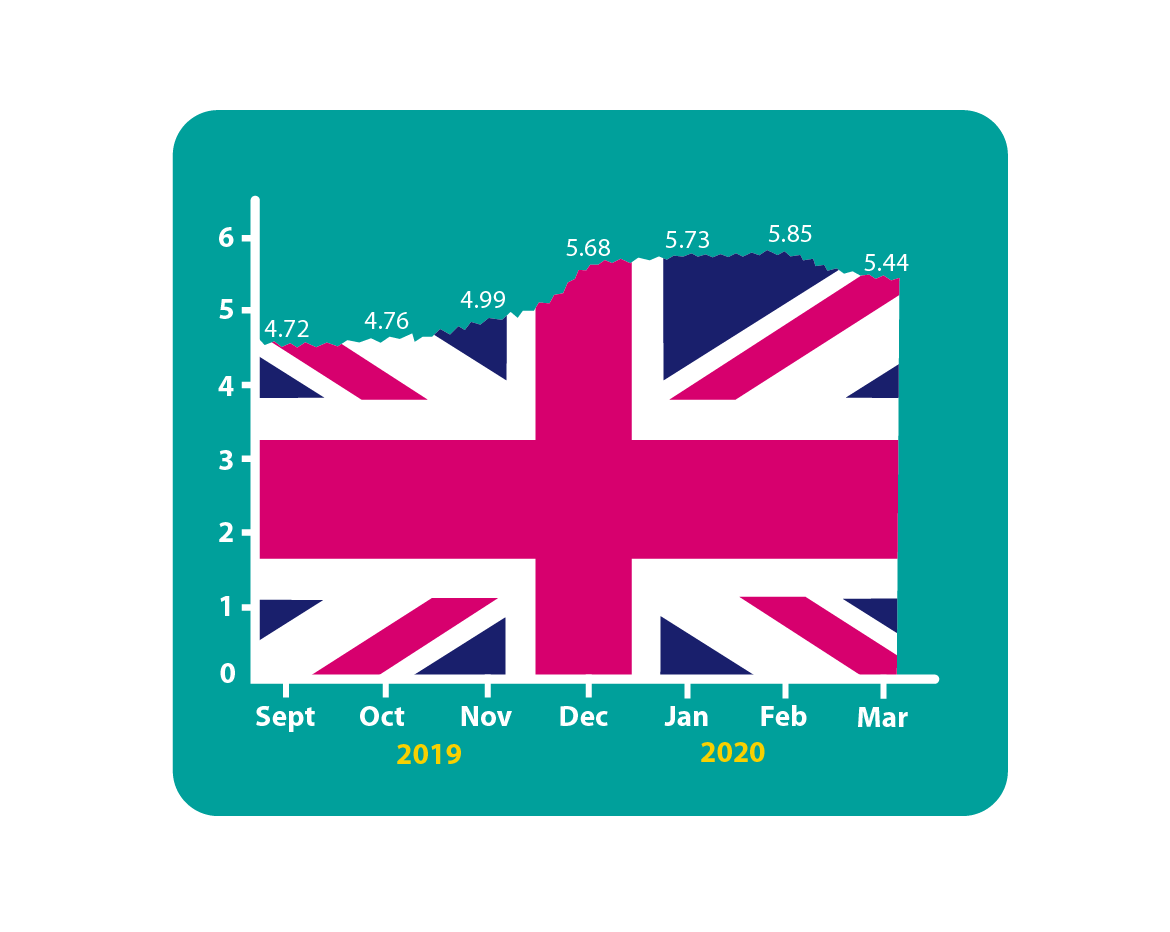

Last month we warned that the record level of the UK’s well- being needed to be re-visited once the impact of the coronavirus had been assessed… and look at what has happened since! The outbreak has dominated the media and infected business confidence around the world. It is still early days in the development of the virus, but already the Accountagility Index (AAX) has lost 41 basis points this month, falling to 5.44, from a peak of 5.85 in February. Any score above 5.00 is positive, so overall the UK is still doing well. The AAX is still the only measure of the UK’s overall health, both economic and political.

See below for more detailed analysis, or watch an interview with our Brexometer guru David West laying out the context.

What factors caused the index to go down this month?

The overwhelming negative factor was the drop in the UK markets, with both FTSE 100 and FTSE 250 (mid-caps) falling by around the same ratio. This one factor has dominated the Index, accounting for most of the downward change. All of this is down to a loss of confidence in the global economy to continue with Business As Usual over the coming months. Demand in Asia, lengthening supply chains, and reduced domestic consumer demand in areas such as travel and entertainment, are all cited as contributory concerns. Inflation also rose sharply, and may be impacted by supply-side factors and consumer stockpiling. GDP has held up and was set for a positive 2020 outlook, but this is now compromised, in the short term at least.

What were the other factors?

There were positives too; sentiment rose, due to the lifting of uncertainty from Brexit and from a clear General Election result. For the first time in ten months, all three UK sectors are now in the positive (above 50 out of 100), with the Construction sector showing the strongest rebound. The UK debt ratio dropped below 80% to record its most positive level since August 2016. That’s a good platform for dealing with the turbulence ahead.

All COVID-19 news has rather put the important UK-EU trade negotiations into the shade. Over recent weeks, the two sides have set out their stalls and warned each other of the dire impacts of failing to agree a deal. To get a deal done by the target date of the end of this year, all the key negotiating items need to be agreed at a high level by June. We await this date with bated breath but there’s no great expectation that such a timetable is feasible. Perhaps a positive mind-set in these talks could go viral too!

How is the economy looking?

It’s also been impacted by the outbreak. In pure economic terms, the Index fell 55 basis points from 6.07 last month, to 5.52, a large fall but still well into the black. Over the course of the next few years, HS2 going ahead (as we predicted) will have a positive impact on the UK, especially in the Construction sector. Good news amongst the gloom.

Guidance for FP&A Professionals

The rapid impact of COVID-19, inside ten weeks from being unknown prior to 31/12/19 to a major threat to global prosperity now, shows how planning needs to be a more reactive and central part of an organisation’s DNA. Can there be a more powerful wake-up call?

As far as assumptions informing the AAX, here are some details for planners. Two assumptions have moved over the past month:

- There is now a lower risk to the integrity of the UK from agitation for Scottish independence, due to other factors overshadowing it

- There is less clarity around the date for the EU/UK trade deal happening by 31/12/2020, because of the sabre-rattling from both sides after the first round of negotiations, and the need to agree the principles by the end of June

What happens next?

The next Brexometer measurement will be taken early in April 2020, when a lot more about the Coronavirus on the UK economy will be known. We will also see how the two sides are manoeuvring in the EU trade negotiations. How will UK investment and confidence perform in the face of these factors? How will other factors affect the Index? How will the economy react? Keep following the Brexometer to find out.

The Brexometer was calculated on 9th March 2020.

Article written by David West, Sales and Marketing Director, Accountagility.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.