2017 budgets might be locked and loaded at your company, but that does not mean that they need to be anchors on your company’s ability to anticipate, respond and react effectively to dynamic market conditions in 2017. Companies all sizes are upgrading from Excel and all its related headaches to leverage cost-effective cloud-based budgeting and planning solutions that fuel business agility by allowing companies to implement driver-based planning and forecasting.

2017 budgets might be locked and loaded at your company, but that does not mean that they need to be anchors on your company’s ability to anticipate, respond and react effectively to dynamic market conditions in 2017. Companies all sizes are upgrading from Excel and all its related headaches to leverage cost-effective cloud-based budgeting and planning solutions that fuel business agility by allowing companies to implement driver-based planning and forecasting.

Companies that implement driver-based planning have finance organizations that deliver strategic value by acting as trusted advisors across departmental lines, identifying potential pitfalls and new opportunities, and providing senior management with a dynamic financial plan that informs better decisions across the enterprise.

“The budgeting process at most companies has to be the most ineffective practice in management…it hides opportunity and stunts growth…In fact when companies win, in most cases it is despite their budgets, not because of them.” - Jack Welch, from the book “Winning”. Effective budgeting comes with an understanding of its key objectives by everyone involved in the process. In the vein of the philosophy of KIS (keep it simple) the main objectives of budgeting can be characterized as follows:

- Setting targets/goalposts/lines in the sand

- Facilitating planning across the enterprise

- Managing costs

- Optimize resource allocation

- Create strategic alliance across the enterprise

- Monitor & control financial metrics- i.e., margins, DSO, DPO

In terms of navigating the journey from non-value add budgeting to budgeting that delivers strategic value and planning the first step is mitigating and/or eliminating inherent barriers to effective budgeting framed in terms of people, process and technology:

People

- Do you have the right people involved in the budgeting process?

- Do they care? Do they have the proper incentives to care?

- Do they have the resources and support they need to add value?

Process

- Is the process well-defined?

- Is the process consistent across all departments, borders, etc.?

- Is the process flexible enough to allow continuous improvement?

Technology

- What systems are bring leveraged and why?

- Do you have systems integrability?

- Do your systems facilitate one version of data truth?

- Do your systems facilitate collaboration?

- Can your systems handle the data needed? Adequate functionality?

In term of budgeting and planning, it is not uncommon for people to use these terms interchangeably as times which cam be a bit dangerous. So, before a discussion of driver-based planning the following will be helpful:

- Budget - What you would like to happen

- Plan - How you are going to make it happen

- Forecast - What is actually going to happen

Just as in budgeting, financial planning and analysis here are inherent challenges that can be mitigated and/or erased before investments in people and technology are made to optimize the strategic delivered by the FP&A function.

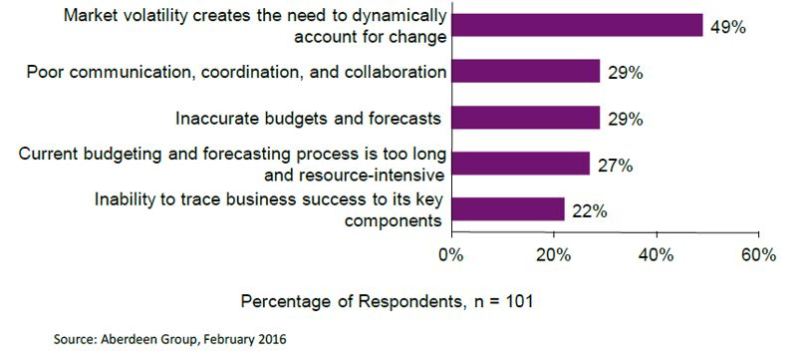

According to the Aberdeen Group in a February 2016 study, the top challenges companies face in FP&A are as follows:

The same framework in terms of people, process, and technology discussed above can be used above to set the stage for a successful journey from static budgeting and planning to driver-based planning.

Driver-based planning focuses on identifying and modeling the relationships that key factors have company value At a more micro-level, companies endeavor to create the right incentives for employee behaviors which impact value drivers (as measured and monitored by KPIs and their relationships to these value drivers) that impact company value. Is the spirit of keeping it simple, driver-based budgeting and planning in a nutshell:

- Identify Factors That Drive Company Value

- Establish Relationships between KPIs & Value Drivers

- Incentivize Actions that Impact Performance Measured/Captured by KPIs that Impact Company Value

In terms of identifying measuring drivers of company value "that matter":

- In Order to Achieve our Strategic Objectives X, Y, Z need to happen, and/or if X,Y,Z (internal and external factors) happen our progress will be derailed or accelerated.

- Are they Industry Specific- ( Possibly )

- Are they Company Specific- ( Possibly )

- Are they Company Size Specific- ( Possibly )

- Are they based Company Risk Tolerance Specific-( Possibly )

I will outline a quick example of key drivers of company value and building relationships to key KPIs as I believe more and more companies will find that the drivers used (or a subset of them) will become the "norm" over the next 5-10 years.

