Less than a quarter of a Financial Analyst’s time is spent with high value-add analysis -...

(Part 2 of a two-part article)

(Part 2 of a two-part article)

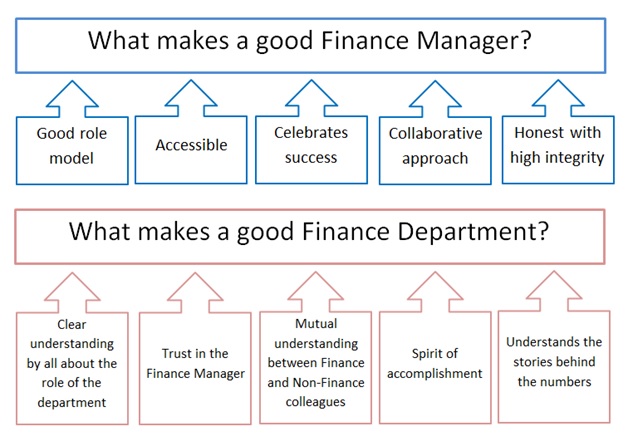

The first part of this article highlighted what attributes moves an individual from a bog-standard finance manager, assuming all basic tasks and accountabilities are achieved, to someone who would be perceived as much more than just competent at the role and in fact makes them a ‘good’ finance manager.

Of course, a finance manager is nothing without the team that they work with and that got me thinking about what makes a good finance team and pushes the department forward from being perceived as a ‘bean counters’ and a group of people that are constantly saying no to a real business partner function and being the engine room of any organisation.

I have summarised my thoughts under 5 broad headings:

Clear understanding about the role of the department

Finance department colleagues need to know what the finance department does! This isn’t meant from a task-based perspective, the team should be clear on creating, updating, and maintaining financial models or comparing historical results against budgets and forecasts, and performing variance analysis to explain differences in performance and make improvements going forward, what I mean is that the finance team need to understand their position from a higher level view – how does the finance team fit into the wider business and what functions does it perform.

The finance department needs to foster a service orientated culture within the team where the ‘customers’ include other departments within the organisation as well as senior management.

The finance team knows how rows of data fit in with the organisations objectives and adopt a prevailing sense of mission. The team should ensure a sense of purpose and contribute to the greater goals of the organisation.

The rest of the organisation should see finance as a business partner. Perhaps unfairly the perception of the finance team in a lot of organisations is as enforcers, not helped by the range of job titles including audit officer, controller etc., but the team should be seen as a key part of the company.

Trust in the finance manager

Colleague trust in management is essential to competitiveness and productivity.

Trust is about open communication, about wanting the bad news fast. Not that the finance manager is going to over react when things go wrong but be able to help with a problem.

Being able to trust in the finance manager links back to the finance manager being a good role model where there shouldn’t be a perception of double standards for senior management, they should see the finance manager working the hours required to get the job done and working hard to achieve results.

Mutual understanding between finance and non-finance colleagues

Non-finance colleagues should be able to understand finance. This is helped by finance teams presenting and disseminating finance data to non-finance staff.

If you are able to get non-finance staff interested in finance concepts this helps the organisation as a whole. If the inventory manager is asking what is EBITDA they’re that much closer to knowing how they are able to contribute to it.

Finance colleagues need to understand how the operation works. They need to move away from the office environment and get into the warehouse / transport departments / stores etc. to see how they work and what is done in these areas feed into the numbers produced by the finance team.

Spirit of accomplishment

Work is a big part of life and having a sense of purpose and accomplishment is a big motivator for many people.

People take pride in the quality of their work whether that is attention to detail or re-organising a filing system that contributes to the effectiveness and productivity of the department.

Having a spirit of accomplishment links back to the collaborative approach and celebrating success elements of the finance manager role.

By enabling a spirit of accomplishment it encourages creativity within the finance team and raises the standards of what is possible.

Understands the stories behind the numbers

The role of the finance team is now not only to compile rows of data and ensure attention to detail and accuracy but also be able to articulate this data and understand what is behind the numbers.

What are the mitigating factors driving productivities or other KPI performance? The finance team needs to be able to not only display the numbers but also provide the story behind the numbers to be able to be a true business partner.

These are my thoughts on what makes a good finance manager (part 1 of the article) and a good finance team which I have summarised in the above graphic but what do you think?

What should a finance manager or finance department be doing to fit into your view of what good looks like?

I would love to hear your views.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.