The strength of those working in FP&A often comes when they worked in different industries or with BU’s from different countries. They learned a little bit more about the impact management can have on the numbers under different circumstances. To develop a long-range forecast, financials need to look beyond current events and steer away from business plans based on extrapolation.

The strength of those working in FP&A often comes when they worked in different industries or with BU’s from different countries. They learned a little bit more about the impact management can have on the numbers under different circumstances. To develop a long-range forecast, financials need to look beyond current events and steer away from business plans based on extrapolation.

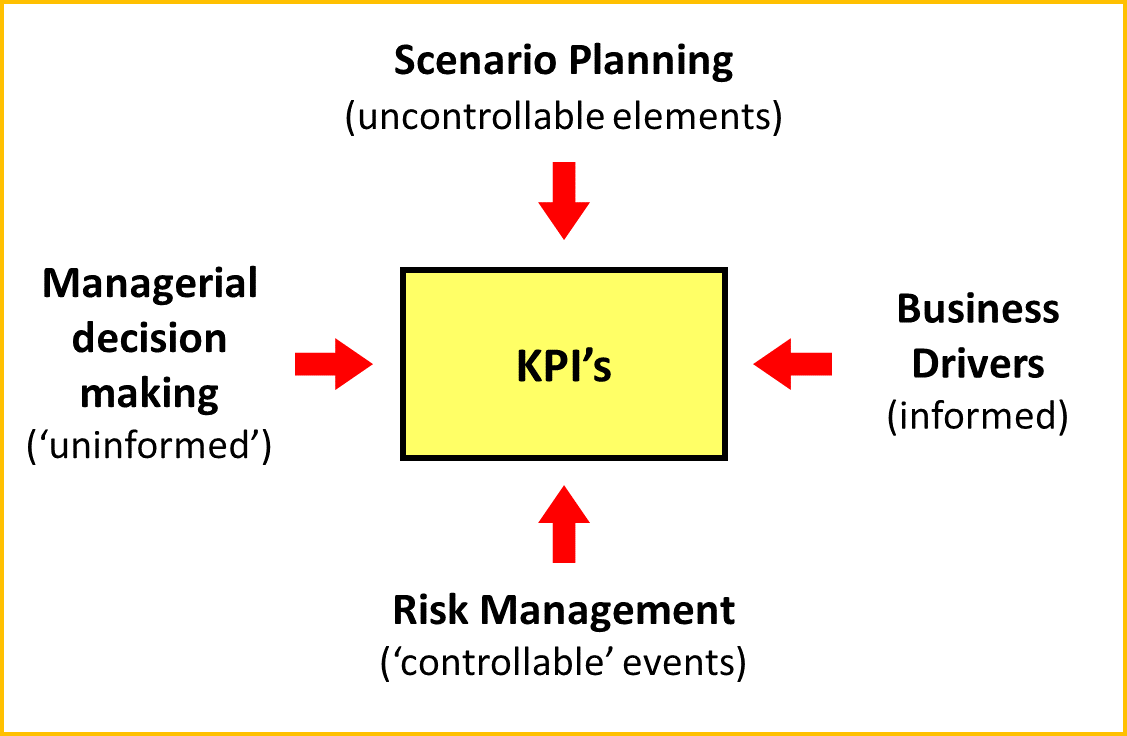

Scenario Planning

Although often confused with describing future ‘desired’ states of the business, the essence of scenario planning is understanding the operational and financial impact of uncontrollable variables. Monitoring specific indicators has proven to be good practice.

- In one case, inventory levels of related suppliers in a leading market started to rise, indicating a slowdown. Although the local market was booming, 2 years later the business almost went bankrupt.

- In another classical case, an intercompany loan of a foreign spin-off was US dollar indexed and FX-rates turned negative, slowly. The local finance manager had looked at future contracts, but the head office didn’t want to change the indexation. A year later, the central treasury had to capitalise the company, which could have been avoided.

Financials can look at indicators like price indices, industrial production, interest rates and see how they impact their industry. Subsequently, they can estimate when their business is affected, 1 or 2 years down the road, in the case an indicator goes up, down or stays the same.

Managerial Decision Making

Many mergers don’t achieve the expected results. Cost reduction programs often fail to meet the targets. Academics have a hard time explaining the reasons why. Management is sometimes ‘uninformed’ about the consequences of their decision.

- When management was betting on a large ‘project’ for a major client to save the business from going under, estimating a possible failure before additional financing was obtained, would have been wise.

- On various occasions, when there was a management change, either through internal promotion or a major restructuring, sales stalled for a while.

For financials to project the impact of management decisions accordingly, they must sit at the table, validate the business assumptions and impact on the organisation, and stay involved in the progress.

Risk Management

From e.g. COSO we know that there are 4 key risk areas influencing any business: strategic risk, operational risk, financial reporting risk and compliance. The long-term risks are reasonably ‘controllable’ because the company can be prepared.

- With major new legislation, e.g. SOX, FCPA, or GDPR, operations will be adjusted. The additional spend coming with it, resonates for several years.

- Although geopolitical tensions are uncontrollable, the long-term commercial and operational impact of e.g. ‘Brexit’ or ‘US trade barriers’ can be identified.

When local financials are given support in understanding these risks, they will be able to provide clear input on the estimates of spend and sales for the coming years.

Business Drivers

Adjusting business focus too late, could mean losing market leadership. Business drivers, in general, define the operations, or business model. In general, management is well informed which business model works best.

- When sales activities moved from direct sales to regional account-based marketing, the company was able to timely restructure the sales organisation, staying ahead of the competition.

- A major corporation was years ahead in outsourcing every part of their operations, focussing on their core strength, making them less vulnerable to the (internet) disruption of today.

Finance can help define local investment needs on time when business drivers indicate a different model. In this way, it is possible for even corporate finance to support local operations.

In sum, the application of scenario planning, managerial decision making, risk management and business drivers becomes useful, when the FP&A professional makes the link to the KPI’s of the organisation. Information from these four areas will improve the quality of the Long-Range Forecast, making the case for the use of business intelligence and analytics throughout the organisation.

The article was first published in Unit 4 Prevero Blog

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.