Following on from the success of the 7th London FP&A Circle, I had the pleasure of attending the 21st London FP&A Board which shares the latest professional trends and developments with the UK FP&A community, open exclusively by invitation to senior finance practitioners.

On the 20th November in one of London’s most iconic buildings, The Gherkin, over 45 senior finance professionals gained an insight into Swiss Re’s major ‘Atlas’ Finance Transformation programme, and the power of Blockchain in finance, both of which can help evolve the FP&A function into the ultimate trusted strategic advisor to the C-suite.

Atlas Finance Transformation Project at Swiss Re

Simon Jukes, Finance Director at Swiss Re, discussed the company’s Finance Transformation project, Atlas, with the challenges facing all companies: the need to do more with less, and respond faster with it.

External Environment and Risk

Simon set out the PEST analysis facing Swiss Re, driving the need for newer technology and a more responsive platform to drive and enhance shareholder, and stakeholder more broadly, value.

As a reinsurer, Swiss Re is having to contend with a multitude of global trends, such as climate change, technological advances, longer life expectancy and political disruption as well as new and emerging risks. New technology is part of this, with concerns over the increased prevalence of fraud, cybercrime and security. In addition, the emergence of alternative capital and FinTechs, who can move with relative speed and do not require the full operational machinery, and cost, that traditional companies have, poses an additional risk.

Transformation

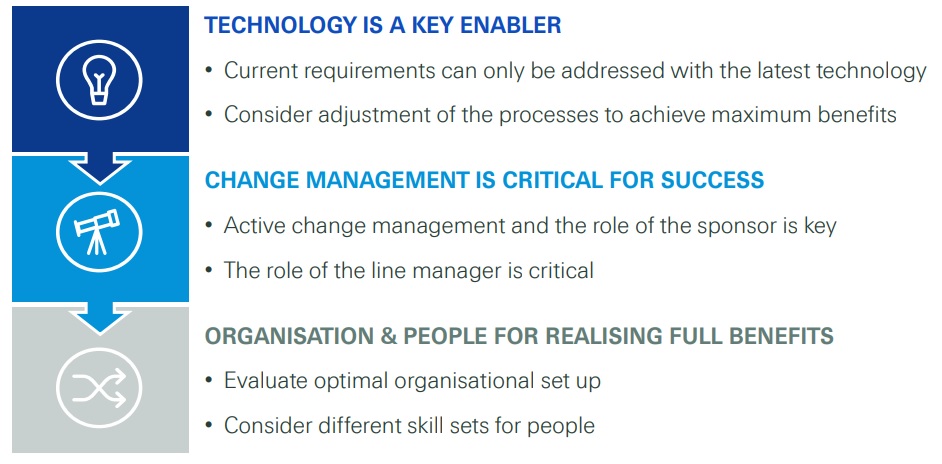

This is driving the need for responsiveness; which in turn is driving the need for exceptional financial analysis and modelling, which requires financial systems that provide the scope for analysis and decision support, against non-value add administration, primarily through reconciliations of various sources and systems.

Common to most companies, the Atlas transformation programme seeks amongst other objectives to achieve “one source of the truth”, using it as a foundation to be able to conduct real time analysis and modelling, through both economic and traditional valuation measures. This also gives scope for further layering with AI and other emergent technologies like Blockchain.

The new accounting roles

From this, Simon highlighted what he thought are the new career paths in FP&A: the performance architect, who knows how to query and build models, to perform scenario analysis and stress test results; and the commercial advisor, who knows how to interpret the results and translate them into actionable insights and drive a decision - skills where the FP&A function both relies upon, and leverages, to be the aforementioned trusted strategic advisor. This differs from the current set up, where business partnering for example, is still constrained by traditional accounting activities.

Kotter’s change management rules still apply

Blockchain Technology and FP&A

Richard Phipps, Solution Design & Delivery Director at Swiss Re, first asked the audience who had experience with Blockchain. Much to his expectations, only one person put their hand up, highlighting his desire to explain what Blockchain is.

