As the 4th Industrial revolution makes sizeable impacts on our lives through various sectors like taxis/ride...

The Global Artificial Intelligence / Machine Learning FP&A Committee was created in March 2018 with the aim to see how the latest developments in those technologies can influence modern Financial Planning and Analytics.

The Global Artificial Intelligence / Machine Learning FP&A Committee was created in March 2018 with the aim to see how the latest developments in those technologies can influence modern Financial Planning and Analytics.

On the 14th of November, the Committee held its third meeting. 18 members, representatives of global organisations such as Bank of America, HSBC, Nielsen, PepsiCo and etc., joined the online event from 9 countries – Canada, Germany, Japan, the Netherlands, Switzerland, UAE, the UK, Ukraine, the USA.

Two presenters shared their insights and vision on the subject. Xena Ugrinsky, Principal and Founder at GenreX, delivered a presentation on the future of AI/ML for FP&A. Takeshi Murakami, Group Controller at Microsoft, shared an interesting case study on leveraging AI/ML in decision making.

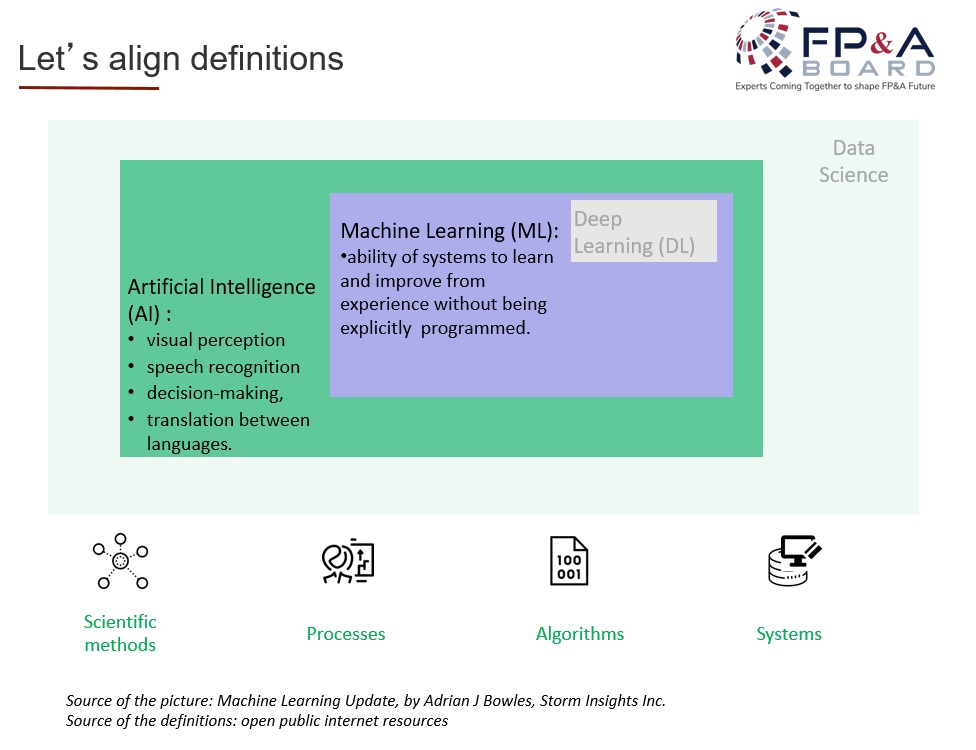

Any analytical process starts from data and Artificial Intelligence is a part of Data Science. Data quality is one of the biggest FP&A issues right now. Therefore, it is not a surprise that the meeting started with a discussion about big data and data quality.

AI/ML depends on data quality

There are two sides to every coin: on one hand, more data means better forecasting results but, on the other hand, it is difficult to manage data growth. For years companies have been trying to find the best way to store big data and also to enable easy access to it.

Several years ago, data lakes became a trend and an obvious solution, but its implementation led to more problems – they were not able to drive anticipated results or create value due to the quality of data that filled them. Lakes soon turned into swamps.

Artificial Intelligence and Machine Learning, which depends on data and is used to detect patterns, will not thrive in a polluted ecosystem. AI has an important role to play in improving the quality of data: for example, in identifying the outliers and removing data irregularities.

At the meeting, Takeshi Murakami mentioned that the finance department and data scientists should work closely together to make ML a beneficial tool for companies. It will help to improve data quality, automate analytics and improve the quality of forecasting.

Forecasting: the human mind is averse to uncertainties

It is not only the quality of data input that should be taken into consideration. When talking about the forecasting process, it is important to remember that uncertainties are unavoidable. Humans often fail in identifying uncertainties partly because the human mind unfavourably disposes of them.

At the meeting, Xena Ugrinsky referred to a problem with forecast accuracy which the Latin America subsidiary of Stanley Black & Decker was able to overcome due to the implementation of AI/ML and incorporation of diverse internal and external data. The company began using algorithms to determine optimal scenarios and managed to improve financial forecasting by 60%.