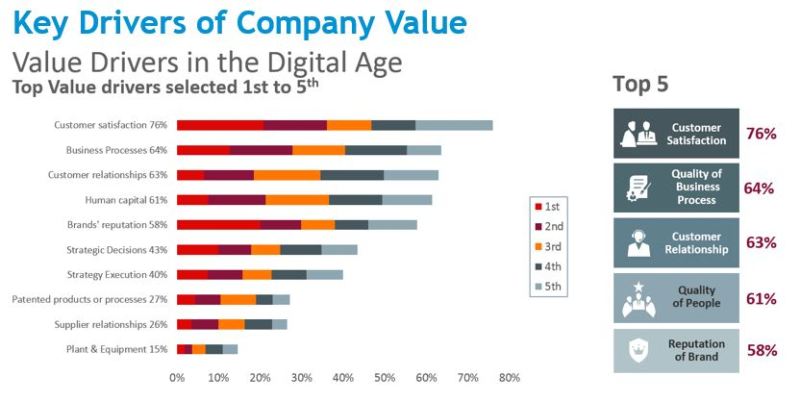

The following represent key drivers of company value according to a survey by the CIMA, The Digital Imperative: Measure and Manage What’s Next:

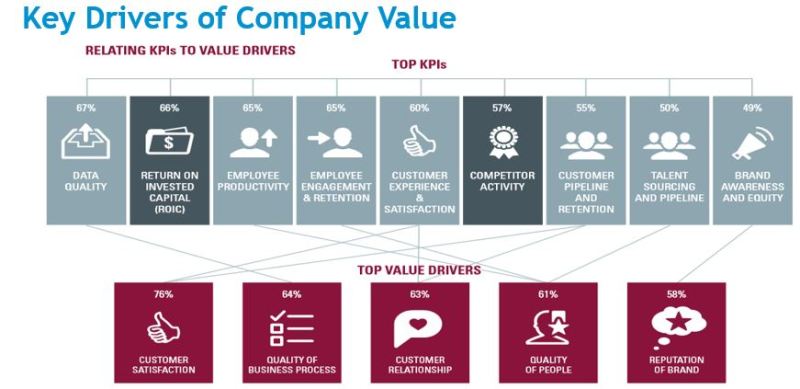

Also courtesy of the aforementioned CIMS study:

In terms of key success factors for successful driver-based planning I offer the following:

- Executive Support

- Strategic Focus on Agility

- Collaborative Environment (including technology)

- Scenario Modeling

- Data/Fact Based Decision Making

- Formal Documentation, Management & Governance of Assumptions

- A Rolling Planning/Forecasting Horizon

- Commitment to the Continuous Improvement and Alignment of Procedures, Process & Systems

The key benefits of driver-based planning include:

- Increased Business Agility

- Improved Strategic Alignment across the Enterprise

- Improved Accountability across the Enterprise

- Better Understanding of Customers

- Better Understanding of Employees

- Better Understanding of What Factors Impact Your Company and Why

- Informed Decision Making across the Enterprise

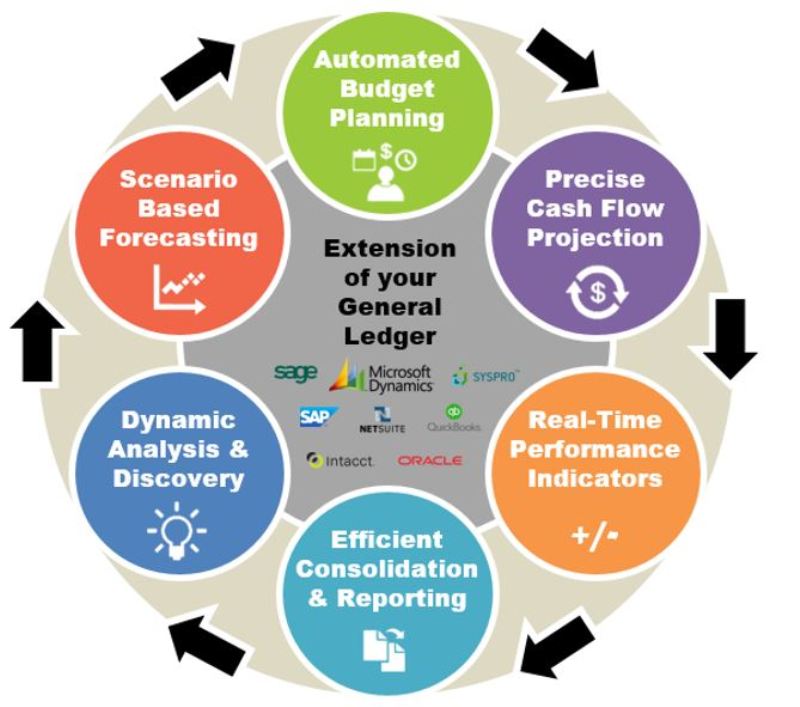

In terms of the functionality of what a cloud-based budgeting, planning and forecasting solution looks life I can suggest the following characteristics:

In closing, I offer 4 key takeaways:

- Effective budgeting, planning and forecasting start with removing and mitigating inherent barriers to success.

- Technology to deliver “best in class” strategic value from the FP&A functions is no longer cost prohibitive for most companies, but technology needs to be “right-sized”.

- Driver-based planning and forecasting enables strategic agility and aligns decisions across the enterprise to optimize factors/variables that impact shareholder value.

- Develop professional connections with those who face the same challenges you face in budgeting, planning and forecasting.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.