Blockchain in a sentence

Richard highlighted the technology has been in use for over 10 years, and pulled out the Wikipedia summary of Blockchain. This was summarised to:

A list of blocks (record of data), linked by Cryptography (electronic locks and keys), through a networked, shared database, with a consensus mechanism where all have to agree to any additions or alterations of said blocks.

Distributed Ledger

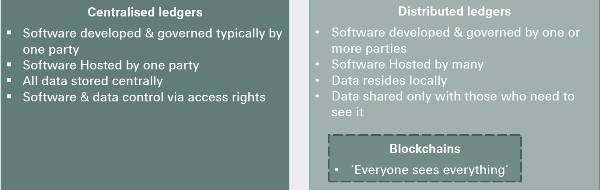

From here, Richard gave an explanation of distributed ledgers, and how these differ from the currently used centralised ledgers.

As “Everyone sees everything”, and records cannot be unilaterally altered, it is the subject of incredible interest, from Financial Institutions with settlement functionality, to the retailers with supply chain integrity and safety.

Relevance to FP&A

- Business model changes

- Volume of data

- Link to AI/ML

- Data timeliness

- Data accuracy

- Cashflow / Liquidity improvement

Blockchain offers the above through data integrity, ability to handle and share incredible volume of data, accuracy and a standardised format.

The Future

Richard estimated that Blockchain will take about 3-5 years to be commonplace, but production data is likely to available within the year. However, there are challenges in the meantime.

Challenges and Next Steps

- Education

- Governance

- Network effect / penetration

- Incentives

- Collaborative approaches

- Pace of change

- Legacy systems and processes

- Expectations

The nature of Blockchain, and the distributed ledger system, requires a fundamental re-shift in mindset and ways of working. Firstly, many have heard of Blockchain but few understand it, which needs to change to manage the expectations of what it can deliver and how. Furthermore, as “Everyone sees everything”, a more ‘agile’ approach (i.e. the 4 fundamental principles which, broadly, rely on collaboration, people and output over documentation and processes) is required, which also requires a greater reliance on governance striking the balance between control and output.

FP&A Breakout Discussions

Attendees then broke out into 4 separate groups to discuss the following:

- How Blockchain technology will impact FP&A in the near future;

- What are the key features of the 21st-century FP&A function;

- What are the key steps in FP&A Analytical Transformation; and

- What are the key requirements to the modern FP&A tools?

Conclusions from the Breakout Session

Michael Judd, Senior Director of Strategic Finance Transformation at Anaplan, gives his perspective here.

During Breakout sessions, participants highlighted that:

- Blockchain technology still requires trust in the inputs of financial and other (employment, market etc) data, for both operational and strategic (M&A etc) initiatives – again, highlighting “Garbage in, Garbage out”;

- Our stakeholders need to be engaged, with an appreciation of the data we have, and how the FP&A function wishes to define itself and tangibly add value;

- Tools need to be easy to use. There needs to be a centralised source with one source of the truth, offering the ability to plan at multiple levels and aggregate these. When modelling, drilling down to the detail is essential, and tools need to be able to handle high volumes of data, with a visual output of the data itself; and

- For the FP&A function to truly business partner, it should become more forward-looking, embracing more external data, against an inordinate focus on internal historical data, with a mixture of financial and non-financial data, to convey the full business context. There is a question over whether the FP&A function should be separate to finance and the CFO.

It appears, despite the risks, that the biggest challenge is not technology itself- on the contrary, it is proving to be a great unlocker of the FP&A function achieving its potential -but education, culture and the urgency of the ‘change agenda’.

I hope you will join the conversation at the next FP&A Board event, as we continue to discuss these challenges and share how we overcome them, as look to fulfill the potential of FP&A to become the strategic advisory unit, and the bedrock of business decisions.

Our Sponsors

We are very grateful to our global sponsor and partner Anaplan for their great support and to Swiss Re for hosting the London FP&A Board.