As an FP&A professional, you deal with data. Your data travels a long way from its...

The corporate planning process is a controversial subject on which opinions differ widely. Some see a well-structured planning process as an opportunity to gain a competitive edge over rivals. Others regard it as an outright waste of time.

The corporate planning process is a controversial subject on which opinions differ widely. Some see a well-structured planning process as an opportunity to gain a competitive edge over rivals. Others regard it as an outright waste of time.

Our experience has shown that an effectively implemented planning process brings companies a clear added value in many respects. Enterprises are helped to achieve their set targets or to take corrective action if unforeseen changes occur in the background conditions. True to the motto “Some people plan so as not to fail. Others fail, because they do not plan”.

The Challenge Confronting Businesses

It is an indisputable fact that a majority of enterprises do plan, but have to contend with all kinds of challenges. If a company cannot find the right answers to these challenges, there is a risk that planning will not be taken seriously; this will have a negative impact on the business.

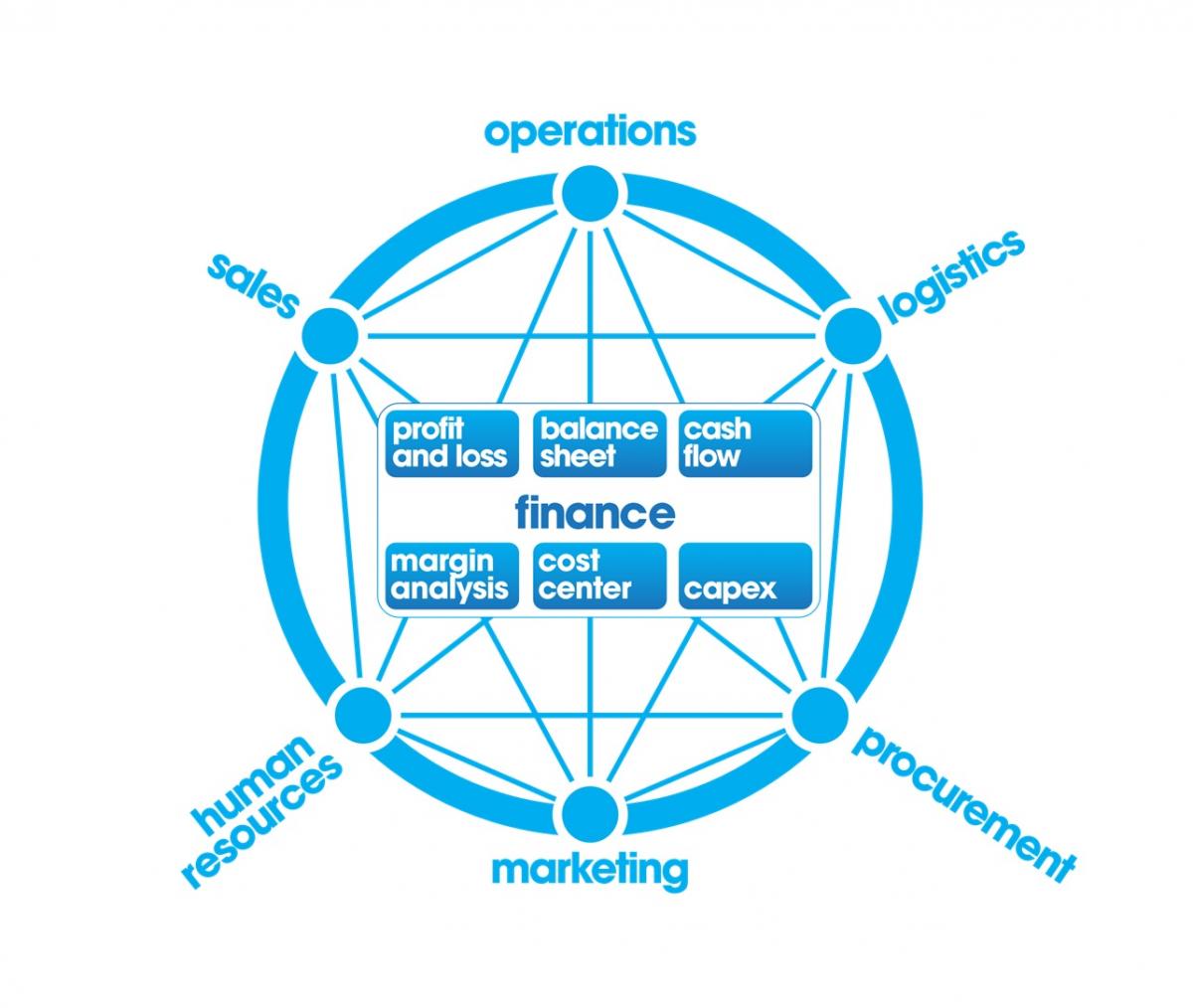

One essential challenge is the integration of partial plans into the overall corporate planning. A self-contained planning model (profit and loss, balance sheet, cash flow and partial operational plans) leads to a substantial improvement of profitability, balance sheet structure, net current assets and cash flow. The resources released in this way can, for instance, be used for product development or for marketing activities.

