This article was published first on gtnews.com

This article was published first on gtnews.com

Two-and-a-half years since its formation, the London Financial Planning and Analysis (FP&A) Board is setting itself ambitious goals.

The Board has acquired two official sponsors; Michael Page, the specialist recruitment firm, which now provides its central London office as the venue for Board meetings; and Metapraxis, the consultancy, analytics for financial professionals and software provider.

For its 10th meeting, held in mid-March, Board members embarked on developing a generic blueprint for FP&A analytical transformation and an advanced FP&A analytics maturity model.

What are the basic ingredients of advanced FP&A analytics? Getting the discussion underway the Board’s founder and managing director, Larysa Melnychuk, suggested that it should be proactive, forward-looking, agile, available in real time, multidimensional and integrated – although these elements are no more than the basic essentials.

The combination should be enough to provide the business with good quality information that enables better business decision-making in a timely manner, while also providing unique insights that make a difference to that process.

Members who attended this month’s meeting, which included several based overseas who participated via speakerphone and others who travelled to London from Germany and Ukraine to attend in person, were presented with the proposition that there are five stages in developing an FP&A analytics maturity model.

These five stages are: basic, developing, defined, advanced and ultimately a leading FP&A model is arrived at. Many companies have made significant advances in the FP&A activities in recent years to reach either stage two (developing) or stage three (defined). Moving to the fifth and final stage “means [the company] having clever people who have a lot of energy.”

The initial stage lacks any formal process, while the final stage has a fully integrated planning process. As a leading model, its features also include leading analytical measures, an integrated driver-based planning model, a flexible planning solution integrated with business intelligence (BI), real-time collaborative planning, easy multi-dimensional scenario analysis and advanced analytics. It is proactive and therefore regularly evolving and adapting to a changing business environment.

As one Board member noted, the stage at which your company is at largely reflects quality of data that it has available. At stage one the company may have no data at all, or only data that is either poor or inconsistent. The range of data available to it reflects whether it is still only at stage one, or has made progress nearer stage five.

A company that has experienced organic growth, or has expanded through mergers and acquisitions (M&A) may be unaware of what data it possesses, where it is held and what it lacks. Projects often are not undertaken because of a perception – rightly or wrongly -that the data available is insufficient.

The next step lies in understanding the company’s business model, what the key drivers are and what it aims to achieve through FP&A.

Konica Minota’s strategy

Keynote speaker at the meeting was Igor Panivko, chief financial officer (CFO) for Konica Minolta Ukraine, who had travelled from Kyiv to London to attend. He described how self-service business intelligence (BI) had transformed FP&A analytics at the technology company.