AI / ML can free up employees’ time for value-adding tasks

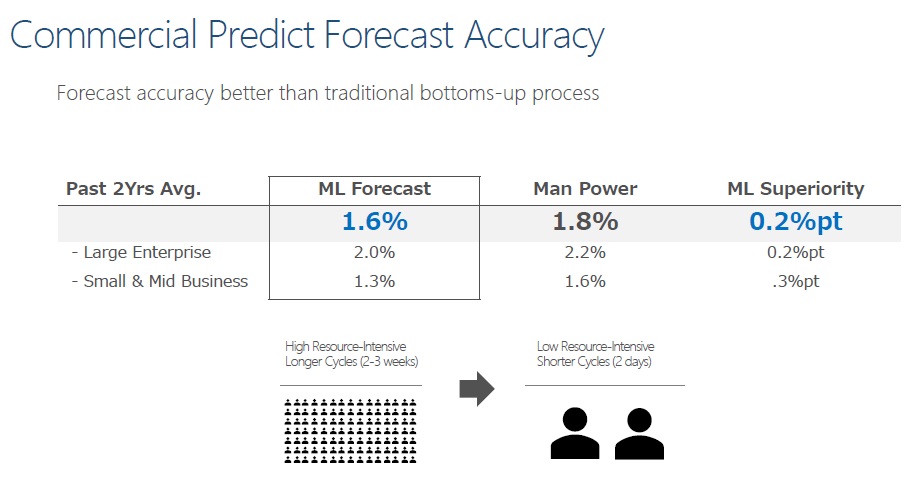

Microsoft Finance enhanced forecast accuracy by using ML instead of the traditional bottom-up process. With more data, which was also more complex than in previous years, Microsoft managed to improve the accuracy of forecasting by 0.2%.

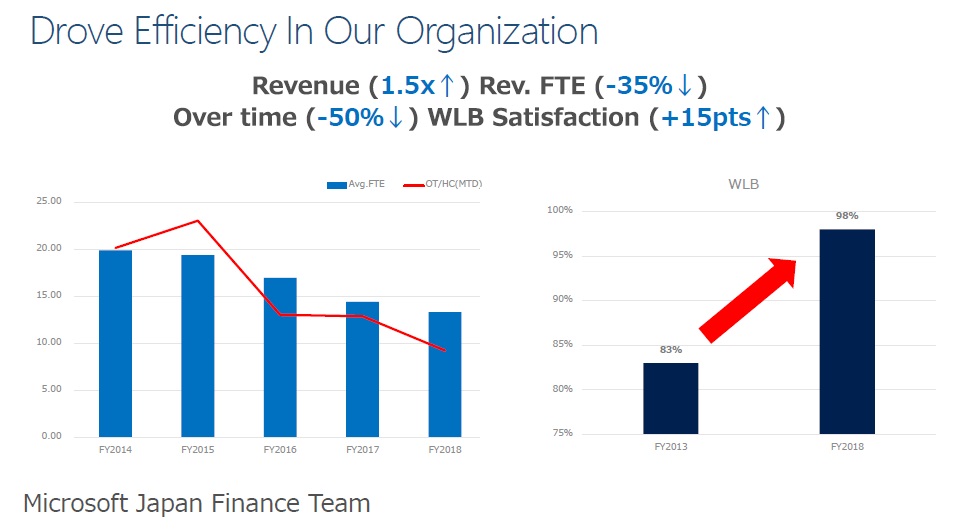

Although these are undoubtedly great achievements, Takeshi Murakami also emphasised another important implication. Microsoft used to have a lot of finance and operation practitioners involved in the forecasting process for 2-3 weeks. Most of the time was spent on collecting, compiling and having a discussion on data. Now it takes only two people to do the job in two days with much better data accuracy than before. In 4 years, the company successfully reduced overtime by 50% by utilising the power of ML in the forecasting process, together with other digital transformation changes.

Humans cannot analyse all data simultaneously and make real-time dynamic predictions. Even if it were possible, it would be time-consuming and would prevent humans from investing their time in more value-adding work. On the contrary, it is an easy task for AI/ML technology.

ML also made it possible for the Microsoft finance department to increase the frequency of forecasting to meet the requirements of an ever-changing business environment.

ML does not utterly exclude humans from processes

Human Intelligence can be enhanced by the power of Artificial Intelligence. At the Committee meeting, it was also mentioned that ML cannot take into account one-time events (e.g. an earthquake or tax increase). Therefore, the outcome should always be adjusted by humans.

Although Microsoft is planning to gradually increase the involvement of ML in financial forecasting, business units will still be playing an important role in the final validation of the forecasts. Advanced analytics does not imply that the only task of machine learning is to predict the future – it should also give finance professionals recommendations and, hence, help them in decision making.

The Artificial Intelligence / Machine Learning FP&A Committee focuses on promoting better practices for using AI/ML within Financial Planning and Analysis (FP&A). The Committee members are senior finance practitioners and data science experts.

In 2019, there will be three Committee meetings with interesting case studies from all around the world.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.