Many companies fail to implement fully integrated overall and result planning (profit and loss, balance sheet and cash flow) while many others find it hard to integrate their partial operational plans into the overall/result planning.

The reasons for the failure are very complex and would provide enough content for an own blog, so here we introduce you to the essential building blocks of an integrated planning solution and will take a closer look at the benefits of driver-based planning during this blog.

So that companies can effectively implement an integrated planning solution and thus benefit from the resulting competitive advantages, the following points should be noted.

|

Arears |

Description |

|

Planning Responsibility |

Management must define the plan responsible employees, and they must have business and technical know-how |

|

Planning Concept |

Development of professional and business concept |

|

Planning Areas |

Definition Planning Areas with the distinction between overall and result plans (income statement, balance sheet and cash flow) and partial plans (sales, employees, marketing, travel, consulting) |

|

Planning Dimensions |

Business Dimensions (Drivers) for Reporting and Planning |

|

Planning Drivers and Reference Values |

Definition of value drivers and reference values |

|

Planning Integration |

Automatic linking of the overall and result plans (income statement, balance sheet and cash flow) to the partial plans (sales, employees, marketing, travel, consulting) |

|

Planning Simulation |

By linking the plans, simulation and scenario analyzes can be performed directly |

|

Planning Tool – Technical Solution |

The technical solution must be able to automatically carry out the requirements described above without interrupting the calculation process

|

The following graphic illustrates the relationship between the overall and result planning (P & L, balance sheet and cash flow) and the partial plans.

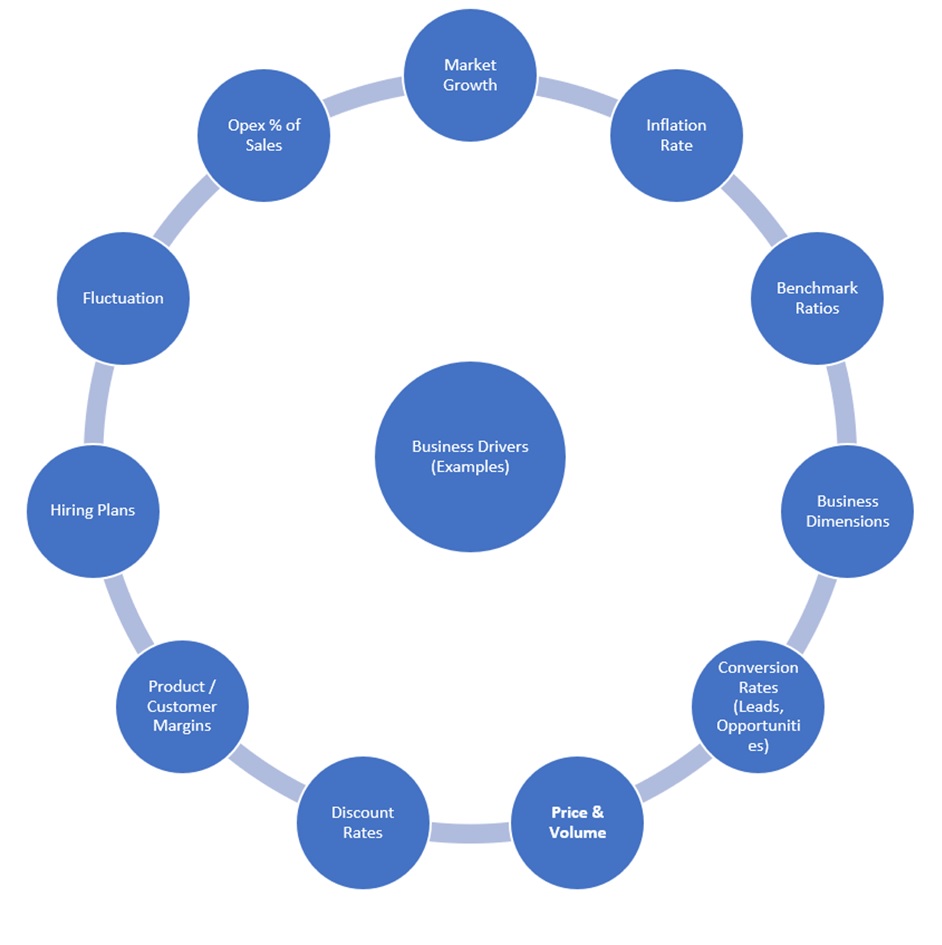

Success factor Value Drivers and Reference Values:

One important contributory factor to better acceptance and greater accuracy of the planning process lies in the definition of value drivers and the use of reference values.