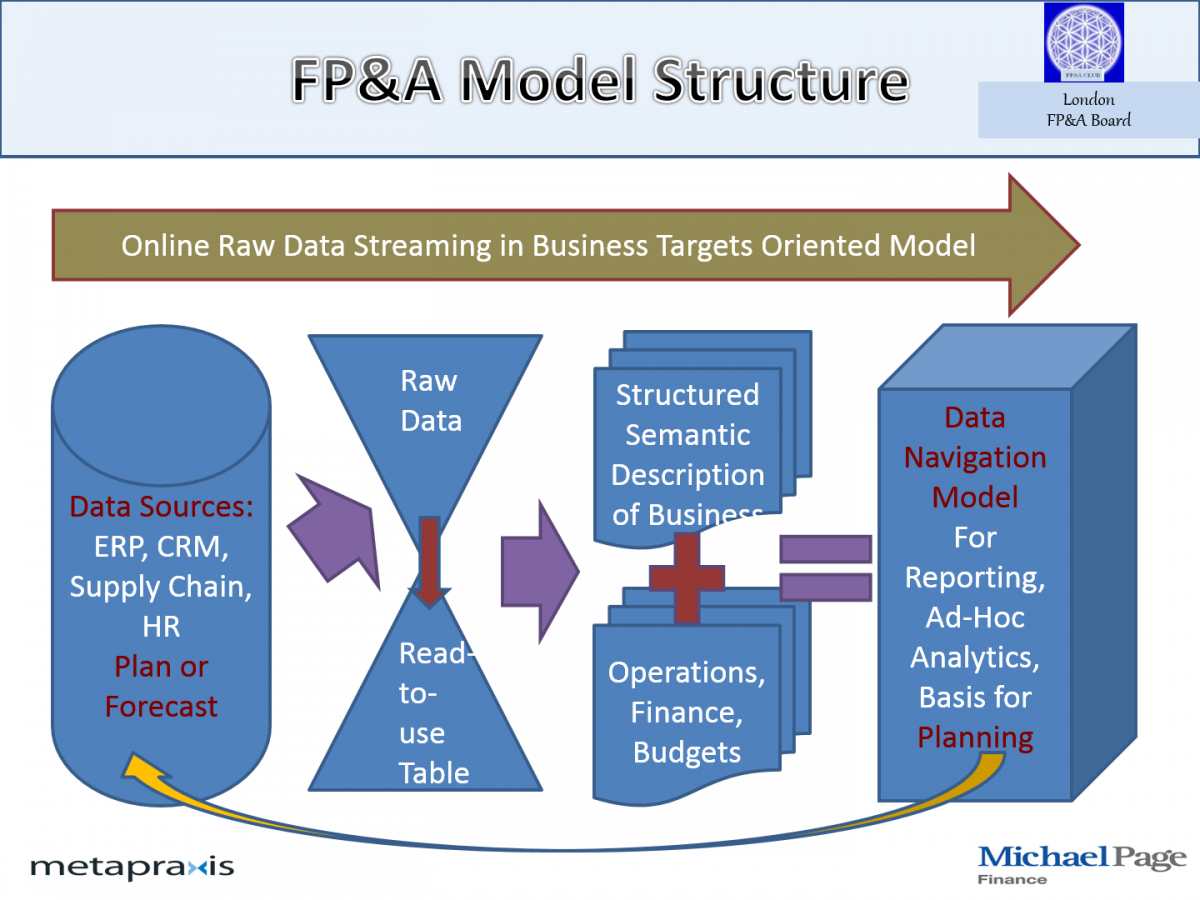

Konica Minolta had defined analysis of its multidimensional profitability as a key strategy and having started out with advanced Excel modelling, progressed to BI modelling. Raw data was able to be converted into high quality data that requires no additional processing and the FP&A BI model is under constant development and improvement.

Figure 1 – FP&A model structure

Figure 1 – FP&A model structure

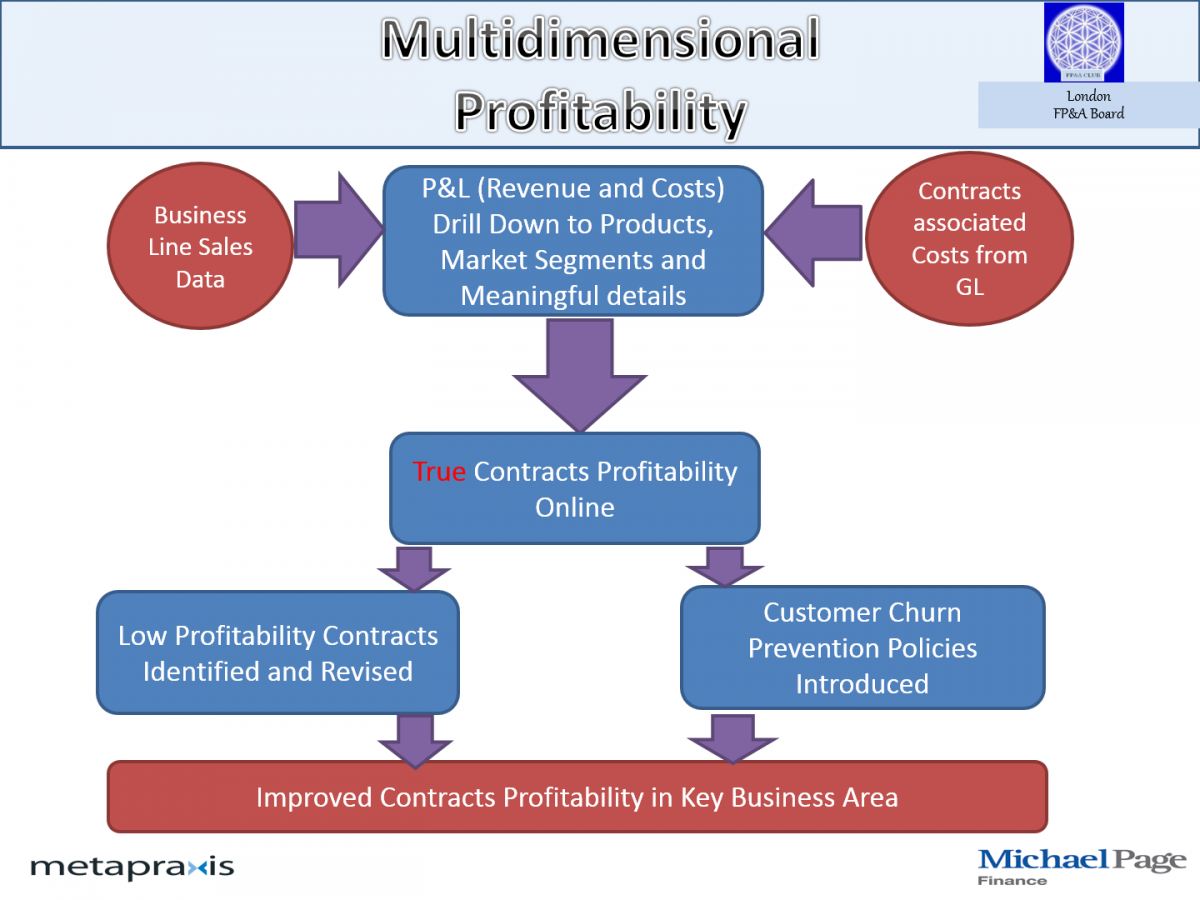

This refinement enables Konica Minolta to have an online picture of the profitability of each contract, identify and revised those contracts that have only low profitability and to introduce policies to minimise customer ‘churn’ – as per Figure 2 below.

