"Is your forecasting more judgemental than analytical?" The FP&A Board members were trying to answer this question at the third Brussels session. 30 senior finance practitioners debated on how Rolling Forecast (RF) can be more value-adding.

"Is your forecasting more judgemental than analytical?" The FP&A Board members were trying to answer this question at the third Brussels session. 30 senior finance practitioners debated on how Rolling Forecast (RF) can be more value-adding.

Agenda

- Rolling Forecast: main definitions, advantages and disadvantages.

- Rolling Forecast: key factors of success.

- Beyond Budgeting and Rolling Forecast.

- Three Stages of Rolling Forecast Maturity - group work.

- Conclusions and recommendations.

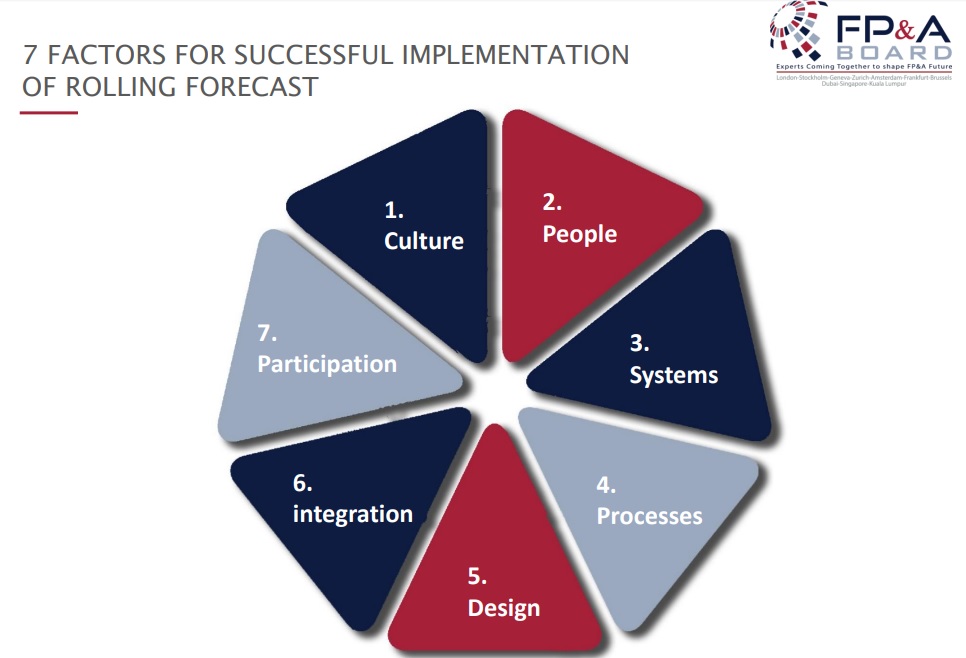

The traditional Business Culture is one of the biggest barriers to successful Rolling Forecast implementation. The participants were looking for some ways to overcome the barrier. At the meeting, several ideas were suggested that can help implement Rolling Forecast:

- Make sure that your basics are right before the RF implementation: e.g. data quality, key external and internal driver, the business model, etc.

- Driver based model is the way to go. It is important to keep judgment to the minimum and not to forget about expanding analytical driver-based approach.

- RF is important for Business Partnering. Finance people should work on this together with stakeholders.

- The right tools should be flexible. Therefore, Excel will not be appropriate.

- RF is great for planning integration.

- The human aspect of RF is very important. One of the most important tasks is the target setting. It should be less emotional but analytical. The question is how to remove it from the forecasting process.

- RF is either very powerful or extremely non-value adding. It cannot be anywhere in-between. Therefore, it is better not to implement it if you are not ready.

Our Sponsors

We are grateful to our global partners Regus, AFP and Page Group!