The aim is to significantly accelerate the planning process by means of a driver-based logic and reduce complexity, thus leaving more time for analysis, simulation and scenario modeling. The input of planning values per company, cost center, profit and loss account and month is extremely time-consuming and can be greatly simplified by using value drivers in planning.

The basic idea behind this concept enables the persons responsible for planning to choose the relevant value driver for each account, planning element and business dimension, to enter a value for the planning element and then move on directly to an analysis based on the predefined calculation logic (final planning value and monthly distribution).

The planning model within a company must have the flexibility to leverage existing drivers and easily integrate additional enterprise-specific drivers without abandoning the concept of integrated planning.

Integration of all partial plans with the overall and result planning (profit and loss, balance sheet, cash flow) is essential to enable the management to perform simulations and scenario analyses and, by the same token, determine the impact on important profit and loss, balance sheet and cash flow items. The following examples show which questions, among others, may receive a direct answer.

- What effect do adjustments of sales and purchasing prices have on volumes, profitability and net current assets?

- Are the planned marketing activities consistent with the sales and margin plan for different product groups?

- What impact will there be on the profit and loss, balance sheet and cash flow items if I move X per cent of my staff from site A to site B?

- The implementation of a strategically important project results in a great deal of travel activity. What is the best and most cost-effective site for various discussions?

- The uncertain currency situation may have an enormous impact on our business. What effect will +/- percentage variations of the key currency pairs have on our balance sheet, profit and loss and cash flow positions and what form could a possible currency hedging strategy (FX hedging) take?

Value Drivers for Profit & Loss Statement

The profit and loss view of the business is an important component. Companies need the opportunity to define their relevant business dimensions with specific reference to customers. These are based on standardized business dimensions (company, version and currency) that are important for meaningful reporting and planning. In addition, companies have the opportunity to define generic business dimensions that give them complete flexibility for reporting and planning. These dimensions can, for example, be fed with information from the cost centers, profit centers, business units, divisions or regions and are then available for various purposes. The table below shows an example of possible business dimensions.

|

Category |

Sales & costs |

Staff |

Marketing |

Travel costs |

Profit and loss, balance sheet, cash flow |

|

Basic dimensions |

Version |

Version |

Version |

Version |

Version |

|

Currency |

Currency |

Currency |

Currency |

Currency |

|

|

Time |

Time |

Time |

Time |

Time |

|

|

Company |

Company |

Company |

Company |

Company |

|

|

Specific dimensions |

Customer |

Role |

Campaigns |

Travel |

Business unit |

|

Product |

Post / person |

Activities |

Travel routes |

Company |

|

|

Measurement parameters |

Quantity, price, sales, M. costs |

Salary, social, tax, bonus, adjustments |

Various marketing costs |

Various travel costs |

Account plan |

The use of reference values is an important basis for the implementation of driver-based planning. Pre-configured drivers and calculation models can refer back to existing reference values and greatly simplify planning. The definition of reference values is individually adjustable and may contain e.g. information about the previous year, the current annual plan, the latest results for the year or the latest forecast for the year.

|

Reference values |

Planning driver |

Distribution driver |

|

Previous year |

Previous year plus X, X% |

Uniform |

|

Current year budget |

Budget plus X, X% |

Last year |

|

Current year latest forecast |

Forecast plus X, X% |

Current year actual / current year forecast |

|

Monthly average (last x months) |

% of sales or % of any other sales or cost drivers |

Month x per quarter |

|

|

Transfer values from partial plans |

Manual monthly input |

|

|

Business model-specific drivers with customer-specific calculation logic |

|

Value Drivers for Partial Plans

It is also possible to integrate company-specific partial plans (important profit and loss and balance sheet items for businesses), which are very often already available in uncoordinated Excel data files. If a business manages to integrate all these in a special application, enormous progress will be made with respect to cause and effect relationships as well as scenario and simulation analyses.