Figure 2 – Multidimensional profitability

Figure 2 – Multidimensional profitability

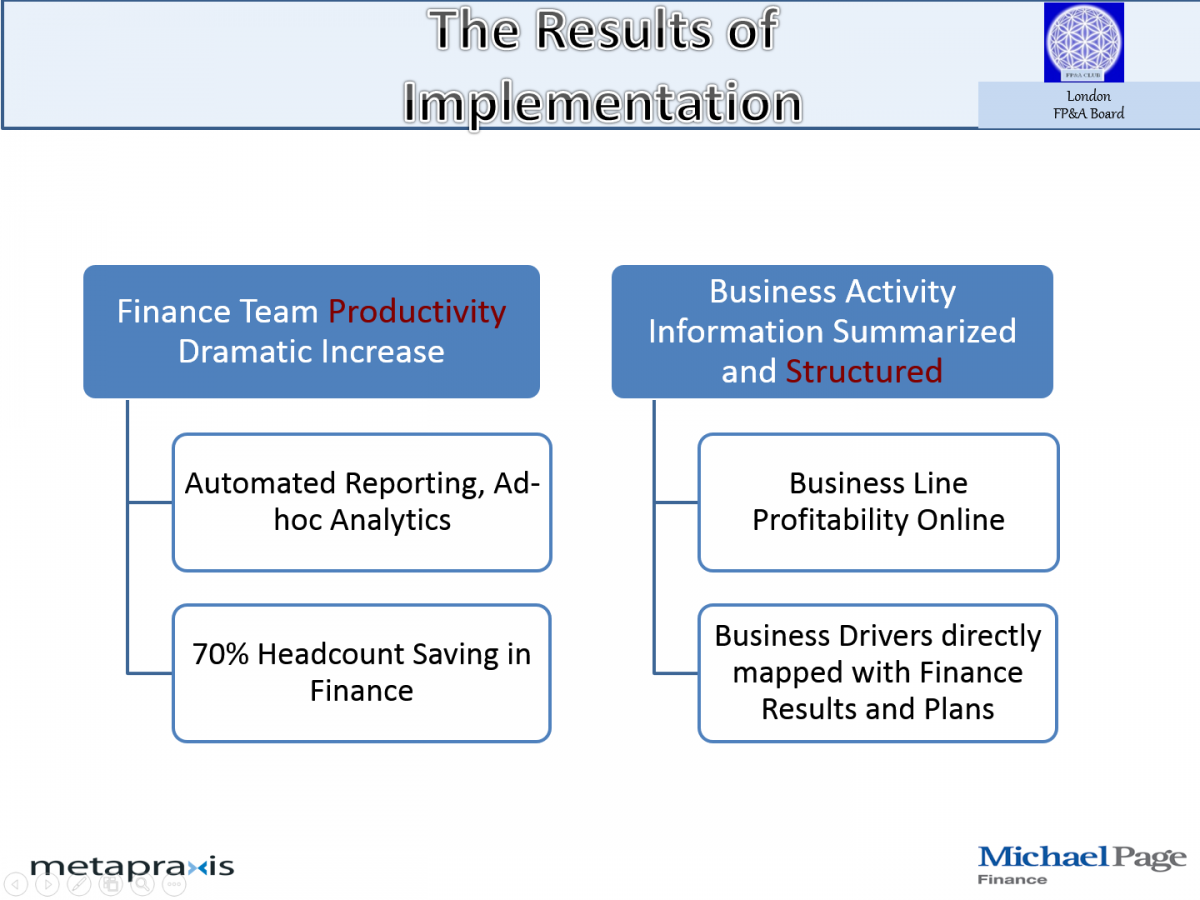

The process has improved the profitability of contracts in the company’s key business areas and has also “dramatically increased” the productivity of its finance team, while business activity information can be summarised and structured.

Figure 3 – The results of implementation

Figure 3 – The results of implementation

Benefits include a headcount saving of 70%, as the automation and logic implemented through this approach allowed Konica Minolta to streamline the analytical force from routine tasks into value-adding analytics work.

What comes next?

Ultimately, analytical transformation is an integral part of the goal in making FP&A more proactive and more valuable to the business. Senior level sponsorship will be secured that much more easily if FP&A’s proponents can clearly demonstrate what it can provide – this could, for example, be via a series of static benchmarks or alternatively through a dynamic model.

Yet the challenges should not be underestimated – there is always the danger that instead of progressing from one stage of development to the next, the process can lose momentum and move backwards if the energy and proactivity are not maintained. It was also acknowledged that although FP&A now routinely uses predictive and prescriptive analytics, it has not yet arrived at the stage where it also employs Big Data analytics.

A further challenge is ensuring that FP&A engages with all areas of the company. It needs to have a story to tell and to relate it in a way that all employees are able to relate to.