The value drivers for partial plans differ widely by company and industry. It is important for each company to first understand the key drivers of their business and make them transparency in an analytical layer. This information allows companies to define drivers for the partial plans of their business. Attached you will find some examples of potential drivers:

Value Drivers for Balance Sheet

For balance sheet planning, companies should again adopt the concept of driver-based planning and the staff members responsible for planning can select pre-configured drivers for each balance sheet item. Based on the existing calculation logic, specific drivers or algorithms can be added at any time.

There are likewise individual planning drivers for all other relevant balance sheet items, enabling a company to model key balance sheet items easily and in a straightforward manner. This provides both a valuable insight into the future economic viability of the business and the opportunity to change parameters at any time and analyze the direct impact on the balance sheet items.

The table below shows an overview of the existing reference values and drivers for the net current asset items and illustrates the resulting opportunities for balance sheet modeling

|

Reference values |

AR (receivables) |

INV (inventory) |

AP (liabilities) |

|

Previous year |

Accounts Receivable ACT LY |

Inventory Value ACT LY |

Accounts Payable Value ACT LY |

|

Latest annual budget |

Days Sales Outstanding ACT |

Days In Inventory ACT |

Days Payable Outstanding ACT |

|

Latest annual forecast |

Days Sales Outstanding ACT LY |

Days In Inventory ACT LY |

Days Payable Outstanding ACT LY |

|

Monthly average (last x months) |

Days Sales Outstanding Input Year Even |

Days In Inventory Input Yr Even |

Days Payable Outstanding Input Yr Even |

|

|

Accounts Receivable % Revenue |

Days In Inventory % Revenue |

Accounts Payable % Revenue |

|

|

|

Days In Inventory % COGS |

Accounts Payable % COGS |

|

|

Entry per Month |

Entry per Month |

Entry per Month |

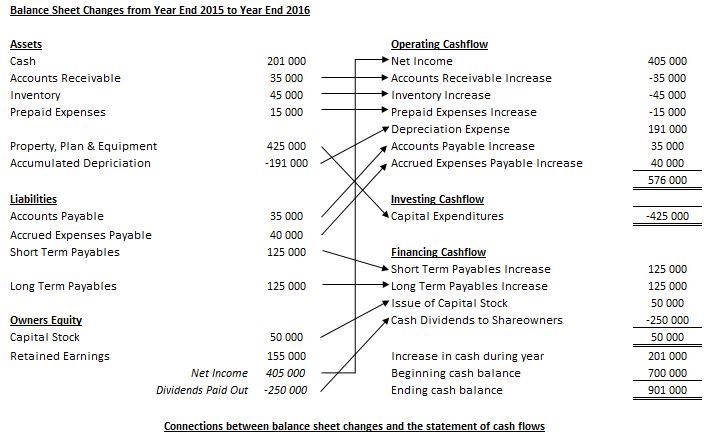

Cash Flow Statement — Closing the Loop

When dealing with the cash flow statement, many users have difficulty tracing the relevant items. However, with a complete profit and loss account and a constantly updated monthly balance sheet movement per item, the preparation of the cash flow becomes a simple mapping exercise. Once defined, rolling cash flow planning brings a huge competitive advantage for companies. This enables important information to be gained and corrective action taken if developments are moving in the wrong direction (e.g. excess net current assets). This in turn enables companies to optimize all kinds of planning items and so make more liquid resources available.

The following overview illustrates a possible presentation of the mapping of profit and loss and balance sheet items for the cash flow statement.

Conclusion

Our experience has shown that few businesses have described a comprehensive overall and result planning (profit and loss, balance sheet, cash flow) in a central application. Even fewer companies integrate important partial plans into the same application. However, this means that substantial potential is lost; that loss could be avoided by coordinating resources, cooperation between the different business units and an understanding of the dependencies between all the partial plans. Moreover, corporate strategy can be better implemented, monitored and optimized by integrated planning.

Companies must create the conditions needed to deploy integrated planning. The following factors are particularly relevant here:

- employees responsible for planning

- preparation of a business concept

- technical implementation of the business concept

- using best practice methods such as driver-based planning

The implementation of a concept of this kind enables companies to achieve a competitive edge over their rivals which goes further than a reduction of administrative planning expenditure and creation of more time for analysis. From the business management angle, the added value of integrated planning lies in the opportunity to make important cause and effect relationships transparent so enabling corrective action to be taken and financial items optimized. The cash resources gained in this way can be used, for instance, to achieve the strategic goal (product development, marketing investment, expansion of personnel, reduction of debts).

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.